V Seminário sobre Riscos, Estabilidade Financeira e Economia

... However, the reader would benefit from a paper revision. First, the exposition of the model and the results can be improved. For example: • You do not define theta and gamma in the theoretical model. I had to read the paper Dubey, Geanakoplos and Shubik (2005) to understand this point. You should de ...

... However, the reader would benefit from a paper revision. First, the exposition of the model and the results can be improved. For example: • You do not define theta and gamma in the theoretical model. I had to read the paper Dubey, Geanakoplos and Shubik (2005) to understand this point. You should de ...

IFAMA 2015: Creating a new market mechanism for regaining trust

... was known to all parties involved, today this knowledge is obscured. There is no longer a one-to-one relation between traders and produce. Traders negotiate a price for produce they themselves still need to acquire. This in itself is not a problem - current demand is higher than present production. ...

... was known to all parties involved, today this knowledge is obscured. There is no longer a one-to-one relation between traders and produce. Traders negotiate a price for produce they themselves still need to acquire. This in itself is not a problem - current demand is higher than present production. ...

Course Outline School of Business and Economics FNCE 4190

... Upon completing this course, students will be able to: ...

... Upon completing this course, students will be able to: ...

Financial Markets - North Clackamas School District

... What Kind of Return Do You Want? ◦ Safe investments have lowest return through fixed interest rates ◦ Stocks, bonds—no guaranteed rates; stocks—higher return over time ◦ If investing over long period, can risk losses in stock some years if less time and money, may want safer investment ...

... What Kind of Return Do You Want? ◦ Safe investments have lowest return through fixed interest rates ◦ Stocks, bonds—no guaranteed rates; stocks—higher return over time ◦ If investing over long period, can risk losses in stock some years if less time and money, may want safer investment ...

Price Differentiation

... In freight transport, a higher discount, if a shipper commits to a higher volume over a time period Combining different terms and discount structures leads to a very wide variety of volume discount schemes (Nagle and Holden, 1994) (Wilson, 1993), in order to ...

... In freight transport, a higher discount, if a shipper commits to a higher volume over a time period Combining different terms and discount structures leads to a very wide variety of volume discount schemes (Nagle and Holden, 1994) (Wilson, 1993), in order to ...

AEP One Page Report

... cheap gas prices are shifting the focus to natural gas fired plants, while renewable fuels sources are also receiving attention. Extreme temperature swings and population growth are all factors that influence revenue for utilities. Investment Thesis: Among the electric utilities AEP has demonstrated ...

... cheap gas prices are shifting the focus to natural gas fired plants, while renewable fuels sources are also receiving attention. Extreme temperature swings and population growth are all factors that influence revenue for utilities. Investment Thesis: Among the electric utilities AEP has demonstrated ...

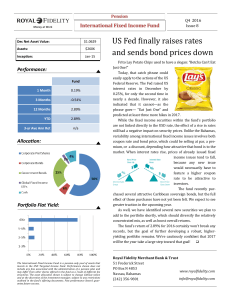

US Fed finally raises rates and sends bond prices down

... Federal Reserve. The Fed raised US interest rates in December by 0.25%, for only the second time in nearly a decade. However, it also indicated that it cannot—as the phrase goes— “Eat Just One” and predicted at least three more hikes in 2017. While the fixed income securities within the fund’s portf ...

... Federal Reserve. The Fed raised US interest rates in December by 0.25%, for only the second time in nearly a decade. However, it also indicated that it cannot—as the phrase goes— “Eat Just One” and predicted at least three more hikes in 2017. While the fixed income securities within the fund’s portf ...

Unemployment, Vacancies, Wages

... • Real Business Cycles (RBC) • Dynamic Stochastic General Equilibrium (DSGE): money; market clearing and sticky price/wage versions ...

... • Real Business Cycles (RBC) • Dynamic Stochastic General Equilibrium (DSGE): money; market clearing and sticky price/wage versions ...

2. MLS Agents Are Excited About Your Home

... The job of an agent is to report to sellers what home buyers are willing to pay for a home at a specific point in time. Who Then Controls Price? Generally speaking, it is the overall economic condition of the economy itself and the local user market. Who Is The Local User Market? It consists of buye ...

... The job of an agent is to report to sellers what home buyers are willing to pay for a home at a specific point in time. Who Then Controls Price? Generally speaking, it is the overall economic condition of the economy itself and the local user market. Who Is The Local User Market? It consists of buye ...

3rd Quarter - Legacy Asset Management

... business with tax cuts and incentives for capital investment, earnings growth and valuations should gain momentum. In the short-term, we will be looking for opportunities to sell our cost basis in securities that have jumped in the recent market rally and reinvest resources into unloved or ignored d ...

... business with tax cuts and incentives for capital investment, earnings growth and valuations should gain momentum. In the short-term, we will be looking for opportunities to sell our cost basis in securities that have jumped in the recent market rally and reinvest resources into unloved or ignored d ...

Chapter 2

... • The value of the company’s stock would be $57.14 million. This is the expected market value given the variables that we have assumed. However, this may not be the maximum value the company could achieve. The variables in the equation may have to change. Because k is a function of the company’s lev ...

... • The value of the company’s stock would be $57.14 million. This is the expected market value given the variables that we have assumed. However, this may not be the maximum value the company could achieve. The variables in the equation may have to change. Because k is a function of the company’s lev ...

