* Your assessment is very important for improving the work of artificial intelligence, which forms the content of this project

Download Plain-Vanilla Interest Rate Swap

Survey

Document related concepts

Transcript

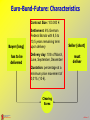

Betriebswirtschaftliche Bewertungsmethoden TOPIC 2 Grundlagen der Konstruktion, Bewertung und des Einsatzes von Zinsfutures und Zinsswaps zur Steuerun von zinsbedingten Risiken Prof. Dr. Rainer Stachuletz Corporate Finance Prof. Dr. Rainer Stachuletz Corporate Finance Berlin School of Economics slide no.: 1 EURO – BUND FUTURES Prof. Dr. Rainer Stachuletz Corporate Finance Berlin School of Economics slide no.: 2 Euro-Bund-Future: Characteristics Contract Size: 100.000 € Buyer (long) has to be delivered Settlement: 6% German Federal Bonds with 8,5 to 10,5 years remaining term upon delivery Delivery day: 10th of March, June, September, December Seller (short) must deliver Quotation: percentage at a minimum price movement of 0,01% (10 €). Clearing Eurex Prof. Dr. Rainer Stachuletz Corporate Finance Berlin School of Economics slide no.: 3 Euro-Bund-Futures Delivery Day/Months Purchase at 10th March 10. March Delivery latest at 10th Dec. 10. June 10. Sept. 10. Dec. Time to maturity max. 9 month Prof. Dr. Rainer Stachuletz Corporate Finance Berlin School of Economics slide no.: 4 Euro-Bund-Future: Mechanisms 1 Prof. Dr. Rainer Stachuletz Corporate Finance Berlin School of Economics The market yield of 10y governmental german bonds is at 6% and does not change to the maturity of the future: The seller must deliver 100.000 € nominal at futures maturity. This will cost 100.000 €. 2 The market yield drops from 6% to 5%, i.e. the bond‘s price will rise to 107,72: The seller must deliver 100.000 € nominal, which now equals 107.720 Euro. At the settlement date, the buyer receives a payment of 7.720 €. 3 The market yield rises to 10%, i.e. the price then will drop to 75,42. Now the seller has to pay 75.420 € to deliver 100.000 € nominal. At settlement the seller gets a payment of 24.580 € per contract. slide no.: 5 Euro-Bund-Futures: Pricing Prof. Dr. Rainer Stachuletz Corporate Finance Berlin School of Economics slide no.: 6 Short-Future-Position and Margin - Account 5 Days to Settlement Futures Interest Rate Future Change Value -1 -1 -1 -1 0 8,00% 86,58% 0,00% 0,00 8,50% 83,60% -2,98% 2.980,00 7,50% 89,70% 6,10% -6.100,00 7,00% 92,98% 3,28% -3.280,00 7,00% 92,98% 0,00% 0,00 Margin 2.500,00 Credits/Debits Current Balance 2.500,00 Maintenance 0,00 2.500,00 2.980,00 5.480,00 0,00 5.480,00 -6.100,00 -620,00 3.120,00 2.500,00 -3.280,00 -780,00 3.280,00 2.500,00 -6.400,00 0,00 Taking a short position would only make sense, if the future interest rate is expected to rise (see the profit of 2,980 due to a rise of 50 BP). Only in that case the Future, contracted at 86,58% could be „delivered“ at lower prices. As this is not the case, after 4 days the game ends with a total loss of 6,400 Euro. Prof. Dr. Rainer Stachuletz Corporate Finance Berlin School of Economics slide no.: 7 How to Hedge a Bond – Portfolio Using Bund Futures Assume a small bond – portfolio, that contains following positions. Current prices are calculated at an 8% flat rate: Bonds Nominal Value (Purchase Price) Coupon Time to Maturity Current Price A B 10.000.000,00 10.000.000,00 8% 6% 10y 8y 10.000.000,00 8.851.000,00 Total 