Chapter 01 - Investments: Background and Issues Chapter 01

... 2. A derivative asset provides a payoff that depends on the values of a primary asset. The primary asset has a claim on the real assets of a firm, whereas a derivative asset does not. 3. Asset allocation is the allocation of an investment portfolio across broad asset classes. Security selection is t ...

... 2. A derivative asset provides a payoff that depends on the values of a primary asset. The primary asset has a claim on the real assets of a firm, whereas a derivative asset does not. 3. Asset allocation is the allocation of an investment portfolio across broad asset classes. Security selection is t ...

Document

... can exhibit large upside. Essentially, and in contrast to most theory, such investor behavior leads to high risk being desirable, not punished, at least at the margin. As before, “desirable” means “excess demand” which means “higher price” which means “lower expected return.” A large and growing lit ...

... can exhibit large upside. Essentially, and in contrast to most theory, such investor behavior leads to high risk being desirable, not punished, at least at the margin. As before, “desirable” means “excess demand” which means “higher price” which means “lower expected return.” A large and growing lit ...

SM_C14_Reilly1ce

... In the Black-Scholes model, the expected future value of a stock is a function of the riskfree interest rate and the dividend yield. As long as the risk-free rate is greater than the dividend yield, the future expected value will be greater than today’s price. The longer the time period, the higher ...

... In the Black-Scholes model, the expected future value of a stock is a function of the riskfree interest rate and the dividend yield. As long as the risk-free rate is greater than the dividend yield, the future expected value will be greater than today’s price. The longer the time period, the higher ...

1 , 2

... However, before using a model, careful analysis must be made in order to assess the appropriateness of the model under the specific conditions of DFA. Modifications may be ...

... However, before using a model, careful analysis must be made in order to assess the appropriateness of the model under the specific conditions of DFA. Modifications may be ...

Weekly Commentary 10-13-14 PAA

... subcategory of the Real Estate Investment Trust (REIT) industry as calculated by Dow Jones. * Yahoo! Finance is the source for any reference to the performance of an index between two specific periods. * Opinions expressed are subject to change without notice and are not intended as investment advic ...

... subcategory of the Real Estate Investment Trust (REIT) industry as calculated by Dow Jones. * Yahoo! Finance is the source for any reference to the performance of an index between two specific periods. * Opinions expressed are subject to change without notice and are not intended as investment advic ...

Lesotho: Launching of the Maseru Securities Market On the 22nd

... alternative source of capital upon listing with it and provide the public diversified investment opportunities together with a secondary market to trade the acquired financial assets. Launching of the Maseru Securities Market will provide the central location and enable Basotho (Lesotho nationals) t ...

... alternative source of capital upon listing with it and provide the public diversified investment opportunities together with a secondary market to trade the acquired financial assets. Launching of the Maseru Securities Market will provide the central location and enable Basotho (Lesotho nationals) t ...

NOTEBOOK12.1 - Plymouth State College

... Financial managers are responsible for the "capitalization of the firm", or identifying and executing sources of funding. The two major sources are stocks (selling equity) and bonds (issuing debt), with a third, and not inconsequential, source being the internally generated capitalization from earni ...

... Financial managers are responsible for the "capitalization of the firm", or identifying and executing sources of funding. The two major sources are stocks (selling equity) and bonds (issuing debt), with a third, and not inconsequential, source being the internally generated capitalization from earni ...

File - Mustafa Hassan

... We will assume that the beta will not change in the coming years because Sainsbury is a defensive, matured and large corporation and it need large transactions to be affected, and the same for the risk free rate as we will assume that the market will be stable. In the other hand, in the calculations ...

... We will assume that the beta will not change in the coming years because Sainsbury is a defensive, matured and large corporation and it need large transactions to be affected, and the same for the risk free rate as we will assume that the market will be stable. In the other hand, in the calculations ...

Why does UK stay out of the Euro

... Increased confidence of the investors in the future prospects of the economy and, therefore, in the inflow of long-term investments. ...

