Lecture Five

... Is the condition of zero alphas for all stocks as implied by the CAPM met Not perfect but one of the best available Is the CAPM testable Proxies must be used for the market portfolio CAPM is still considered the best available description of security pricing and is widely accepted ...

... Is the condition of zero alphas for all stocks as implied by the CAPM met Not perfect but one of the best available Is the CAPM testable Proxies must be used for the market portfolio CAPM is still considered the best available description of security pricing and is widely accepted ...

Week 2: Information Risk and Corporate Governance

... Were these high risk bets due only to perverse incentives in compensation contracts or did moral hazard play a role? The effects are hard to separate. When firms are “too big to fail” some firms appear to take actions that put the risk of bad outcomes on the government (and ultimately on taxpayers). ...

... Were these high risk bets due only to perverse incentives in compensation contracts or did moral hazard play a role? The effects are hard to separate. When firms are “too big to fail” some firms appear to take actions that put the risk of bad outcomes on the government (and ultimately on taxpayers). ...

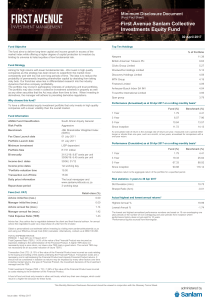

First Avenue Sanlam Collective Investments Equity Fund

... SA. Collective investment schemes are generally medium- to long-term investments. Please note that past performance is not necessarily a guide to future performance, and that the value of investments / units / unit trusts may go down as well as up. A schedule of fees and charges and maximum commissi ...

... SA. Collective investment schemes are generally medium- to long-term investments. Please note that past performance is not necessarily a guide to future performance, and that the value of investments / units / unit trusts may go down as well as up. A schedule of fees and charges and maximum commissi ...

Chapter 1: Introduction

... A Review of Some Financial Economics Principles Arbitrage: A market situation whereby an investor can make a profit with: no equity and no risk. Efficiency: A market is said to be efficient if prices are such that there exist no arbitrage opportunities. Alternatively, a market is said to be ineffic ...

... A Review of Some Financial Economics Principles Arbitrage: A market situation whereby an investor can make a profit with: no equity and no risk. Efficiency: A market is said to be efficient if prices are such that there exist no arbitrage opportunities. Alternatively, a market is said to be ineffic ...

Synopsis_2014_v3 ed 7 and 8

... The course is mixing “The History of Financial Crises” and “The Risk management of Financial Institutions”. Given the recent financial crises, which is not over yet, this course is very up to date with the present situation. You will get both an historical perspective and learn about the (perhaps) i ...

... The course is mixing “The History of Financial Crises” and “The Risk management of Financial Institutions”. Given the recent financial crises, which is not over yet, this course is very up to date with the present situation. You will get both an historical perspective and learn about the (perhaps) i ...

The Economic Situation - Reserve Bank of Australia

... contemplated in a number of countries. The question is how much scope the relevant governments have for such actions, before encountering the potential limits to credibility of their own balance sheets. Those who already had largish deficits – which will get bigger as economic activity weakens – and ...

... contemplated in a number of countries. The question is how much scope the relevant governments have for such actions, before encountering the potential limits to credibility of their own balance sheets. Those who already had largish deficits – which will get bigger as economic activity weakens – and ...

Technical Market Overview

... the market digests various factors it now deems important, or it may be the beginning of a normal correction in equity prices. Furthermore, it is important here to note that, historically, when the market ignores substantive economic data and then alternately adjust its outlook based on factors prev ...

... the market digests various factors it now deems important, or it may be the beginning of a normal correction in equity prices. Furthermore, it is important here to note that, historically, when the market ignores substantive economic data and then alternately adjust its outlook based on factors prev ...

Not Too Hot, Not Too Cold (with the exception of Japan)

... Buying commodities allows for a source of diversification for those sophisticated persons who wish to add this asset class to their portfolios and who are prepared to assume the risks inherent in the commodities market. Any commodity purchase represents a transaction in a non-incomeproducing asset a ...

... Buying commodities allows for a source of diversification for those sophisticated persons who wish to add this asset class to their portfolios and who are prepared to assume the risks inherent in the commodities market. Any commodity purchase represents a transaction in a non-incomeproducing asset a ...

