* Your assessment is very important for improving the work of artificial intelligence, which forms the content of this project

Download Increase the power of one-on-one conversations by using our

Quantitative easing wikipedia , lookup

History of investment banking in the United States wikipedia , lookup

Market (economics) wikipedia , lookup

Mark-to-market accounting wikipedia , lookup

Investment management wikipedia , lookup

Securities fraud wikipedia , lookup

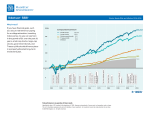

Short (finance) wikipedia , lookup

Legendary market images in a convenient, easy-to-share format. 4 Reference and Communication Materials Increase the power of one-on-one conversations by using our intelligent images to illustrate investment concepts. For quick reference, all images include NASD-reviewed speaking points on the back, clearly explaining each graphic. Images are available in a Market Charts Kit of 15, housed in a convenient package that travels easily to client meetings. Our most popular image (“SBBI”) is also available in multi-format kit. And we’ve updated the entire lineup for 2007 with a fresh new design. SBBI Print Kit: The easiest way to share your insight ® TM Stocks, Bonds, Bills, and Inflation 1926–2006 $13,706 10,000 $2,658 1,000 Compound Annual Return Small Stocks Large Stocks Long-Term Govt Bonds Treasury Bills Inflation 100 12.6% 10.4 5.5 3.7 3.0 $71 $18 $11 1926 1930 1935 1940 1945 1950 1955 1960 1965 1970 1975 1980 1985 Gramm-Leach-B ey Act Start of Gu f War Stock market crash Start of ow nf at onary per od May Day, the deregu at on of brokerage fees Arab o embargo Fed targets monetary supp y Tet offens ve n V etnam JFK assass nated Sputn k aunched U S Treasury-Federa Reserve Accord Genera Agreement on Tar ffs and Trade 010 Pear Harbor G ass-Steaga Act Secur t es Exchange Act Stock Market Crash Note: Images in catalog contain sample data $1 1990 1995 September 11th 10 2000 2005 Hypo hetical value of $1 nvested at the beginn ng of 1926 Assumes re nvestment of ncome and no transaction costs or taxe s Th s s for llustrati e purposes only and not nd cat ve of any investment An nvestment cannot be made direc ly n an ndex Past performance is no guarantee of future results Go e nment bonds and T easu y b lls are gua anteed by the fu l fai h and c edit of the U S government as to he t mely payment of p inc pal and inte est wh le stocks a e not gua anteed and have been more volat le than he other asset classes Furthe more sma l company tocks a e mo e volatile than large company sto ks and a e subject to sign ficant pr ce fluctuat ons bu iness isks and a e th nly traded Source Small Company Stocks epresented by the fif h cap tal zat on quint le of stocks on the NYSE for 1926 1981 and the pe forman e of the Dimensional Fund Advisors Inc U S Micro Cap Portfol o therea ter Large Company Stocks Standard & Poor’s 500 which is an unmanaged group of secu it es and ons dered to be epresentat ve of the stock market in gene al Gove nment Bonds 20 year U S Gove nment Bond Treasury B lls 30 day U S Treasury Bi l In lat on Consumer Pr ce Index ©2007 Mo ningstar Inc All r ghts reserved The Unde ly ng data is from the Stocks Bonds Bi ls and Inflation SBBI ) Yea book by Roger G Ibbotson and Rex Sinquef eld updated annua ly Demonstrate the value of asset allocation with this practical system of NASD-reviewed presentation materials, based on the classic Stocks, Bonds, Bills, and Inflation ® image. The poster, charts, and notepads illustrate growth of $1 invested in four major asset classes since 1926, within the context of key political and economic events. SBBI Print Kit includes $100 3 One SBBI Poster (25'' x 38'') 3 Two Laminated SBBI Market Charts 3 Three SBBI Chart Pads (25 sheets per pad, 8.5'' x 11'') PRI YS0 200I