Extending Factor Models of Equity Risk to Credit Risk, Default Correlation, and Corporate Sustainability

... We propose “revenue weighted” expected average life as a measure of systemic stress on an economy By revenue weighting we capture the stress in the real economy Avoids bias of cap weighting since failing firm’s have small market capitalization and don’t count as much ...

... We propose “revenue weighted” expected average life as a measure of systemic stress on an economy By revenue weighting we capture the stress in the real economy Avoids bias of cap weighting since failing firm’s have small market capitalization and don’t count as much ...

draft1 140212

... Market Portfolio Theory (MPT). However over this period Anglo’s returns have been less, generating a -0.14 (%?) return and 0.02 risk which equates to a -7.57 gradient, weaker than the market. However within the last 6 months the return has been 0.04 and 0.02 risk giving a 6 month gradient of 0.44 sh ...

... Market Portfolio Theory (MPT). However over this period Anglo’s returns have been less, generating a -0.14 (%?) return and 0.02 risk which equates to a -7.57 gradient, weaker than the market. However within the last 6 months the return has been 0.04 and 0.02 risk giving a 6 month gradient of 0.44 sh ...

Lecture 6 Classification of Interest Rate Models

... • Designed to be exactly consistent with current term structure of interest rates • Current term structure is an input • Useful for valuing interest rate contingent securities • Requires frequent recalibration to use model over any length of time • Difficult to use for time series modeling ...

... • Designed to be exactly consistent with current term structure of interest rates • Current term structure is an input • Useful for valuing interest rate contingent securities • Requires frequent recalibration to use model over any length of time • Difficult to use for time series modeling ...

Bonds Payable * A corporate debt

... If market rate > stated rate, issue at a discount If market rate < stated rate, issue at a premium ...

... If market rate > stated rate, issue at a discount If market rate < stated rate, issue at a premium ...

Natural Gas Price/Supply Assessment Information Wholesale Market

... market for delivery tomorrow (actual transportation may delay that “tomorrow” for up to three days here) and a financial futures market for defining prices and quantities to guide contracts for future physical delivery next month, next winter, or next year (the market actually goes out three years, ...

... market for delivery tomorrow (actual transportation may delay that “tomorrow” for up to three days here) and a financial futures market for defining prices and quantities to guide contracts for future physical delivery next month, next winter, or next year (the market actually goes out three years, ...

GLOSSARY OF KEY TERMS DISCUSSED IN

... A bank account which allows instant access to deposits. Interest is subject to change and is not fixed unlike usual investments. Capital Financing Requirement (CFR) The underlying need to borrow for capital purposes derived from the Council’s balance sheet. At its simplest level this is simply the v ...

... A bank account which allows instant access to deposits. Interest is subject to change and is not fixed unlike usual investments. Capital Financing Requirement (CFR) The underlying need to borrow for capital purposes derived from the Council’s balance sheet. At its simplest level this is simply the v ...

Domestic Bank Regulation and Financial Crises: Theory and

... do, and what role they play in the build-up of an unsustainable lending boom. What we still don’t quite understand is why guarantees, implicit or explicit, are extended in the first place (and even when there is a good story to explain their presence, the literature has been agnostic on why they wor ...

... do, and what role they play in the build-up of an unsustainable lending boom. What we still don’t quite understand is why guarantees, implicit or explicit, are extended in the first place (and even when there is a good story to explain their presence, the literature has been agnostic on why they wor ...

Recent Financial Turmoil - What`s New by Dr Peter

... Mankiw (1986) analyzes a credit market plagued by lemons problems……a small rise in the riskless interest rate can lead to collapse. The increase in the loan rate reduces the average quality of borrowers. This forces the loan rate up further to offset the lemons effect. If the lemons problem is sever ...

... Mankiw (1986) analyzes a credit market plagued by lemons problems……a small rise in the riskless interest rate can lead to collapse. The increase in the loan rate reduces the average quality of borrowers. This forces the loan rate up further to offset the lemons effect. If the lemons problem is sever ...

The Role and functions of a stock exchange

... a stock exchange cont’d Provides a physical location for buying and selling securities that have been listed for trading on that exchange ...

... a stock exchange cont’d Provides a physical location for buying and selling securities that have been listed for trading on that exchange ...

