FIN 534 FIN534 Quiz 9 - Welcome to homeworks.16mb.com!

... expect to see zero accounts payable on its balance sheet. If one of your firm’s customers is “stretching” its accounts payable, this may be a nuisance but it will not have an adverse financial impact on your firm if the customer periodically pays off its entire balance. 2 points Question 10 1. Which ...

... expect to see zero accounts payable on its balance sheet. If one of your firm’s customers is “stretching” its accounts payable, this may be a nuisance but it will not have an adverse financial impact on your firm if the customer periodically pays off its entire balance. 2 points Question 10 1. Which ...

HKMA column 251

... risks. And it is not just credit risks that are of concern to banks. When they choose to invest money in financial assets denominated in foreign currencies, they incur exchange risk as well. When investing in debt securities that pay a fixed rate of interest, they additionally incur interest rate r ...

... risks. And it is not just credit risks that are of concern to banks. When they choose to invest money in financial assets denominated in foreign currencies, they incur exchange risk as well. When investing in debt securities that pay a fixed rate of interest, they additionally incur interest rate r ...

Mid-Year Investment Review

... another reason to buy. It can be a lucrative time to own equities, but a hazardous one as well, as meltups tend to resolve into their more familiar antonym. Riding a melt-up and surviving with your gains in pocket demands a well-timed exit via a “bigger fool” counterparty to your liquidating transac ...

... another reason to buy. It can be a lucrative time to own equities, but a hazardous one as well, as meltups tend to resolve into their more familiar antonym. Riding a melt-up and surviving with your gains in pocket demands a well-timed exit via a “bigger fool” counterparty to your liquidating transac ...

Is the U.S. Economy Headed for a Hard Landing?

... These high risk mortgages have enabled many families to buy homes who otherwise would not have been able to afford one, and has also financed many speculative purchases, which have certainly stimulated housing construction, which in turn has been a very important boost for the US economy in recent y ...

... These high risk mortgages have enabled many families to buy homes who otherwise would not have been able to afford one, and has also financed many speculative purchases, which have certainly stimulated housing construction, which in turn has been a very important boost for the US economy in recent y ...

Annual Report 2013 - Debt Managers Standards Association

... monitored to ensure that consumers are not being misled and are provided with transparent, clear and truthful information regarding these products and services. In addition the DEMSA Code requires that members ensure that all business acquired through third parties and introducers is properly and co ...

... monitored to ensure that consumers are not being misled and are provided with transparent, clear and truthful information regarding these products and services. In addition the DEMSA Code requires that members ensure that all business acquired through third parties and introducers is properly and co ...

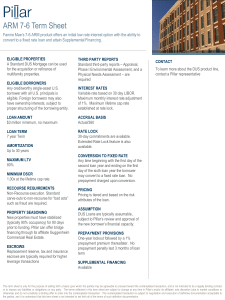

ARM 7-6 Term Sheet

... This term sheet is only for the purpose of setting forth a basis upon which the parties may be agreeable to proceed toward the contemplated transaction, and is not intended to be a legally binding contract or to impose any liabilities or obligations on any party. The terms reflected in this term she ...

... This term sheet is only for the purpose of setting forth a basis upon which the parties may be agreeable to proceed toward the contemplated transaction, and is not intended to be a legally binding contract or to impose any liabilities or obligations on any party. The terms reflected in this term she ...

Adaptation of Fishing Communities in the Philippines

... credit arm of the Department of Agriculture. The financing scheme has been quite successful with repayment rate at 95%. However, climate change has brought about more frequent typhoons as well as pests and diseases which have affected the productivity of fisheries, thus, hindering fishers from payin ...

... credit arm of the Department of Agriculture. The financing scheme has been quite successful with repayment rate at 95%. However, climate change has brought about more frequent typhoons as well as pests and diseases which have affected the productivity of fisheries, thus, hindering fishers from payin ...

PDF

... R111,659. The effects for the other non-black races are similar. Compared to male-headed households, female-headed households are 3 percentage points less likely to have positive debt and the estimated average reduction in debt, if positive, is R17,608. Finally, compared to non-rural households, rur ...

... R111,659. The effects for the other non-black races are similar. Compared to male-headed households, female-headed households are 3 percentage points less likely to have positive debt and the estimated average reduction in debt, if positive, is R17,608. Finally, compared to non-rural households, rur ...

