cost of capital

... we want one-third (or $60,000) to be debt ($180,000*1/3 = $60,000) and the other $120,000 to be common equity ($180,000*2/3=$120,000). Of the $120,000 of equity, only $20,000 of new common stock needs to be sold since we will have $100,000 available in the form of retained earnings. These amounts re ...

... we want one-third (or $60,000) to be debt ($180,000*1/3 = $60,000) and the other $120,000 to be common equity ($180,000*2/3=$120,000). Of the $120,000 of equity, only $20,000 of new common stock needs to be sold since we will have $100,000 available in the form of retained earnings. These amounts re ...

personal statement - Bath Savings Institution

... Name(s):__________________________________________________________________________ Address:__________________________________________________________________________ ___________________________________________________________________________ ...

... Name(s):__________________________________________________________________________ Address:__________________________________________________________________________ ___________________________________________________________________________ ...

Newsletter January 2017 - odyssey capital – managers

... 2017 has started with somewhat of a bang in markets with many companies reporting Christmas trading results. For some, these represented a great start to the new year while others not so great. Richemont, an important part of your portfolios, has had a difficult two years, with what can only be desc ...

... 2017 has started with somewhat of a bang in markets with many companies reporting Christmas trading results. For some, these represented a great start to the new year while others not so great. Richemont, an important part of your portfolios, has had a difficult two years, with what can only be desc ...

Working Paper No. 693

... Yet another rescue plan for the European Monetary Union (EMU) is making its way through central Europe, raising the total funding available to the equivalent of $600 billion. Germany agreed to raise its contribution to the fund by more than $100 billion equivalent. No one is foolish enough to believ ...

... Yet another rescue plan for the European Monetary Union (EMU) is making its way through central Europe, raising the total funding available to the equivalent of $600 billion. Germany agreed to raise its contribution to the fund by more than $100 billion equivalent. No one is foolish enough to believ ...

pairs class - #14

... CARD #__________________________________________EXP. ___________ SIGNATURE_________________________________________ Name as it appears on the credit card:__________________________________________ I (we), agree to pay the course fees on the dates specified to the Council for Relationships. If I (we) ...

... CARD #__________________________________________EXP. ___________ SIGNATURE_________________________________________ Name as it appears on the credit card:__________________________________________ I (we), agree to pay the course fees on the dates specified to the Council for Relationships. If I (we) ...

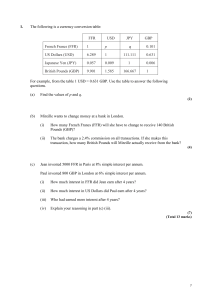

Financial Maths Questions File

... How many months will it take for Angela to completely pay off the $4000 loan? ...

... How many months will it take for Angela to completely pay off the $4000 loan? ...

EMW09_Vincent

... financial services firm focused on select, niche international markets. By using its capital and expertise, INTL seeks to facilitate wholesale, cross-border financial flows through market making and trading of international financial instruments. ...

... financial services firm focused on select, niche international markets. By using its capital and expertise, INTL seeks to facilitate wholesale, cross-border financial flows through market making and trading of international financial instruments. ...

U.S. Household Debt, 1975- 2007

... often provides an economic benefit, such as a place to live or a car to drive. (Although while cars tend to rapidly depreciate, houses tend to retain their economic value.) Of course, a loan taken out to purchase goods which don‟t provide the same sort of economic benefit in the long run – such as a ...

... often provides an economic benefit, such as a place to live or a car to drive. (Although while cars tend to rapidly depreciate, houses tend to retain their economic value.) Of course, a loan taken out to purchase goods which don‟t provide the same sort of economic benefit in the long run – such as a ...

Africa Is there economic hope

... percent of total exports, but that declined to about 20 percent in 2001 because of the economic devastation of the genocide and a worldwide crash in coffee prices. Since then, the government has focused on increasing the volume and quality of coffee exports as it tries to revive the economy; coffee ...

... percent of total exports, but that declined to about 20 percent in 2001 because of the economic devastation of the genocide and a worldwide crash in coffee prices. Since then, the government has focused on increasing the volume and quality of coffee exports as it tries to revive the economy; coffee ...

