Weekly news. NBKR press-release №40/2013 (October 07

... protesters who declared their requirements as they could not repay their indebtedness to the financial institutions for a long time and applying aggravated political situation they appealed to honest borrowers not to comply with the contractual requirements. Several dozens of people, who allegedly w ...

... protesters who declared their requirements as they could not repay their indebtedness to the financial institutions for a long time and applying aggravated political situation they appealed to honest borrowers not to comply with the contractual requirements. Several dozens of people, who allegedly w ...

Common Currency and Determinants of Government Bond

... on the cost of public debt caused by the global financial crisis. To account for credit risk, the authors include a panel of seven EMU countries with a significant history of Collateralised Debt Obligations. With such an approach they have found a limited impact of deteriorated fiscal balances compa ...

... on the cost of public debt caused by the global financial crisis. To account for credit risk, the authors include a panel of seven EMU countries with a significant history of Collateralised Debt Obligations. With such an approach they have found a limited impact of deteriorated fiscal balances compa ...

asset liability management

... interest rate scenario ( for contracting new loan at low rate ) • Premature withdrawal of deposits in rising interest rate scenario ( for reinvestment at higher rate ) • In either case, bank will receive lower ...

... interest rate scenario ( for contracting new loan at low rate ) • Premature withdrawal of deposits in rising interest rate scenario ( for reinvestment at higher rate ) • In either case, bank will receive lower ...

File - your own free website

... on the loan, and never really are able to pay down the principle loan If the government is focused on paying off loans from 1st world countries, there is little money to reinvest back into the country to help them escape the cycles of poverty (ie. money is leaving the country vs. staying in the coun ...

... on the loan, and never really are able to pay down the principle loan If the government is focused on paying off loans from 1st world countries, there is little money to reinvest back into the country to help them escape the cycles of poverty (ie. money is leaving the country vs. staying in the coun ...

“save social security” bonds

... keeping U.S. bonds in the foreign asset mix would likely increase volatility in world financial markets. Rather than having to turn to riskier private securities, investors could buy Triple-S bonds backed by the full faith and credit of the U.S. government and just as secure as today’s Treasury bond ...

... keeping U.S. bonds in the foreign asset mix would likely increase volatility in world financial markets. Rather than having to turn to riskier private securities, investors could buy Triple-S bonds backed by the full faith and credit of the U.S. government and just as secure as today’s Treasury bond ...

Justification for the 09.05.2017 decision by the FCMC Board on

... 2 percentage points, the benchmark buffer rate increases linearly from zero to 2.5% of riskweighted assets. In case of the credit-to-GDP gap of -38%, the benchmark buffer rate is 0%. According to the "narrow credit" definition, the credit-to-GDP ratio was 45% by the end of 2016, but its additional g ...

... 2 percentage points, the benchmark buffer rate increases linearly from zero to 2.5% of riskweighted assets. In case of the credit-to-GDP gap of -38%, the benchmark buffer rate is 0%. According to the "narrow credit" definition, the credit-to-GDP ratio was 45% by the end of 2016, but its additional g ...

Adjustable Rate Mortgage

... ◦ Builder “draws” payments as needed. Often high risk. Blended-Rate Loan Equity Loan ◦ Using built up equity to take out some cash ...

... ◦ Builder “draws” payments as needed. Often high risk. Blended-Rate Loan Equity Loan ◦ Using built up equity to take out some cash ...

1. You were hired as a consultant to Keys Company, and you were

... 5. The Nunnally Company has equal amounts of low-risk, average-risk, and high-risk projects. Nunnally estimates that its overall WACC is 12%. The CFO believes that this is the correct WACC for the company’s average-risk projects, but that a lower rate should be used for lower risk projects and a hig ...

... 5. The Nunnally Company has equal amounts of low-risk, average-risk, and high-risk projects. Nunnally estimates that its overall WACC is 12%. The CFO believes that this is the correct WACC for the company’s average-risk projects, but that a lower rate should be used for lower risk projects and a hig ...

How does a monetary policy affect the economy

... can issue equity easily and buy extra assets and thus invest. However, when Ms is reduced, public spends less on stock-markets, thus equity prices and q falls and firms are reluctant to invest, they rather buy up existing firms. Keynesians also argue that interest rate rise makes bonds more attracti ...

... can issue equity easily and buy extra assets and thus invest. However, when Ms is reduced, public spends less on stock-markets, thus equity prices and q falls and firms are reluctant to invest, they rather buy up existing firms. Keynesians also argue that interest rate rise makes bonds more attracti ...

