Australia in Hock?

... To some extent, the recent rise can be seen as a once-off adjustment to lower inflation. Debt levels remain well below those in the United Kingdom and some other countries in the 1980s, when many households were over-burdened. • Debt service ratios in Australia are below their peaks of the late 1980 ...

... To some extent, the recent rise can be seen as a once-off adjustment to lower inflation. Debt levels remain well below those in the United Kingdom and some other countries in the 1980s, when many households were over-burdened. • Debt service ratios in Australia are below their peaks of the late 1980 ...

CSS Slideshow for 1997-98 Counselor Workshops

... • generally 9 months • Minimum Payment • generally $40 ...

... • generally 9 months • Minimum Payment • generally $40 ...

Financial Crisis In US

... reserves of grain and animals, charged interest much like today Italy, Medici of Florence: first modern loan and deposit system to handle multiple currency, later improved by Dutch and British, imported to American colonies Growing pains through a period of minimal regulation, legislation during Civ ...

... reserves of grain and animals, charged interest much like today Italy, Medici of Florence: first modern loan and deposit system to handle multiple currency, later improved by Dutch and British, imported to American colonies Growing pains through a period of minimal regulation, legislation during Civ ...

Worse than Japan? - τμημα χρηματοοικονομικης και τραπεζικης

... is likely to force a reliance on government demand that is bigger and longer-lasting than many now imagine. In the aftermath of Japan’s bubble, firms spent more than a decade paying down debt and rebuilding their balance-sheets. This sharp rise in corporate saving was countered by a drop in the savi ...

... is likely to force a reliance on government demand that is bigger and longer-lasting than many now imagine. In the aftermath of Japan’s bubble, firms spent more than a decade paying down debt and rebuilding their balance-sheets. This sharp rise in corporate saving was countered by a drop in the savi ...

Notification of countercyclical buffer in Denmark

... The house price-to-income gap is defined as deviations of the ratio of house price to income from its long-term trend. The trend is estimated for the period from 1st quarter 1973 to 2nd quarter 2014 and calculated in the same way as for the credit-to-GDP gap, cf. Appendix A. The trend is not indexed ...

... The house price-to-income gap is defined as deviations of the ratio of house price to income from its long-term trend. The trend is estimated for the period from 1st quarter 1973 to 2nd quarter 2014 and calculated in the same way as for the credit-to-GDP gap, cf. Appendix A. The trend is not indexed ...

Private Placements and Infrastructure Finance.qxp

... in-house specialist debt investors. The very private nature of the assets has ensured their reputation remains obscure. However, there are excellent opportunities for pension funds in these asset classes which are uncovered by delving further into the fixed income markets. It is likely that the majo ...

... in-house specialist debt investors. The very private nature of the assets has ensured their reputation remains obscure. However, there are excellent opportunities for pension funds in these asset classes which are uncovered by delving further into the fixed income markets. It is likely that the majo ...

open market operations

... When banks need to borrow reserves from other banks they go to the Fed Funds Market. Banks offer their excess funds to other banks for overnight lending to meet their reserve requirements. The Federal Reserve does not decree this interest rate, but they use bonds to add or take from this pool of mon ...

... When banks need to borrow reserves from other banks they go to the Fed Funds Market. Banks offer their excess funds to other banks for overnight lending to meet their reserve requirements. The Federal Reserve does not decree this interest rate, but they use bonds to add or take from this pool of mon ...

Key Issues House Prices Closing in on “Normal” Level

... Ratio of House Prices to Rent 10-City Case-Shiller Index divided by Owner's Equivalent Rent; ...

... Ratio of House Prices to Rent 10-City Case-Shiller Index divided by Owner's Equivalent Rent; ...

Answers to Chapter 12 Questions

... the accumulation of assets, liabilities, and equity as of a specific point in time. The Report of Income refers to the bank's income statement which presents information about the flow of revenues and expenses between two points in time. 2. a-3; b-1; c-2. 3. a-5,6,12; b-2,10; c-3, 13; d-1,8,15; e-9, ...

