Course Outline School of Business and Economics FNCE 4190

... institutions, including deposit-taking institutions, insurance companies, securities firms, investment banks, mutual funds, hedge funds, pension funds, and finance companies; regulation of the financial industry; measuring risk, including interest rate risk, market risk, credit risk, liquidity risk, ...

... institutions, including deposit-taking institutions, insurance companies, securities firms, investment banks, mutual funds, hedge funds, pension funds, and finance companies; regulation of the financial industry; measuring risk, including interest rate risk, market risk, credit risk, liquidity risk, ...

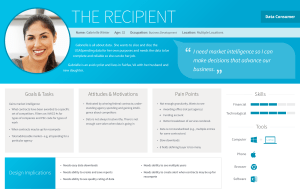

I need market intelligence so I can make decisions that advance our

... set of competitors. Filters on: NAICS #s for types of companies and PSC code for types of work ...

... set of competitors. Filters on: NAICS #s for types of companies and PSC code for types of work ...

Q3 2016 - Partnervest

... Global equity prices and pound sterling recovered from the panic selling that greeted the news Britain’s EU departure in June. (See Partnervest Brexit Market Commentary June 29, 2016) However, we fear the coming Brexit (UK expects to commence negotiations in March 2017) may imperil European banks th ...

... Global equity prices and pound sterling recovered from the panic selling that greeted the news Britain’s EU departure in June. (See Partnervest Brexit Market Commentary June 29, 2016) However, we fear the coming Brexit (UK expects to commence negotiations in March 2017) may imperil European banks th ...

Capital Markets Institutions, Instruments, and Risk

... Nonprofit Organization 71 Foreign Investors 72 Financial Institutions 75 Financial Intermediaries 76 Role of Governments in Financial Markets Regulation of Financial Markets 80 Acting as Financial Intermediaries 83 ...

... Nonprofit Organization 71 Foreign Investors 72 Financial Institutions 75 Financial Intermediaries 76 Role of Governments in Financial Markets Regulation of Financial Markets 80 Acting as Financial Intermediaries 83 ...

Semi Annual Letter

... the last three years. The robust growth rate is attributable to soaring consumption and rising productivity. The wealth impacts of the stock market gains and a near full employment economy have pushed consumer confidence to a 30-year high. Real consumption has been growing at about 6.0% annually, le ...

... the last three years. The robust growth rate is attributable to soaring consumption and rising productivity. The wealth impacts of the stock market gains and a near full employment economy have pushed consumer confidence to a 30-year high. Real consumption has been growing at about 6.0% annually, le ...

Topics in economic theory

... Walrasian and in a non-Walrasian setting. After having developed the Walrasian model and derived its properties in terms of welfare, we shall introduce factors like externalities and public goods to understand how they invalidate the previous efficiency results and, moreover, which are possible meas ...

... Walrasian and in a non-Walrasian setting. After having developed the Walrasian model and derived its properties in terms of welfare, we shall introduce factors like externalities and public goods to understand how they invalidate the previous efficiency results and, moreover, which are possible meas ...

Weekly Commentary 09-23-13 PAA

... * Quantitative Easing is a government monetary policy occasionally used to increase the money supply by buying government securities or other securities from the market. Quantitative easing increases the money supply by flooding financial institutions with capital in an effort to promote increased l ...

... * Quantitative Easing is a government monetary policy occasionally used to increase the money supply by buying government securities or other securities from the market. Quantitative easing increases the money supply by flooding financial institutions with capital in an effort to promote increased l ...

Presentation

... different variable rates – For instance one may be based on the LIBOR and the other on the Prime Rate of a country. Obviously a fixed-fixed swap will not make sense. ...

... different variable rates – For instance one may be based on the LIBOR and the other on the Prime Rate of a country. Obviously a fixed-fixed swap will not make sense. ...

“Bailouts and Financial Fragility” by Todd Keister

... liabilities and short-run value of banks assets. So he assumes that this indicator has information (which is true) as we all know that maintaining a balance between short-term assets and short-term liabilities is critical I should say that Proposition 3 is beautifully simple and intuitive and for on ...

... liabilities and short-run value of banks assets. So he assumes that this indicator has information (which is true) as we all know that maintaining a balance between short-term assets and short-term liabilities is critical I should say that Proposition 3 is beautifully simple and intuitive and for on ...

X - Foster School of Business

... Would apply modified impairment guidance in Topic 320 • An allowance approach would be used for recognizing impairment losses, which would allow for credit loss reversals • Allowance will be limited to the difference between amortized cost and fair value • Requirement to consider the length of time ...

... Would apply modified impairment guidance in Topic 320 • An allowance approach would be used for recognizing impairment losses, which would allow for credit loss reversals • Allowance will be limited to the difference between amortized cost and fair value • Requirement to consider the length of time ...