EDITOR`S CORNER Managing Investments for

... evaluated regularly, it is also important to recognize that the whims of the capital markets can bring about extended shortfalls on any single metric. Imagine two strategies, each of which is “perfect” for one of the first two objectives. ■ Model Portfolio 1. The first strategy begins with an assump ...

... evaluated regularly, it is also important to recognize that the whims of the capital markets can bring about extended shortfalls on any single metric. Imagine two strategies, each of which is “perfect” for one of the first two objectives. ■ Model Portfolio 1. The first strategy begins with an assump ...

FRBSF E L CONOMIC ETTER

... drop in risk-free Treasury rates have been offset in many cases by another key feature of the financial turmoil, namely, a sharp rise in interest rate risk spreads, as riskier borrowers have had to pay higher premiums to compensate lenders for a perceived increase in the probability of default or lo ...

... drop in risk-free Treasury rates have been offset in many cases by another key feature of the financial turmoil, namely, a sharp rise in interest rate risk spreads, as riskier borrowers have had to pay higher premiums to compensate lenders for a perceived increase in the probability of default or lo ...

World Economic Situation and Prospects 2004

... Global financial assets Global merchandise trade )Global financial assets as a percentage of GDP (right axis )Global merchandise trade as a percentage of GDP (right axis ...

... Global financial assets Global merchandise trade )Global financial assets as a percentage of GDP (right axis )Global merchandise trade as a percentage of GDP (right axis ...

CONDUCT, PERFORMANCE AND DISCIPLINARY PROCEDURE

... As part of a supportive, well established and high-performing team, to advise mainly borrowers, and occasionally lenders, on their debt financing arrangements including accessing the debt capital markets, secured funding, refinancing, banking contracts and acquisition finance. ...

... As part of a supportive, well established and high-performing team, to advise mainly borrowers, and occasionally lenders, on their debt financing arrangements including accessing the debt capital markets, secured funding, refinancing, banking contracts and acquisition finance. ...

ps1_2008_solutions

... Vertical differentiation in automobiles demands a more detailed analysis by different segments Breakfast cereals are offered to consumers in a wide range of products with different features (horizontal differentiation). Perhaps the different types of products should be studied individually as th ...

... Vertical differentiation in automobiles demands a more detailed analysis by different segments Breakfast cereals are offered to consumers in a wide range of products with different features (horizontal differentiation). Perhaps the different types of products should be studied individually as th ...

The Risk-Return Relationship in Asean-5 Stock Markets

... Figure 1. The Risk Premium of the ASEAN-5 Stock Exchanges using all assets in each stock exchange Considering the top 100 assets in 2012, only in Thailand and the Philippines are the market risk premium found to be positive, though not significant, whereas negative risk premiums are found in other t ...

... Figure 1. The Risk Premium of the ASEAN-5 Stock Exchanges using all assets in each stock exchange Considering the top 100 assets in 2012, only in Thailand and the Philippines are the market risk premium found to be positive, though not significant, whereas negative risk premiums are found in other t ...

Investors want active management

... While investors had become wary due to recent market volatility, 45 per cent of respondents believed recent market falls were a short-term correction. "This volatility also presents a strong case for active management to take advantage of price movements," Legg Mason Australia head Annalisa Clark sa ...

... While investors had become wary due to recent market volatility, 45 per cent of respondents believed recent market falls were a short-term correction. "This volatility also presents a strong case for active management to take advantage of price movements," Legg Mason Australia head Annalisa Clark sa ...

Asset_Pricing_Theori..

... • mt+1 (stochastic discount factor; pricing kernel) is the same across all assets at time t+1 • It values future payoffs by “discounting” them back to the present, with adjustment for risk: ...

... • mt+1 (stochastic discount factor; pricing kernel) is the same across all assets at time t+1 • It values future payoffs by “discounting” them back to the present, with adjustment for risk: ...

TLS Call for Application_Code 0105_ 20-12-05 1

... Field of Activity _______________________________________________________ ...

... Field of Activity _______________________________________________________ ...