Price

... time before lowering prices to more competitive levels •Ex: iPhone, new albums, movies ...

... time before lowering prices to more competitive levels •Ex: iPhone, new albums, movies ...

File

... • Harder to calculate financial costs of creating a service process or performance than a manufactured good • Variability of inputs and outputs: – How can firms define a “unit of service” and establish basis for pricing? ...

... • Harder to calculate financial costs of creating a service process or performance than a manufactured good • Variability of inputs and outputs: – How can firms define a “unit of service” and establish basis for pricing? ...

The Structure and Performance of Securities Markets

... Expect to earn a profit by “buying low and selling high” Take a risk on a change of price in the securities they own ...

... Expect to earn a profit by “buying low and selling high” Take a risk on a change of price in the securities they own ...

Equity Risk, Credit Risk, Default Correlation, and Corporate Sustainability

... covariance with the market value of debt – When interest rates rise equity values usually drop, but market value of debt definitely declines, reducing leverage – Convert to pair-wise asset correlation values ...

... covariance with the market value of debt – When interest rates rise equity values usually drop, but market value of debt definitely declines, reducing leverage – Convert to pair-wise asset correlation values ...

Presentation (PowerPoint File)

... portfolio (where X = X1 + X2 + … + XD is the set of “firm-achievable” random variables), and let XdXd be such that X1+…+XD=X*. ...

... portfolio (where X = X1 + X2 + … + XD is the set of “firm-achievable” random variables), and let XdXd be such that X1+…+XD=X*. ...

Value Versus Growth - CORDA Investment Management

... and pays attention to his dividend returns and to the operating results of his companies.” 2015 was a case study exactly to that regard. The Dow Jones Industrial average and the S&P 500 Index both finished the year about where they first started. The path along the way, 252 trading days in all, was ...

... and pays attention to his dividend returns and to the operating results of his companies.” 2015 was a case study exactly to that regard. The Dow Jones Industrial average and the S&P 500 Index both finished the year about where they first started. The path along the way, 252 trading days in all, was ...

Everything You Wanted to Know about Asset Management for

... with the market value of debt When interest rates rise equity values usually drop, but market value of debt definitely declines, reducing leverage Convert to pair-wise asset correlation values ...

... with the market value of debt When interest rates rise equity values usually drop, but market value of debt definitely declines, reducing leverage Convert to pair-wise asset correlation values ...

Extending Factor Models of Equity Risk to Credit Risk and Default Correlation

... with the market value of debt When interest rates rise equity values usually drop, but market value of debt definitely declines, reducing leverage Convert to pair-wise asset correlation values ...

... with the market value of debt When interest rates rise equity values usually drop, but market value of debt definitely declines, reducing leverage Convert to pair-wise asset correlation values ...

FRBSF E L CONOMIC ETTER

... est rate premium is enough to offset the increased demand for foreign funds, implying consumers borrow less during economic downturns than during upturns. Contagion and external factors Currency and banking crises in emerging market economies have tended to be bunched together over the last decade. ...

... est rate premium is enough to offset the increased demand for foreign funds, implying consumers borrow less during economic downturns than during upturns. Contagion and external factors Currency and banking crises in emerging market economies have tended to be bunched together over the last decade. ...

New Financial Intermediaries: Private Equity and the Corporation

... High free cash flow to repay debt Debt disciplines managers; requires shareholder focus LBO movement ended in scandal, replaced in 1990s by PE ...

... High free cash flow to repay debt Debt disciplines managers; requires shareholder focus LBO movement ended in scandal, replaced in 1990s by PE ...

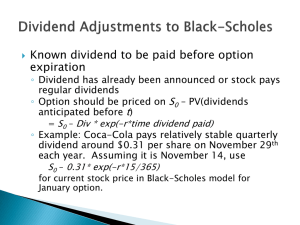

Option Price and Portfolio Simulation

... stock having the same volatility as the stock on which the option is written and growing at the risk-free rate of interest. The cash flows are discounted continuously at the risk-free rate The option price does not depend on the growth rate of the stock! ...

... stock having the same volatility as the stock on which the option is written and growing at the risk-free rate of interest. The cash flows are discounted continuously at the risk-free rate The option price does not depend on the growth rate of the stock! ...