20.000.000,00 18.851.000,00 Now you expect the term – structure to rise to 10% flat. Due to the rising rates your devaluation risk is as follows: Prof. Dr. Rainer Stachuletz Corporate Finance Berlin School of Economics Bonds Nominal Value (Purchase Price) Coupon Time to Maturity Current Price A B 10.000.000,00 10.000.000,00 8% 6% 10y 8y 8.770.000,00 7.866.000,00 Total 20.000.000,00 16.636.000,00 slide no.: 8 How to Hedge a Bond – Portfolio Using Bund Futures Due to the expected future interest rate scenario, you are exposed to the risk of devaluation. According to Internationalo Financial Reporting Standards you will have to depreciate your bond – portfolio. The depreciation of 2,215 mio € is going to worsen your profit and loss account. Bonds Nominal Value (Purchase Price) Current Price at 8% Current Price at 10% Profit Loss A B 10.000.000,00 10.000.000,00 10.000.000,00 8.851.000,00 8.770.000,00 7.866.000,00 1.230.000,00 985.000,00 Total 20.000.000,00 18.851.000,00 16.636.000,00 2.215.000,00 To compensate for this risk, you decide to hedge using an instrument, that will profit from rising rates. A short position in Bund Futures, where the seller has to deliver 100.000 € nominal per contract, will gain from rising rates. A declining Bund Future price allows for a „cheap“ delivery. Prof. Dr. Rainer Stachuletz Corporate Finance Berlin School of Economics slide no.: 9 How to Hedge a Bond – Portfolio Using Bund Futures Today (flat rate at 8%) you may take a short Bund-Future position at a Future-price of 86.56. If the interest rates rise to a level of 10%, the Bund – Future will be quoted at 78.66. The short position will gain Profits 7.900 € (86,560 – 78,660) per contract, thus you need to short 280 contracts ( 2,215 mio€ / 7,900 T€), to hedge the risk of a portfolio devaluation at 2,215 mio €. + 7,900 (In this Ex. 156 K to hedge A and 124 K to hedge B.) 78,66 Prof. Dr. Rainer Stachuletz Corporate Finance Berlin School of Economics 86,56 Future Price Rising interest rates cause declining Future Prices slide no.: 10 How to Hedge a Bond – Portfolio Using Bund Futures After the interest rate has risen to 10%, the total account of your bond – and your hedge (Bund-Future) – portfolio looks as follows: Bonds Nominal Value (Purchase Price) A B 10.000.000,00 10.000.000,00 Total 20.000.000,00 Profit/Loss Bonds Profit / Loss Bund Future Profit / Loss Total -1.230.000,00 -985.000,00 1.232.400,00 979.600,00 2.400,00 -5.400,00 2.212.000,00 -3.000,00 -2.215.000,00 The total loss in your bond – portfolio (- 2,215 Mio €) is compensated by profits from your hedge – portfolio (+ 2,212 Mio €). Prof. Dr. Rainer Stachuletz Corporate Finance Berlin School of Economics slide no.: 11 Interest Rate Swaps Prof. Dr. Rainer Stachuletz Corporate Finance Berlin School of Economics slide no.: 12 Basic Concept Interest Rate Swap 1. A swap is an agreement between two parties to exchange interest payments within a defined period of time, calculated of an agreed contract – volume. Frequently swaps simply regulate to exchange floating rate payments against fixed rate payments et vice versa. 2. The contract volume will not be exchanged. Also interest payments will not be fully exchanged, but only the saldo. 