* Your assessment is very important for improving the workof artificial intelligence, which forms the content of this project

Download JPMorgan Japan Smaller Company (Yen) Fund Unit Trust Range

Survey

Document related concepts

Private equity in the 2000s wikipedia , lookup

International investment agreement wikipedia , lookup

Stock trader wikipedia , lookup

Special-purpose acquisition company wikipedia , lookup

Private equity wikipedia , lookup

Private equity secondary market wikipedia , lookup

History of investment banking in the United States wikipedia , lookup

Exchange rate wikipedia , lookup

Environmental, social and corporate governance wikipedia , lookup

Investment banking wikipedia , lookup

Currency intervention wikipedia , lookup

Early history of private equity wikipedia , lookup

Mutual fund wikipedia , lookup

Socially responsible investing wikipedia , lookup

Fund governance wikipedia , lookup

Transcript

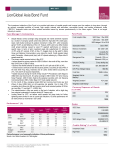

Risk Asset Management Company of the Year, Asia2) 1 2 3 4 5 For Hong Kong Investors only JPMorgan Japan Smaller Company (Yen) Fund Unit Trust Range May 2017 •• The Fund invests primarily in the shares of small to medium sized Japanese companies. •• The Fund is therefore exposed to diversification, smaller companies, currency, liquidity and equity risks. •• Investors may be subject to substantial losses. •• Investors should not solely rely on this document to make any investment decision. Investment objective Fund manager Japan Equity Team, Japan Launch date 05.06.80 Total fund size (m) USD 94.2 Denominated currency and NAV per unit 12 month NAV: High Low Current charge: Initial Redemption Management fee YEN 56,143 YEN 56,215 (27.04.17) YEN 47,955 (15.09.16) 5.0% of NAV 0% 1.5% p.a. SEDOL/ISIN code B4253P6/HK0000055696 Bloomberg code JFJSMCI HK Statistical analysis 5 years Since launch1) 0.91 0.93 0.76 Alpha % 0.01 0.03 0.04 Beta 0.97 1.06 1.11 14.78 18.13 28.22 Sharpe ratio 0.99 1.09 - Annualised tracking error % 6.04 6.61 18.44 Average annual return % 14.71 19.82 4.78 Annualised volatility % 300 300 200 200 100 100 0 0 03 04 05 06 07 08 09 10 11 12 13 14 15 16 17 JPMorgan Japan Smaller Company (Yen) Fund Russell/Nomura Small Cap Total Index -100 Cumulative performance % (in denominated currency) Fund Benchmark 1 month 1 year 3 years 5 years Since launch +2.7 +1.7 +7.8 +20.2 +50.9 +53.2 +147.0 +133.7 +461.4 - Calendar year performance % (in denominated currency) Fund Benchmark 2012 2013 2014 2015 2016 2017YTD +9.6 +18.4 +79.5 +52.9 +10.8 +13.1 +18.1 +16.1 -3.6 +4.8 +5.0 +4.2 PORTFOLIO ANALYSIS 3 years Correlation 400 % CHANGE Portfolio information REBASED PERFORMANCE FROM 31.12.02 TO 28.04.17 (in denominated currency) To provide long-term capital growth by investing primarily in the shares of small to medium-sized Japanese companies. 4.7% 4.9% 5.0% 5.6% 6.3% 8.0% 8.5% 10.9% 13.5% 15.9% 28.4% -11.6% Other Financing Business Pharmaceutical Metal Products Precision Instruments Information & Communication Chemicals Electric Appliances Machinery Retail Trade Services Others Net Liquidity Top five holdings (as at end March 2017) Holding Disco Corporation Nidec Corporation Start Today Co., Ltd. Asahi Intecc Co., Ltd. Seria Co., Ltd. For more information, please contact your bank, financial adviser or visit www.jpmorganam.com.hk Sector Machinery Electric Appliances Retail Trade Precision Instruments Retail Trade Country/region Japan Japan Japan Japan Japan % 3.6 3.0 3.0 2.8 2.5 Unless stated otherwise, all information as at the last valuation date of the previous month. Source: J.P. Morgan Asset Management/Nomura (NAV to NAV in denominated currency with income reinvested). Source of star rating: Morningstar, Inc. Risk ratings (if any) are based on J.P. Morgan Asset Management’s assessment of relative risk by asset class and historical volatility of the fund where applicable. The risk ratings are reviewed annually or as appropriate and for reference only. Investors are advised to consult our Investment Advisers before investing. Any overweight in any investment holding exceeding the limit set out in the Investment Restrictions was due to market movements and will be rectified shortly. Top ten holdings is available upon request. It should be noted that due to the difference of the fund domiciles the valuation points used by Unit Trust range and SICAV range of funds for fair valuation (where applied) may vary. For details please refer to the respective offering document(s). 1)With the exception of the “Average annual return” figure, all data are calculated from the month end after inception. 2)Issued by the Asset Triple A Asset Servicing, Fund Management and Investors Awards 2016, reflecting performance of previous calendar year. The investment returns are calculated in denominated currency. For funds/classes denominated in foreign currencies, US/HK dollar-based investors are therefore exposed to fluctuations in the currency exchange rate. Investment involves risk. Past performance is not indicative of future performance. Please refer to the offering document(s) for details, including the risk factors. This document has not been reviewed by the SFC. Issued by JPMorgan Funds (Asia) Limited.