View as DOC (2) 248 KB

... international market. Specifically the European Central Bank's promise to do whatever was necessary to protect the Euro followed by the US Federal Reserve providing $85bn per month in asset purchases and the Japanese government seeking to break 25yrs of economic stagnation with a huge quantitative e ...

... international market. Specifically the European Central Bank's promise to do whatever was necessary to protect the Euro followed by the US Federal Reserve providing $85bn per month in asset purchases and the Japanese government seeking to break 25yrs of economic stagnation with a huge quantitative e ...

File

... Structured notes usually are packaged investments assembled by security dealers that offer customers flexible yields in order to protect their customers' investments against losses due to inflation and changing interest rates. Most structured notes are based upon government or federal agency securit ...

... Structured notes usually are packaged investments assembled by security dealers that offer customers flexible yields in order to protect their customers' investments against losses due to inflation and changing interest rates. Most structured notes are based upon government or federal agency securit ...

Gloom, Doom and the Hidden Rays of Hope

... markets index of developing nations fell 22.88%. Even the assets that are supposed to zig when the stock market zags were down comparably for the quarter. The Wilshire REIT index of real estate investment trusts was down 12.10% for the third quarter; moving it down 2.54% for the year. Commodities to ...

... markets index of developing nations fell 22.88%. Even the assets that are supposed to zig when the stock market zags were down comparably for the quarter. The Wilshire REIT index of real estate investment trusts was down 12.10% for the third quarter; moving it down 2.54% for the year. Commodities to ...

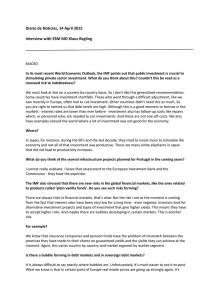

here - Agri SA

... On the other side, given that the economy is showing signs of slow growth while the rand continues a downward trajectory, demand for imports is likely to reduce quite significantly. One could argue that this will also benefit local producers because demand for locally produced agricultural products ...

... On the other side, given that the economy is showing signs of slow growth while the rand continues a downward trajectory, demand for imports is likely to reduce quite significantly. One could argue that this will also benefit local producers because demand for locally produced agricultural products ...

President’s Message

... be igniting another housing bubble, while we are still trying to recover from the last one. These combined government policies are encouraging consumption (housing is consumption) when the U.S. economy has a negative real savings rate, when government deficits (including unfunded liabilities) are co ...

... be igniting another housing bubble, while we are still trying to recover from the last one. These combined government policies are encouraging consumption (housing is consumption) when the U.S. economy has a negative real savings rate, when government deficits (including unfunded liabilities) are co ...

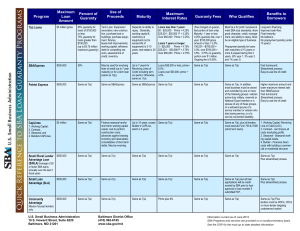

Program Maximum Loan Amount Percent of Guaranty Use of

... servicing fee of 0.625%1.5% on unpaid balance Ongoing guaranty fee (FY 2012) is 0.9375% of principal outstanding. Ongoing fee % does not change during term. ...

... servicing fee of 0.625%1.5% on unpaid balance Ongoing guaranty fee (FY 2012) is 0.9375% of principal outstanding. Ongoing fee % does not change during term. ...

key facts

... The total cost of this settlement is KM 2.4 billion. This settlement is not perfect, but it is fair and affordable for BiH. It ensures that as many as 80% of all accounts will be quickly returned, in full. It is also flexible as the Law leaves room for the BiH Council of Ministers to reduce th ...

... The total cost of this settlement is KM 2.4 billion. This settlement is not perfect, but it is fair and affordable for BiH. It ensures that as many as 80% of all accounts will be quickly returned, in full. It is also flexible as the Law leaves room for the BiH Council of Ministers to reduce th ...

Subject: Bond Buyer Coverage

... sovereign rating after Fitch yesterday announced its analysts had given the credit its highest general obligation rating. Fitch analyst Katherine McManus said she was unsure if this was the first rating of its kind because most tribal deals are private placements with ratings not available to the pu ...

... sovereign rating after Fitch yesterday announced its analysts had given the credit its highest general obligation rating. Fitch analyst Katherine McManus said she was unsure if this was the first rating of its kind because most tribal deals are private placements with ratings not available to the pu ...

Summary - WikiLeaks

... Interestingly, Liu Mingkang, chairman of the China Banking Regulatory Commission (CBRC), announced on October 23rd that the rate of NPLs in China’s commercial banks at the end of the third quarter was 1.66 percent, down from 2.42 percent at the end of 2008. To be fair, Liu cautioned against rising N ...