PDF - BTR Capital Management

... which started the year growing solidly, may actually contract for the first time since World War II. The questions on peoples’ minds now are about how long the weakness will persist, and whether there is a risk that the recession we’re in will turn into something worse. Our view is that while the U. ...

... which started the year growing solidly, may actually contract for the first time since World War II. The questions on peoples’ minds now are about how long the weakness will persist, and whether there is a risk that the recession we’re in will turn into something worse. Our view is that while the U. ...

ANGLO AMERICAN FUNDING FACTSHEET

... ANGLO AMERICAN FUNDING FACTSHEET 21 February 2017 This factsheet provides a high level overview of the Group’s main financing arrangements as at 31 December 2016. 1. Net debt management The Group’s policy is to hold the majority of its cash and borrowings at the corporate centre. Business units may ...

... ANGLO AMERICAN FUNDING FACTSHEET 21 February 2017 This factsheet provides a high level overview of the Group’s main financing arrangements as at 31 December 2016. 1. Net debt management The Group’s policy is to hold the majority of its cash and borrowings at the corporate centre. Business units may ...

- Seckman High School

... making a payment using a money order? 4. What is the difference between a cashiers check and a personal check? 5. What is a prepayment penalty? Why might you still wish to pay off a loan early, even when there is a prepayment penalty? Slide 14 ...

... making a payment using a money order? 4. What is the difference between a cashiers check and a personal check? 5. What is a prepayment penalty? Why might you still wish to pay off a loan early, even when there is a prepayment penalty? Slide 14 ...

data1 fasb eitf abstracts 9522

... borrowings outstanding under a revolving credit agreement that includes both a subjective acceleration clause and a requirement to maintain a lock-box arrangement, whereby remittances from the borrower’s customers reduce the debt outstanding, are considered short-term obligations. Task Force members ...

... borrowings outstanding under a revolving credit agreement that includes both a subjective acceleration clause and a requirement to maintain a lock-box arrangement, whereby remittances from the borrower’s customers reduce the debt outstanding, are considered short-term obligations. Task Force members ...

REAL ESTATE ECONOMICS - Chapter Quizzes

... 1. A demand deposit that must be paid by the depositor’s bank to the payee upon presentation is known as: a. cash. b. check. c. money order. d. all of the above. 2. California is in which district of the Federal Reserve System? a. 16th b. 13th c. 12th d. 11th 3. The rate of interest at which member ...

... 1. A demand deposit that must be paid by the depositor’s bank to the payee upon presentation is known as: a. cash. b. check. c. money order. d. all of the above. 2. California is in which district of the Federal Reserve System? a. 16th b. 13th c. 12th d. 11th 3. The rate of interest at which member ...

Corporate Financing

... M & A means a change in management, and also is usually accompanied with an Increased Indebtedness(D/E ratio): Debts have become even more important in corporate financing. ...

... M & A means a change in management, and also is usually accompanied with an Increased Indebtedness(D/E ratio): Debts have become even more important in corporate financing. ...

BG Perspective 2

... much higher than anticipated by the financiers, the insurance provided only the mirage of a backstop. What was thought to insure against losses only added to the losses. Will things get as bad as the Great Depression? During the Depression of the 1930s, incomes fell, on average, by 30 percent and un ...

... much higher than anticipated by the financiers, the insurance provided only the mirage of a backstop. What was thought to insure against losses only added to the losses. Will things get as bad as the Great Depression? During the Depression of the 1930s, incomes fell, on average, by 30 percent and un ...

Financial Definitions and Ratios as they are used

... a. Free Cash Flow is the money left after investment that a company can either put in the bank or give to shareholders in the form of a dividend. b. Even if Profit is small, Depreciation can deliver a Cash Flow from Operations since you never actually write a check for Depreciation. The money is sit ...

... a. Free Cash Flow is the money left after investment that a company can either put in the bank or give to shareholders in the form of a dividend. b. Even if Profit is small, Depreciation can deliver a Cash Flow from Operations since you never actually write a check for Depreciation. The money is sit ...

Quiz 3

... 3. When a firm issues preferred stock, it combines the disadvantages of equity finance with the disadvantages of debt finance. The disadvantage that preferred stock shares with equity (compared to debt finance) is: a. The dividends paid to preferred shareholders are paid out of the firm’s after-tax ...

... 3. When a firm issues preferred stock, it combines the disadvantages of equity finance with the disadvantages of debt finance. The disadvantage that preferred stock shares with equity (compared to debt finance) is: a. The dividends paid to preferred shareholders are paid out of the firm’s after-tax ...