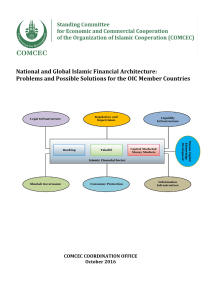

National and Global Islamic Financial Architecture: Problems and

... Professor Dr. Habib Ahmed. The team members include: Mr. Peter Casey (Chap. 5), Mr. Md. Abdul Awwal Sarker (Chap. 4: Bangladesh), Mr. Mouhamadou Lamine Mbacke (Chap. 4: Senegal), Dr. Shehab Marzban & Asmaa Nabwy (Chap. 4: Egypt), Mr. Moosa Khoory (Chap. 4: UAE), Dr. Rifki Ismal (Chap. 4: Indonesia), ...

... Professor Dr. Habib Ahmed. The team members include: Mr. Peter Casey (Chap. 5), Mr. Md. Abdul Awwal Sarker (Chap. 4: Bangladesh), Mr. Mouhamadou Lamine Mbacke (Chap. 4: Senegal), Dr. Shehab Marzban & Asmaa Nabwy (Chap. 4: Egypt), Mr. Moosa Khoory (Chap. 4: UAE), Dr. Rifki Ismal (Chap. 4: Indonesia), ...

Islamic Capital Market

... system collapses. At the same time Islamic financial system is not just the “interest free” financial system .It has other unique features of Islamic economics like risk sharing, property rights, rights and duties of the individual and society (Zamir & Greuning, 2008, p. 42) Islamic finance is becom ...

... system collapses. At the same time Islamic financial system is not just the “interest free” financial system .It has other unique features of Islamic economics like risk sharing, property rights, rights and duties of the individual and society (Zamir & Greuning, 2008, p. 42) Islamic finance is becom ...

Download attachment

... the general welfare of the community for their own spiritual uplift and to attain beneficient reward in the hereafter. Faridi states that empirical and historical evidence suggests substantial spending of this nature in Muslim countries. He attaches so much importance to such welfare oriented resour ...

... the general welfare of the community for their own spiritual uplift and to attain beneficient reward in the hereafter. Faridi states that empirical and historical evidence suggests substantial spending of this nature in Muslim countries. He attaches so much importance to such welfare oriented resour ...

Download attachment

... financial sector as well as stability of individual financial institutions. The subject is important because finance affects the economy and its participants in multiple ways. A disruption in finance can result in disruption of payments system, that is despite having the resources/money the agents a ...

... financial sector as well as stability of individual financial institutions. The subject is important because finance affects the economy and its participants in multiple ways. A disruption in finance can result in disruption of payments system, that is despite having the resources/money the agents a ...

Liquidity Coverage Ratio

... recommendation intended to promote common understanding and sound industry practices which are encouraged to be adopted; “banking institutions” refers to licensed banks, licensed investment banks and licensed Islamic banks except for licensed international Islamic banks; “debt securities” includes a ...

... recommendation intended to promote common understanding and sound industry practices which are encouraged to be adopted; “banking institutions” refers to licensed banks, licensed investment banks and licensed Islamic banks except for licensed international Islamic banks; “debt securities” includes a ...

2016The World`s Leading Islamic Finance News Provider

... liquidity management instruments and applying more stringently its principle of profit and loss-sharing. As Basel III helps the banking industry to enhance its capitalization and resilience to unexpected shocks, it will also tackle the lack of available liquidity management instruments for Islamic f ...

... liquidity management instruments and applying more stringently its principle of profit and loss-sharing. As Basel III helps the banking industry to enhance its capitalization and resilience to unexpected shocks, it will also tackle the lack of available liquidity management instruments for Islamic f ...

banking mergers and acquisitions in the eu: overview

... acquisitions (M&As) in Europe during the 1990s and at offering economic evaluation and strategic analyses of the process. The main characteristics of this process in the 1990s were the emergence of “mega banks” at the national scale, a slight increase of cross-border transactions and the emergence o ...

... acquisitions (M&As) in Europe during the 1990s and at offering economic evaluation and strategic analyses of the process. The main characteristics of this process in the 1990s were the emergence of “mega banks” at the national scale, a slight increase of cross-border transactions and the emergence o ...

Download attachment

... Research in the area of Islamic banking and finance has mushroomed since the new millennium. As the Islamic banking industry continues to grow at impressive rates, researchers have pondered on fundamental questions relating to whether Islamic banks are unique from an economic standpoint. Islamic ban ...

... Research in the area of Islamic banking and finance has mushroomed since the new millennium. As the Islamic banking industry continues to grow at impressive rates, researchers have pondered on fundamental questions relating to whether Islamic banks are unique from an economic standpoint. Islamic ban ...

