Substituted Compliance - Program on International Financial Systems

... same manner as domestic firms, and over the years has gone to considerable lengths to articulate bright-line rules that clearly define when foreign issuers will be subject to US regulation. So, for example, starting in the 1960s, most American firms with more than 500 shareholders and assets above a ...

... same manner as domestic firms, and over the years has gone to considerable lengths to articulate bright-line rules that clearly define when foreign issuers will be subject to US regulation. So, for example, starting in the 1960s, most American firms with more than 500 shareholders and assets above a ...

Dynamic Correlation or Tail Dependence Hedging for Portfolio

... From a modeling perspective, our paper is inspired by the large literature on modeling asset comovements. Popular choices for the time-varying correlation phenomenon are multivariate GARCH models (e.g. Bollerslev et al. (1988) or the principal component GARCH of Alexander (2002)), the parsimonious ...

... From a modeling perspective, our paper is inspired by the large literature on modeling asset comovements. Popular choices for the time-varying correlation phenomenon are multivariate GARCH models (e.g. Bollerslev et al. (1988) or the principal component GARCH of Alexander (2002)), the parsimonious ...

January 31, 2017 - Tortoise Index Solutions

... Non-U.S. Securities Risk. Investments in securities of non-U.S. issuers involve risks not ordinarily associated with investments in securities and instruments of U.S. issuers, including risks relating to political, social and economic developments abroad, differences between U.S. and foreign regula ...

... Non-U.S. Securities Risk. Investments in securities of non-U.S. issuers involve risks not ordinarily associated with investments in securities and instruments of U.S. issuers, including risks relating to political, social and economic developments abroad, differences between U.S. and foreign regula ...

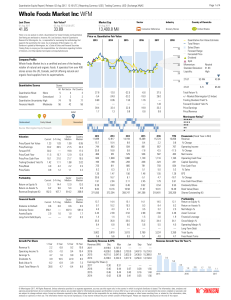

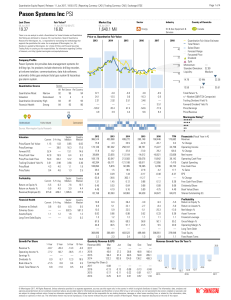

Whole Foods Market Inc WFM

... their clients in making an investment decision. While Morningstar has obtained data, statistics and information from sources it believes to be reliable, Morningstar does not perform an audit or seeks independent verification of any of the data, statistics, and information it receives. The quantitati ...

... their clients in making an investment decision. While Morningstar has obtained data, statistics and information from sources it believes to be reliable, Morningstar does not perform an audit or seeks independent verification of any of the data, statistics, and information it receives. The quantitati ...

Chapter 16 -- Operating and Financial Leverage

... Define, discuss, and quantify “total firm risk” and its two components, “business risk” and “financial risk.” Understand what is involved in determining the appropriate amount of financial leverage for a firm. ...

... Define, discuss, and quantify “total firm risk” and its two components, “business risk” and “financial risk.” Understand what is involved in determining the appropriate amount of financial leverage for a firm. ...

Low Correlation Strategy Trust Information Memorandum

... The law normally requires people who offer financial products to give information to investors before they invest. This requires those offering financial products to have disclosed information that is important for investors to make an informed decision. The usual rules do not apply to this offer be ...

... The law normally requires people who offer financial products to give information to investors before they invest. This requires those offering financial products to have disclosed information that is important for investors to make an informed decision. The usual rules do not apply to this offer be ...

Not All Benchmarks Are Created Equal

... For professional investors only. Not suitable for private customers. The information herein was obtained from various sources. We do not guarantee every aspect of its accuracy. The information is for your private information and is for discussion purposes only. A variety of market factors and assump ...

... For professional investors only. Not suitable for private customers. The information herein was obtained from various sources. We do not guarantee every aspect of its accuracy. The information is for your private information and is for discussion purposes only. A variety of market factors and assump ...

Optimal Federal Public Debt Composition

... Unit II: The Analytical Framework of the Federal Public Debt Benchmark With regard to defining an optimal long-term public debt composition (benchmark), it represents the desired profile for the debt structure and constitutes a guide for delineating the government's short and medium-term financing s ...

... Unit II: The Analytical Framework of the Federal Public Debt Benchmark With regard to defining an optimal long-term public debt composition (benchmark), it represents the desired profile for the debt structure and constitutes a guide for delineating the government's short and medium-term financing s ...

Belief Regimes and Sovereign Debt Crises

... emerging market spreads over benchmark risk-free bonds are volatile. Second, while large spikes in spreads are correlated with declines in output, the correlation is relatively weak. In fact, a sizable proportion of such spikes occur when growth is positive and in line with historical means. Third, ...

... emerging market spreads over benchmark risk-free bonds are volatile. Second, while large spikes in spreads are correlated with declines in output, the correlation is relatively weak. In fact, a sizable proportion of such spikes occur when growth is positive and in line with historical means. Third, ...

