File

... •Financial markets are those markets that exist for buying and selling financial assets. •The most important financial assets for individual investors are bonds, stocks and mutual funds. •A bond is issued by a corporation or government as a way of borrowing money. •An individual who purchases a bon ...

... •Financial markets are those markets that exist for buying and selling financial assets. •The most important financial assets for individual investors are bonds, stocks and mutual funds. •A bond is issued by a corporation or government as a way of borrowing money. •An individual who purchases a bon ...

United States of America Long-Term Rating Lowered To 'AA+' On

... The political brinksmanship of recent months highlights what we see as America's governance and policymaking becoming less stable, less effective, and less predictable than what we previously believed. The statutory debt ceiling and the threat of default have become political bargaining chips in the ...

... The political brinksmanship of recent months highlights what we see as America's governance and policymaking becoming less stable, less effective, and less predictable than what we previously believed. The statutory debt ceiling and the threat of default have become political bargaining chips in the ...

Investor Presentation May 2014

... • The passage of the SEC crowdfunding rules will expand the pool of individuals eligible to provide funding to small businesses ...

... • The passage of the SEC crowdfunding rules will expand the pool of individuals eligible to provide funding to small businesses ...

Presentation by Mr. Christopher Towe, Deputy Director, Monetary

... Risks of a further deterioration Key policy requirements The multilateral response ...

... Risks of a further deterioration Key policy requirements The multilateral response ...

Stochastic Optimal Control and the U.S. Financial Debt Crisis

... the housing bubble burst, the sale of supposedly AAA assets at fire sale prices had a cascading effect on the rest of the financial system as the house of cards created by the quants collapsed. In light of this devastating critique of quant methodology, one wonders whether the defects identified by ...

... the housing bubble burst, the sale of supposedly AAA assets at fire sale prices had a cascading effect on the rest of the financial system as the house of cards created by the quants collapsed. In light of this devastating critique of quant methodology, one wonders whether the defects identified by ...

Heads I win, tails I win

... particular, it should retire most of the nominal gilts outstanding, at all maturities, as well as index-linked gilts with maturities less than 10 years, financing these purchases by sales of index-linked gilts with maturities of at least 15 years, with preference given to very long maturities - 30 a ...

... particular, it should retire most of the nominal gilts outstanding, at all maturities, as well as index-linked gilts with maturities less than 10 years, financing these purchases by sales of index-linked gilts with maturities of at least 15 years, with preference given to very long maturities - 30 a ...

FHLBank Investor Presentation

... by their nature, forward-looking statements involve risks or uncertainties. Therefore, the actual results could differ materially from those expressed or implied in these forward-looking statements or could affect the extent to which a particular objective, projection, estimate, or prediction is rea ...

... by their nature, forward-looking statements involve risks or uncertainties. Therefore, the actual results could differ materially from those expressed or implied in these forward-looking statements or could affect the extent to which a particular objective, projection, estimate, or prediction is rea ...

Banking - mshsLyndaHampton

... businesses or individuals for payments is a basic function of day-to-day financial activity at a bank. Checking Accounts are the most commonly used payment service. Money that you place in a checking account is called a demand deposit because you can withdraw the money at any time, or on demand. ...

... businesses or individuals for payments is a basic function of day-to-day financial activity at a bank. Checking Accounts are the most commonly used payment service. Money that you place in a checking account is called a demand deposit because you can withdraw the money at any time, or on demand. ...

Tax-adjusted discount rates with investor taxes and risky

... certainly admits the possibility that investor taxes make the net tax advantage to debt less than the full corporate tax rate.1 The changes to the U.S. tax code introduced in 2003 also favors dividend income over interest income for most investors. In other countries, there are even stronger reasons ...

... certainly admits the possibility that investor taxes make the net tax advantage to debt less than the full corporate tax rate.1 The changes to the U.S. tax code introduced in 2003 also favors dividend income over interest income for most investors. In other countries, there are even stronger reasons ...

Characteristics of Money Market Instruments

... Treasury bills (also known as T-bills) are short-term securities issued by governments, normally national governments, often using auction mechanisms, as part of their liquidity management operations. Credit risk is very low or effectively non-existent, depending on the credit standing of the issuin ...

... Treasury bills (also known as T-bills) are short-term securities issued by governments, normally national governments, often using auction mechanisms, as part of their liquidity management operations. Credit risk is very low or effectively non-existent, depending on the credit standing of the issuin ...

Spring 2016 - Stonebrooke Asset Management Ltd

... A greater number of economic pundits have recently suggested that a recession is already underway. The majority still believe however that the current slow down is but a pause in the slow growth, low inflation environment that has persisted for the past several years. In the U.S. the index of new ma ...

... A greater number of economic pundits have recently suggested that a recession is already underway. The majority still believe however that the current slow down is but a pause in the slow growth, low inflation environment that has persisted for the past several years. In the U.S. the index of new ma ...

All material contained in this paper is written by way of general

... • Offers a better return to creditors than they would get in a bankruptcy • Avoids bankruptcy • Still the Section 271 issues ...

... • Offers a better return to creditors than they would get in a bankruptcy • Avoids bankruptcy • Still the Section 271 issues ...

Document

... At t, the investor would get α(U₁/U₂)X and pay interests rfD1: α(U₁/U₂)X - rfD1 > α(X- rf D1) for all X. ...

... At t, the investor would get α(U₁/U₂)X and pay interests rfD1: α(U₁/U₂)X - rfD1 > α(X- rf D1) for all X. ...