Download attachment

... impact not only on the success of Shari’ah based financial instruments, but also on countries’ economic conditions. Summarized from Kuran (2003, 2004) and Yousef (2004), one reason for the economic crisis in the Middle East is the lack of access to, and the quality of, the Islamic law and Islamic kn ...

... impact not only on the success of Shari’ah based financial instruments, but also on countries’ economic conditions. Summarized from Kuran (2003, 2004) and Yousef (2004), one reason for the economic crisis in the Middle East is the lack of access to, and the quality of, the Islamic law and Islamic kn ...

Kingdom of Bahrain: Financial System Stability Assessment

... developing rapidly. A significant challenge is to ensure that the BMA has the staff and skills to keep up with expansion of the financial sector and innovations in its products. The positive reputation of the BMA has contributed to Bahrain’s attractiveness as a financial center. The BMA also strives ...

... developing rapidly. A significant challenge is to ensure that the BMA has the staff and skills to keep up with expansion of the financial sector and innovations in its products. The positive reputation of the BMA has contributed to Bahrain’s attractiveness as a financial center. The BMA also strives ...

Risk Weighted Capital Adequacy Framework

... Standards: A Revised Framework" issued by the BCBS in June 2006 and the Capital Adequacy Standards, “Capital Adequacy Standard for Institutions Other than Insurance Institutions Offering only Islamic Financial Services” issued by the Islamic Financial Services Board in December 2005. Based on the 19 ...

... Standards: A Revised Framework" issued by the BCBS in June 2006 and the Capital Adequacy Standards, “Capital Adequacy Standard for Institutions Other than Insurance Institutions Offering only Islamic Financial Services” issued by the Islamic Financial Services Board in December 2005. Based on the 19 ...

Efficiency of Financial Intermediation: An

... assets or total assets; and (2) interest rate spread – the gap between (simply) lending and deposits rates. Both definitions are subject to limitations. For instance, NIM suffers from a number of problems such as: (1) it does not include any fee and commission, which can change the effective margin; ...

... assets or total assets; and (2) interest rate spread – the gap between (simply) lending and deposits rates. Both definitions are subject to limitations. For instance, NIM suffers from a number of problems such as: (1) it does not include any fee and commission, which can change the effective margin; ...

Download attachment

... instrument on the asset side of the balance sheet (Vogel & Hayes III, 1998). Every contract benchmarked with LIBOR inherits the possibility that in the future the LIBOR rates will rise and that the issuer, on the asset side, will not have made as much profit as future market conditions might dictate ...

... instrument on the asset side of the balance sheet (Vogel & Hayes III, 1998). Every contract benchmarked with LIBOR inherits the possibility that in the future the LIBOR rates will rise and that the issuer, on the asset side, will not have made as much profit as future market conditions might dictate ...

The determinants of cost/profit efficiency of Islamic banks

... massive resources of capital and have much more developed technologies (especially for derivatives and in research). However, for Islamic Banks, they share profits and losses with their customers through the principle of PLS (profit and loss sharing) that promotes partnership and more equitable shar ...

... massive resources of capital and have much more developed technologies (especially for derivatives and in research). However, for Islamic Banks, they share profits and losses with their customers through the principle of PLS (profit and loss sharing) that promotes partnership and more equitable shar ...

World Islamic Banking Competitiveness Report

... A critical reference source for decision makers in the global Islamic finance industry, providing strategic insights from Ernst & Young Dear Banking & Finance Leader, It is with great pleasure that we present to you the 9th annual edition of the World Islamic Banking Competitiveness Report 2012/13, ...

... A critical reference source for decision makers in the global Islamic finance industry, providing strategic insights from Ernst & Young Dear Banking & Finance Leader, It is with great pleasure that we present to you the 9th annual edition of the World Islamic Banking Competitiveness Report 2012/13, ...

Download attachment

... prohibits the charging and paying of interest. Therefore, in countries where Muslim population constitutes an important segment of the society, traditional debt markets cannot flourish. Hence there is a high demand and need for developing alternatives to traditional debt markets that can be acceptab ...

... prohibits the charging and paying of interest. Therefore, in countries where Muslim population constitutes an important segment of the society, traditional debt markets cannot flourish. Hence there is a high demand and need for developing alternatives to traditional debt markets that can be acceptab ...

Islamic FMR- April 2015_(Complete)

... Sajjad Anwar, CFA Muhammad Ali Bhabha, CFA, FRM Syed Suleman Akhtar, CFA Salman Ahmed ...

... Sajjad Anwar, CFA Muhammad Ali Bhabha, CFA, FRM Syed Suleman Akhtar, CFA Salman Ahmed ...

