* Your assessment is very important for improving the work of artificial intelligence, which forms the content of this project

Download liquidity risk - Islamic Development Bank

History of the Federal Reserve System wikipedia , lookup

Moral hazard wikipedia , lookup

Land banking wikipedia , lookup

Islamic banking and finance wikipedia , lookup

Financial economics wikipedia , lookup

Investment fund wikipedia , lookup

Fractional-reserve banking wikipedia , lookup

Asset-backed commercial paper program wikipedia , lookup

Systemic risk wikipedia , lookup

Investment management wikipedia , lookup

Shadow banking system wikipedia , lookup

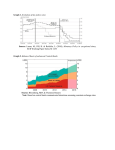

LIQUIDITY RISK & LIQUIDITY MANAGEMENT in Islamic banks Salman Syed Ali Distance Learning Course: Current Issues in Islamic Finance Overview Baking Theory—Why banks exist? Liquidity Issues in Islamic banks -----------------------------Sources of liquidity risk in IBs How it is managed and the consequences -----------------------------What is being done and further developments 2 Banking Theory—Why banks exist? Banks as providers of liquidity insurance to depositors and clients Rationale for deposit taking and lending by same institution (bank) Theory of bank intermediation The Nature of Banking Firm Brings in Liquidity Risk 3 Excess of Wet or Dry Liquidity Surplus Drag on competitiveness Liquidity Shortage Assassin of banks 4 Islamic Banks are likely to be more stable They have profit sharing on both the liability side and asset side 5 In practice, Islamic Banks have fixed income assets but have profit sharing on liability side. The IBs therefore, are still more stable than conventional banks. Solvent Asset tied finance 6 While majority of Islamic banks experience excess liquidity Some have also faced liquidity crisis Many different risks culminate in liquidity risk 7 Liquidity crunch can be a real problem Example of Financial Crisis in Turkey 2000-2001 Islamic financial institutions there faced sever liquidity problems One Islamic institution Ihlas Finans was closed during the crisis 8 LIQUIDITY RISK: Definition Risk of Funding [at appropriate maturities and rates] Risk of Liquidating Assets [in time at reasonable prices] 9 Investment Firm’s Definition “liquidity risk includes both the risk of being unable to fund [its] portfolio of assets at appropriate maturities and rates and the risk of being unable to liquidate a position in a timely manner at reasonable prices.” * * J.P. Morgan Chase (2000). 10 Regulators Definition “risk to a bank’s earnings and capital arising from its inability to timely meet obligations when they come due without incurring unacceptable losses.”* * Office of the Comptroller (2000) 11 LIQUIDITY RISK: Sources Incorrect judgment and complacency Unanticipated change in cost of capital Abnormal behavior of financial markets Range of assumptions used Risk activation by secondary sources Break down of payments system Macroeconomic imbalances Contractual forms Financial Infrastructure deficiency 12 Liquidity Risk & Contractual Forms Profit Sharing Contracts Murabaha Salam Istisna Ijarah 13 Resale not permitted Resale permitted but non-existent market Market exists but not active 14 Example of LR in Murabaha Primary LR Secondary LR Receivables are debt cannot be sold Involves buying of commodity then selling on deferred payment This brings in many operational, credit, dispute, and legal risks that can affect realization of receivables 15 Analysis and Diagnosis 16 Liquidity Surplus Problem Excess Liquidity is the current norm with Islamic banks Where to park for short-term? Use of most Islamic modes requires longer tenor investment, murabaha leads to illiquidity (liquidity risk). This induces banks to hold more liquidity, but this is costly. This leads to very short-term murabaha low earnings. Excess liquidity Use of commodity murabaha Absence of LoLR facility is also a reason 17 Examples of Problems with Commodity Murabaha 18 High Proportion of Short-Term Int’l Murabaha in Total Murabaha,Bank-A (2002) 26.3 % 19 High Proportion of Short-Term Int’l Murabaha inTotal Murabaha (Bank-B) 2002 2004 50.4% 43.7% 20 Low Income from Short Term Murabaha (Bank-B) Income from Shortterm Murabaha Income from Short-term Murabaha 19 % 15.1 % 2002 2004 Income from Other Murabaha 81 % Income from Other Murabaha 84.9% 21 Approaches to Liquidity Management Asset Side Liquidity Management Liabilities Side Liquidity Management Two Sided Approach Islamic Banks are mostly using Asset Approach to liquidity management Large size banks use two sided approach Approach varies b/w retail and investment banks 22 Liquidity Management: Current Practices of IBs To cope with Excess Liquidity Commodity Murabaha Sukuk Ijarah and Salam Stock Markets Problems and Issues of these practices To manage Liquidity Shortage Reverse Commodity Murabaha Mixing of deposits Various types of reserves for confidence building 23 New Ideas: Going Forward Mutual funds Mutual fund of sukuk (LMC) IBs’ local club for mutual cooperation Development of secondary market in sukuk (issues involved: increasing the float, shorter term) Sequence of Funds instead of Demand Deposits IFSB Guidelines for risk management 24 Existing Maturity Structure of Sukuk 25 Maturity Transformation through Pooled Sukuk Long-term Sukuk with different time remaining to maturity Investor Sukuk-A Investor Issue Pooled Sukuk of ShorterTerm Sukuk-B Sukuk-C SPV- 2 Mutual Fund of Sukuk Investor Investor 26 LMC’s Short Term Sukuk Program Repackages longer instruments into monthly maturity certificates –Guaranteed monthly entry and exit dates –Intra-month entry and exit also available (no penalties) –Flexibility of investment amounts –Fully secured by underlying Sukuk portfolio –Monthly returns Source for this slide: LMC Presentation 27 Conclusions What is needed What can be done Thank You