... Interestingly, Liu Mingkang, chairman of the China Banking Regulatory Commission (CBRC), announced on October 23rd that the rate of NPLs in China’s commercial banks at the end of the third quarter was 1.66 percent, down from 2.42 percent at the end of 2008. To be fair, Liu cautioned against rising N ...

1 - Massey University

... 5. The Kiyotaki and Moore model of credit cycles is described in the following terms. The economy is composed of risk neutral infinitely lived agents who seek to maximise the discounted sum of their expected consumptions. There are only two goods: a nonstorable physical good used for consumption and ...

... 5. The Kiyotaki and Moore model of credit cycles is described in the following terms. The economy is composed of risk neutral infinitely lived agents who seek to maximise the discounted sum of their expected consumptions. There are only two goods: a nonstorable physical good used for consumption and ...

Weekly Commentary 02-10-14 PAA

... downturn was due to hedge funds derisking their portfolios, and some credit earnings with stocks’ positive movement as almost 66 percent of companies in the Standard & Poor’s 500 Index that have reported this quarter have exceeded earnings expectations forecast by analysts. Bonds aren’t doing what t ...

... downturn was due to hedge funds derisking their portfolios, and some credit earnings with stocks’ positive movement as almost 66 percent of companies in the Standard & Poor’s 500 Index that have reported this quarter have exceeded earnings expectations forecast by analysts. Bonds aren’t doing what t ...

Peter/Marko changes in GREEN

... currency and local currency issuer credit ratings to BBB+ from A- on Dec. 8, citing concerns about the country's rising budget deficit. This is the first time since Greece joined the eurozone that it has been downgraded below an "A" grade rating. Meanwhile, rating agency Standard & Poor's warned Dec ...

... currency and local currency issuer credit ratings to BBB+ from A- on Dec. 8, citing concerns about the country's rising budget deficit. This is the first time since Greece joined the eurozone that it has been downgraded below an "A" grade rating. Meanwhile, rating agency Standard & Poor's warned Dec ...

Monetizing the Debt - Federal Reserve Bank of St. Louis

... are solely driven by the Fed’s policy. Second, the Fed increases the monetary base whenever it purchases any asset—not only when it purchases government debt. For example, the Fed has completed its purchase of $1.25 trillion in mortgage-backed securities (MBS) in an effort to support the sagging mor ...

... are solely driven by the Fed’s policy. Second, the Fed increases the monetary base whenever it purchases any asset—not only when it purchases government debt. For example, the Fed has completed its purchase of $1.25 trillion in mortgage-backed securities (MBS) in an effort to support the sagging mor ...

Factsheet Floating Rate Income Trust USD

... instruments, including derivatives, which may be used to gain or reduce market exposure and/or risk management. Certain transactions the funds may utilize may give rise to a form of leverage through either (a) additional market exposure or (b) borrowing capital in an attempt to increase investment r ...

... instruments, including derivatives, which may be used to gain or reduce market exposure and/or risk management. Certain transactions the funds may utilize may give rise to a form of leverage through either (a) additional market exposure or (b) borrowing capital in an attempt to increase investment r ...

18 - Finance

... Firms usually seek a balance of short-term, intermediate-term, and long-term sources of funds. Short-term credit includes all debt obligations that were originally scheduled for repayment within one year. Short-term debt may be either secured or unsecured and can be obtained from a variety of source ...

... Firms usually seek a balance of short-term, intermediate-term, and long-term sources of funds. Short-term credit includes all debt obligations that were originally scheduled for repayment within one year. Short-term debt may be either secured or unsecured and can be obtained from a variety of source ...

Download attachment

... Refers to the sale of goods on a deferred payment basis at a price which includes a profit margin agreed to by both parties. Refers to debt financing, i.e. the provision of financial resources required for production, commerce and services by way of sale/purchase of trade documents and papers. It is ...

... Refers to the sale of goods on a deferred payment basis at a price which includes a profit margin agreed to by both parties. Refers to debt financing, i.e. the provision of financial resources required for production, commerce and services by way of sale/purchase of trade documents and papers. It is ...

CHAPTER 13 Capital Structure and Leverage

... EPS is maximized at 50%, but primary interest is stock price, not E(EPS). The example shows that we can push up E(EPS) by using more debt, but the risk resulting from increased leverage more than offsets the benefit of higher E(EPS). ...

... EPS is maximized at 50%, but primary interest is stock price, not E(EPS). The example shows that we can push up E(EPS) by using more debt, but the risk resulting from increased leverage more than offsets the benefit of higher E(EPS). ...