Comparing Different Asset Classes for Banking

... of choice due to the fact that it has the strongest guarantees for growth, death benefit, and premium commitment. That said, those guarantees come with the tradeoff of having less funding flexibility than you would with other asset classes since it requires at least some sort of minimum annual premi ...

... of choice due to the fact that it has the strongest guarantees for growth, death benefit, and premium commitment. That said, those guarantees come with the tradeoff of having less funding flexibility than you would with other asset classes since it requires at least some sort of minimum annual premi ...

Credit: The Promise to Pay

... Disclosure Act is an amendment to the Truth in Lending Act. The act institutes fair and transparent practices of providing credit. ...

... Disclosure Act is an amendment to the Truth in Lending Act. The act institutes fair and transparent practices of providing credit. ...

Markets Defy Fed`s Bond-Buying Push

... much of a deceleration makes it harder to achieve low "real" interest rates—that is, rates adjusted for inflation— and could lead to outright deflation.) In normal times, the Fed spurs the economy by moving short-term interest rates down, but it had already pushed those close to zero. Moving longer- ...

... much of a deceleration makes it harder to achieve low "real" interest rates—that is, rates adjusted for inflation— and could lead to outright deflation.) In normal times, the Fed spurs the economy by moving short-term interest rates down, but it had already pushed those close to zero. Moving longer- ...

Syllabus - Baylor University

... Each investor group has the same amount of money to invest and their total net worth equals the value of all securities. In other words, all the interest income from muni’s as well as all corporate NOI mentioned above must flow through securities purchased by the three investor groups listed above. ...

... Each investor group has the same amount of money to invest and their total net worth equals the value of all securities. In other words, all the interest income from muni’s as well as all corporate NOI mentioned above must flow through securities purchased by the three investor groups listed above. ...

Can Trumponomics Fix What`s Broken?

... from increased retention, as noted there are huge differences between the economic and debt related backdrops between today and the early 80’s. The true burden on taxpayers is government spending, because the debt requires future interest payments out of future taxes. As debt levels, and subsequentl ...

... from increased retention, as noted there are huge differences between the economic and debt related backdrops between today and the early 80’s. The true burden on taxpayers is government spending, because the debt requires future interest payments out of future taxes. As debt levels, and subsequentl ...

Teaching students how to manage money can pay off

... executive of Future Finance, a new private student loan lender in the UK, says that he has devised a way to cut defaults and to get borrowers into the repayment habit early: the company requires its customers to pay back small monthly amounts as soon as they take out a loan rather than wait until th ...

... executive of Future Finance, a new private student loan lender in the UK, says that he has devised a way to cut defaults and to get borrowers into the repayment habit early: the company requires its customers to pay back small monthly amounts as soon as they take out a loan rather than wait until th ...

Economics - Spring Branch ISD

... accounts that pay a higher rate of interest than do savings and checking accounts. 10. True or false; Funds placed in a CD, cannot be removed until the end of a certain time period, such as one or two years. 11. The first bankers in history were goldsmiths. ...

... accounts that pay a higher rate of interest than do savings and checking accounts. 10. True or false; Funds placed in a CD, cannot be removed until the end of a certain time period, such as one or two years. 11. The first bankers in history were goldsmiths. ...

Financial Policy - Pioneer Valley Veterinary Hospital, Inc

... The corporation will accept checks with check numbers greater than 300 from established clients only. An established client is someone who has had more than one year of history of on time payments with the company. The fee for a returned check is $20.00. In addition to the above payment methods, the ...

... The corporation will accept checks with check numbers greater than 300 from established clients only. An established client is someone who has had more than one year of history of on time payments with the company. The fee for a returned check is $20.00. In addition to the above payment methods, the ...

Buying or Leasing a Car and Your Credit Score

... Q. Does buying or leasing a car have equal effect on your credit report? I need a new car but I'm also casually house shopping. Thinking the need for a car will increase well before I purchase a home I was wondering if there's any advantage to either strategy in this scenario. -- Shopper A. It's sma ...

... Q. Does buying or leasing a car have equal effect on your credit report? I need a new car but I'm also casually house shopping. Thinking the need for a car will increase well before I purchase a home I was wondering if there's any advantage to either strategy in this scenario. -- Shopper A. It's sma ...

UNIT 6: THE FINANCIAL PLAN When the company has more

... Can pays in advance less the interests of the discount. Once reaching maturity, when the customer has to pay if he didn’t do it, the bank would charge us with the interests of the return. We would have to charge our client the new nominal amount plus of returning costs. ...

... Can pays in advance less the interests of the discount. Once reaching maturity, when the customer has to pay if he didn’t do it, the bank would charge us with the interests of the return. We would have to charge our client the new nominal amount plus of returning costs. ...

U.S. “Quantitative Easing” is Fracturing the Global Economy Michael

... [that] pushed up the ratio of household net worth to disposable personal income to nearly 640 percent.” Instead of saving, most Americans borrowed as much as they could to buy property they expected to rise in price. For really the first time in history an entire population sought to get rich by run ...

