Subscribe About/Contact Advertise Français All articles

... products, and several months ago we wrote about the gaps in regulatory and accounting standards, and highlighted failures in corporate governance. True, there may have been ignorance about the amount of debt outstanding and who was exposed, but clearly the regulatory structure was simply unable to d ...

... products, and several months ago we wrote about the gaps in regulatory and accounting standards, and highlighted failures in corporate governance. True, there may have been ignorance about the amount of debt outstanding and who was exposed, but clearly the regulatory structure was simply unable to d ...

Effective Manager Programme

... A notional charge representing the extent to which an asset has been worn out or used up during the year. ...

... A notional charge representing the extent to which an asset has been worn out or used up during the year. ...

Slide 1

... WASHINGTON, May 8 (Reuters) – Democrats wrote to officials to raise issues with the Fed's massive ...

... WASHINGTON, May 8 (Reuters) – Democrats wrote to officials to raise issues with the Fed's massive ...

Course Contents/Syllabus

... Understanding the structure of banking and financial institutions and the legal environment in which it operates is the basic objective of the course. The course is designed so that the students are aware of the latest advancements in the banking and non-banking companies. The course also prov ...

... Understanding the structure of banking and financial institutions and the legal environment in which it operates is the basic objective of the course. The course is designed so that the students are aware of the latest advancements in the banking and non-banking companies. The course also prov ...

Joao Carlos Ferraz (ES)

... As market based finance can be relied only partially for development financing, a stronger configuration for a national financial industry is where private and public institutions co-live . But… attention!!! Time and place do matter in defining: (i) a DB place in development and, (ii) the public/pri ...

... As market based finance can be relied only partially for development financing, a stronger configuration for a national financial industry is where private and public institutions co-live . But… attention!!! Time and place do matter in defining: (i) a DB place in development and, (ii) the public/pri ...

Development Banks

... As market based finance can be relied only partially for development financing, a stronger configuration for a national financial industry is where private and public institutions co-live . But… attention!!! Time and place do matter in defining: (i) a DB place in development and, (ii) the public/pri ...

... As market based finance can be relied only partially for development financing, a stronger configuration for a national financial industry is where private and public institutions co-live . But… attention!!! Time and place do matter in defining: (i) a DB place in development and, (ii) the public/pri ...

Overview of the Indian Economy: Budget 2008 and beyond

... “If America's subprime crisis demonstrates the pitfalls of untrammelled finance, India illustrates the opposite danger. Since its regulators get blamed only for mishaps, not for lost growth and wasted opportunities, they are too conservative. ... New ideas are banned unless explicitly permitted. Th ...

... “If America's subprime crisis demonstrates the pitfalls of untrammelled finance, India illustrates the opposite danger. Since its regulators get blamed only for mishaps, not for lost growth and wasted opportunities, they are too conservative. ... New ideas are banned unless explicitly permitted. Th ...

... The Course of Consumer Margins in Turkey In an economy, turning points of the consumer loan margins should be analyzed in conjunction with the events shaping the economic climate of the country (See chart). In Turkey, it can be observed that margins jumped sharply after the 2008 global crisis mainly ...

Why the unstable euro financial market hurts the U.S. economy July

... potentially significant impacts from the European debt. There really isn’t as much linkage with the U.S. banks to the European issue. It’s more the European banks to the European banks.” (:13) But while U.S. banks may not be linked closely with European banks, Wobbekind says what happens in Europe w ...

... potentially significant impacts from the European debt. There really isn’t as much linkage with the U.S. banks to the European issue. It’s more the European banks to the European banks.” (:13) But while U.S. banks may not be linked closely with European banks, Wobbekind says what happens in Europe w ...

NCEA Level 1 Accounting Notes

... The donation increases the accumulated fund / equity (by increasing net surplus / profit)/ from (because of) an increase in the club’s bank account (but not from members’ contributions). The barbecue is depreciated to recognise use of the asset each year you have it / or the barbecue is depreciated ...

... The donation increases the accumulated fund / equity (by increasing net surplus / profit)/ from (because of) an increase in the club’s bank account (but not from members’ contributions). The barbecue is depreciated to recognise use of the asset each year you have it / or the barbecue is depreciated ...

dow jones newswire coverage

... in mid-1998 that still hasn't reversed itself, Ffrench-David pointed out. A smattering of other influential economic thinkers, including billionaire financier George Soros and Nobel laureate Joseph Stiglitz, have also taken IMF policy prescriptions to task while arguing for greater regulation in glo ...

