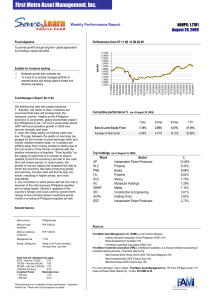

08.20.09-salef - First Metro Asset Management Inc

... GDP will record positive growth in 2009 and recover strongly next year; 2. cash will chase equity as interest rates stay low. The gap between the yields on earnings (as gauged by the inverse of price-earnings ratio) and money market remains wide, i.e. investors are shifting away from money market to ...

... GDP will record positive growth in 2009 and recover strongly next year; 2. cash will chase equity as interest rates stay low. The gap between the yields on earnings (as gauged by the inverse of price-earnings ratio) and money market remains wide, i.e. investors are shifting away from money market to ...

Deriving Market Expectations for the Euro-Dollar

... Describing the market implied probability distribution of asset prices has now become a focal area in finance. Such implied probability distribution would reflect investors’ expectations or market sentiment about the future movements of asset prices. The method typically used to derive market expect ...

... Describing the market implied probability distribution of asset prices has now become a focal area in finance. Such implied probability distribution would reflect investors’ expectations or market sentiment about the future movements of asset prices. The method typically used to derive market expect ...

view presentation here - Asia Pacific Union For Housing Finance

... was ignited in the subprime segment, often equated with low income Unfolded in the country where government related entities had remained major players, with a mandate to deepen the market (Fannie Mae and ...

... was ignited in the subprime segment, often equated with low income Unfolded in the country where government related entities had remained major players, with a mandate to deepen the market (Fannie Mae and ...

Alfred M. Pollard, General Counsel Attention: Comments/RIN 2590

... to serve the credit needs of my community. This regulation could put me in a situation where I may not be able to support growing business loan demand because my institution might get too close to the CFI asset cap and become subject to the more stringent ongoing 10 percent of assets test. Having th ...

... to serve the credit needs of my community. This regulation could put me in a situation where I may not be able to support growing business loan demand because my institution might get too close to the CFI asset cap and become subject to the more stringent ongoing 10 percent of assets test. Having th ...

in Word Format

... of business administration, I discovered that your company offers internships in Debt Capital Markets. I am writing to inquire about possible internship opportunities with COMPANY. My work background and course studies have supplied me with many skills and an understanding of dealing with Capital Ma ...

... of business administration, I discovered that your company offers internships in Debt Capital Markets. I am writing to inquire about possible internship opportunities with COMPANY. My work background and course studies have supplied me with many skills and an understanding of dealing with Capital Ma ...

Fractional Differo-Integral Calculus for Finance: some Results

... Since the pioneer works of Bachelier and Working, the classical approach concerning the analysis of the financial asset returns has been characterized by the assumptions of independent and identical distribution of probability for the random variables ...

... Since the pioneer works of Bachelier and Working, the classical approach concerning the analysis of the financial asset returns has been characterized by the assumptions of independent and identical distribution of probability for the random variables ...

Proposal: An Anatomy of Vacancy Rate in the Real Estate Market

... market health. Yet the same vacancy rate across markets may have very different implications because the underlying forces that induce vacancies may be very different. In this paper we specify and solve a formal theoretical model of vacancy behavior to analyze such differences. Our model is similar ...

... market health. Yet the same vacancy rate across markets may have very different implications because the underlying forces that induce vacancies may be very different. In this paper we specify and solve a formal theoretical model of vacancy behavior to analyze such differences. Our model is similar ...

Proposal: An Anatomy of Vacancy Rate in the Real Estate Market

... market health. Yet the same vacancy rate across markets may have very different implications because the underlying forces that induce vacancies may be very different. In this paper we specify and solve a formal theoretical model of vacancy behavior to analyze such differences. Our model is similar ...

... market health. Yet the same vacancy rate across markets may have very different implications because the underlying forces that induce vacancies may be very different. In this paper we specify and solve a formal theoretical model of vacancy behavior to analyze such differences. Our model is similar ...

Back To School Early September is a time for transition, often from

... remind us that tensions in the Middle East remain ever present. All of this is causing investors some uncertainty – and opportunity. In general, Morgan Stanley & Co.’s economics and strategy teams believe the global economy continues to heal form the financial crisis of 2008 and 2009. In a switch fr ...

... remind us that tensions in the Middle East remain ever present. All of this is causing investors some uncertainty – and opportunity. In general, Morgan Stanley & Co.’s economics and strategy teams believe the global economy continues to heal form the financial crisis of 2008 and 2009. In a switch fr ...