The Effect of Market Power on Stability and Performance of Islamic

... SCP hypothesis larger banks may increase profits, and hence building high ‘capital buffer’, allowing them to be less prone to liquidity or macroeconomic shocks (Boyd et al., 2004). Second, and similar to the first channel, larger banks may increase their charter value, encouraging bank managers to d ...

... SCP hypothesis larger banks may increase profits, and hence building high ‘capital buffer’, allowing them to be less prone to liquidity or macroeconomic shocks (Boyd et al., 2004). Second, and similar to the first channel, larger banks may increase their charter value, encouraging bank managers to d ...

ethical investment: empirical evidence from ftse islamic index

... constituents. The GIIS are reviewed semi-annually in the first week of March and September. If a stock drops out of the FTSE All-World Index markets, it is removed from the relevant GIIS index. Further, if a stock of the GIIS fails to meet the eligibility criteria, the management committee removes i ...

... constituents. The GIIS are reviewed semi-annually in the first week of March and September. If a stock drops out of the FTSE All-World Index markets, it is removed from the relevant GIIS index. Further, if a stock of the GIIS fails to meet the eligibility criteria, the management committee removes i ...

Islamic Financial Services Unit | Annual Report 2013/14

... It was a year of vitality and transformation and as we record our highest ever profits in history, we are enthused to state that we have come back stronger than ever before. This was in part, due to our team, individuals who wholeheartedly embraced the idea of taking this venture to higher heights. ...

... It was a year of vitality and transformation and as we record our highest ever profits in history, we are enthused to state that we have come back stronger than ever before. This was in part, due to our team, individuals who wholeheartedly embraced the idea of taking this venture to higher heights. ...

44 STRESS TEST FOR ISLAMIC AND CONVENTIONAL BANKS

... fall below any of the two minimum ratios required. The paper reveals that the overall pool of risk for the banking sector as a whole and for the conventional banking sector has declined whereas it increased for the Islamic banking sector. It further finds that the weight of individual risk type has ...

... fall below any of the two minimum ratios required. The paper reveals that the overall pool of risk for the banking sector as a whole and for the conventional banking sector has declined whereas it increased for the Islamic banking sector. It further finds that the weight of individual risk type has ...

Download attachment

... capital markets. The evolution and development of Islamic banks as depository institutions has also encouraged the development of non-banking Islamic financial institutions including investment funds and insurance companies managed by various Islamic banks. In addition, since 1984, there has been an ...

... capital markets. The evolution and development of Islamic banks as depository institutions has also encouraged the development of non-banking Islamic financial institutions including investment funds and insurance companies managed by various Islamic banks. In addition, since 1984, there has been an ...

Download attachment

... the issuance of Islamic capital market securities (sukuk) by corporates and public sector entities amid greater demand for alternative investments. As the sukuk market continues to develop, new challenges and opportunities for debt managers arise as structured finance instruments are receiving incre ...

... the issuance of Islamic capital market securities (sukuk) by corporates and public sector entities amid greater demand for alternative investments. As the sukuk market continues to develop, new challenges and opportunities for debt managers arise as structured finance instruments are receiving incre ...

Download attachment

... Results of the study showed that the main reason for the clash of opinions on bai` dayn among the past Islamic jurists centred on the ability of the seller to deliver the items sold. This was stated by Ibnu Taimiyyah himself and was also based on statements made in the great books of the four mazhab ...

... Results of the study showed that the main reason for the clash of opinions on bai` dayn among the past Islamic jurists centred on the ability of the seller to deliver the items sold. This was stated by Ibnu Taimiyyah himself and was also based on statements made in the great books of the four mazhab ...

Islamic banking and finance

Islamic banking (Arabic: مصرفية إسلامية) is banking or banking activity that is consistent with the principles of sharia (Islamic law) and its practical application through the development of Islamic economics. As such, a more correct term for Islamic banking is sharia compliant finance.Sharia prohibits acceptance of specific interest or fees for loans of money (known as riba, or usury), whether the payment is fixed or floating. Investment in businesses that provide goods or services considered contrary to Islamic principles (e.g. pork or alcohol) is also haraam (""sinful and prohibited""). Although these prohibitions have been applied historically in varying degrees in Muslim countries/communities to prevent unIslamic practices, only in the late 20th century were a number of Islamic banks formed to apply these principles to private or semi-private commercial institutions within the Muslim community.As of 2014, sharia compliant financial institutions represented approximately 1% of total world assets. By 2009, there were over 300 banks and 250 mutual funds around the world complying with Islamic principles and as of 2014 total assets of around $2 trillion were sharia-compliant. According to Ernst & Young, although Islamic Banking still makes up only a fraction of the banking assets of Muslims, it has been growing faster than banking assets as a whole, growing at an annual rate of 17.6% between 2009 and 2013, and is projected to grow by an average of 19.7% a year to 2018.