3. Plain-Vanilla-Swaps are based upon David Ricardo‘s Theory of Trade. Prof. Dr. Rainer Stachuletz Corporate Finance Berlin School of Economics slide no.: 13 Basic Concept Interest Rate Swap Fixed Rate B A Floating Rate The party paying the fixed rate is called to be in a PayerSwap-position, while the party receiving fixed rates takes the Receiver-Swap-position. When the contract is signed, the N.P.V. of both cash flows, the variable and the fixed equal zero. Prof. Dr. Rainer Stachuletz Corporate Finance Berlin School of Economics slide no.: 14 Plain Vanilla Interest Rate Swap Pricing Banks publish their swap-conditions. Usually the fixed rates offered referring payer or receiver-swaps are determined by the current term structure of interest rates: Term structure (26th Dec. 2005) WestLB (26th Dec. 2005) Maturity 1J 2J 3J 4J 5J 6J 7J 8J 9J 10J 15J Prof. Dr. Rainer Stachuletz Corporate Finance Berlin School of Economics WestLB receives 2.894 3.054 3.139 3.182 3.236 3.286 3.337 3.387 3.437 3.483 3.671 - WestLB pays 2.844 3.004 3.089 3.132 3.186 3.236 3.287 3.337 3.387 3.433 3.621 1y 2y 3y 4y 5y 6y 7y 8y 9y Average returns 2,65% 2,82% 2,92% 3,01% 3,09% 3,16% 3,23% 3,29% 3,35% 10y 3,41% Maturity slide no.: 15 Plain-Vanilla Interest Rate Swap Example: Two corporations, A (Rating AAA) and B (Rating A) are exposed to very different market conditions: Prof. Dr. Rainer Stachuletz Corporate Finance Berlin School of Economics floating rate fixed rate target A Euribor 5.0 % floating B Euribor + 0.50 6.5 % fixed slide no.: 16 Plain-Vanilla Interest Rate Swap 1. Step: A and B chose financing contracts at their relatively best positions, i.e. A choses a fixed rate while B enters a floating rate loan. Straight Bond A issues a straight bond at 5%. A Prof. Dr. Rainer Stachuletz Corporate Finance Berlin School of Economics 5% fixe rate Floating rate loan B issues a floating rate loan at EUR + 0.5%. EURIBOR + 0.50 % B slide no.: 17 Plain-Vanilla Interest Rate Swap 2. Step: A and B sign a swap-arrangement, with A receiving a fixed rate of 5.5 % from B and paying Euribor to B. Straight Bond A issues a straight bond at 5%. Floating rate loan B issues a floating rate loan at EUR + 0.5%. 5% fixe rate EURIBOR + 0.50 % B A Euribor SWAP Prof. Dr. Rainer Stachuletz Corporate Finance Berlin School of Economics Fixe rate 5.5 % SWAP slide no.: 18 Plain-Vanilla Interest Rate Swap Balance of Payment A: FIXED Balance of Payment B: FLOAT. FIXED Floating Bond - 5% Swap + 5.5 % - Euribor Swap - 5.5 % + Eur Total + 0.5 - Euribor Total - 5.5 % - 0.5 LOAN BOND - Eur + 0.5 Floating Loan EURIBOR + 0.50 % 5% Fixed Rate A SWAP Prof. Dr. Rainer Stachuletz Corporate Finance Berlin School of Economics Euribor Fixed rate 5.5 % B SWAP slide no.: 19 Plain-Vanilla Interest Rate Swap More realistic: A und B contract a Swap – agreement by a financial intermediator (JPSwap). Floating Rate Loan Bond EUR + 0.50 % 5% fixed EUR A 5.75 % fixed 5.25 % fixed B EURIBOR JPSwap Prof. Dr. Rainer Stachuletz Corporate Finance Berlin School of Economics slide no.: 20 Plain-Vanilla Interest Rate Swap Balance A: FIXED Balance JPSwap: Balance B: FIXED FLOAT. FIXED Payer - 5.25 % +Euribor LOAN - Euribor Swap - 5.75 % + Eur Total - 5.75 % - 0.5 % FLOAT. Bond -5% Swap + 5.25 % - Euribor Receiver + 5.75 % Total + 0.25 % - Euribor Total + 0.5 Straight Bond - Eur + 0.5 Float. Rate Loan EUR + 0.50 % 5% FIXED EUR A FLOAT. 