6) The Capital Asset Pricing Model

... returns to that which makes the “tangency portfolio” and the net demand for the riskfree asset equal the fixed supply of these assets. Alternatively, one could model the economy’s asset return distributions as fixed but allow the quantities of these assets to be elastically supplied. This type of ec ...

... returns to that which makes the “tangency portfolio” and the net demand for the riskfree asset equal the fixed supply of these assets. Alternatively, one could model the economy’s asset return distributions as fixed but allow the quantities of these assets to be elastically supplied. This type of ec ...

View PDF

... humans and the markets they trade in are not always rational, leading to market anomalies that persist for longer than the efficient market group would like to believe. In and of themselves, hedge funds are a challenge to the hypothesis. The fees, liquidity, and K-1s would deter us from investing if ...

... humans and the markets they trade in are not always rational, leading to market anomalies that persist for longer than the efficient market group would like to believe. In and of themselves, hedge funds are a challenge to the hypothesis. The fees, liquidity, and K-1s would deter us from investing if ...

Liquidity Now!

... Loans to support private equity deals could not be syndicated, forcing the banks to hold those loans on their own books. Banks are also being forced to honor credit guarantees to previously offbalance-sheet conduits and other back-up credit lines, further reducing the banks' capital available to sup ...

... Loans to support private equity deals could not be syndicated, forcing the banks to hold those loans on their own books. Banks are also being forced to honor credit guarantees to previously offbalance-sheet conduits and other back-up credit lines, further reducing the banks' capital available to sup ...

vinergy resources ltd. - Canadian Securities Exchange

... such as "could", "should", "expect", "believe", "will" and similar expressions and statements relating to matters that are not historical facts but are forward-looking statements. Such forward-looking statements are subject to both known and unknown risks and uncertainties which may cause the actual ...

... such as "could", "should", "expect", "believe", "will" and similar expressions and statements relating to matters that are not historical facts but are forward-looking statements. Such forward-looking statements are subject to both known and unknown risks and uncertainties which may cause the actual ...

Workshop 8 - Yr 7-10 Economics and Business

... Carry cash book through to next game modified cash payment and cash receipt journals - cash flow statement and balance sheet – not given money 5-6 boards Sometimes allocate groups Bring in food and drink 2 periods each time through At end, calculate assets and prepare balance sheet – n ...

... Carry cash book through to next game modified cash payment and cash receipt journals - cash flow statement and balance sheet – not given money 5-6 boards Sometimes allocate groups Bring in food and drink 2 periods each time through At end, calculate assets and prepare balance sheet – n ...

How the Bond Market Affects Mortgage Rates

... 5.8% for an issue of 5-year duration. If this issue is made coincident with an economic or political event which drives down its value (say an unexpected "Yes" vote in a Quebec referendum), the effect on interest rates is immediate. The individual $100,000 denomination bond may fall in value to $95, ...

... 5.8% for an issue of 5-year duration. If this issue is made coincident with an economic or political event which drives down its value (say an unexpected "Yes" vote in a Quebec referendum), the effect on interest rates is immediate. The individual $100,000 denomination bond may fall in value to $95, ...

Panel_2_-_Leslie_Seidman

... Investors routinely add operating leases to lessee balance sheets using incomplete disclosures Possible new approach: What are the assets and liabilities relating to the lease contract? Present value of expected lease payments? Implications for lessors (revenue recognition) – Is there a point where ...

... Investors routinely add operating leases to lessee balance sheets using incomplete disclosures Possible new approach: What are the assets and liabilities relating to the lease contract? Present value of expected lease payments? Implications for lessors (revenue recognition) – Is there a point where ...

Barone

... he borrow from abroad: that is, creditors are not allowed to observed and the borrower, for example, could secretly lend abroad rather than invest in the proyects. Finally, the realized aoutput is freely observed by lenders. ...

... he borrow from abroad: that is, creditors are not allowed to observed and the borrower, for example, could secretly lend abroad rather than invest in the proyects. Finally, the realized aoutput is freely observed by lenders. ...

OVERVIEW

... Ongoing turbulence in global markets, increased inflationary risks due to the upsurge in food, energy and commodity prices and the stagnation threat faced by developed economies require all our economic units to act cautiously in their decisions for the sake of financial stability in the upcoming pe ...

... Ongoing turbulence in global markets, increased inflationary risks due to the upsurge in food, energy and commodity prices and the stagnation threat faced by developed economies require all our economic units to act cautiously in their decisions for the sake of financial stability in the upcoming pe ...