FRBSF E L CONOMIC ETTER

... to help financial markets function in an orderly way, supervising and regulating banks and bank holding companies to ensure the safety and soundness of the banking system, and conducting monetary policy to achieve its congressionally mandated goals of price stability and maximum sustainable output a ...

... to help financial markets function in an orderly way, supervising and regulating banks and bank holding companies to ensure the safety and soundness of the banking system, and conducting monetary policy to achieve its congressionally mandated goals of price stability and maximum sustainable output a ...

Olivia de Posson joins DWC LLP as Head of Marketing

... We are pleased to announce the arrival of Olivia de Posson as Head of Marketing at Digital World Capital. Prior to DWC, Olivia led Sales and Marketing at Acheron Capital, an Alternative Asset Manager with a focus on Private Debt. Previously, she setup a Financial Executive Search business and lectur ...

... We are pleased to announce the arrival of Olivia de Posson as Head of Marketing at Digital World Capital. Prior to DWC, Olivia led Sales and Marketing at Acheron Capital, an Alternative Asset Manager with a focus on Private Debt. Previously, she setup a Financial Executive Search business and lectur ...

Materials - StevensonHighSchoolScienceClub

... financial market. In order to make the model more accurate and fitting, it is necessary to develop models that take into consideration assumptions not addressed or fully addressed by the BlackScholes model. Many models, which are variants of the Black-Scholes model, have been proposed over time, wit ...

... financial market. In order to make the model more accurate and fitting, it is necessary to develop models that take into consideration assumptions not addressed or fully addressed by the BlackScholes model. Many models, which are variants of the Black-Scholes model, have been proposed over time, wit ...

The Returns and Risks From Investing

... Risk is the chance that the actual outcome is different than the expected ...

... Risk is the chance that the actual outcome is different than the expected ...

Key Contributors Economy

... recommendation. Individuals should consult with their investment adviser regarding their particular circumstances. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, accounting, legal or tax advice. Conte ...

... recommendation. Individuals should consult with their investment adviser regarding their particular circumstances. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, accounting, legal or tax advice. Conte ...

Commodity market prices

... But while average prices and returns may be higher over the long run, volatility is also expected to be elevated. For example, in some instances the speed of expected demand growth relative to capacity combined with input supply problems would increase the frequency of intermittent supply shortages ...

... But while average prices and returns may be higher over the long run, volatility is also expected to be elevated. For example, in some instances the speed of expected demand growth relative to capacity combined with input supply problems would increase the frequency of intermittent supply shortages ...

sia perspectives - Stegner Investment Associates, Inc.

... rate at which depository institutions lend balances at the Fed to other depository institutions overnight. Changes in the federal funds rate trigger a chain of events that affect other short-term interest rates, foreign exchange rates, long-term interest rates, the amount of money and credit, and, u ...

... rate at which depository institutions lend balances at the Fed to other depository institutions overnight. Changes in the federal funds rate trigger a chain of events that affect other short-term interest rates, foreign exchange rates, long-term interest rates, the amount of money and credit, and, u ...

Risks in International Investing

... $2.00 / £. The one year forward exchange rate for the pound is $1.95/£. • How can you earn a riskless arbitrage profit based on these quotes? 1.Borrow $1 at 6.15%: Will owe $1.0615 in one year 2.Convert $1 to pounds: $1 / $2.00/£ = £0.50 3.Invest £0.50 at 10%: Will yield £.50 x 1.10 = £0.55. 4.Sell ...

... $2.00 / £. The one year forward exchange rate for the pound is $1.95/£. • How can you earn a riskless arbitrage profit based on these quotes? 1.Borrow $1 at 6.15%: Will owe $1.0615 in one year 2.Convert $1 to pounds: $1 / $2.00/£ = £0.50 3.Invest £0.50 at 10%: Will yield £.50 x 1.10 = £0.55. 4.Sell ...

1) Corporate financial plans are often used as a basis

... 1) Corporate financial plans are often used as a basis for judging subsequent performance. What can be learned from such comparisons? What problems might arise and how might you cope with such problems? The ability to meet or exceed the targets embodied in a financial plan is obviously a reassuring ...

... 1) Corporate financial plans are often used as a basis for judging subsequent performance. What can be learned from such comparisons? What problems might arise and how might you cope with such problems? The ability to meet or exceed the targets embodied in a financial plan is obviously a reassuring ...

Finance&ExcelCh10

... • 20 – 40 years or so: split the difference between them • 40 + years: use the geometric ...

... • 20 – 40 years or so: split the difference between them • 40 + years: use the geometric ...

Module 22 Financial Sector

... • Reducing Risk • Providing Liquidity (The ease by which an asset can be converted to cash) ...

