oecd economic outlook

... Macroeconomic policy is also faced with a more hazy picture of OECD economies’ supply capacity than previously. Both globalisation and structural reform have boosted potential growth rates in the past and will hopefully continue to do so. But sharply higher energy prices and higher costs of capital ...

... Macroeconomic policy is also faced with a more hazy picture of OECD economies’ supply capacity than previously. Both globalisation and structural reform have boosted potential growth rates in the past and will hopefully continue to do so. But sharply higher energy prices and higher costs of capital ...

Immigrants’ Access to Financial Services & Asset Accumulation

... samples wealthy households and second the SCF includes accounts that are likely to be held by wealthy individuals in its definition of transaction accounts (money market mutual funds and call accounts at brokerage firms, for example). In addition, even when sampling weights are used the SIPP under- ...

... samples wealthy households and second the SCF includes accounts that are likely to be held by wealthy individuals in its definition of transaction accounts (money market mutual funds and call accounts at brokerage firms, for example). In addition, even when sampling weights are used the SIPP under- ...

PROFILE OF KEY SENIOR MANAGEMENT

... namely Food and Beverages Malaysia (F&B Malaysia) which encompasses both Soft Drinks and Dairies Malaysia; Food and Beverages Thailand (F&B Thailand, previously known as Dairies Thailand); Property and Others segments. For F&B Malaysia, impacted by the weak consumer sentiment, revenue declined margi ...

... namely Food and Beverages Malaysia (F&B Malaysia) which encompasses both Soft Drinks and Dairies Malaysia; Food and Beverages Thailand (F&B Thailand, previously known as Dairies Thailand); Property and Others segments. For F&B Malaysia, impacted by the weak consumer sentiment, revenue declined margi ...

Corporate Risks and Property Insurance: Evidence From the

... companies’ unsystematic risks profile.11 The availability of property insurance coverage also enables managers of companies with high unsystematic risk to realize ex post economic advantages (e.g., less volatile net cash flows) following an asset-debilitating loss such as that arising from fire damage. ...

... companies’ unsystematic risks profile.11 The availability of property insurance coverage also enables managers of companies with high unsystematic risk to realize ex post economic advantages (e.g., less volatile net cash flows) following an asset-debilitating loss such as that arising from fire damage. ...

building today, for tomorrow - EZRA HOLDINGS LIMITED

... S$371 million market capitalisation at the time of its listing in 2005. Unitholders who have held MLT units since its listing would have enjoyed a total return of approximately 175%2, consisting of 83% in capital appreciation and a distribution yield of 92%. However, there have been some challenges ...

... S$371 million market capitalisation at the time of its listing in 2005. Unitholders who have held MLT units since its listing would have enjoyed a total return of approximately 175%2, consisting of 83% in capital appreciation and a distribution yield of 92%. However, there have been some challenges ...

The Diamond Investment Promise

... On the other side of the equation is demand. The leading consumer demand – by price point and growth – is bridal jewelry. In India, bridal jewelry is switching from gold to diamond jewelry; in China, diamond wedding rings are spreading from trend-setting Shanghai and Beijing to other urban areas; an ...

... On the other side of the equation is demand. The leading consumer demand – by price point and growth – is bridal jewelry. In India, bridal jewelry is switching from gold to diamond jewelry; in China, diamond wedding rings are spreading from trend-setting Shanghai and Beijing to other urban areas; an ...

Bank of England Inflation Report August 2006

... Uncertainty about growth and inflation may also have made equities less attractive to investors. Risk-averse investors typically demand higher returns from assets which offer an uncertain future return, such as equities. And this equity risk premium could have risen if perceptions of risk had increa ...

... Uncertainty about growth and inflation may also have made equities less attractive to investors. Risk-averse investors typically demand higher returns from assets which offer an uncertain future return, such as equities. And this equity risk premium could have risen if perceptions of risk had increa ...

LINCOLN NATIONAL CORP

... Changes in GAAP, including convergence with International Financial Reporting Standards, that may result in unanticipated changes to our net income; Lowering of one or more of our debt ratings issued by nationally recognized statistical rating organizations and the adverse effect such action may hav ...

