n ation, Stock Prices And Leverage In Emerging Markets:

... prices and inflation using each Emerging Market stock as the cross-section unit. Second, I follow an aggregated market approach, in which capital weighted priceearning ratios are created. Third, a sector-country approach is used, which is similar to the previous one but aggregating weighted price-ea ...

... prices and inflation using each Emerging Market stock as the cross-section unit. Second, I follow an aggregated market approach, in which capital weighted priceearning ratios are created. Third, a sector-country approach is used, which is similar to the previous one but aggregating weighted price-ea ...

Spatial competition among multi

... mill pricing and spatial discriminatory pricing, outlets of competing firms never agglomerate. In contrast, under Cournot competition, outlets of competing firms may agglomerate at finitely many market points; a result that is consistent with the clustering of stores of competing firms at various sh ...

... mill pricing and spatial discriminatory pricing, outlets of competing firms never agglomerate. In contrast, under Cournot competition, outlets of competing firms may agglomerate at finitely many market points; a result that is consistent with the clustering of stores of competing firms at various sh ...

EAST WEST BANCORP INC (Form: 10-Q, Received

... verbs. You should not place undue reliance on these statements, as they are subject to risks and uncertainties, including, but not limited to, those described in the documents incorporated by reference. When considering these forward-looking statements, you should keep in mind these risks and uncert ...

... verbs. You should not place undue reliance on these statements, as they are subject to risks and uncertainties, including, but not limited to, those described in the documents incorporated by reference. When considering these forward-looking statements, you should keep in mind these risks and uncert ...

The Relationship between Ownership Structure and Dividend Policy

... expertise and due to the importance of their investment in the company [24]. This influence over management affects a company’s dividend policy. According to Aguenaou et al. [1], institutional investors exert pressure so they can receive a high level of dividends in order to reduce agency costs; thi ...

... expertise and due to the importance of their investment in the company [24]. This influence over management affects a company’s dividend policy. According to Aguenaou et al. [1], institutional investors exert pressure so they can receive a high level of dividends in order to reduce agency costs; thi ...

- amtek holdings berhad

... The Audit Committee is appointed by the Board of Directors from amongst their members and shall comprise of not less than three (3) members of whom a majority shall be Independent Non-Executive Directors of the Company. The members of the Audit Committee shall elect a Chairman from among their numbe ...

... The Audit Committee is appointed by the Board of Directors from amongst their members and shall comprise of not less than three (3) members of whom a majority shall be Independent Non-Executive Directors of the Company. The members of the Audit Committee shall elect a Chairman from among their numbe ...

Long-Term and Global Tradeoffs between Bio

... their likely impact on the rest of agriculture. Questions such as how large the ethanol and biodiesel sectors will become and their impact on corn and soybean markets have increased in importance as these sectors have grown. The large run-up in corn and soybean meal prices will have important impact ...

... their likely impact on the rest of agriculture. Questions such as how large the ethanol and biodiesel sectors will become and their impact on corn and soybean markets have increased in importance as these sectors have grown. The large run-up in corn and soybean meal prices will have important impact ...

Regulatory Capital Requirements for Microinsurance in the

... made of assets that are not admitted for purposes of assessing solvency Liabilities should be valued using a gross premium method and currently-realistic assumptions; Until a gross premium valuation basis is in place, consideration should be given to requiring life insurers to test the sufficien ...

... made of assets that are not admitted for purposes of assessing solvency Liabilities should be valued using a gross premium method and currently-realistic assumptions; Until a gross premium valuation basis is in place, consideration should be given to requiring life insurers to test the sufficien ...

Are the Golden Years of Central Banking Over?

... order to support aggregate demand. These quantitative easing policies blur the distinction between monetary and fiscal policy and so make the concept of central bank independence problematic, to say the least. The Report also identifies other challenges, which though less pressing, are likely to pro ...

... order to support aggregate demand. These quantitative easing policies blur the distinction between monetary and fiscal policy and so make the concept of central bank independence problematic, to say the least. The Report also identifies other challenges, which though less pressing, are likely to pro ...

Bank of England Inflation Report February 2011

... profile is markedly higher than in November, largely reflecting further rises in commodity and import prices since then. Further ahead, inflation is likely to fall back, as those effects diminish and downward pressure from spare capacity persists. But both the timing and extent of that decline in in ...

... profile is markedly higher than in November, largely reflecting further rises in commodity and import prices since then. Further ahead, inflation is likely to fall back, as those effects diminish and downward pressure from spare capacity persists. But both the timing and extent of that decline in in ...

Securities and Secrets: Insider Trading and the Law of Contracts

... protective the security rules are of investors' interests, the less likely they are to shy away from the capital market. 15 More frequently, however, commentators treat fairness as a distinct goal of securities law.1" Yet, these commentators have not struggled with a definition of fairness, but have ...

... protective the security rules are of investors' interests, the less likely they are to shy away from the capital market. 15 More frequently, however, commentators treat fairness as a distinct goal of securities law.1" Yet, these commentators have not struggled with a definition of fairness, but have ...

