Privatization and Politics - FGV

... Agreement which allows the transfer of third-party credit risk from one party to another. One party in the swap faces credit risk from a third party, and the counterparty in the credit default swap agrees to insure this risk in exchange for regular periodic payments (essentially an insurance premium ...

... Agreement which allows the transfer of third-party credit risk from one party to another. One party in the swap faces credit risk from a third party, and the counterparty in the credit default swap agrees to insure this risk in exchange for regular periodic payments (essentially an insurance premium ...

Selecting sources of finance for business

... working capital requirements are expected to grow by 10% in the coming year. The corporation tax bill is expected to be $120m. Tax and dividends are paid nine months after the year end. Required: Calculate ABC’s expected net cash flow for the year ending 30 June 20X4 without the new investment. Com ...

... working capital requirements are expected to grow by 10% in the coming year. The corporation tax bill is expected to be $120m. Tax and dividends are paid nine months after the year end. Required: Calculate ABC’s expected net cash flow for the year ending 30 June 20X4 without the new investment. Com ...

Misunderstanding the Great Depression, making the next one worse

... • Fisher's “Debt Deflation” theory ignored: • “because of the counterargument that debtdeflation represented no more than a redistribution from one group (debtors) to another (creditors). • Absent implausibly large differences in marginal spending propensities among the groups … pure redistributions ...

... • Fisher's “Debt Deflation” theory ignored: • “because of the counterargument that debtdeflation represented no more than a redistribution from one group (debtors) to another (creditors). • Absent implausibly large differences in marginal spending propensities among the groups … pure redistributions ...

2nd Homework - Samuel Moon Jung

... worth because of the increased burden of indebtedness. B) rising interest rates worsen adverse selection and moral hazard problems. C) lenders reduce their lending due to declining stock prices (equity deflation) that lowers the value of collateral. D) corporations pay back their loans before the sc ...

... worth because of the increased burden of indebtedness. B) rising interest rates worsen adverse selection and moral hazard problems. C) lenders reduce their lending due to declining stock prices (equity deflation) that lowers the value of collateral. D) corporations pay back their loans before the sc ...

Columbia VP High Yield Bond Fund — Class 2

... assets (including the amount of any borrowings for investment purposes) in high-yield debt instruments (commonly referred to as "junk" bonds or securities). It may invest up to 25% of its net assets in debt instruments of foreign issuers. The fund may invest in debt instruments of any maturity and d ...

... assets (including the amount of any borrowings for investment purposes) in high-yield debt instruments (commonly referred to as "junk" bonds or securities). It may invest up to 25% of its net assets in debt instruments of foreign issuers. The fund may invest in debt instruments of any maturity and d ...

The liberalisation of the capital market

... (Struensee) sent out orders for release of the interest rate. This decree meant that the previously fixed interest rate of 4 percent was lifted. This release of the interest rate solved one of the major economic problems of the day: lack of venture capital. ...

... (Struensee) sent out orders for release of the interest rate. This decree meant that the previously fixed interest rate of 4 percent was lifted. This release of the interest rate solved one of the major economic problems of the day: lack of venture capital. ...

Methods for Teaching Personal Financial Literacy 7/8/13 See notes

... Website: GeniRevolution.org/corresponds with LEI lessons Bankrate.com great for calculators on loans Federal Reserve site also has calculators Key role of Stock Market Investors more likely to purchase stocks Limited loss – only purchase price Bonds ...

... Website: GeniRevolution.org/corresponds with LEI lessons Bankrate.com great for calculators on loans Federal Reserve site also has calculators Key role of Stock Market Investors more likely to purchase stocks Limited loss – only purchase price Bonds ...

Loan Intrest

... • Permits buying expensive items. • Permits you to use the item while paying for it. • Provides financial flexibility--spread payments over long period of time. ...

... • Permits buying expensive items. • Permits you to use the item while paying for it. • Provides financial flexibility--spread payments over long period of time. ...

Real Estate Investment

... Bridges gap between project costs and construction debt financing Level of risk depends on amount of capital invested and guarantees given ...

... Bridges gap between project costs and construction debt financing Level of risk depends on amount of capital invested and guarantees given ...

Introduction to Investments

... Bonds that provide some sort of security to investors. Example: A mortgage debenture ...

... Bonds that provide some sort of security to investors. Example: A mortgage debenture ...

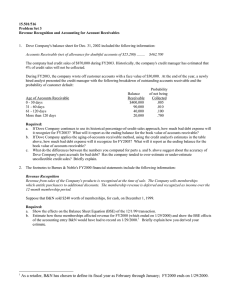

15.501/516 Problem Set 3 Revenue Recognition and Accounting for Account Receivables

... a. If Dove Company continues to use its historical percentage-of-credit-sales approach, how much bad debt expense will it recognize for FY2003? What will it report as the ending balance for the book value of accounts receivable? b. If Dove Company applies the aging-of-accounts receivable method, usi ...

... a. If Dove Company continues to use its historical percentage-of-credit-sales approach, how much bad debt expense will it recognize for FY2003? What will it report as the ending balance for the book value of accounts receivable? b. If Dove Company applies the aging-of-accounts receivable method, usi ...

Jamaica_en.pdf

... huge debt burden of some 135% of GDP and tight fiscal measures will have to be continued for some considerable time. The country’s economy is expected to grow by 3% in 2008. ...

... huge debt burden of some 135% of GDP and tight fiscal measures will have to be continued for some considerable time. The country’s economy is expected to grow by 3% in 2008. ...

Why Won`t Those Banks Lend

... Some observers see high inflation as the result of such an increase in lending. With more money chasing the same amount of goods and services, you have a classic demand inflation scenario. While we see this as a real risk a couple of years out, we do not see it as an immediate risk as: (a) factory ...

... Some observers see high inflation as the result of such an increase in lending. With more money chasing the same amount of goods and services, you have a classic demand inflation scenario. While we see this as a real risk a couple of years out, we do not see it as an immediate risk as: (a) factory ...

Phil Cosson Senior Municipal Advisor

... • May target mill rate rather than specific dollar amount of levy • Large expansion of tax base can present opportunity to borrow while minimizing mill rate impact: – Closure of a tax increment district – Large development outside of a tax increment district ...

... • May target mill rate rather than specific dollar amount of levy • Large expansion of tax base can present opportunity to borrow while minimizing mill rate impact: – Closure of a tax increment district – Large development outside of a tax increment district ...