TRMCX TRMIX TAMVX RRMVX Mid-Cap Value Fund Investor Class

... MidCap 400 Index or the Russell Midcap Value Index. As of December 31, 2016, the market capitalization ranges for the S&P MidCap 400 Index and the Russell Midcap Value Index were approximately $957.9 million to $13.4 billion, and $727.1 million to $39.6 billion, respectively. The market capitalizati ...

... MidCap 400 Index or the Russell Midcap Value Index. As of December 31, 2016, the market capitalization ranges for the S&P MidCap 400 Index and the Russell Midcap Value Index were approximately $957.9 million to $13.4 billion, and $727.1 million to $39.6 billion, respectively. The market capitalizati ...

Introduction to Share Buyback Valuation

... about USD 780b, made dividend payouts of about USD 280b and share buybacks of almost USD 400b.3 It is shown in the treatise that the companies in the S&P 500 index have had a historical tendency to increase share buybacks when the share price was high relative to the estimated value to long-term sha ...

... about USD 780b, made dividend payouts of about USD 280b and share buybacks of almost USD 400b.3 It is shown in the treatise that the companies in the S&P 500 index have had a historical tendency to increase share buybacks when the share price was high relative to the estimated value to long-term sha ...

Reforming Major Interest Rate Benchmarks

... The IOSCO review (mentioned under 1.) found that all three relevant administrators have made significant progress in implementing the majority of the Principles. Given the short timeframe, administrators have made good progress in implementing most of the governancerelated Principles and have mostl ...

... The IOSCO review (mentioned under 1.) found that all three relevant administrators have made significant progress in implementing the majority of the Principles. Given the short timeframe, administrators have made good progress in implementing most of the governancerelated Principles and have mostl ...

The Relationship Between Individual Stock Trading And Returns

... The Journal of Applied Business Research – November/December 2013 ...

... The Journal of Applied Business Research – November/December 2013 ...

call-for-input on the crowdfunding rules

... In March 2014, we said we would conduct a full post-implementation review of the regime and market in 2016, in particular in relation to investor protection. This paper is a call for evidence as part of that post-implementation review. In it, we summarise some of the changes we have seen in the mark ...

... In March 2014, we said we would conduct a full post-implementation review of the regime and market in 2016, in particular in relation to investor protection. This paper is a call for evidence as part of that post-implementation review. In it, we summarise some of the changes we have seen in the mark ...

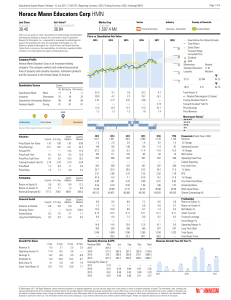

Horace Mann Educators Corp HMN

... their clients in making an investment decision. While Morningstar has obtained data, statistics and information from sources it believes to be reliable, Morningstar does not perform an audit or seeks independent verification of any of the data, statistics, and information it receives. The quantitati ...

... their clients in making an investment decision. While Morningstar has obtained data, statistics and information from sources it believes to be reliable, Morningstar does not perform an audit or seeks independent verification of any of the data, statistics, and information it receives. The quantitati ...

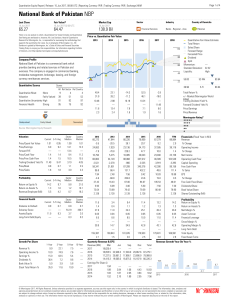

National Bank of Pakistan NBP

... their clients in making an investment decision. While Morningstar has obtained data, statistics and information from sources it believes to be reliable, Morningstar does not perform an audit or seeks independent verification of any of the data, statistics, and information it receives. The quantitati ...

... their clients in making an investment decision. While Morningstar has obtained data, statistics and information from sources it believes to be reliable, Morningstar does not perform an audit or seeks independent verification of any of the data, statistics, and information it receives. The quantitati ...

CHAPTER 5: RISK AND RETURN

... Next best are long-term bonds – but they break even (at best) after taxes and inflation Short-term Treasury bills and money market instruments deplete capital ...

... Next best are long-term bonds – but they break even (at best) after taxes and inflation Short-term Treasury bills and money market instruments deplete capital ...

INTER PIPELINE LTD. $3,000,000,000 Common Shares Preferred

... holders thereof will become entitled to receive Common Shares or such other securities, and any other terms specific to the Subscription Receipts being offered. Where required by statute, regulation or policy, and where Securities are offered in currencies other than Canadian dollars, appropriate di ...

... holders thereof will become entitled to receive Common Shares or such other securities, and any other terms specific to the Subscription Receipts being offered. Where required by statute, regulation or policy, and where Securities are offered in currencies other than Canadian dollars, appropriate di ...

