INTERPRETATION AND METHODOLOGY Financial ratios Return

... Price-To-Book Ratio (P/B Ratio) A ratio used to compare a stock's market value to its book value. It is calculated by dividing the share price at the end of the period and the book value per share. Calculated as: ...

... Price-To-Book Ratio (P/B Ratio) A ratio used to compare a stock's market value to its book value. It is calculated by dividing the share price at the end of the period and the book value per share. Calculated as: ...

10-CAPM

... • FROM CHAPTER 8 – assumed return on a risky asset was related to the return on a market index ...

... • FROM CHAPTER 8 – assumed return on a risky asset was related to the return on a market index ...

Commodities and Sentiment

... The information herein is not intended to be an offer to buy or sell, or a solicitation of an offer to buy or sell, any securities or other financial instrument and including any expression of opinion, has been obtained from or is based upon sources believed to be reliable but is not guaranteed as t ...

... The information herein is not intended to be an offer to buy or sell, or a solicitation of an offer to buy or sell, any securities or other financial instrument and including any expression of opinion, has been obtained from or is based upon sources believed to be reliable but is not guaranteed as t ...

Livestock Pricing

... Then users of the goods, i.e., the ones using negotiated prices in formulas, do not have to pay for them and benefit from not having to discover prices. ...

... Then users of the goods, i.e., the ones using negotiated prices in formulas, do not have to pay for them and benefit from not having to discover prices. ...

The land of the rising sun

... This information is of a general nature only and has been prepared without taking into account the objectives, financial situation or needs of any particular person. Before acting on the information, a person should consider its appropriateness having regard to these factors. Advance Asset Managemen ...

... This information is of a general nature only and has been prepared without taking into account the objectives, financial situation or needs of any particular person. Before acting on the information, a person should consider its appropriateness having regard to these factors. Advance Asset Managemen ...

Charting and Technical Analysis

... Behavioral basis: If you decide to use a charting pattern or technical indicator, you need to be aware of the investor behavior that gives rise to its success. You can modify or abandon the indicator if the underlying behavior changes. Don’t trust, verify: It is important that you back-test your ind ...

... Behavioral basis: If you decide to use a charting pattern or technical indicator, you need to be aware of the investor behavior that gives rise to its success. You can modify or abandon the indicator if the underlying behavior changes. Don’t trust, verify: It is important that you back-test your ind ...

Correlation of Risks, Integrating Risk Measurement – Risk

... A supervisory tool that identifies thrifts with excessive interest rate risk A starting point for assessing the quality of interest rate risk management practices at individual thrifts Identify outlier thrifts that need more supervisory attention Identify systemic interest rate risk trends wit ...

... A supervisory tool that identifies thrifts with excessive interest rate risk A starting point for assessing the quality of interest rate risk management practices at individual thrifts Identify outlier thrifts that need more supervisory attention Identify systemic interest rate risk trends wit ...

1. value: 3.00 points Investors expect the market rate of return this

... Suppose investors believe the stock will sell for $53 at year-end. Is the stock a good or bad buy? What will investors do? ...

... Suppose investors believe the stock will sell for $53 at year-end. Is the stock a good or bad buy? What will investors do? ...

Fair value - fek.zcu.cz

... or cash equivalents that could currently be obtained by selling the asset in an orderly disposal. Assets are carried at the present discounted value of the future net cash inflows that the item is expected to generate in the normal course of business. Liabilities are carried at the present discounte ...

... or cash equivalents that could currently be obtained by selling the asset in an orderly disposal. Assets are carried at the present discounted value of the future net cash inflows that the item is expected to generate in the normal course of business. Liabilities are carried at the present discounte ...

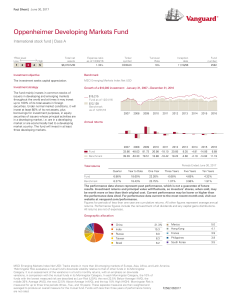

Oppenheimer Developing Markets Fund - Vanguard

... social, regulatory, and political risks of that region, as well as the Chinese government’s significant level of control over China’s economy and currency. A disruption of relations between China and its neighbors or trading partners could severely impact China’s export-based economy. Small Cap: Con ...

... social, regulatory, and political risks of that region, as well as the Chinese government’s significant level of control over China’s economy and currency. A disruption of relations between China and its neighbors or trading partners could severely impact China’s export-based economy. Small Cap: Con ...

Slide 1

... • In the US interest is tax deductible but rent is not • This creates a significant incentive to turn rent payments into tax deductible interest payments • This is what 100% mortgages do ...

... • In the US interest is tax deductible but rent is not • This creates a significant incentive to turn rent payments into tax deductible interest payments • This is what 100% mortgages do ...

Systematic and Unsystematic Risk

... R + U (expected + unexpected) Investors form “expectations” about future Expected information is already discounted by the market • i.e., the value of the information is already incorporated into the stock prices • Attempts to exploit Public information (make large returns) will not be successful C ...

... R + U (expected + unexpected) Investors form “expectations” about future Expected information is already discounted by the market • i.e., the value of the information is already incorporated into the stock prices • Attempts to exploit Public information (make large returns) will not be successful C ...

The Returns and Risks From Investing

... Management, Tenth Edition, John Wiley & Sons Prepared by G.D. Koppenhaver, Iowa State University ...

... Management, Tenth Edition, John Wiley & Sons Prepared by G.D. Koppenhaver, Iowa State University ...

Getting a Read on Risk

... is a lot of the topic of my recent book, is that if we examine what the central banks are doing—which is trying to manipulate and control the economy under conventional economic theory—those actions should not be necessary if the economy is self-stabilizing. We have a quite fascinating confusion at ...

... is a lot of the topic of my recent book, is that if we examine what the central banks are doing—which is trying to manipulate and control the economy under conventional economic theory—those actions should not be necessary if the economy is self-stabilizing. We have a quite fascinating confusion at ...

Traditional insurance products will not go out of vogue - Sa-Dhan

... The markets are showing volatile patterns. There are many options across asset classes available to the investors. Puneet Nanda, chief investment officer, ICICI Prudential Life Insurance Company, shares his expert opinion on some of the issues raised by FE Investor. Excerpts: What is your outlook on ...

... The markets are showing volatile patterns. There are many options across asset classes available to the investors. Puneet Nanda, chief investment officer, ICICI Prudential Life Insurance Company, shares his expert opinion on some of the issues raised by FE Investor. Excerpts: What is your outlook on ...