Chapter 17

... increasingly obvious the market is overvalued, no one really knows at the time when it will turn around. They just tell you later that they knew. • Debate continues on whether the Fed should step in more vigorously and keep these bubbles from forming. How could it do that? Very simply: raise the mar ...

... increasingly obvious the market is overvalued, no one really knows at the time when it will turn around. They just tell you later that they knew. • Debate continues on whether the Fed should step in more vigorously and keep these bubbles from forming. How could it do that? Very simply: raise the mar ...

Change of Time Method in Mathematical Finance

... Process’, Proc. N.A.S. USA, v. 35)-introduced the notion of change of time (CT) (time-changed Brownian motion) Bochner (1955) (‘Harmonic Analysis and the Theory of Probability’, UCLA Press, 176)-further development of CT Feller (1966) (‘An Introduction to Probability Theory’, vol. II, NY: Wiley) ...

... Process’, Proc. N.A.S. USA, v. 35)-introduced the notion of change of time (CT) (time-changed Brownian motion) Bochner (1955) (‘Harmonic Analysis and the Theory of Probability’, UCLA Press, 176)-further development of CT Feller (1966) (‘An Introduction to Probability Theory’, vol. II, NY: Wiley) ...

Discussion of External Constraints on Monetary Policy and the Financial Accelerator

... (i) Scope of Regime Comparisons in This Paper Paper compares fixed rates with one particular form of flexible rates under two specific shocks. This is a little narrow: • The form of flexibility can matter a lot: E.g. money ...

... (i) Scope of Regime Comparisons in This Paper Paper compares fixed rates with one particular form of flexible rates under two specific shocks. This is a little narrow: • The form of flexibility can matter a lot: E.g. money ...

Economies - JMSC Courses

... The report included heavy revisions to prior months' data and some methodology changes. On balance, the job picture in recent months looked stronger after the changes. Prices of U.S. Treasuries eased after the report as traders scaled back expectations of the extent of additional rate cuts by the Fe ...

... The report included heavy revisions to prior months' data and some methodology changes. On balance, the job picture in recent months looked stronger after the changes. Prices of U.S. Treasuries eased after the report as traders scaled back expectations of the extent of additional rate cuts by the Fe ...

The U.S. is engaged in a mortal economic game

... 97.3 billion in pension money for retired state employees, and invests another $ 25.3 billion for school districts and state and local governments. A close friend of mine sat on the Board for ten years. Auditors warned them year after year about complex and high-risk investments but these warnings ...

... 97.3 billion in pension money for retired state employees, and invests another $ 25.3 billion for school districts and state and local governments. A close friend of mine sat on the Board for ten years. Auditors warned them year after year about complex and high-risk investments but these warnings ...

Strategic Finanancial Management

... investment. The standard deviation is a measure to determine the risk of the actual returns based upon expected variables. These expectations are not always correct. Moreover, these economic situations and returns are only expectations of what are to take place in the future, and cannot be the sole ...

... investment. The standard deviation is a measure to determine the risk of the actual returns based upon expected variables. These expectations are not always correct. Moreover, these economic situations and returns are only expectations of what are to take place in the future, and cannot be the sole ...

“International” Finance?

... Crossing, managers may pursue their own private interests at the expense of shareholders when they are not closely monitored. These calamities have painfully reinforced the importance of corporate governance i.e. the financial and legal framework for regulating the relationship between a firm’s mana ...

... Crossing, managers may pursue their own private interests at the expense of shareholders when they are not closely monitored. These calamities have painfully reinforced the importance of corporate governance i.e. the financial and legal framework for regulating the relationship between a firm’s mana ...

Reduce Prescription Drug Prices

... several neurology medications. For example, two multiple sclerosis drugs accounted for $1.9 billion in Medicare Part D catastrophic coverage in 2015 with average monthly prices of $5,600 each. This reflects an 84 percent increase in price from 2010 to 2015. Recently approved therapies for Duchenne m ...

... several neurology medications. For example, two multiple sclerosis drugs accounted for $1.9 billion in Medicare Part D catastrophic coverage in 2015 with average monthly prices of $5,600 each. This reflects an 84 percent increase in price from 2010 to 2015. Recently approved therapies for Duchenne m ...

Dan diBartolomeo

... – It should also be noted that a market capitalization weighted portfolio of high sustainability stocks produce both higher returns and lower risk than the S&P 500. These results ignore trading costs which are apt to be very substantial in the case of equal weighted portfolios – Leveraging up the eq ...

... – It should also be noted that a market capitalization weighted portfolio of high sustainability stocks produce both higher returns and lower risk than the S&P 500. These results ignore trading costs which are apt to be very substantial in the case of equal weighted portfolios – Leveraging up the eq ...

Chapter 3: The IS

... • It is the situation in which the money demand is perfectly elastic. Usually, liquidity trap occurs at very low interest rate. • An increase in money supply cannot change the interest rate when there is a liquidity trap. • When there is a liquidity trap, the fiscal policy is more effective since th ...

... • It is the situation in which the money demand is perfectly elastic. Usually, liquidity trap occurs at very low interest rate. • An increase in money supply cannot change the interest rate when there is a liquidity trap. • When there is a liquidity trap, the fiscal policy is more effective since th ...