Answers to Chapter 24 Questions

... Answers to Chapter 24 Questions 1. Loans sold without recourse means that after selling the loan the originator of the loan can take it off the balance sheet. In the event the loan is defaulted, the buyer of the loan has no recourse to the seller for any claims, transferring the credit risk entirely ...

... Answers to Chapter 24 Questions 1. Loans sold without recourse means that after selling the loan the originator of the loan can take it off the balance sheet. In the event the loan is defaulted, the buyer of the loan has no recourse to the seller for any claims, transferring the credit risk entirely ...

DEPARTMENT OF LABOR AND EMPLOYMENT

... limited gaming or pari-mutuel wagering for which the licensee is required to file form W-2G, or a substantially equivalent form with the United States Internal Revenue Service (IRS). Cash prize payment does not apply to the awarding of merchandise or other non-cash items. Cash prize payment does not ...

... limited gaming or pari-mutuel wagering for which the licensee is required to file form W-2G, or a substantially equivalent form with the United States Internal Revenue Service (IRS). Cash prize payment does not apply to the awarding of merchandise or other non-cash items. Cash prize payment does not ...

3.3 E Poor Investment Decisions

... amount a company will be prepared to invest. A rise in interest rates increases the cost of borrowing, so projects financed this way lose some of their attractiveness and profit is reduced. ...

... amount a company will be prepared to invest. A rise in interest rates increases the cost of borrowing, so projects financed this way lose some of their attractiveness and profit is reduced. ...

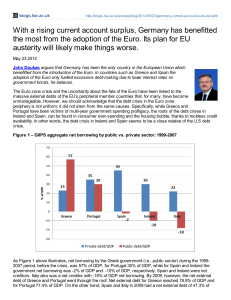

With a rising current account surplus, Germany has benefitted the

... GDP and 42.9% of GDP, respectively, similar to that of 48.5% of GDP for Germany. What is interesting here to note is that the public sector net external debt of countries like Spain and Italy, skyrocketed in a very short span of time (2007-2009). Similarly, the Irish public sector external debt dur ...

... GDP and 42.9% of GDP, respectively, similar to that of 48.5% of GDP for Germany. What is interesting here to note is that the public sector net external debt of countries like Spain and Italy, skyrocketed in a very short span of time (2007-2009). Similarly, the Irish public sector external debt dur ...

C15.0021 Money, Banking, and Financial Markets

... On the last equation variance and leverage ratio would affect the risk premium. But NOTICE that the key variables are A, market value of assets, and asset risk 2 Neither of which are directly observable. An Option Model Example is given on page 237. The KMV model uses the OPM to extract the impli ...

... On the last equation variance and leverage ratio would affect the risk premium. But NOTICE that the key variables are A, market value of assets, and asset risk 2 Neither of which are directly observable. An Option Model Example is given on page 237. The KMV model uses the OPM to extract the impli ...

How a Banker Looks at Financial Leverage

... satisfactory. Assets are often approached from the vantage point of "What is their replacement value?" But replacement has no value if revenue and profits cannot be generated. Generally, whenever the return on assets exceeds the cost of debt, leverage is favorable, and the higher the leverage factor ...

... satisfactory. Assets are often approached from the vantage point of "What is their replacement value?" But replacement has no value if revenue and profits cannot be generated. Generally, whenever the return on assets exceeds the cost of debt, leverage is favorable, and the higher the leverage factor ...

15 Mosec

... • Efficient financing – Via securitization, it is possible to achieve a higher target rating for the instruments than the lenders credit rating – Lender can obtain funding at lower interest rates applicable to highly rated instruments • Balance sheet management – Securitization as a tool for ALM. – ...

... • Efficient financing – Via securitization, it is possible to achieve a higher target rating for the instruments than the lenders credit rating – Lender can obtain funding at lower interest rates applicable to highly rated instruments • Balance sheet management – Securitization as a tool for ALM. – ...

Opening Pandora`s box

... The result of the historic referendum held in Greece yesterday shows a strong win for the No vote (60%+). In this piece, we offer our updated thoughts on the current situation. Significance of the strong “no” vote The size of the “no” vote has added a new dimension to the situation as it potentially ...

... The result of the historic referendum held in Greece yesterday shows a strong win for the No vote (60%+). In this piece, we offer our updated thoughts on the current situation. Significance of the strong “no” vote The size of the “no” vote has added a new dimension to the situation as it potentially ...

Desperately seeking a line in safe assets

... Official acknowledgment that this has become a real issue came this week when central bankers and regulators, meeting in Basel, Switzerland, agreed how first-ever global liquidity standards should be applied to banks. The original plan was to keep the definition of “high quality liquid assets” relat ...

... Official acknowledgment that this has become a real issue came this week when central bankers and regulators, meeting in Basel, Switzerland, agreed how first-ever global liquidity standards should be applied to banks. The original plan was to keep the definition of “high quality liquid assets” relat ...

Government units` financial situation cautiously positive

... Government units' financial situation cautiously positive For the first time in two years, the government units ended 2015 in positive territory again. The good result was driven primarily by the high surpluses of the Confederation and the social security funds. A surplus can probably be expected in ...

... Government units' financial situation cautiously positive For the first time in two years, the government units ended 2015 in positive territory again. The good result was driven primarily by the high surpluses of the Confederation and the social security funds. A surplus can probably be expected in ...