Credit Default Swaps on Government Debt with an Analysis of Ireland

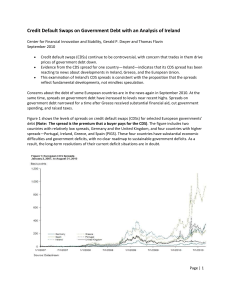

... information about positions to regulators. The second part permits financial regulators to restrict CDS transactions for up to three months in distressed markets. The reason given for these restrictions is to stop "negative price spirals" in government bonds stemming from CDS trading (European Commi ...

... information about positions to regulators. The second part permits financial regulators to restrict CDS transactions for up to three months in distressed markets. The reason given for these restrictions is to stop "negative price spirals" in government bonds stemming from CDS trading (European Commi ...

construction loans - Mt. McKinley Bank

... We will be happy to discuss your plans and answer any questions you may have regarding financing your construction project. Generally construction loans are for an 18 month period of time and require a 25% down payment or equity in the project before the construction loan is booked. Most owner build ...

... We will be happy to discuss your plans and answer any questions you may have regarding financing your construction project. Generally construction loans are for an 18 month period of time and require a 25% down payment or equity in the project before the construction loan is booked. Most owner build ...

Bond insurers and the markets

... cities, universities and the like to raise long-term funds, much of it from individuals. Were the monolines to lose their top-notch ratings, they fear, many issuers could struggle to meet higher funding costs. Municipal borrowers are already being affected by the lack of confidence in the insurers. ...

... cities, universities and the like to raise long-term funds, much of it from individuals. Were the monolines to lose their top-notch ratings, they fear, many issuers could struggle to meet higher funding costs. Municipal borrowers are already being affected by the lack of confidence in the insurers. ...

COMMERCIAL INFORMATION AND CREDIT ANALYSIS

... Lenders always choose their clientele. An important source of new business for most lenders is introductions from professional advisers such as accountants and solicitors. But, a bank has no obligation to lend to customers introduced in this way. 2. The application by the customer; The application ( ...

... Lenders always choose their clientele. An important source of new business for most lenders is introductions from professional advisers such as accountants and solicitors. But, a bank has no obligation to lend to customers introduced in this way. 2. The application by the customer; The application ( ...

act government borrowings and gross debt

... has adopted a centralised approach to its debt raising and debt management activities to ensure that competitive borrowing rates are achieved, commensurate with the Territory’s credit rating. In some instances lease finance structures are established between an external financier and a Territory age ...

... has adopted a centralised approach to its debt raising and debt management activities to ensure that competitive borrowing rates are achieved, commensurate with the Territory’s credit rating. In some instances lease finance structures are established between an external financier and a Territory age ...

ANNEXURE 2: FINANCIAL RATIOS It is important for business

... and industry standards. These ratios can assist in decision making to enhance growth profitability and debt management in a business. These ratios can provide early warning indications to allow you to solve your business problems before the business can be completely destroyed. Financiers and credit ...

... and industry standards. These ratios can assist in decision making to enhance growth profitability and debt management in a business. These ratios can provide early warning indications to allow you to solve your business problems before the business can be completely destroyed. Financiers and credit ...

Econ Unit 2 Personal Finance Notes

... borrowers can get themselves into serious financial trouble! Credit Cards v. Debit Cards When you use a credit card, you are borrowing money from the credit issuers as a loan that you will pay back with interest APR is the annual percentage rate that is charged for borrowing; these rates vary (usu ...

... borrowers can get themselves into serious financial trouble! Credit Cards v. Debit Cards When you use a credit card, you are borrowing money from the credit issuers as a loan that you will pay back with interest APR is the annual percentage rate that is charged for borrowing; these rates vary (usu ...

2016 Loan Generation Marketing Webinar Series

... A strategic approach to mortgage marketing can help you grow loans, control risk and develop member relationships with arguably the greatest potential to achieve Primary Financial Institution status by acquiring the member’s home loan! Learn how to refinance members from high mortgage rates, help ma ...

... A strategic approach to mortgage marketing can help you grow loans, control risk and develop member relationships with arguably the greatest potential to achieve Primary Financial Institution status by acquiring the member’s home loan! Learn how to refinance members from high mortgage rates, help ma ...