... Changes in GAAP, including convergence with International Financial Reporting Standards, that may result in unanticipated changes to our net income; Lowering of one or more of our debt ratings issued by nationally recognized statistical rating organizations and the adverse effect such action may hav ...

Equity Risk Premiums (ERP)

... should examine the factors that determine equity risk premiums. After all, equity risk premiums should reflect not only the risk that investors see in equity investments but also the price they put on that risk. Risk Aversion The first and most critical factor, obviously, is the risk aversion of inv ...

... should examine the factors that determine equity risk premiums. After all, equity risk premiums should reflect not only the risk that investors see in equity investments but also the price they put on that risk. Risk Aversion The first and most critical factor, obviously, is the risk aversion of inv ...

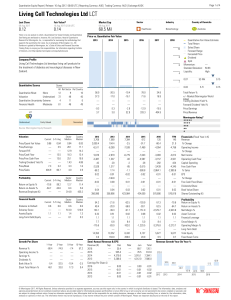

Living Cell Technologies Ltd LCT

... their clients in making an investment decision. While Morningstar has obtained data, statistics and information from sources it believes to be reliable, Morningstar does not perform an audit or seeks independent verification of any of the data, statistics, and information it receives. The quantitati ...

... their clients in making an investment decision. While Morningstar has obtained data, statistics and information from sources it believes to be reliable, Morningstar does not perform an audit or seeks independent verification of any of the data, statistics, and information it receives. The quantitati ...

Rentier Incomes and Financial Crises: An Empirical Examination of Trends... Cycles in Some OECD Countries

... countries for which we have sufficient data – Iceland, Spain, and Sweden experienced a decline in rentier share over those decades. Table 1 also presents data on the non-financial profits share for many of the countries in our sample. The final column of table 1 shows that out of the twelve countrie ...

... countries for which we have sufficient data – Iceland, Spain, and Sweden experienced a decline in rentier share over those decades. Table 1 also presents data on the non-financial profits share for many of the countries in our sample. The final column of table 1 shows that out of the twelve countrie ...

Firm Productivity, Innovation, and Financial Development

... development facilitates the reallocation of capital to high-growth industries, a result echoed in Hartman et al. (2007). The importance of this capital reallocation should not be underestimated. In fact, Hsieh and Klenow (2009) attribute the success of the past decade’s high performers— China and In ...

... development facilitates the reallocation of capital to high-growth industries, a result echoed in Hartman et al. (2007). The importance of this capital reallocation should not be underestimated. In fact, Hsieh and Klenow (2009) attribute the success of the past decade’s high performers— China and In ...

american capital agency corp. - corporate

... that at the time of purchase, we designate a security as held-to-maturity, available-for-sale or trading depending on our ability and intent to hold such security to maturity. Securities classified as trading and available-for-sale are reported at fair value, while securities classified as held-to-m ...

... that at the time of purchase, we designate a security as held-to-maturity, available-for-sale or trading depending on our ability and intent to hold such security to maturity. Securities classified as trading and available-for-sale are reported at fair value, while securities classified as held-to-m ...

Temperature, Aggregate Risk, and Expected Returns

... provide evidence that temperature raises expected equity returns and through this raises the cost of borrowing in the aggregate economy. Our evidence comes in two forms. First, using data on global capital markets and a cross-section of commonly used US stock portfolios, we find that the risk-exposu ...

... provide evidence that temperature raises expected equity returns and through this raises the cost of borrowing in the aggregate economy. Our evidence comes in two forms. First, using data on global capital markets and a cross-section of commonly used US stock portfolios, we find that the risk-exposu ...

QM 3.2 - SmallParty.org

... inside firms, in many cases it is valuable to simplify matters by assuming—as we will throughout this book—that firms act like optimizing individuals and that their objective is to maximize profit. An aside about individual people Economists say that optimizing individuals pursue utility maximizatio ...

... inside firms, in many cases it is valuable to simplify matters by assuming—as we will throughout this book—that firms act like optimizing individuals and that their objective is to maximize profit. An aside about individual people Economists say that optimizing individuals pursue utility maximizatio ...

4th yr Project - Department of Real Estate and Construction

... According to Mwaura (2006) Kenya has been urbanizing at 7 to 8 percent annually. According to GOK (2007) the proportion of the Kenyans living in urban areas is estimated to reach 60 per cent by the year 2030. Over the period 1979-1999 Nairobi City experienced high population growth rates that ranged ...