... [that] pushed up the ratio of household net worth to disposable personal income to nearly 640 percent.” Instead of saving, most Americans borrowed as much as they could to buy property they expected to rise in price. For really the first time in history an entire population sought to get rich by run ...

Focus on emerging market corporate debt_Insights_r4

... classes in which we expect positive net issuance this year, as strong issuance in Asia and Latin America offsets weakness in Europe, the Middle East and Africa. New issuance is positive because it increases not only the size of the market but also the diversity, in terms both of sectors and of singl ...

... classes in which we expect positive net issuance this year, as strong issuance in Asia and Latin America offsets weakness in Europe, the Middle East and Africa. New issuance is positive because it increases not only the size of the market but also the diversity, in terms both of sectors and of singl ...

CHAPTER5HOMEWORKWITHANSWERS

... A savings account with daily compounding will have higher earnings than an account with quarterly compounding. ...

... A savings account with daily compounding will have higher earnings than an account with quarterly compounding. ...

June 2006 - Many Nations

... report card. You are assigned a ‘grade’ that tells potential lenders how reliable you likely are to pay back borrowed money. Your credit rating includes details about your payment history and credit sources, including any bankruptcy or tax lien information. To prevent damaging your credit, use your ...

... report card. You are assigned a ‘grade’ that tells potential lenders how reliable you likely are to pay back borrowed money. Your credit rating includes details about your payment history and credit sources, including any bankruptcy or tax lien information. To prevent damaging your credit, use your ...

NPL resolution - World Bank Group

... Another drawback in most of CEE jurisdictions is that they are rather debtorfriendly and it is not unusual that debtors are granted extensive options to contest and delay the bankruptcy or enforcement procedure and in some cases – even to avoid its initiation. Moreover, companies often choose to ent ...

... Another drawback in most of CEE jurisdictions is that they are rather debtorfriendly and it is not unusual that debtors are granted extensive options to contest and delay the bankruptcy or enforcement procedure and in some cases – even to avoid its initiation. Moreover, companies often choose to ent ...

B. Medium-Term policies

... We propose a public debt target of 35 percent of GDP on average between 20072011. This assumes strong structural reforms—yielding average annual GDP growth of 5½ percent over this period—and implementation of the second pension pillar. It is consistent with 3 percent per annum growth in real public ...

... We propose a public debt target of 35 percent of GDP on average between 20072011. This assumes strong structural reforms—yielding average annual GDP growth of 5½ percent over this period—and implementation of the second pension pillar. It is consistent with 3 percent per annum growth in real public ...

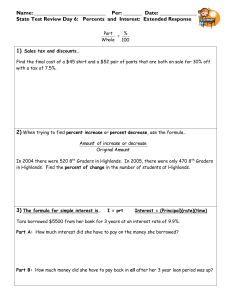

Name - White Plains Public Schools

... In 2004 there were 520 8th Graders in Highlands. In 2005, there were only 470 8th Graders in Highlands. Find the percent of change in the number of students at Highlands. ...

... In 2004 there were 520 8th Graders in Highlands. In 2005, there were only 470 8th Graders in Highlands. Find the percent of change in the number of students at Highlands. ...

June 2008 Performance Review – Listed Hybrid Sector

... Although it is having short term negative impact on hybrid sector returns, there are some intriguing imperfections in credit markets, particularly in the hybrid sector where the marginal investor/divestor is charging an extremely high risk premium, resulting in extremely attractive yields. Evidence ...

... Although it is having short term negative impact on hybrid sector returns, there are some intriguing imperfections in credit markets, particularly in the hybrid sector where the marginal investor/divestor is charging an extremely high risk premium, resulting in extremely attractive yields. Evidence ...

SAMPLE Bad Debt Policy

... beginning during fiscal year 1999, by 40 percent and (2) for cost reporting periods beginning during a subsequent fiscal year, by 45 percent. ...

... beginning during fiscal year 1999, by 40 percent and (2) for cost reporting periods beginning during a subsequent fiscal year, by 45 percent. ...

A Distressed Nation on the Brink of Collapse

... to acquire all of this debt at very low interest rates. But inflation, if it occurred, would push interest rates higher. As the country rolls over its bonds at a higher interest rate, its debt payments would increase. Eventually, interest payments would take up a huge chunk of Japan’s budget require ...

... to acquire all of this debt at very low interest rates. But inflation, if it occurred, would push interest rates higher. As the country rolls over its bonds at a higher interest rate, its debt payments would increase. Eventually, interest payments would take up a huge chunk of Japan’s budget require ...

Unconventional Monetary policy

... unconventional monetary policy does work – asset market purchases do lower yields and longer term interest rates and these lower yields in turn have a positive effect on the economy. This is why central banks are still contemplating further stages of QE. However, there are also many things we do not ...

... unconventional monetary policy does work – asset market purchases do lower yields and longer term interest rates and these lower yields in turn have a positive effect on the economy. This is why central banks are still contemplating further stages of QE. However, there are also many things we do not ...