NBER WORKING PAPER SERIES ENDOGENOUS FINANCIAL AND TRADE OPENNESS Joshua Aizenman Ilan Noy

... financial and commercial integrations of developing countries and recurring financial instability and crises. These developments have led to contentious debates regarding the desirability of financial openness. Prominent economists have concluded that the gains from financial integration are illusiv ...

... financial and commercial integrations of developing countries and recurring financial instability and crises. These developments have led to contentious debates regarding the desirability of financial openness. Prominent economists have concluded that the gains from financial integration are illusiv ...

Client Assets - Bank of Ireland Private Banking

... document. Any investment, trading or hedging decision of a party will be based on their own judgement and not upon any view expressed by BOIPBL. Reference in this document to specific securities should not be construed as a recommendation to buy or sell these securities, but is included for the purp ...

... document. Any investment, trading or hedging decision of a party will be based on their own judgement and not upon any view expressed by BOIPBL. Reference in this document to specific securities should not be construed as a recommendation to buy or sell these securities, but is included for the purp ...

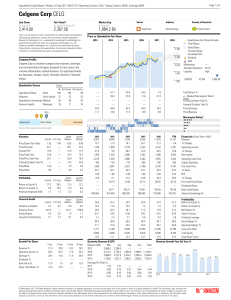

Celgene Corp CELG

... their clients in making an investment decision. While Morningstar has obtained data, statistics and information from sources it believes to be reliable, Morningstar does not perform an audit or seeks independent verification of any of the data, statistics, and information it receives. The quantitati ...

... their clients in making an investment decision. While Morningstar has obtained data, statistics and information from sources it believes to be reliable, Morningstar does not perform an audit or seeks independent verification of any of the data, statistics, and information it receives. The quantitati ...

Investment Decisions and Financial Standing of Portuguese Firms

... and Tirole (1997) works through a reduction in the supply of available resources to the credit market (be it a credit crunch, a collateral squeeze or a savings squeeze), showing that poorly capitalized firms suffer disproportionally. A particular feature of this model is that credit rationing might ...

... and Tirole (1997) works through a reduction in the supply of available resources to the credit market (be it a credit crunch, a collateral squeeze or a savings squeeze), showing that poorly capitalized firms suffer disproportionally. A particular feature of this model is that credit rationing might ...

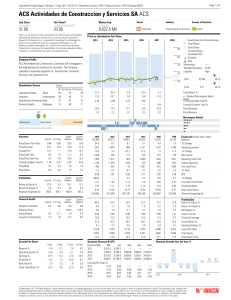

ACS Actividades de Construccion y Servicios SA ACS

... their clients in making an investment decision. While Morningstar has obtained data, statistics and information from sources it believes to be reliable, Morningstar does not perform an audit or seeks independent verification of any of the data, statistics, and information it receives. The quantitati ...

... their clients in making an investment decision. While Morningstar has obtained data, statistics and information from sources it believes to be reliable, Morningstar does not perform an audit or seeks independent verification of any of the data, statistics, and information it receives. The quantitati ...

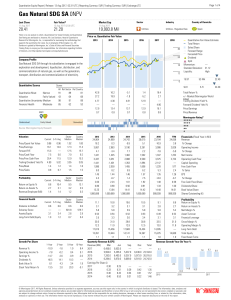

Gas Natural SDG SA 0NPV

... their clients in making an investment decision. While Morningstar has obtained data, statistics and information from sources it believes to be reliable, Morningstar does not perform an audit or seeks independent verification of any of the data, statistics, and information it receives. The quantitati ...

... their clients in making an investment decision. While Morningstar has obtained data, statistics and information from sources it believes to be reliable, Morningstar does not perform an audit or seeks independent verification of any of the data, statistics, and information it receives. The quantitati ...

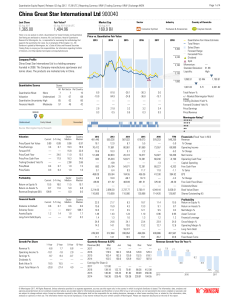

China Great Star International Ltd 900040

... their clients in making an investment decision. While Morningstar has obtained data, statistics and information from sources it believes to be reliable, Morningstar does not perform an audit or seeks independent verification of any of the data, statistics, and information it receives. The quantitati ...