... Increased confidence of the investors in the future prospects of the economy and, therefore, in the inflow of long-term investments. ...

Download Document

... Treasury bonds, the expected cash flows are essentially certain, while for another investment such as a “start-up” technology company, the future cash flows (earnings) expectation would be that earnings will grow in the future, but that expectation will be highly uncertain. Financial theory says tha ...

... Treasury bonds, the expected cash flows are essentially certain, while for another investment such as a “start-up” technology company, the future cash flows (earnings) expectation would be that earnings will grow in the future, but that expectation will be highly uncertain. Financial theory says tha ...

Chapter 10

... parties where one party will realize a gain and the other party will realize a loss due to a change in value of the factor underlying the instrument. Option holders pay a specific “up front” price that gives them the right to buy (“call”) or sell (“put”) a specific quantity at a specific price of a ...

... parties where one party will realize a gain and the other party will realize a loss due to a change in value of the factor underlying the instrument. Option holders pay a specific “up front” price that gives them the right to buy (“call”) or sell (“put”) a specific quantity at a specific price of a ...

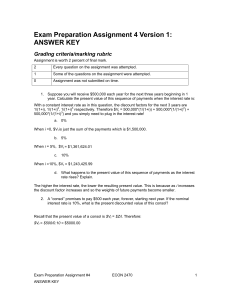

Exam Preparation Assignment 4 Version 1: ANSWER KEY

... 6. Suppose the Bank of Canada implements a contractionary monetary policy that is at least partially unexpected. Explain what effect this will have on stock prices. This contractionary monetary policy will cause the interest rate to rise and output to fall. The higher interest rate will reduce the p ...

... 6. Suppose the Bank of Canada implements a contractionary monetary policy that is at least partially unexpected. Explain what effect this will have on stock prices. This contractionary monetary policy will cause the interest rate to rise and output to fall. The higher interest rate will reduce the p ...

Financing Infrastructure Through Capital Market

... Creditworthy or credit enhanced borrowers Acceptance of cost recovery principles and/or appropriate subsidy where required Developed capital market – access - yield curves to price risk- tradability Risk/reward in balance Clear policy framework Capacity to deal with defaults Trust from investment se ...

... Creditworthy or credit enhanced borrowers Acceptance of cost recovery principles and/or appropriate subsidy where required Developed capital market – access - yield curves to price risk- tradability Risk/reward in balance Clear policy framework Capacity to deal with defaults Trust from investment se ...

Morgan Stanley Newsletter

... Investors should carefully consider the investment objectives and risks as well as charges and expenses of an exchange traded fund before investing. To obtain a prospectus, contact your Financial Advisor or visit the fund company’s website. The prospectus contains this and other information about th ...

... Investors should carefully consider the investment objectives and risks as well as charges and expenses of an exchange traded fund before investing. To obtain a prospectus, contact your Financial Advisor or visit the fund company’s website. The prospectus contains this and other information about th ...

Strong Demand for Muni Bonds Yields Pros, Cons

... however, we believe EM equities provide a higher expected return relative to other asset classes. We are tactically underweight fixed income. Within fixed income, we prefer areas of the market that are more credit-sensitive and less sensitive to changes in interest rates, such as investment-grade co ...

... however, we believe EM equities provide a higher expected return relative to other asset classes. We are tactically underweight fixed income. Within fixed income, we prefer areas of the market that are more credit-sensitive and less sensitive to changes in interest rates, such as investment-grade co ...

A quantitative take on recent market volatility

... in these commentaries at the time of publication; however, accuracy cannot be guaranteed. Market conditions may change and the manager accepts no responsibility for individual investment decisions arising from the use of or reliance on the information contained herein. Commissions, trailing commissi ...

... in these commentaries at the time of publication; however, accuracy cannot be guaranteed. Market conditions may change and the manager accepts no responsibility for individual investment decisions arising from the use of or reliance on the information contained herein. Commissions, trailing commissi ...