BM 418 Personal Finance

... 10. You are the CFO ACE Manufacturing Company, a family-owned manufacturing firm in Utah. It has been around for a while, with 6 million shares outstanding and a book value per share of $40. It has expected earnings per share next year of $2. You know that similar companies trade in the US at a pros ...

... 10. You are the CFO ACE Manufacturing Company, a family-owned manufacturing firm in Utah. It has been around for a while, with 6 million shares outstanding and a book value per share of $40. It has expected earnings per share next year of $2. You know that similar companies trade in the US at a pros ...

Real versus Financial Assets

... Informational Role of Financial Markets • If a firm performing well, investors will bid up ,on the other hand, a company’s prospects seem poor, investors will bid down • However, Some companies can be “hot” for a short period of time, attract a large flow of investor capital, and then fail after onl ...

... Informational Role of Financial Markets • If a firm performing well, investors will bid up ,on the other hand, a company’s prospects seem poor, investors will bid down • However, Some companies can be “hot” for a short period of time, attract a large flow of investor capital, and then fail after onl ...

EC381: Financial and Capital Markets

... each is trying to achieve by their purchase of sale of bonds. ...

... each is trying to achieve by their purchase of sale of bonds. ...

Investment Insights CIO REPORTS

... sector concentration. Investments in real estate securities can be subject to fluctuations in the value of the underlying properties, the effect of economic conditions on real estate values, changes in interest rates, and risk related to renting properties, such as rental defaults. There are special ...

... sector concentration. Investments in real estate securities can be subject to fluctuations in the value of the underlying properties, the effect of economic conditions on real estate values, changes in interest rates, and risk related to renting properties, such as rental defaults. There are special ...

The Impact of Macroeconomic Instability on the Banking Sector

... In this paper, Samuelson by utilizing the Ricardian theory of comparative advantage has investigated the impact of economic growth of china on American economy which has been significant in recent decades. He has considered the various assumptions regarding the economic relation of China with Americ ...

... In this paper, Samuelson by utilizing the Ricardian theory of comparative advantage has investigated the impact of economic growth of china on American economy which has been significant in recent decades. He has considered the various assumptions regarding the economic relation of China with Americ ...

Macromodels at Central Banks: Quo Vadis?

... One important agenda for future research is to include measures of expectations in our estimation strategies: • Del Negro and Eusepi (2009):Tests for alternative theories of expectation formation for inflation. • This will also help in better identifying “news” shocks. ...

... One important agenda for future research is to include measures of expectations in our estimation strategies: • Del Negro and Eusepi (2009):Tests for alternative theories of expectation formation for inflation. • This will also help in better identifying “news” shocks. ...

January 31, 2013 Good Morning: The equity markets continue to

... Stage II is marked by growing confidence among all investors which should drive equity prices significantly higher. It is stage III that will prove worrisome. It is the speculative stage when the markets uncouple from reality. Stage I [fear] is when pessimism dominates investor psyches so that they ...

... Stage II is marked by growing confidence among all investors which should drive equity prices significantly higher. It is stage III that will prove worrisome. It is the speculative stage when the markets uncouple from reality. Stage I [fear] is when pessimism dominates investor psyches so that they ...

Corporate Finance Chap 1

... sources of financing (from internal financing to equity) according to the law of least effort, or of least resistance, preferring to raise equity as a financing means “of last resort”. Once internal funds have been used and on its depletion, debts are issued, and when it is not sensible to issue any ...

... sources of financing (from internal financing to equity) according to the law of least effort, or of least resistance, preferring to raise equity as a financing means “of last resort”. Once internal funds have been used and on its depletion, debts are issued, and when it is not sensible to issue any ...

S t

... Uses risk-neutral probabilities, and therefore risk-free discount rate Distribution of payoffs a byproduct Pricing of asset claims and assessing the risks of the asset Control variate method increases conversion speed Incorporate jumps by mixing Poisson and lognormal variables Simulated correlated r ...

... Uses risk-neutral probabilities, and therefore risk-free discount rate Distribution of payoffs a byproduct Pricing of asset claims and assessing the risks of the asset Control variate method increases conversion speed Incorporate jumps by mixing Poisson and lognormal variables Simulated correlated r ...

CV sample

... Supervised a three-professional-team to undertake due diligence and to wrap up an investment memo for a newspaper client's restructuring and back door listing process Advised FTSE 100 client on a $200 MM acquisition of a smaller competitor, supervising due diligence, financial valuation and mode ...

... Supervised a three-professional-team to undertake due diligence and to wrap up an investment memo for a newspaper client's restructuring and back door listing process Advised FTSE 100 client on a $200 MM acquisition of a smaller competitor, supervising due diligence, financial valuation and mode ...