... their clients in making an investment decision. While Morningstar has obtained data, statistics and information from sources it believes to be reliable, Morningstar does not perform an audit or seeks independent verification of any of the data, statistics, and information it receives. The quantitati ...

Frame - Frips

... mechanic can often diagnose a problem by the sound of an engine, and a physician who has seen many cases of congestive heart failure develops a good feel for how much diuretic to administer. Interestingly, Charlie Munger once stated: "Warren often talks about these discounted cash flows, but I've ne ...

... mechanic can often diagnose a problem by the sound of an engine, and a physician who has seen many cases of congestive heart failure develops a good feel for how much diuretic to administer. Interestingly, Charlie Munger once stated: "Warren often talks about these discounted cash flows, but I've ne ...

One Size Fits All? Costs and Benefits of Uniform Accounting Standards

... neoclassical approach to understand the economic consequences of a uniform accounting standard. Policymakers have often discussed the greater transparency and investor confidence as benefits of a single international accounting standard (e.g., Cox (2008) and Schapiro (2009)), and the empirical accou ...

... neoclassical approach to understand the economic consequences of a uniform accounting standard. Policymakers have often discussed the greater transparency and investor confidence as benefits of a single international accounting standard (e.g., Cox (2008) and Schapiro (2009)), and the empirical accou ...

Financial Investments, Information Flows, and Caste Affiliation

... Emerging economies are characterized by a limited participation of private households in financial markets (Honohan, 2008). On the one hand this might be explained by the relatively large fixed transaction costs associated with financial market participation (Cole et al., 2009). Especially poor indi ...

... Emerging economies are characterized by a limited participation of private households in financial markets (Honohan, 2008). On the one hand this might be explained by the relatively large fixed transaction costs associated with financial market participation (Cole et al., 2009). Especially poor indi ...

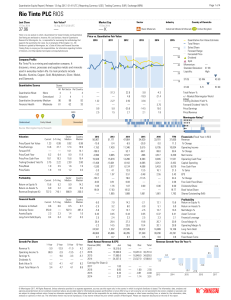

Rio Tinto PLC RIOS

... their clients in making an investment decision. While Morningstar has obtained data, statistics and information from sources it believes to be reliable, Morningstar does not perform an audit or seeks independent verification of any of the data, statistics, and information it receives. The quantitati ...

... their clients in making an investment decision. While Morningstar has obtained data, statistics and information from sources it believes to be reliable, Morningstar does not perform an audit or seeks independent verification of any of the data, statistics, and information it receives. The quantitati ...

What rate of return can we expect over the next decade?

... “fundamental” can be any variable that stock prices are expected to mean-revert towards, such as earnings, dividends, GDP, or similar. The stock-price multiple is the ratio of stock prices to the fundamental, such as the stock price-earnings multiple, stock price-dividend multiple, etc. Recognizing ...

... “fundamental” can be any variable that stock prices are expected to mean-revert towards, such as earnings, dividends, GDP, or similar. The stock-price multiple is the ratio of stock prices to the fundamental, such as the stock price-earnings multiple, stock price-dividend multiple, etc. Recognizing ...

What rate of return can we expect over the next decade?

... “fundamental” can be any variable that stock prices are expected to mean-revert towards, such as earnings, dividends, GDP, or similar. The stock-price multiple is the ratio of stock prices to the fundamental, such as the stock price-earnings multiple, stock price-dividend multiple, etc. Recognizing ...

... “fundamental” can be any variable that stock prices are expected to mean-revert towards, such as earnings, dividends, GDP, or similar. The stock-price multiple is the ratio of stock prices to the fundamental, such as the stock price-earnings multiple, stock price-dividend multiple, etc. Recognizing ...

presentation

... These forward-looking statements are based on a series of assumptions, both general and specific, in particular the application of accounting principles and methods in accordance with IFRS (International Financial Reporting Standards) as adopted in the European Union, as well as the application of e ...

... These forward-looking statements are based on a series of assumptions, both general and specific, in particular the application of accounting principles and methods in accordance with IFRS (International Financial Reporting Standards) as adopted in the European Union, as well as the application of e ...

Ch10

... • Derivatives allow risk about the value of the underlying asset to be transferred from one party to another. For example, a wheat farmer and a miller could sign a futures contract to exchange a specified amount of cash for a specified amount of wheat in the future. Both parties have reduced a futur ...