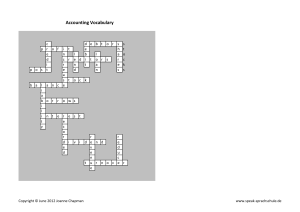

Accounting Vocabulary - SPEAK

... debtors (AmE Accounts receivable) stock (AmE inventory) balance post borrows interest dividend turnover ...

... debtors (AmE Accounts receivable) stock (AmE inventory) balance post borrows interest dividend turnover ...

solve(A*m^NR*(m^N-1)/(m

... remains constant over the life of the loan. So if J denotes the monthly interest rate, we have R = JP + (amount applied to principal), and the new principal after the payment is applied is P + JP R = P(1 + J) R = Pm R , where m = 1 + J. So a table of the amount of the principal still outst ...

... remains constant over the life of the loan. So if J denotes the monthly interest rate, we have R = JP + (amount applied to principal), and the new principal after the payment is applied is P + JP R = P(1 + J) R = Pm R , where m = 1 + J. So a table of the amount of the principal still outst ...

Document

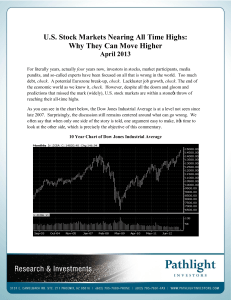

... It can be argued that leverage is more sustainable in an environment of super-low interest rates. Leverage matters less than debt servicing, does it not? This is only true if low interest rates are sustainable in the face of very loose monetary policy. The jury is still out on this issue. Yet, one n ...

... It can be argued that leverage is more sustainable in an environment of super-low interest rates. Leverage matters less than debt servicing, does it not? This is only true if low interest rates are sustainable in the face of very loose monetary policy. The jury is still out on this issue. Yet, one n ...

Essay questions for Chapter 3

... that the high debt to GDP ratio of the bailout recipient countries would decline as the real GDP was expected to increase. Greece, however, is in its sixth year of recession, and its public debt to GDP ratio has drastically increased particularly after Greece received its first bailout in 2010 (see ...

... that the high debt to GDP ratio of the bailout recipient countries would decline as the real GDP was expected to increase. Greece, however, is in its sixth year of recession, and its public debt to GDP ratio has drastically increased particularly after Greece received its first bailout in 2010 (see ...

Introduction to Bloomberg

... DES – Provides a detailed (4 page) description of the company and its financials. This includes an overview of the company, dividend information, index membership, ratio analysis, corporate actions, insider trading, institutional ownership, sales and EPS charts. Links to the financial statements are ...

... DES – Provides a detailed (4 page) description of the company and its financials. This includes an overview of the company, dividend information, index membership, ratio analysis, corporate actions, insider trading, institutional ownership, sales and EPS charts. Links to the financial statements are ...

Uncertainty and the Disappearance of International Credit

... external debt (old definition) at $104.5 billion. The government later revised the figure upward to $113.6 billion (still using the old definition). The figure jumped to $164.34 billion under the new definition, about a 60% increase over what was initially reported by the Financial Times in May. The ...

... external debt (old definition) at $104.5 billion. The government later revised the figure upward to $113.6 billion (still using the old definition). The figure jumped to $164.34 billion under the new definition, about a 60% increase over what was initially reported by the Financial Times in May. The ...

Is there a future for the EU after the crisis?

... • Inadequate decision-making procedures in the EU/Eurozone and various member states (e.g. EFSF ratification process) • Lack of leadership at the national and European level Representational dilemmas • The temporary loss of sovereignty and self-determination • The rise of populist parties across the ...

... • Inadequate decision-making procedures in the EU/Eurozone and various member states (e.g. EFSF ratification process) • Lack of leadership at the national and European level Representational dilemmas • The temporary loss of sovereignty and self-determination • The rise of populist parties across the ...

Why We Should Never Pay Down the National Debt

... borrowing: one is based on the possible effects on financial markets;35 the other is based on the diversion of economic resources to unproductive ends. If the government’s total debt were to become large enough, it could become impossible for the government to repay all of its debts. Because lenders ...

... borrowing: one is based on the possible effects on financial markets;35 the other is based on the diversion of economic resources to unproductive ends. If the government’s total debt were to become large enough, it could become impossible for the government to repay all of its debts. Because lenders ...