Values Based Management_Text_4

... has an extensive history, it is not always understood in the same way by everyone in every situation. A wide range of well-known authors of economic theories refer to the term of value, inter alia V. Pareto, R. Valras, F. Quesnay, K. Marks, J.S. Mill, J. M. Keynes and many others. According to E. Ku ...

... has an extensive history, it is not always understood in the same way by everyone in every situation. A wide range of well-known authors of economic theories refer to the term of value, inter alia V. Pareto, R. Valras, F. Quesnay, K. Marks, J.S. Mill, J. M. Keynes and many others. According to E. Ku ...

What Does a Mutual Fund`s Average Credit Quality

... average credit quality calculation, any linear scheme will produce the claimed Average Credit Quality of AA. Putnam’s reported AA Average Credit Quality implies that the Income Fund’s probability of default or expected loss due to credit risk is equivalent to a portfolio of AA rated bonds. According ...

... average credit quality calculation, any linear scheme will produce the claimed Average Credit Quality of AA. Putnam’s reported AA Average Credit Quality implies that the Income Fund’s probability of default or expected loss due to credit risk is equivalent to a portfolio of AA rated bonds. According ...

IOSR Journal of Business and Management (IOSR-JBM)

... perfect market premise there will be free and speedy mobility of information from one person to another person in the market. Information will not be hidden or concealed for long. The information will be available to the market without any time lag. The free and quick flow of information facilitates ...

... perfect market premise there will be free and speedy mobility of information from one person to another person in the market. Information will not be hidden or concealed for long. The information will be available to the market without any time lag. The free and quick flow of information facilitates ...

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

... product offerings include canned, frozen and bottled produce and snack chips and its products are sold under private label as well as national and regional brands that the Company owns or licenses, including Seneca, Libby’s, Aunt Nellie’s Farm Kitchen, Stokely’s, Read, Taste of the West, Cimarron, a ...

... product offerings include canned, frozen and bottled produce and snack chips and its products are sold under private label as well as national and regional brands that the Company owns or licenses, including Seneca, Libby’s, Aunt Nellie’s Farm Kitchen, Stokely’s, Read, Taste of the West, Cimarron, a ...

Managers` Views on Dividend Policy of Nepalese Enterprises

... resources efficiently within the economies (Adhikari, 2013, p.333). However, investors consider several things before they invest their funds in any particular stocks available in the market. Among them, so far the most important subject matter is return from investment in stocks that partly depends ...

... resources efficiently within the economies (Adhikari, 2013, p.333). However, investors consider several things before they invest their funds in any particular stocks available in the market. Among them, so far the most important subject matter is return from investment in stocks that partly depends ...

MARKET INFORMATION AND THE ELITE LAW FIRM

... the benefits that law firms provide to their clients? Among law firms, what does the relative ranking or prestige of a law firm actually reflect? Although these questions are of enormous and urgent practical interest, the scholarship addressing them remains surprisingly limited. We can begin our inq ...

... the benefits that law firms provide to their clients? Among law firms, what does the relative ranking or prestige of a law firm actually reflect? Although these questions are of enormous and urgent practical interest, the scholarship addressing them remains surprisingly limited. We can begin our inq ...

Standard Bank Group

... and assurance. They have resources at the centre and embedded within the business lines. Central resources provide groupwide oversight of risks, while resources embedded within the business lines support management in ensuring that their specific risks are effectively managed as close to the source ...

... and assurance. They have resources at the centre and embedded within the business lines. Central resources provide groupwide oversight of risks, while resources embedded within the business lines support management in ensuring that their specific risks are effectively managed as close to the source ...

Portfolio Risk Calculation and Stochastic Portfolio Optimization by A

... 3. COPULA . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . ...

... 3. COPULA . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . ...

NBER WORKING PAPER SERIES ENDOGENOUS FINANCIAL AND TRADE OPENNESS Joshua Aizenman Ilan Noy

... financial and commercial integrations of developing countries and recurring financial instability and crises. These developments have led to contentious debates regarding the desirability of financial openness. Prominent economists have concluded that the gains from financial integration are illusiv ...

... financial and commercial integrations of developing countries and recurring financial instability and crises. These developments have led to contentious debates regarding the desirability of financial openness. Prominent economists have concluded that the gains from financial integration are illusiv ...

Client Assets - Bank of Ireland Private Banking

... document. Any investment, trading or hedging decision of a party will be based on their own judgement and not upon any view expressed by BOIPBL. Reference in this document to specific securities should not be construed as a recommendation to buy or sell these securities, but is included for the purp ...

... document. Any investment, trading or hedging decision of a party will be based on their own judgement and not upon any view expressed by BOIPBL. Reference in this document to specific securities should not be construed as a recommendation to buy or sell these securities, but is included for the purp ...