Year 9 Financial Management Revision Booklet Name: Date: Topics

... Calculate the total cost of NAB shares. 2000 x $25.78 = $51,560 b) James later sold the shares when they reached a price of $27.16. Calculate the total amount James received and his total profit. 2000 x $27.16 = $54,320 Profit = $54,320 - $51,560 22. Define the term credit. Credit is an agreement in ...

... Calculate the total cost of NAB shares. 2000 x $25.78 = $51,560 b) James later sold the shares when they reached a price of $27.16. Calculate the total amount James received and his total profit. 2000 x $27.16 = $54,320 Profit = $54,320 - $51,560 22. Define the term credit. Credit is an agreement in ...

Monthly strategy report february 2015

... move completely randomly, but we will be able to predict how they will act over longer periods, since the sum of these small moments of chaos must approach zero. This idea is very useful for many things, among others, to describe physical processes such as diffusion or osmosis and, also, movements i ...

... move completely randomly, but we will be able to predict how they will act over longer periods, since the sum of these small moments of chaos must approach zero. This idea is very useful for many things, among others, to describe physical processes such as diffusion or osmosis and, also, movements i ...

Winner Determined by Information

... accounts, etc., and maintained a top-ranking position for 2 years in a row in terms of customer satisfaction in the survey this year on financial institutions conducted by Nihon Keizai Shimbun Inc. This position is being supported by its Meguro Production Center (Shinagawa-ku, Tokyo) which plays a c ...

... accounts, etc., and maintained a top-ranking position for 2 years in a row in terms of customer satisfaction in the survey this year on financial institutions conducted by Nihon Keizai Shimbun Inc. This position is being supported by its Meguro Production Center (Shinagawa-ku, Tokyo) which plays a c ...

U.S. “Quantitative Easing” is Fracturing the Global Economy Michael

... rate would mean “slower nominal income growth. Slower nominal income growth, in turn, means that less of the needed adjustment in household debt-to-income ratios will come from rising incomes. This puts more of the adjustment burden on paying down debt.” And it is debt deflation that is plaguing the ...

... rate would mean “slower nominal income growth. Slower nominal income growth, in turn, means that less of the needed adjustment in household debt-to-income ratios will come from rising incomes. This puts more of the adjustment burden on paying down debt.” And it is debt deflation that is plaguing the ...

The Global Economic Crisis: Systemic Failures and

... relations and macroeconomic policies. The speculative bubbles, starting with the United States housing price bubble, were made possible by an active policy of deregulating financial markets on a global scale, widely endorsed by Governments around the world. The spreading of risk and the severing of ...

... relations and macroeconomic policies. The speculative bubbles, starting with the United States housing price bubble, were made possible by an active policy of deregulating financial markets on a global scale, widely endorsed by Governments around the world. The spreading of risk and the severing of ...

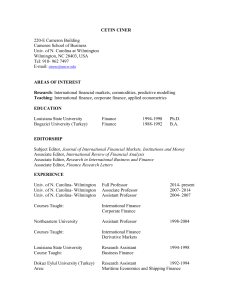

cetin ciner - University of North Carolina Wilmington

... from an Emerging Market (with A. Karagozoglu), 2008, International Review of Financial Analysis 17, 664- 680. 17) Dynamic Linkages between International Bond Markets (sole-authored), 2007, Journal of Multinational Financial Management 17, 290- 303. 18) Transactions, Volume and Volatility: Evidence f ...

... from an Emerging Market (with A. Karagozoglu), 2008, International Review of Financial Analysis 17, 664- 680. 17) Dynamic Linkages between International Bond Markets (sole-authored), 2007, Journal of Multinational Financial Management 17, 290- 303. 18) Transactions, Volume and Volatility: Evidence f ...

Presentation title

... out by IMF. Fed to inject further $ 800bn into economy December : US in recession from December 2007 is acknowledged ...

... out by IMF. Fed to inject further $ 800bn into economy December : US in recession from December 2007 is acknowledged ...

Lecture 11

... bonds directly and the price of other assets indirectly, this is because the purchase of govt bonds will result in increased money holding for those that sell bonds, as bong sellers rebalance their portfolios and buy assets the price of these other assets rise as well, rising asset price lead to red ...

... bonds directly and the price of other assets indirectly, this is because the purchase of govt bonds will result in increased money holding for those that sell bonds, as bong sellers rebalance their portfolios and buy assets the price of these other assets rise as well, rising asset price lead to red ...

ECON 3303 Money and Banking Exam 1 Spring 2013

... 13) Economists group commercial banks, savings and loan associations, credit unions, mutual funds, mutual savings banks, insurance companies, pension funds, and finance companies together under the heading financial intermediaries. Financial intermediaries A) can hurt the performance of the economy. ...