5.75 % Fest 5.25 % FIXED B EURIBOR JPSwap Prof. Dr. Rainer Stachuletz Corporate Finance Berlin School of Economics slide no.: 21 Example: Risk Management with Asset Swaps Corporation A receives interest revenues generated by a 100 Mio. € bond investment (6y to maturity, 8% coupon). The bonds have been put on the assets side at their costs of purchase (100%). The financial management of A forcasts the interest rates to rise by 1% over the next year. years 1 rcurrent 3,0% 4,0% 5,0% 6,0% 7,0% 8,0% rin1year 4,0% 5,0% 6,0% 7,0% 8,0% 9,0% rspot,0 3,0% 4,02% 5,07% 6,16% 7,31% 8,55% rspot,1 4,0% 5,03% 6,08% Prof. Dr. Rainer Stachuletz Corporate Finance Berlin School of Economics 2 3 4 7,2% 5 8,4% 6 9,6% Rising rates will lead to declining prices (depreciations). Secondly, in case of rising rates, A is not properly invested which may affect her competetive position. Risk management may prevent from losses. slide no.: 22 Example: Risk Management with Asset Swaps To manage the forecasted interest rate related risk, A enters a 6y Payer-Swap (paying a fixed rate of 8%, receiving a floating rate at 12-m-Euribor. The contract volume mirrors the nominal value of the risky asset (100 Mio €): Bond Debtor Payer Swap 8% fixed rate 8% fixed rate Corporation A Swapbank Euribor Prof. Dr. Rainer Stachuletz Corporate Finance Berlin School of Economics slide no.: 23 Example: Risk Management with Asset Swaps – Close out If, one year later, the interest rates would have risen by linearly 1.5%, the future cash flows referring the 100 Mio € Swap (which now matures in 5y !) could be valued using the new spot rates: Average Returns Spot Rates 4,50% 5,50% 6,50% 7,50% 8,50% 9,50% 4,50000% 5,52777% 6,58990% 7,70163% 8,88307% 10,16229% 0 1 2 Cash Flow 100.000.000 -8.000.000 -8.000.000 Spot rates 4,50% 5,53% Present values 100.000.000 -7.655.502 -7.183.836 3 -8.000.000 6,59% -6.606.050 4 5 NPV -8.000.000 -108.000.000 7,70% 8,88% -5.945.671 -70.570.285 2.038.655 Value of the swap contract is at 2,038,655 Mio €. To close out, A will be paid the swap‘s present value. Prof. Dr. Rainer Stachuletz Corporate Finance Berlin School of Economics slide no.: 24 Example: Risk Management with Asset Swaps – 2nd Swap Bond Debtor 1st. Payer Swap 8% fixed rate Theoretically, after one year A could enter a second swap, where she becomes a fixed rate receiver (5y at 8,5%) 8% fixed rate Corporation A Swapbank 1 Euribor 8,5% fixed rate Euribor Swapbank 2 Prof. Dr. Rainer Stachuletz Corporate Finance Berlin School of Economics 2nd. Receiver Swap The advantage of 0.5% or 500 T€ over a period of 5 years has a present value of 2.038.655 €. A second swap could be reasonable to ensure the advantage and to protect from tax payments. slide no.: 25 Example: Risk Management with Asset Swaps – Efficiency If interest rates rise as forcasted, the value of the 100 Mio. bonds investment will decrease to 97,961 Mio €: 0 1 2 Cash Flow 8.000.000 8.000.000 Spot rates 4,50% 5,53% PV 97.961.345 7.655.502 7.183.836 3 8.000.000 6,59% 6.606.050 4 8.000.000 7,70% 5.945.671 5 108.000.000 8,88% 70.570.285 A necessary depreciation will affect the profit and loss account by a loss of 2.038.655 € (100 Mio purchase price minus 97,961,345 € current market price). In our case, the swap – based risk management has shown a positive present value of 2,038,655 €. A close out and the close out payment at this amount would perfectly compensate the loss from the bond‘s investment. Prof. Dr. Rainer Stachuletz Corporate Finance Berlin School of Economics slide no.: 26