5 3 6 7

... In recent years, the federal government and the Bank of Canada have taken several actions to tighten mortgage lending rules. These changes were made to tackle Canadians’ high debt levels and prevent a US-style housing market free fall. In particular, we’ve seen significant restrictions placed on the ...

... In recent years, the federal government and the Bank of Canada have taken several actions to tighten mortgage lending rules. These changes were made to tackle Canadians’ high debt levels and prevent a US-style housing market free fall. In particular, we’ve seen significant restrictions placed on the ...

Possible Project for 2011 Mathematical Problems in Industry

... likelihood that the option will be exercised and how to price the option. There are many kinds of borrowers, including corporations, financial institutions, insurance companies, municipalities, sovereign governments, and special purpose vehicles (entities that borrow from investors to finance the pu ...

... likelihood that the option will be exercised and how to price the option. There are many kinds of borrowers, including corporations, financial institutions, insurance companies, municipalities, sovereign governments, and special purpose vehicles (entities that borrow from investors to finance the pu ...

Products, services, customers, geography

... you money if you leave an item with them, such as jewelry, firearms, cameras or electronic devices. Usually, the shop must keep your item for 30 days. Within that time, you must repay the loan. If you don’t, the pawned item belongs to the store, and it is put up for sale. Loans from the pawnshop are ...

... you money if you leave an item with them, such as jewelry, firearms, cameras or electronic devices. Usually, the shop must keep your item for 30 days. Within that time, you must repay the loan. If you don’t, the pawned item belongs to the store, and it is put up for sale. Loans from the pawnshop are ...

January 2011 - Cypress Financial Planning

... a higher interest rates than a savings account. They are available in term periods of three months to five years, with higher interest rates offered for longer lock-up periods. By purchasing a CD, one invests a fixed sum of money for a fixed period of time. In exchange, the bank pays interest, usual ...

... a higher interest rates than a savings account. They are available in term periods of three months to five years, with higher interest rates offered for longer lock-up periods. By purchasing a CD, one invests a fixed sum of money for a fixed period of time. In exchange, the bank pays interest, usual ...

- the Other Canon

... achieved by down-sizing the labor force and scaling back production so as to squeeze out more revenue rather than seeking to expand market share by undertaking new direct investment. Land, the economy’s largest asset, hardly can be increased, but it can be bid up in price. Likewise, stock market pri ...

... achieved by down-sizing the labor force and scaling back production so as to squeeze out more revenue rather than seeking to expand market share by undertaking new direct investment. Land, the economy’s largest asset, hardly can be increased, but it can be bid up in price. Likewise, stock market pri ...

Credit Quiz Show

... What website supported by the federal government entitles consumers to one free credit report each year from each of the three major credit bureaus? ...

... What website supported by the federal government entitles consumers to one free credit report each year from each of the three major credit bureaus? ...

Presentation - Keith Rankin

... closed system of payments must balance. The circular flow model advanced emphasises the emergence of creditors, and their tendency to persevere with a savings habit (intentionally selling more than they buy) long after such abstemious behaviour has served its underlying usefulness. The paper suggest ...

... closed system of payments must balance. The circular flow model advanced emphasises the emergence of creditors, and their tendency to persevere with a savings habit (intentionally selling more than they buy) long after such abstemious behaviour has served its underlying usefulness. The paper suggest ...

Bank Loans vs. Global High Yield

... In fact, most international markets are developing their belowinvestment credit markets out of necessity (as the U.S. did in the early 1990s). European financial institutions are shrinking their balance sheets, while Asian corporates are seeking diversified funding source (see figures 10 and 11). Th ...

... In fact, most international markets are developing their belowinvestment credit markets out of necessity (as the U.S. did in the early 1990s). European financial institutions are shrinking their balance sheets, while Asian corporates are seeking diversified funding source (see figures 10 and 11). Th ...

Can someone please provide some assistance with responding to the

... significant and advanced the discussion and needs to be between 250 and 350 words. Thank you so much in advance for all your help. I really appreciate it! Cynthia’s post below Capital structure refers to the division of the cash flows of a firm. The firm divides the cash flows by following two conce ...

... significant and advanced the discussion and needs to be between 250 and 350 words. Thank you so much in advance for all your help. I really appreciate it! Cynthia’s post below Capital structure refers to the division of the cash flows of a firm. The firm divides the cash flows by following two conce ...