Regime Switching in Volatilities and Correlation between Stock and Bond markets

... The correlation between bond and stock markets plays an important role in asset allocation as well as risk management. In tranquil time, investors would choose to invest more in equity markets to seek higher returns while they might "‡ee" to bond markets in turbulent market condition. So accurate mo ...

... The correlation between bond and stock markets plays an important role in asset allocation as well as risk management. In tranquil time, investors would choose to invest more in equity markets to seek higher returns while they might "‡ee" to bond markets in turbulent market condition. So accurate mo ...

Commonalities and Prescriptions in the Vertical Dimension of Global

... corporate governance practices exists both within a particular country as well as across national borders. Second, the various legal systems that relate to corporate governance aim at protecting different interests, and they do so in diverse ways. A national model simply cannot incorporate all of th ...

... corporate governance practices exists both within a particular country as well as across national borders. Second, the various legal systems that relate to corporate governance aim at protecting different interests, and they do so in diverse ways. A national model simply cannot incorporate all of th ...

Economics of Money, Banking, and Financial Markets, 8e

... A) A liquid asset is one that can be quickly and cheaply converted into cash. B) The demand for a bond declines when it becomes less liquid, decreasing the interest rate spread between it and relatively more liquid bonds. C) The differences in bond interest rates reflect differences in default risk ...

... A) A liquid asset is one that can be quickly and cheaply converted into cash. B) The demand for a bond declines when it becomes less liquid, decreasing the interest rate spread between it and relatively more liquid bonds. C) The differences in bond interest rates reflect differences in default risk ...

The Link between IPO Underpricing and Trading Volume: Evidence

... between underwriter’s trading profits and IPO underpricing. Based on the second explanation, higher liquidity is not a goal but a by-product as it is argued by Reese (2003). The reasoning relies on the book-building model of Benveniste and Spindt (1989). In their model, underwriters of initial publi ...

... between underwriter’s trading profits and IPO underpricing. Based on the second explanation, higher liquidity is not a goal but a by-product as it is argued by Reese (2003). The reasoning relies on the book-building model of Benveniste and Spindt (1989). In their model, underwriters of initial publi ...

Economics of Money, Banking, and Financial Markets, 8e

... 31) When the expected inflation rate increases, the demand for bonds ________, the supply of bonds ________, and the interest rate ________, everything else held constant. A) increases; increases; rises B) decreases; decreases; falls C) increases; decreases; falls D) decreases; increases; rises Answ ...

... 31) When the expected inflation rate increases, the demand for bonds ________, the supply of bonds ________, and the interest rate ________, everything else held constant. A) increases; increases; rises B) decreases; decreases; falls C) increases; decreases; falls D) decreases; increases; rises Answ ...

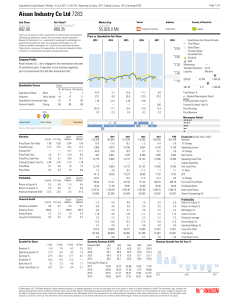

Aisan Industry Co Ltd 7283

... their clients in making an investment decision. While Morningstar has obtained data, statistics and information from sources it believes to be reliable, Morningstar does not perform an audit or seeks independent verification of any of the data, statistics, and information it receives. The quantitati ...

... their clients in making an investment decision. While Morningstar has obtained data, statistics and information from sources it believes to be reliable, Morningstar does not perform an audit or seeks independent verification of any of the data, statistics, and information it receives. The quantitati ...

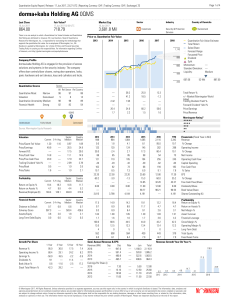

dorma+kaba Holding AG 0QMS

... their clients in making an investment decision. While Morningstar has obtained data, statistics and information from sources it believes to be reliable, Morningstar does not perform an audit or seeks independent verification of any of the data, statistics, and information it receives. The quantitati ...

... their clients in making an investment decision. While Morningstar has obtained data, statistics and information from sources it believes to be reliable, Morningstar does not perform an audit or seeks independent verification of any of the data, statistics, and information it receives. The quantitati ...

Target price forecasts: Fundamentals and behavioural factor

... Finally, we find a positive association between target prices and future stock returns. However, this association is significantly weaker when the 52-week high is high relative to the current price and when recent market sentiment is relatively more positive. Thus, while target price forecasts appe ...

... Finally, we find a positive association between target prices and future stock returns. However, this association is significantly weaker when the 52-week high is high relative to the current price and when recent market sentiment is relatively more positive. Thus, while target price forecasts appe ...

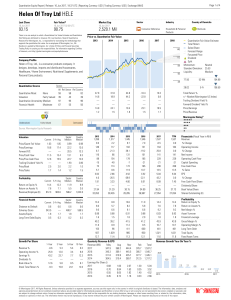

Helen Of Troy Ltd HELE

... their clients in making an investment decision. While Morningstar has obtained data, statistics and information from sources it believes to be reliable, Morningstar does not perform an audit or seeks independent verification of any of the data, statistics, and information it receives. The quantitati ...

... their clients in making an investment decision. While Morningstar has obtained data, statistics and information from sources it believes to be reliable, Morningstar does not perform an audit or seeks independent verification of any of the data, statistics, and information it receives. The quantitati ...