... 13) Economists group commercial banks, savings and loan associations, credit unions, mutual funds, mutual savings banks, insurance companies, pension funds, and finance companies together under the heading financial intermediaries. Financial intermediaries A) can hurt the performance of the economy. ...

CC form 228

... Disclosure is voluntary. However, failure to provide complete information and provide responses may result in a disapproval of the requested action. ...

... Disclosure is voluntary. However, failure to provide complete information and provide responses may result in a disapproval of the requested action. ...

This PDF is a selection from a published volume from... Economic Research Volume Title: NBER International Seminar on Macroeconom

... the negative impact of sudden stops on firms’ investment. The second motive looks very much like a precautionary one too, and in fact Caballero and Panageas (2007) use for reserves the term of precautionary resources. In a sense, financial underdevelopment in the form of domestic financial constrain ...

... the negative impact of sudden stops on firms’ investment. The second motive looks very much like a precautionary one too, and in fact Caballero and Panageas (2007) use for reserves the term of precautionary resources. In a sense, financial underdevelopment in the form of domestic financial constrain ...

Bailouts Won`t Save a Global Economy That`s Breaking Apart

... The current flap over “saving” the domestic auto sector is a case in point. What is being discussed will be no more effective than the bank bailout, and is, in fact, an adjunct of the bank bailout. The auto sector has, like most of American industry, been transformed into an appendage of the financi ...

... The current flap over “saving” the domestic auto sector is a case in point. What is being discussed will be no more effective than the bank bailout, and is, in fact, an adjunct of the bank bailout. The auto sector has, like most of American industry, been transformed into an appendage of the financi ...

Abstract - International Association for Energy Economics

... energy speculative bubble or price spike can have negative economic effects through macroeconomic transmission; namely that energy induced inflation is countered by higher interest rates, ultimately leading to lower economic ...

... energy speculative bubble or price spike can have negative economic effects through macroeconomic transmission; namely that energy induced inflation is countered by higher interest rates, ultimately leading to lower economic ...

The Global Financial Crisis: Causes and Solutions

... expand its role in as a dominant player in providing financial services. Many financial products and derivatives were introduced as a result of increasing global trade and liberalization. The involvement of many financial and investment banks in the mortgage market (securities and loans) is an examp ...

... expand its role in as a dominant player in providing financial services. Many financial products and derivatives were introduced as a result of increasing global trade and liberalization. The involvement of many financial and investment banks in the mortgage market (securities and loans) is an examp ...

Real versus Financial Assets

... Informational Role of Financial Markets • If a firm performing well, investors will bid up ,on the other hand, a company’s prospects seem poor, investors will bid down • However, Some companies can be “hot” for a short period of time, attract a large flow of investor capital, and then fail after onl ...

... Informational Role of Financial Markets • If a firm performing well, investors will bid up ,on the other hand, a company’s prospects seem poor, investors will bid down • However, Some companies can be “hot” for a short period of time, attract a large flow of investor capital, and then fail after onl ...

Download: Turkey's Economy and the Global Economic Crisis (pdf)

... provided a buffer against external shocks. Fiscal discipline was the cornerstone of our economic program. We have achieved noteworthy success on the fiscal policy front. By ...

... provided a buffer against external shocks. Fiscal discipline was the cornerstone of our economic program. We have achieved noteworthy success on the fiscal policy front. By ...

circular-flow diagram

... Transactions: The Circular-Flow Diagram Trade takes the form of barter when people directly ...

... Transactions: The Circular-Flow Diagram Trade takes the form of barter when people directly ...

On Global Currencies Jeffrey Frankel, Harpel Professor, Harvard

... Experience of other emerging markets suggests it is better to exit from a peg in good times, when the BoP is strong, than to wait until the currency is under attack. Introducing some flexibility now, even though not ready for free floating. ...

... Experience of other emerging markets suggests it is better to exit from a peg in good times, when the BoP is strong, than to wait until the currency is under attack. Introducing some flexibility now, even though not ready for free floating. ...

Financialization

Financialization is a term sometimes used in discussions of the financial capitalism that has developed over the decades between 1980 and 2010, in which financial leverage tended to override capital (equity), and financial markets tended to dominate over the traditional industrial economy and agricultural economics.Financialization describes an economic system or process that attempts to reduce all value that is exchanged (whether tangible or intangible, future or present promises, etc.) into a financial instrument. The intent of financialization is to be able to reduce any work product or service to an exchangeable financial instrument, like currency, and thus make it easier for people to trade these financial instruments.Workers, through a financial instrument such as a mortgage, may trade their promise of future work or wages for a home. The financialization of risk sharing is what makes possible all insurance. The financialization of a government's promises (e.g., US government bonds) is what makes possible all government deficit spending. Financialization also makes economic rents possible.