* Your assessment is very important for improving the work of artificial intelligence, which forms the content of this project

Download docx - Minds on the Markets

Rate of return wikipedia , lookup

Modified Dietz method wikipedia , lookup

Investment management wikipedia , lookup

Financialization wikipedia , lookup

Beta (finance) wikipedia , lookup

Credit rationing wikipedia , lookup

Business valuation wikipedia , lookup

Investment fund wikipedia , lookup

Securitization wikipedia , lookup

Lattice model (finance) wikipedia , lookup

Moral hazard wikipedia , lookup

Present value wikipedia , lookup

Financial economics wikipedia , lookup

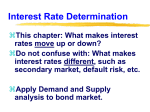

Collateralized mortgage obligation wikipedia , lookup

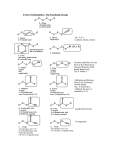

Types of Risk Lesson 2 Identifying and Measuring Risk Types of Risk Aim: What are the most common risks that can cause our expected return of an investment to be lower than the actual return? Do Now: Identify three corporations that have gone bankrupt or which are struggling. Types of Risk Do Now answer: Corporations that have gone bankrupt in the last several years include GM, Linens N’ Things and Borders (book seller). Corporations that are struggling include Radio Shack, Sears, JC Penney, Barnes & Noble and Staples. Types of Risk There are several causes that result in realized return being unequal to expected return. These are called Risks. Foreign Exchange Risk Interest Rate Risk Types of risk that can affect the value of the cash flows received by the investor: Credit Risk Default Risk Liquidity Risk Inflationary Risk (a type of interest rate risk) 1. Interest Rate Risk The risk bondholders face because of the relationship between bond prices and interest rates. Interest rates and bond prices are inversely related. This means, when interest rates go up, the price of bonds will decrease, and vice versa. 1. Interest Rate Risk What Causes Interest Rate Changes? There are many factors that can cause inflation, including supply and demand of money (both foreign and domestic) and monetary policy (explained in Module 6). A bond’s coupon market value is affected by changes in the market interest rate. 1. Interest Rate Risk Bonds can be defined in terms of how they are priced. Par bond: A bond with a coupon in line with rates offered in the market. Discount bond: A bond with a coupon below rates offered in the market (and which basically suffer from Interest Rate Risk). Premium bond: A bond with a coupon above rates offered in the market. 1. Interest Rate Risk - Example Frizzle, Inc. offers a new issue of bonds carrying a 7% coupon ($70 interest payment), paid annually. The bond will mature in 3 years. The face value of the bond is $1,000 and the bond is selling at par ($1,000 per bond). 1. Interest Rate Risk - Example Scenario: Interest rates rise to 8%. • If new bonds are now issued, their coupon rate would be 8% and their price would be $1,000. • Investors would not pay $1,000 for the existing 7% bond when they could purchase the newly issued 8% bond at a price of $1,000. • The price of the 7% would have to decline to make it equally as attractive to investors as the 8% bond. 1. Interest Rate Risk - Example Scenario: Interest rates fall to 6%. • If interest rates drop to 6%, the bond’s coupon rate will be greater than the interest rate, meaning the bond will be selling at a premium. P0 = ? C = $70 i = 6% N = 3 M = $1,000 (value @ maturity) P0 = $1,026.73 2. Inflation Risk Inflation The rate at which price levels rise across the entire economy. As inflation occurs, the purchasing power of a dollar falls. In an inflationary period, $1 will not be able to buy as much as it did previously. In other words, one dollar today will not be able to buy as much as a year from now. Inflation Risk The rate of inflation is more than investors expected. Had they known, they would have demanded a higher coupon. How Does Inflation Affect Bonds? When an investor is buying the bond today, inflation is already built into the expected return. The investor is buying the bond today with money that has a certain degree of purchasing power. If the investor expects inflation to increase, the purchasing power of the cash flows paid on the bond (coupons and return of principal at maturity), will decrease (it can purchase less). The investor will demand a higher return. How Does Inflation Affect Bonds? If expected inflation is less than the actual level of A portion of the inflation, the investor has expected return not been adequately (also known as compensated for the yield to maturity) decrease in the is a premium for purchasing power of the cash flows received. expected inflation. Thus, their realized return will be less than expected return. 3. Credit / Default Risk Credit: The lending of money, such as when an investor purchases a company’s bond. Credit risk: Risk that arises when the borrower’s financial condition erodes and it is less able to pay its lenders. Risk that the bond will be downgraded by the rating agencies. Bonds issued by lowerrated companies have a higher chance of default. 3. Credit / Default Risk Credit risk taken to its end means that the borrower defaults on its scheduled coupon payments. 4. Liquidity Risk Liquidity: A measure of how quickly an asset can be converted into cash through sale. Liquidity risk: Risk that arises from the difficulty of selling a financial instrument quickly without a significant loss in value. 