... According to Mwaura (2006) Kenya has been urbanizing at 7 to 8 percent annually. According to GOK (2007) the proportion of the Kenyans living in urban areas is estimated to reach 60 per cent by the year 2030. Over the period 1979-1999 Nairobi City experienced high population growth rates that ranged ...

Financial Development in Sub-Saharan Africa

... adoption of mobile banking technologies, as well as in areas where it is falling short. Finally, the paper also provides a detailed set of policy recommendations. Why should we care about financial development? There are many reasons why deeper financial development—the increase in deposits and loan ...

... adoption of mobile banking technologies, as well as in areas where it is falling short. Finally, the paper also provides a detailed set of policy recommendations. Why should we care about financial development? There are many reasons why deeper financial development—the increase in deposits and loan ...

Why is gold different from other assets? An

... These results support the notion that gold may be an effective portfolio diversifier. It is thought that the reasons which set gold apart from other commodities stem from three crucial attributes of gold: it is fungible, indestructible and, most importantly, the inventory of above-ground stocks of g ...

... These results support the notion that gold may be an effective portfolio diversifier. It is thought that the reasons which set gold apart from other commodities stem from three crucial attributes of gold: it is fungible, indestructible and, most importantly, the inventory of above-ground stocks of g ...

Ineffi cient Investment Waves - The University of Chicago Booth

... The presence of a two-sided externality radically changes the outcome of policy interventions. In general, policies targeted on raising prices in recessions help mitigate underinvestment, but make overinvestment in booms worse. As an example, consider a transfer scheme that does not allow the price ...

... The presence of a two-sided externality radically changes the outcome of policy interventions. In general, policies targeted on raising prices in recessions help mitigate underinvestment, but make overinvestment in booms worse. As an example, consider a transfer scheme that does not allow the price ...

2011 Annual Report (Opens in a new Window)

... Federal Funds Target Rate to 0.25% by year-end 2008 which was, at that time, its lowest point since 1955. Today, three years later, interest rates remain at very low levels, and per recent FOMC statements, these unprecedented low interest rates are expected to be in place until the end of 2014 – thr ...

... Federal Funds Target Rate to 0.25% by year-end 2008 which was, at that time, its lowest point since 1955. Today, three years later, interest rates remain at very low levels, and per recent FOMC statements, these unprecedented low interest rates are expected to be in place until the end of 2014 – thr ...

Chapter 10

... A measure often used by investors to evaluate the market price of a company’s ordinary shares. PowerPoint Slides t/a Accounting: What the Numbers Mean Marshall, McCartney, van Rhyn, McManus, Viele Slides prepared by Sandra Chapple Copyright 2005 McGraw-Hill Australia Pty Ltd ...

... A measure often used by investors to evaluate the market price of a company’s ordinary shares. PowerPoint Slides t/a Accounting: What the Numbers Mean Marshall, McCartney, van Rhyn, McManus, Viele Slides prepared by Sandra Chapple Copyright 2005 McGraw-Hill Australia Pty Ltd ...

Measuring and explaining the volatility of capital flows towards

... We distinguish between domestic macroeconomic and financial factors. The domestic macroeconomic variables considered are per capita GDP in levels and rates of growth to reflect both the level of economic development and dynamism of our sample countries; inflation and public deficits to capture the ‘qual ...

... We distinguish between domestic macroeconomic and financial factors. The domestic macroeconomic variables considered are per capita GDP in levels and rates of growth to reflect both the level of economic development and dynamism of our sample countries; inflation and public deficits to capture the ‘qual ...

The Economic Value of Natural and Built Coastal Assets

... example wastewater infrastructure, amenities, car parks, roads and bridges. In many cases, local authorities have responsibility for extensive coastal assets that will be at risk from climate change associated impacts (namely sea level rise and storm tide inundation), which places increasing pres ...

... example wastewater infrastructure, amenities, car parks, roads and bridges. In many cases, local authorities have responsibility for extensive coastal assets that will be at risk from climate change associated impacts (namely sea level rise and storm tide inundation), which places increasing pres ...