... the accumulation of assets, liabilities, and equity as of a specific point in time. The Report of Income refers to the bank's income statement which presents information about the flow of revenues and expenses between two points in time. 2. a-3; b-1; c-2. 3. a-5,6,12; b-2,10; c-3, 13; d-1,8,15; e-9, ...

Developing a Financial Planning Model

... Internal data that describes the current state of the system Firm’s financial statements Resources and capacities ...

... Internal data that describes the current state of the system Firm’s financial statements Resources and capacities ...

The Great Liquidity Squeeze of 2017: Cash dries up as loan

... cash flow will naturally be available from the current mix of assets and liabilities, given an assumed future interest rate path. ...

... cash flow will naturally be available from the current mix of assets and liabilities, given an assumed future interest rate path. ...

Term Structure

... “The bond will pay interest at a rate of 16% of par, semiannually on each October 15 and April 15 from April 15, 2009 through April 15, 2024. The annual interest rate is 16%. On April 15, 2024 the bond will make its final interest payment and also pay the holder the par value of $1,000. ...

... “The bond will pay interest at a rate of 16% of par, semiannually on each October 15 and April 15 from April 15, 2009 through April 15, 2024. The annual interest rate is 16%. On April 15, 2024 the bond will make its final interest payment and also pay the holder the par value of $1,000. ...

debt indicators - Henrico County

... This indicator will trigger a warning if the increase in debt service consistently exceeded the increase in net operating revenues. The issuance of debt normally results in a slight increase in this indicator, because in the year following the issuance of debt, the amount of debt service generally g ...

... This indicator will trigger a warning if the increase in debt service consistently exceeded the increase in net operating revenues. The issuance of debt normally results in a slight increase in this indicator, because in the year following the issuance of debt, the amount of debt service generally g ...

Ontario District Commercial Banking Presentation to: Ontario North

... • We are still lending money for commercial real estate! • Bank debt syndication market and the securitization vehicles that became popular a few years back has dried up on larger mortgage deals Our lending policies for both owner occupied and investment properties have not changed due to current ec ...

... • We are still lending money for commercial real estate! • Bank debt syndication market and the securitization vehicles that became popular a few years back has dried up on larger mortgage deals Our lending policies for both owner occupied and investment properties have not changed due to current ec ...

English

... pay an interest amount on the loan amount. The interest amount is a portion of the total loan amount. Credit cards can sometimes have high interest rates sometimes upwards of 20%! In these cases the amount of interest you must pay can be very large. Simple Interest is calculated based on the loan am ...

... pay an interest amount on the loan amount. The interest amount is a portion of the total loan amount. Credit cards can sometimes have high interest rates sometimes upwards of 20%! In these cases the amount of interest you must pay can be very large. Simple Interest is calculated based on the loan am ...

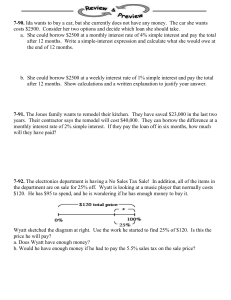

7-95.

... 7-91. The Jones family wants to remodel their kitchen. They have saved $23,000 in the last two years. Their contractor says the remodel will cost $40,000. They can borrow the difference at a monthly interest rate of 2% simple interest. If they pay the loan off in six months, how much will they have ...

... 7-91. The Jones family wants to remodel their kitchen. They have saved $23,000 in the last two years. Their contractor says the remodel will cost $40,000. They can borrow the difference at a monthly interest rate of 2% simple interest. If they pay the loan off in six months, how much will they have ...

Semester Test Review PowerPoint

... take measures to lessen the frequency oR severity of losses that may occur. Reduce the risk ...

... take measures to lessen the frequency oR severity of losses that may occur. Reduce the risk ...