... in mid-1998 that still hasn't reversed itself, Ffrench-David pointed out. A smattering of other influential economic thinkers, including billionaire financier George Soros and Nobel laureate Joseph Stiglitz, have also taken IMF policy prescriptions to task while arguing for greater regulation in glo ...

Simon Johnson, "Too Big to Save?"

... American Oligarchs and the Financial Crisis The oligarchy and the government policies that aided it did not alone cause the financial crisis that exploded last year. There were many factors that contributed, including excessive borrowing by households and lax lending standards out on the fringes of ...

... American Oligarchs and the Financial Crisis The oligarchy and the government policies that aided it did not alone cause the financial crisis that exploded last year. There were many factors that contributed, including excessive borrowing by households and lax lending standards out on the fringes of ...

here - Chicago Political Economy Group

... cent per $100 of underlying value 2012 notional value on the CME alone was $805 trillion. ...

... cent per $100 of underlying value 2012 notional value on the CME alone was $805 trillion. ...

Twenty years of inflation targeting 1 Introduction

... to the global macroeconomic crisis was the boom and subsequent bust of the US housing market. The boom was associated with the development of new financial securities often backed by housing mortgages. These securities facilitated an increase in mortgage debt by US households, and enabled financial ...

... to the global macroeconomic crisis was the boom and subsequent bust of the US housing market. The boom was associated with the development of new financial securities often backed by housing mortgages. These securities facilitated an increase in mortgage debt by US households, and enabled financial ...

Slide 1

... - Probably best solution … if could figure out how to do it. - Problem: Hard to predict impact? world financial meltdown? ...

... - Probably best solution … if could figure out how to do it. - Problem: Hard to predict impact? world financial meltdown? ...

How the Bond Market Affects Mortgage Rates

... They then determine what price they'll pay for Government of Canada Bonds. The price they'll pay immediately defines the base market rate for wholesale funds. Every day, trends in this rate are watched closely by all Financial Institutions, in order to be in a position to adjust their rates on depos ...

... They then determine what price they'll pay for Government of Canada Bonds. The price they'll pay immediately defines the base market rate for wholesale funds. Every day, trends in this rate are watched closely by all Financial Institutions, in order to be in a position to adjust their rates on depos ...

Changing world of work, and the challenges for Trade Unions

... between 2007 & 2008) – higher loss in countries where pensions were privatized (ex in Latin America) Over 50% drop in FDI in some developing countries (UNCTAD), drop in aid too Wage cuts/wage freeze – real wages fell from 4.7% in 2007 to 1.5% in 2008 – situation worsened in 2009, higher work loads, ...

... between 2007 & 2008) – higher loss in countries where pensions were privatized (ex in Latin America) Over 50% drop in FDI in some developing countries (UNCTAD), drop in aid too Wage cuts/wage freeze – real wages fell from 4.7% in 2007 to 1.5% in 2008 – situation worsened in 2009, higher work loads, ...

11.07.2008 - Erste Bank Analysts: Outlook for insurance markets in

... potential While most of the Western European markets are more or less saturated, Eastern Europe still offers enormous growth potential, mainly based on two facts. Firstly, the economies in Eastern European countries are growing much faster than in Western Europe, resulting in significantly higher GD ...

... potential While most of the Western European markets are more or less saturated, Eastern Europe still offers enormous growth potential, mainly based on two facts. Firstly, the economies in Eastern European countries are growing much faster than in Western Europe, resulting in significantly higher GD ...

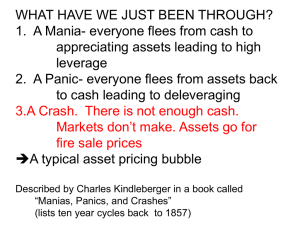

Financialization

Financialization is a term sometimes used in discussions of the financial capitalism that has developed over the decades between 1980 and 2010, in which financial leverage tended to override capital (equity), and financial markets tended to dominate over the traditional industrial economy and agricultural economics.Financialization describes an economic system or process that attempts to reduce all value that is exchanged (whether tangible or intangible, future or present promises, etc.) into a financial instrument. The intent of financialization is to be able to reduce any work product or service to an exchangeable financial instrument, like currency, and thus make it easier for people to trade these financial instruments.Workers, through a financial instrument such as a mortgage, may trade their promise of future work or wages for a home. The financialization of risk sharing is what makes possible all insurance. The financialization of a government's promises (e.g., US government bonds) is what makes possible all government deficit spending. Financialization also makes economic rents possible.