Long-Term Capital Management

... Indonesia, South Korea, and Thailand were most affected by the crisis – marked by high Debt/GDP ratio and alarmingly low forecasted growth ...

... Indonesia, South Korea, and Thailand were most affected by the crisis – marked by high Debt/GDP ratio and alarmingly low forecasted growth ...

1 - International Business courses

... A. Is indicators of real purchasing power, education, and health to give a more comprehensive measure of economic development. B. A measure of the increase of the cost of living. C. The average change in consumer prices over time in a fixed market basket of goods and services. D. Is an adjustment i ...

... A. Is indicators of real purchasing power, education, and health to give a more comprehensive measure of economic development. B. A measure of the increase of the cost of living. C. The average change in consumer prices over time in a fixed market basket of goods and services. D. Is an adjustment i ...

Presentation to the California Bankers Association, 121 Annual Convention Dana Point, CA

... In sum, the economy is doing much better, but is still fragile. On balance, I expect the economy’s moderate growth pace to continue. My forecast calls for real gross domestic product to expand about 2½ percent this year and 2¾ percent next year. The unemployment rate is likely to be around 8 percen ...

... In sum, the economy is doing much better, but is still fragile. On balance, I expect the economy’s moderate growth pace to continue. My forecast calls for real gross domestic product to expand about 2½ percent this year and 2¾ percent next year. The unemployment rate is likely to be around 8 percen ...

4.4 Planning37.38 KB

... starts to collapse e.g. chance of crisis triggering a fall in confidence, fall in aggregate demand, rise in unemployment, opportunity cost of taxpayer’s bail out etc. These external costs need to be internalized, for example, a bank levy and/or regulation needs to be more effective to ensure banking ...

... starts to collapse e.g. chance of crisis triggering a fall in confidence, fall in aggregate demand, rise in unemployment, opportunity cost of taxpayer’s bail out etc. These external costs need to be internalized, for example, a bank levy and/or regulation needs to be more effective to ensure banking ...

Financial Market Crisis Overview I

... We do know however that the automobile industry is in serious trouble and GM and Chrysler are close to bankruptcy and even Toyota recorded its first loss in recent history. Automobile and light truck sales dropped 35% from December 2007 to December 2008 and economists forecast a drop from 13.3 milli ...

... We do know however that the automobile industry is in serious trouble and GM and Chrysler are close to bankruptcy and even Toyota recorded its first loss in recent history. Automobile and light truck sales dropped 35% from December 2007 to December 2008 and economists forecast a drop from 13.3 milli ...

Inflation and Deflation

... amount of money needed within an economy. If there are too many dollars in the system, sales prices inflate to compensate—each dollar buys you less. If currency is in demand, prices deflate—each dollar is able to buy you more. While controlled inflation can help prevent short-term shocks to the eco ...

... amount of money needed within an economy. If there are too many dollars in the system, sales prices inflate to compensate—each dollar buys you less. If currency is in demand, prices deflate—each dollar is able to buy you more. While controlled inflation can help prevent short-term shocks to the eco ...

How similar is the current crisis to the Great Depression?

... deterioration in financial conditions from balance sheet contraction, asset fire sales, and increased demand for liquid assets has been more rapid than during the Great Depression and at least as strong, if not stronger (see Figures 1 and 2 describing financial factors in the US). Feedback effects o ...

... deterioration in financial conditions from balance sheet contraction, asset fire sales, and increased demand for liquid assets has been more rapid than during the Great Depression and at least as strong, if not stronger (see Figures 1 and 2 describing financial factors in the US). Feedback effects o ...

international assets advisory, llc (“iaa”) “pure” foreign currency

... of ways to take a foreign currency position. *Buy a note or bond denominated in the foreign currency *Buy a “derivative” that rises or falls with that currency *Buy an equity (stock) in a company that denominates its income and balance sheets in that currency *Buy a futures contract on that currency ...

... of ways to take a foreign currency position. *Buy a note or bond denominated in the foreign currency *Buy a “derivative” that rises or falls with that currency *Buy an equity (stock) in a company that denominates its income and balance sheets in that currency *Buy a futures contract on that currency ...

Financialization

Financialization is a term sometimes used in discussions of the financial capitalism that has developed over the decades between 1980 and 2010, in which financial leverage tended to override capital (equity), and financial markets tended to dominate over the traditional industrial economy and agricultural economics.Financialization describes an economic system or process that attempts to reduce all value that is exchanged (whether tangible or intangible, future or present promises, etc.) into a financial instrument. The intent of financialization is to be able to reduce any work product or service to an exchangeable financial instrument, like currency, and thus make it easier for people to trade these financial instruments.Workers, through a financial instrument such as a mortgage, may trade their promise of future work or wages for a home. The financialization of risk sharing is what makes possible all insurance. The financialization of a government's promises (e.g., US government bonds) is what makes possible all government deficit spending. Financialization also makes economic rents possible.