* Your assessment is very important for improving the work of artificial intelligence, which forms the content of this project

Download Product Profile

Pensions crisis wikipedia , lookup

Financial economics wikipedia , lookup

Business valuation wikipedia , lookup

Systemic risk wikipedia , lookup

Investor-state dispute settlement wikipedia , lookup

Private equity in the 1980s wikipedia , lookup

Corporate venture capital wikipedia , lookup

Syndicated loan wikipedia , lookup

Beta (finance) wikipedia , lookup

Private equity wikipedia , lookup

International investment agreement wikipedia , lookup

Private equity in the 2000s wikipedia , lookup

Stock trader wikipedia , lookup

Land banking wikipedia , lookup

Private equity secondary market wikipedia , lookup

Early history of private equity wikipedia , lookup

Investment banking wikipedia , lookup

Fund governance wikipedia , lookup

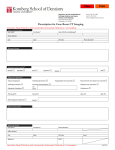

Mutual Fund Product Profile AMG FQ Tax-Managed U.S. Equity Fund AMG FQ Tax-Managed U.S. Equity Fund Mutual Fund Product Profile PAGE 1 ABOUT FIRST QUADRANT, L.P. (FQ) Overview of FQ: u FQ offers strategies in three main areas: Founded in 1988 u $20.4 billion assets under management1,2 u Headquartered in Pasadena, CA u Partnership with employee ownership u Beta strategies that offer efficient participation in global growth u Alpha strategies that offer low correlation to broad markets u Total return solutions that strategically u 89 total employees – 29 investment professionals 1 combine beta and alpha seek to maximize risk-adjusted returns u Global, institutional client base u Systematic, theory-based process INVESTMENT PHILOSOPHY FQ believes that significant and recurring fundamental market inefficiencies present opportunities for profit. With inefficiencies changing over time, FQ believes it is necessary to conduct ongoing research to keep the investment process ahead of the curve. FQ also believes that market inefficiencies exist for a variety of reasons including: In certain dimensions of the market, information is not always immediately reflected in the price of securities Certain information is given either too much or too little weight in investors’ decisions Investors fail to respond efficiently to changes in various risk attributes INVESTMENT STRATEGY The AMG FQ Tax-Managed U.S. Equity Fund seeks to achieve superior long-term returns for investors by investing in a diversified portfolio of U.S. equity securities that reflects the characteristics of the Russell 3000® Index in terms of industry, earnings growth, valuation and other similar factors. The Fund invests at least 80% of its assets in equity securities. First Quadrant will manage the Fund’s portfolio to minimize taxable distributions to shareholders and will apply a variety of tax-sensitive investment techniques including: Investing in stocks that pay below-average dividends Employing a buy-and-hold strategy designed to avoid realizing short-term capital gains and defer as long as possible the realization of long-term capital gains Realizing losses on specific securities or specific tax lots of securities to offset realized gains 1 As of June 30, 2016 2 Includes market values for fully funded portfolios and the notional values for margin funded portfolios, all actively managed by First Quadrant and nondiscretionary portfolios managed by joint venture partners using First Quadrant investment signals. First Quadrant is defined in this context as the combination of all discretionary portfolios of First Quadrant, and its joint venture partners, but only wherein First Quadrant has full investment discretion over the portfolios. INVESTMENT PROCESS PORTFOLIO MANAGERS FQ uses a proprietary multi-factor quantitative model to construct portfolios that combine a top-down analysis of market and economic conditions with a bottom-up stock selection process. First Quadrant utilizes an integrated investment process that consists of four key components: 1. Tax Management: maximizes retention of investment gains after taxes 2. Alpha Generation: seeks to provide better return than the market 3. Risk Management: seeks to achieve desired returns by taking diversified positions 4. Transaction Cost Management: minimizes market impact Jia Ye, PhD Partner and Chief Investment Strategist Tax Management 1 Transaction Cost Management 4 2 Alpha Generation 3 Risk Management There is no guarantee that these investment strategies will work under all market conditions, and each investor should evaluate his or her ability to invest for the long term, especially during periods of downturns in the market. David Chrisman, PhD, CFA, Director of Investment Research AMG FQ Tax-Managed U.S. Equity Fund Mutual Fund Product Profile ASSET CLASS/OBJECTIVE STYLE EQUITY The Fund’s investment objective is to achieve long-term after-tax returns for investors. VALUE CORE GROWTH LARGE MID Style box placement is based on Fund’s principal investment strategies BENCHMARK ADVISOR SUBADVISOR PORTFOLIO MANAGERS Russell 3000® Index AMG Funds First Quadrant, L.P. Jia Ye David Chrisman SMALL FUND FACTS Ticker Inception Expense Ratio (Gross/Net)1 Minimum Investment Maximum Sales Load 12b–1 Fees Investor Class MFQAX 03/01/06 1.27%/1.14% $2,000 ($1,000 IRA) — 0.25% Institutional Class MFQTX 12/18/00 1.02%/0.89% $1,000,000 ($50,000 IRA) — — Share Class The Fund’s Investment Manager has contractually agreed, through at least March 1, 2017, to limit Fund operating expenses. The net expense ratio reflects this limitation, while the gross expense ratio does not. Please refer to the Fund’s Prospectus for additional information on the Fund’s expenses. 1 AMG FUNDS AMG Funds provides access to premier asset managers through a unique partnership where the investment managers are truly independent. We are not beholden to a single investment approach or a single manager in delivering quality investment solutions. This innovative approach leverages each manager’s specific expertise to deliver products that cover the complete asset class spectrum. Delivering the talents of all of these portfolio managers under a consolidated platform allows AMG Funds to offer unmatched access to specialized investment expertise. For more information, call 800.368.4410. DISCLOSURES Investors should carefully consider the Fund’s investment objectives, risks, charges and expenses before investing. For this and other information please call 800.835.3879 or visit www.amgfunds.com to download a free prospectus. Read it carefully before investing or sending money. The Fund invests in large-capitalization companies that may underperform other stock funds (such as funds that focus on small- and medium-capitalization companies) when stocks of large-capitalization companies are out of favor. The Fund may use derivative instruments, such as options and futures, for hedging purposes or as part of its investment strategy. There is a risk that a derivative intended as a hedge may not perform as expected. The main risk with derivatives is that some types can amplify a gain or loss, potentially earning or losing substantially more money than the actual cost of the derivative, or that the counterparty may fail to honor its contract terms, causing a loss for the Fund. Use of these instruments may also involve certain costs and risks such as liquidity risk, interest rate risk, market risk, credit risk, management risk and the risk that a fund could not close out a position when it would be most advantageous to do so. The Russell Indices are trademarks of the London Stock Exchange Group companies. Although the Fund is managed to minimize taxable distributions, it may not be able to avoid taxable distributions. The Russell 3000® Index is composed of the 3,000 largest U.S. companies as measured by market capitalization, and represents about 98% of the U.S. stock market. Unlike the Fund, the Russell 3000® Index is unmanaged, is not available for investment and does not incur expenses. AMG Funds are distributed by AMG Distributors, Inc., a member of FINRA/SIPC. www.amgfunds.com Not FDIC Insured May Lose Value Not Bank Guaranteed 063016 PR063