Public Policy and Financial Crises

... Economic changes can make asymmetric information problems more severe, resulting in a higher risk of a crisis A financial crisis becomes more likely, where financial institutions lose a large part of their value In that case the financial system will not be able to channel funds effectively to ...

... Economic changes can make asymmetric information problems more severe, resulting in a higher risk of a crisis A financial crisis becomes more likely, where financial institutions lose a large part of their value In that case the financial system will not be able to channel funds effectively to ...

Other Portfolio Selection Models

... analysis Define efficient sets under alternative assumptions about general characteristics of investor’s utility function – Three stronger assumptions • First Order: non-satiation • Second Order: risk averse (includes first) • Third Order: decreasing absolute risk aversion (includes previous two) ...

... analysis Define efficient sets under alternative assumptions about general characteristics of investor’s utility function – Three stronger assumptions • First Order: non-satiation • Second Order: risk averse (includes first) • Third Order: decreasing absolute risk aversion (includes previous two) ...

INFINZ talk

... and some commentators argue the fallout from sub-prime and the credit crunch that followed represents a huge change in financial fundamentals that is likely to run for some time yet. ...

... and some commentators argue the fallout from sub-prime and the credit crunch that followed represents a huge change in financial fundamentals that is likely to run for some time yet. ...

Becoming an Expert Investor: Combining Analysis and Intuition

... • Industry-wide focus on narrow financial indicators of corporate performance • Diversity siphoned from investment ...

... • Industry-wide focus on narrow financial indicators of corporate performance • Diversity siphoned from investment ...

ASYMPTOTIC FORMULAS FOR THE IMPLIED VOLATILITY AT

... studied standard deviations of asset returns, which are implied in actual call option prices when investors price options according to the Black-Scholes model. For a general model of call option prices, the implied volatility can be obtained by inverting the Black-Scholes call pricing function with ...

... studied standard deviations of asset returns, which are implied in actual call option prices when investors price options according to the Black-Scholes model. For a general model of call option prices, the implied volatility can be obtained by inverting the Black-Scholes call pricing function with ...

I thought love would last forever: I was wrong

... Both diversification and return are tough to find. Years of watching central bank super heroes forcibly inflate the prices of fixed income securities everywhere has left mere mortals scavenging amongst the leftovers. In an equity market context, this has left real estate, infrastructure, healthcare ...

... Both diversification and return are tough to find. Years of watching central bank super heroes forcibly inflate the prices of fixed income securities everywhere has left mere mortals scavenging amongst the leftovers. In an equity market context, this has left real estate, infrastructure, healthcare ...

SOA Exam MFE Flash Cards

... Above: A gap option must be exercised when S K1 for a call or S K1 for a put. Since the owner can lose money at exercise, the term “option” is a bit of a misnomer. This possible negative payoff is reflected in a lower option price. Exchange Option An exchange option, also called an outperforman ...

... Above: A gap option must be exercised when S K1 for a call or S K1 for a put. Since the owner can lose money at exercise, the term “option” is a bit of a misnomer. This possible negative payoff is reflected in a lower option price. Exchange Option An exchange option, also called an outperforman ...

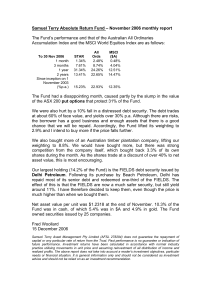

November 2006 - Samuel Terry

... chance that we will be repaid. Accordingly, the Fund lifted its weighting to 2.9% and I intend to buy more if the price falls further. We also bought more of an Australian timber plantation company, lifting our weighting to 8.8%. We would have bought more, but there was strong competition from the c ...

... chance that we will be repaid. Accordingly, the Fund lifted its weighting to 2.9% and I intend to buy more if the price falls further. We also bought more of an Australian timber plantation company, lifting our weighting to 8.8%. We would have bought more, but there was strong competition from the c ...

Money and Investing - St. John the Baptist Diocesan High School

... price and the purchase price that results in the financial gain of the seller. (per share) Capital losses – difference between the selling price and the purchase price that results in the financial loss of the seller. (per share) ...

... price and the purchase price that results in the financial gain of the seller. (per share) Capital losses – difference between the selling price and the purchase price that results in the financial loss of the seller. (per share) ...

MAY 2010. FINAL doc - Institute of Bankers in Malawi

... an investment. Financial risk is measured by the standard deviation and the coefficient of variation. Non financial risk is exposure to uncertainty which is non monetary in nature, e.g. health and safety risk. Return refers to the capital appreciation or loss in the form of cash dividends or interes ...

... an investment. Financial risk is measured by the standard deviation and the coefficient of variation. Non financial risk is exposure to uncertainty which is non monetary in nature, e.g. health and safety risk. Return refers to the capital appreciation or loss in the form of cash dividends or interes ...