... • Reducing Risk • Providing Liquidity (The ease by which an asset can be converted to cash) ...

Collective Investments

... There are various types of collective investments. This factsheet considers the most common which are unit trusts, open ended investment companies (OEICs) and investment trusts. These investments enable individuals to pool their money into a fund which is then invested in a wide range of underlying ...

... There are various types of collective investments. This factsheet considers the most common which are unit trusts, open ended investment companies (OEICs) and investment trusts. These investments enable individuals to pool their money into a fund which is then invested in a wide range of underlying ...

Chpt19

... Gross domestic product is estimated using the expenditure approach. This involves adding together the values of expenditures on newly produced final goods and services made by all economic units: C+I+G+(Ex-IM). Net domestic product is derived from gross domestic product by excluding the value ...

... Gross domestic product is estimated using the expenditure approach. This involves adding together the values of expenditures on newly produced final goods and services made by all economic units: C+I+G+(Ex-IM). Net domestic product is derived from gross domestic product by excluding the value ...

BloombugCapitalWeeklyForecast8

... At present, investors are worried about the news, including the United States auto maker General Motors GM (US): General Motors) may be bankrupt, or the unemployment rate continues to rise. Rumors that the United States market AAA bond rating may have been lowered due to the high budget deficit, des ...

... At present, investors are worried about the news, including the United States auto maker General Motors GM (US): General Motors) may be bankrupt, or the unemployment rate continues to rise. Rumors that the United States market AAA bond rating may have been lowered due to the high budget deficit, des ...

aia-qb

... Identify any arbitrage possibilities. Interest rates are 5% per annum. (4) Portfolio hedging: Futures and options It is now January 200X, the FTSE-100 index is currently at 4000. Short term interest rates are at 5.0% per annum; the expected dividend yield on FTSE stocks is 3.0%. A Fund manager has a ...

... Identify any arbitrage possibilities. Interest rates are 5% per annum. (4) Portfolio hedging: Futures and options It is now January 200X, the FTSE-100 index is currently at 4000. Short term interest rates are at 5.0% per annum; the expected dividend yield on FTSE stocks is 3.0%. A Fund manager has a ...

Personal Finance

... Personal Finance Course Description: This one-semester course covers the basics of personal finance. Topics include financial planning, budgeting, investing, savings, credit, taxes, and insurance. Intended Audience: The course is intended primarily for seniors, and is intended to help prepare to tak ...

... Personal Finance Course Description: This one-semester course covers the basics of personal finance. Topics include financial planning, budgeting, investing, savings, credit, taxes, and insurance. Intended Audience: The course is intended primarily for seniors, and is intended to help prepare to tak ...

The End of The World Is Off The Table

... A Couple of Other Notes We wanted to get in front of a headline that will likely become a bigger issue during the current quarter, “Brexit.” On June 23rd, citizens of Britain will hold a referendum on whether or not to exit the European Union (EU). The EU is a political/economic union of 28 primaril ...

... A Couple of Other Notes We wanted to get in front of a headline that will likely become a bigger issue during the current quarter, “Brexit.” On June 23rd, citizens of Britain will hold a referendum on whether or not to exit the European Union (EU). The EU is a political/economic union of 28 primaril ...

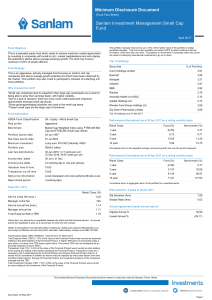

Sanlam Investment Management Small Cap Fund

... This is a philosophy which enables our fund managers to make rational - not emotional - decisions based on in-depth research. This gives them insight into what an asset is truly worth, not what investors are willing to pay based on greed or fear. We take a more practical (pragmatic) approach and inv ...

... This is a philosophy which enables our fund managers to make rational - not emotional - decisions based on in-depth research. This gives them insight into what an asset is truly worth, not what investors are willing to pay based on greed or fear. We take a more practical (pragmatic) approach and inv ...

Derivatives-chapter1

... “What many critics of equity derivatives fail to realize is that the markets for these instruments have become so large not because of slick sales campaigns, but because they are providing economic value to their users” ...

... “What many critics of equity derivatives fail to realize is that the markets for these instruments have become so large not because of slick sales campaigns, but because they are providing economic value to their users” ...

DAINAM Securities

... market in line with its policy set for this year, which aims to keep fluctuation in the exchange rate at not more than 2 percent.The bank added that the rising exchange rate over recent days was due to psychological reasons and market expectations, while was still within the band set by the central ...

... market in line with its policy set for this year, which aims to keep fluctuation in the exchange rate at not more than 2 percent.The bank added that the rising exchange rate over recent days was due to psychological reasons and market expectations, while was still within the band set by the central ...