The Hedge Fund Edge

... promulgated under the Securities Act. Restrictions for such exemptions may involve a limit on the type or number of investors, the size of the offering, or interstate dealings. Under Section 5, hedge funds with U.S. investors typically rely on Rule 506. A key requirement under Rule 506 is the “accre ...

... promulgated under the Securities Act. Restrictions for such exemptions may involve a limit on the type or number of investors, the size of the offering, or interstate dealings. Under Section 5, hedge funds with U.S. investors typically rely on Rule 506. A key requirement under Rule 506 is the “accre ...

Self-esteem and Individual Wealth

... that they are in better control of their financial situation, leading to increased financial selfesteem. Risk reduction may be motivated by a desire to limit the drop in self-esteem that follows a negative outcome. Since the outcome of a choice can only be known in the future, most consumer purchase ...

... that they are in better control of their financial situation, leading to increased financial selfesteem. Risk reduction may be motivated by a desire to limit the drop in self-esteem that follows a negative outcome. Since the outcome of a choice can only be known in the future, most consumer purchase ...

Empirical Investigation of an Equity Pairs Trading Strategy

... recent liquidity crisis period. The evidence suggests that short-term liquidity provision is not the main reason for the pairs trading returns. Our paper extends the findings in Gatev, Goetzmann, and Rouwenhorst (2006), who show that there are abnormal returns from a return-based pairwise relative v ...

... recent liquidity crisis period. The evidence suggests that short-term liquidity provision is not the main reason for the pairs trading returns. Our paper extends the findings in Gatev, Goetzmann, and Rouwenhorst (2006), who show that there are abnormal returns from a return-based pairwise relative v ...

lot size conversion for certain ice futures us north american power

... 10. EMIR Transaction reporting for COB Monday 08 May 2017 will be on the converted positions. Clearing Members are reminded that any pre-migration post trade management actions on Affected Contracts at the Clearing House level and internally between client accounts should be processed at the correc ...

... 10. EMIR Transaction reporting for COB Monday 08 May 2017 will be on the converted positions. Clearing Members are reminded that any pre-migration post trade management actions on Affected Contracts at the Clearing House level and internally between client accounts should be processed at the correc ...

Trade and Capital Flows: A Financial Frictions Perspective

... In particular, we show that in this context trade and net capital ‡ows are complements in less …nancially developed economies. A …nancially underdeveloped economy that opens the capital account without liberalizing trade is likely to experience capital out‡ows. An aggressive trade liberalization can ...

... In particular, we show that in this context trade and net capital ‡ows are complements in less …nancially developed economies. A …nancially underdeveloped economy that opens the capital account without liberalizing trade is likely to experience capital out‡ows. An aggressive trade liberalization can ...

NBER WORKING PAPER SERIES TRADE AND CAPITAL FLOWS: A FINANCIAL FRICTIONS PERSPECTIVE

... In particular, we show that in this context trade and net capital ‡ows are complements in less …nancially developed economies. A …nancially underdeveloped economy that opens the capital account without liberalizing trade is likely to experience capital out‡ows. An aggressive trade liberalization can ...

... In particular, we show that in this context trade and net capital ‡ows are complements in less …nancially developed economies. A …nancially underdeveloped economy that opens the capital account without liberalizing trade is likely to experience capital out‡ows. An aggressive trade liberalization can ...

Risk Management, Governance, Culture, and Risk Taking in

... good risk on a standalone basis. This is because taking the good risk increases the total risk of the bank. At a point in time, how the risk of a project contributes to the total risk of the bank depends on the other risks the bank is exposed to at that time. Consequently, when risk taking is decent ...

... good risk on a standalone basis. This is because taking the good risk increases the total risk of the bank. At a point in time, how the risk of a project contributes to the total risk of the bank depends on the other risks the bank is exposed to at that time. Consequently, when risk taking is decent ...

Guidelines to Emerging Market Regulators

... Risk-based supervision i s r e g a r d e d t o h a v e evolved during the 1990s. However, its roots can be traced back to experiences resulting from a number of financial crises that occurred in the 1980s. Traditionally, supervisors focused on rule based system that relied on review of transactions ...

... Risk-based supervision i s r e g a r d e d t o h a v e evolved during the 1990s. However, its roots can be traced back to experiences resulting from a number of financial crises that occurred in the 1980s. Traditionally, supervisors focused on rule based system that relied on review of transactions ...

Complete issue

... and stable inflation is the most important contribution monetary policy can make to sound economic developments. This provides businesses and households with an anchor for inflation expectations. The inflation average has been around 2% over the past ten years, which is somewhat lower than, but fair ...

... and stable inflation is the most important contribution monetary policy can make to sound economic developments. This provides businesses and households with an anchor for inflation expectations. The inflation average has been around 2% over the past ten years, which is somewhat lower than, but fair ...