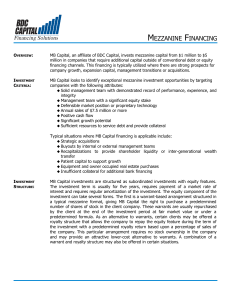

mezzanine financing

... The investment term is usually for five years, requires payment of a market rate of interest and requires regular amortization of the investment. The equity component of the investment can take several forms. The first is a warrant-based arrangement structured in a typical mezzanine format, giving M ...

... The investment term is usually for five years, requires payment of a market rate of interest and requires regular amortization of the investment. The equity component of the investment can take several forms. The first is a warrant-based arrangement structured in a typical mezzanine format, giving M ...

international financing and international financial markets

... 1. Low-cost substitute for loan 2. Allows borrowers to issue own notes 3. Placed/distributed by banks ...

... 1. Low-cost substitute for loan 2. Allows borrowers to issue own notes 3. Placed/distributed by banks ...

Document in Word format

... the US$1 billion contribution was drawn. The loan was organised in the form of a currency swap agreement between the Bank of Thailand and the HKMA at market interest rates. Repayment was also faster than originally scheduled, by a year. The loan also earned us respectable rates of return, averaging ...

... the US$1 billion contribution was drawn. The loan was organised in the form of a currency swap agreement between the Bank of Thailand and the HKMA at market interest rates. Repayment was also faster than originally scheduled, by a year. The loan also earned us respectable rates of return, averaging ...

CHAPTER 7

... 1. Issued by states, counties, cities and state agencies 2. Interest is exempt from Federal taxation 3. Some types, i.e. industrial development bonds, may be completely tax-exempt 4. Tax-preference results in lower offered yields (rationale for computing before-tax equivalent yields) All Rights Rese ...

... 1. Issued by states, counties, cities and state agencies 2. Interest is exempt from Federal taxation 3. Some types, i.e. industrial development bonds, may be completely tax-exempt 4. Tax-preference results in lower offered yields (rationale for computing before-tax equivalent yields) All Rights Rese ...

The Faroese External Debt Statistics 2003 and

... institutions but since such data set would prove to be a “minefield”, not to mention enormous cost to providers we have decided to rely on perhaps more reliable pool of data as provided by the Faroese Tax office. As it is practice for such institution to not only collect taxes, but also check and re ...

... institutions but since such data set would prove to be a “minefield”, not to mention enormous cost to providers we have decided to rely on perhaps more reliable pool of data as provided by the Faroese Tax office. As it is practice for such institution to not only collect taxes, but also check and re ...

chapter06 - IIS-RU

... Permits the bondholder to convert the bond into shares of common stock at a fixed price Investors cannot convert the stocks back to bonds ...

... Permits the bondholder to convert the bond into shares of common stock at a fixed price Investors cannot convert the stocks back to bonds ...

Using Coke-Cola and Pepsico to demonstrate optimal capital

... The trade-off theory of financial leverage shows the impact of increases in financial leverage on the company’s weighted average cost of capital (WACC). Increases in debt in the company’s capital structure increase the tax benefit since the interest payments on the debt is a tax deductible expense. ...

... The trade-off theory of financial leverage shows the impact of increases in financial leverage on the company’s weighted average cost of capital (WACC). Increases in debt in the company’s capital structure increase the tax benefit since the interest payments on the debt is a tax deductible expense. ...

Partner with a Leading Finance Company Ascentium Capital LLC

... Soft Costs: Soft costs such as sales tax, shipping, installation, training and software generally are not financed by a bank. Leasing may cover 100% financing so you avoid substantial out of pocket costs. Down Payment: Banks typically require 20% - 30% down on equipment financing due to concerns abo ...

... Soft Costs: Soft costs such as sales tax, shipping, installation, training and software generally are not financed by a bank. Leasing may cover 100% financing so you avoid substantial out of pocket costs. Down Payment: Banks typically require 20% - 30% down on equipment financing due to concerns abo ...

Commercial Mortgage Backed Securities (CMBS)

... • Savings and loan Associations • Commercial Banks • Life Insurance Companies • Mortgage Companies • Mortgage Brokers ...

... • Savings and loan Associations • Commercial Banks • Life Insurance Companies • Mortgage Companies • Mortgage Brokers ...

Topics – Student Loan Market – Financial Risk – Enrollment Risk

... Federal Loans – Stafford (Subsidized and Unsubsidized) • No Credit Check • Based on need amounts range from $3500 - $5500 subsidized ...

... Federal Loans – Stafford (Subsidized and Unsubsidized) • No Credit Check • Based on need amounts range from $3500 - $5500 subsidized ...