... • Derivatives allow risk about the value of the underlying asset to be transferred from one party to another. For example, a wheat farmer and a miller could sign a futures contract to exchange a specified amount of cash for a specified amount of wheat in the future. Both parties have reduced a futur ...

Intangible assets and SMEs

... The exit of SME owners from their businesses and transfer of these businesses to new owners are issues that are too often ignored within the business life cycle; much rhetoric is expended on start-up and growth but little on exit. Listed companies have well-established markets facilitating the trans ...

... The exit of SME owners from their businesses and transfer of these businesses to new owners are issues that are too often ignored within the business life cycle; much rhetoric is expended on start-up and growth but little on exit. Listed companies have well-established markets facilitating the trans ...

Individual vs. Aggregate Preferences

... Before proving our results formally as theorems, we discuss the economic intuition leading to our conclusions. Our claim is that perfect competition, market frictions, and agent heterogeneity, in addition to the shape of the utility function, all influence the allocation of resources that individual ...

... Before proving our results formally as theorems, we discuss the economic intuition leading to our conclusions. Our claim is that perfect competition, market frictions, and agent heterogeneity, in addition to the shape of the utility function, all influence the allocation of resources that individual ...

NBER WORKING PAPER SERIES FISCAL HEDGING AND THE YIELD CURVE Hanno Lustig

... spending shock by devaluing its nominal liabilities through an immediate inflation or through higher expected future inflation and higher future short run nominal interest rates1 , which in turn reduce the price of outstanding longer term debt today. We introduce two nominal rigidities that render v ...

... spending shock by devaluing its nominal liabilities through an immediate inflation or through higher expected future inflation and higher future short run nominal interest rates1 , which in turn reduce the price of outstanding longer term debt today. We introduce two nominal rigidities that render v ...

Pacific Catastrophe Risk Insurance Pilot

... PCRAFI began at the request of PICs at the 2006 World Bank/International Monetary Fund (IMF) Annual Meetings. It is an innovative program that builds on the principle of regional coordination and provides PICs with disaster risk modelling and assessment tools for enhanced disaster risk management an ...

... PCRAFI began at the request of PICs at the 2006 World Bank/International Monetary Fund (IMF) Annual Meetings. It is an innovative program that builds on the principle of regional coordination and provides PICs with disaster risk modelling and assessment tools for enhanced disaster risk management an ...

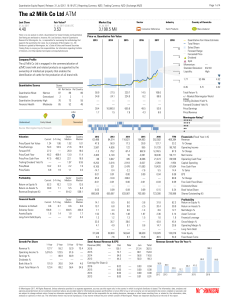

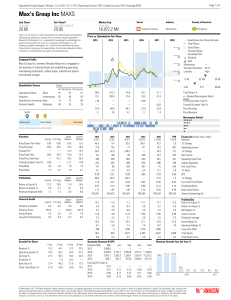

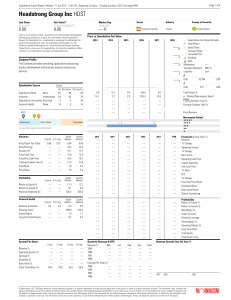

Headstrong Group Inc HDST

... investment research report that exceeds 0.5% of the total issued share capital of the security. To determine if such is the case, please click http://msi.morningstar.com and http://mdi.morningstar.com. The Head of Quantitative Research compensation is derived from Morningstar's overall earnings and ...

... investment research report that exceeds 0.5% of the total issued share capital of the security. To determine if such is the case, please click http://msi.morningstar.com and http://mdi.morningstar.com. The Head of Quantitative Research compensation is derived from Morningstar's overall earnings and ...

printmgr file - Goldman Sachs

... Unsecured short-term borrowings, net Other secured financings (short-term), net Proceeds from issuance of other secured financings (long-term) Repayment of other secured financings (long-term), including the current portion Proceeds from issuance of unsecured long-term borrowings Repayment of unsecu ...

... Unsecured short-term borrowings, net Other secured financings (short-term), net Proceeds from issuance of other secured financings (long-term) Repayment of other secured financings (long-term), including the current portion Proceeds from issuance of unsecured long-term borrowings Repayment of unsecu ...