4. Liquidity Risk Stocks or bonds have some degree of liquidity. However, financial instruments differ in their degree of liquidity: Real Estate is highly illiquid. It normally takes months to sell a piece of real estate for fair value. 5. Foreign Exchange Risk When you invest in a currency other than your own country’s currency, you are taking a risk that movements in foreign exchange rates will adversely affect your return. 5. Foreign Exchange Risk Example: On January 7, 2013, $1.30 was required to obtain 1.00€ (euro). This means that $130 could buy 100.00€. On February 4, 2013, $1.3344 was equivalent to 1.00€ (euro). This means that it required $133.44 to buy 100.00€. Between January 7 and February 4, the US Dollar became weaker against the Euro, requiring more dollars to buy the same 100 Euros. Fluctuating exchange rates can make investments, especially foreign investment ones, risky. 5. Foreign Exchange Risk I.N. Vestor is a US investor who wants to invest in a French stock (Euro is the currency of France). On 1/7/13 he converts $1300 into Euros. He has 1,000.00€ to invest in the French stock market. On 2/4/13 he sells the investment for the same value as he paid. He converts the Euros back into dollars. Calculation: (1,000.00€) * ($1.3344/1€) = $1,334.40 His gain is entirely due to the Euro strengthening against the dollar! Risk vs. Expected Return Risk - Expected Return Tradeoff: Expected return rises with an increase in risk. There is a direct ratio between risk and rate of return. The goal of an investor Expected risk will be is to maximize return incorporated into expected while minimizing risk. return, as taking on some risk is the price of obtaining returns. If you want to have greater returns, you must take on greater risk. Risk vs. Expected Return Risk vs. Expected Return The slope of the line can change over time. If the line gets steeper, investors are only willing to take on more risk if the return is much greater. With a flatter line, investors are willing to take on more risk for less additional potential return. Risk vs. Expected Return The red line shows the “Normal Economy” risk - return tradeoff in the economy. The blue line shows a “Booming Economy” where investors are willing to invest money, taking more risk and less additional return because times are so good they downplay the risk that something will go wrong. The green line shows a “Declining Economy” where an investor requires a greater additional return for taking on more risk. Risk vs. Expected Return * Safest places to put your money: Savings accounts (low risk, lower potential for return) | U.S. T-Bills | Bonds | Stocks (high risk, higher potential for return). Managing Risk Diversification: “Don’t put all of your eggs in one basket!” Diversification helps to decrease risk from a portfolio. It can be achieved by creating a portfolio that contains securities whose prices do not move in a similar manner when the economy changes. Managing Risk Through diversification, an investor can create a portfolio of high return and high risk securities, maintaining the higher return while reducing overall risk. Refer to the below chart: With the highest return and least risk, Portfolio B is the best. Although Portfolio B has the same risk as Portfolio A, it generates more return. Furthermore, it takes on less risk than Portfolio D and generates the same return. Lesson Summary 1 of 2 1. What is the relationship between the direction of interest rates and the market value of existing bonds? 2. What is the risk that a move in interest rates will cause an investor’s bonds to fall? 3. Which risks describes the possibility that the entity to whom you lent money can’t pay it back? 4. What do a situation where it becomes unusually difficult to sell an investment? 5. What risk involves the changing of our currency into another in order to invest? Lesson Summary 2 of 2 6. What is the relationship between the risk an investment has to its potential rate of return? 7. In bad economic times, what happens to the risk / return curve? 8. The most basic strategy for reducing risk is? 9. What is the ultimate goal for a portfolio? 10.What are the most common risks that can cause our expected return of an investment to be lower than the actual return? Web Challenge #1 Challenge: The Bureau of Labor Statistics (BLS) publishes the official Consumer Price Index (CPI) at http://www.bls.gov/cpi/. Find and document the annual inflation rate for each year over the last decade. Using this information, estimate the minimum coupon you would accept on a new 10-year bond investment (with an investment grade corporation), explaining why. Web Challenge #2 Challenge: Diversifying one’s holdings is the most basic form of risk reduction. Research the minimum number of different stocks and/or bonds that experts indicate will provide an investor a reasonable degree of diversification. Summarize the author’s reasoning as well as what parts you agree and disagree with. Web Challenge #3 Q: When a company defaults on its bonds, do bond investors lose everything? A:.Usually not. The corporation usually has assets that can be sold to pay the bondholders. The management of the company may negotiate the bondholders to take a portion of what they’re owed or to convert their bonds into stock. Challenge: Research three companies that have defaulted on their debt obligations in the last year. What have they offered bondholders? What have bondholders demanded?