ICE FUTURES EQUITY INDEX FUTURES: PRIMARY MARKET

... * Both FTSE 100 Declared Dividend Index Futures and FTSE 100 Dividend Index Futures RDSA Withholding The Exchange will apply per lot Exchange and Clearing fee reductions to all of the PMM’s proprietary business booked to the Market Making “M” accounts and executed on screen or via ICE Block. A PMM w ...

... * Both FTSE 100 Declared Dividend Index Futures and FTSE 100 Dividend Index Futures RDSA Withholding The Exchange will apply per lot Exchange and Clearing fee reductions to all of the PMM’s proprietary business booked to the Market Making “M” accounts and executed on screen or via ICE Block. A PMM w ...

PRINCIPLES FOR ECONOMIC

... of society and the real economy. Re-privatization of financial institutions taken over by the government (such as Fannie Mae and Freddie Mac) must not be the default option. Retaining government stakes and exerting more government control in financial corporations may be the best option for insuring ...

... of society and the real economy. Re-privatization of financial institutions taken over by the government (such as Fannie Mae and Freddie Mac) must not be the default option. Retaining government stakes and exerting more government control in financial corporations may be the best option for insuring ...

Political economy of debt

... • Rentiers – the classical image of unearned wealth increasing • Banks and institutional investors (insurance companies, pension funds) – unequal redistribution of profits, interests and fictitious capital ...

... • Rentiers – the classical image of unearned wealth increasing • Banks and institutional investors (insurance companies, pension funds) – unequal redistribution of profits, interests and fictitious capital ...

Aleksandra Vukosavljevic Prezentacija

... Additional safety control devices are needed: Periphery Minus Core CDS Spreads (in bps) Banking union ...

... Additional safety control devices are needed: Periphery Minus Core CDS Spreads (in bps) Banking union ...

the 2016 economic summit conference schedule

... an era of engagement banking – a time when credit unions must engage members in new ways and maintain relevant, contextual interactions. Life and money are inextricably linked, and credit unions can develop lasting bonds along the member life journey. And we can do it better than any neo-bank, start ...

... an era of engagement banking – a time when credit unions must engage members in new ways and maintain relevant, contextual interactions. Life and money are inextricably linked, and credit unions can develop lasting bonds along the member life journey. And we can do it better than any neo-bank, start ...

Financial Stability in the Maldives

... Country Paper - SAARC Finance Governor’s Symposium on ‘Financial Stability’ ...

... Country Paper - SAARC Finance Governor’s Symposium on ‘Financial Stability’ ...

No Case for Complacence* C.P. Chandrasekhar

... imported capital goods would also be affected because of the sudden and sharp increase in the rupee values of such imports. In addition capital and currency market developments can depress domestic demand in multiple ways. Market volatility and rupee depreciation is likely to affect investor sentime ...

... imported capital goods would also be affected because of the sudden and sharp increase in the rupee values of such imports. In addition capital and currency market developments can depress domestic demand in multiple ways. Market volatility and rupee depreciation is likely to affect investor sentime ...

EUROPEAN CRISIS’ EFFECTS UPON THE ROMANIAN ECONOMY

... has remained predominantly national in scope. This may hinder the single market for financial services and increase the chances that financial risks related to the EU–wide activities of systemically important cross–border institutions will not be detected and acted upon. It also complicates financia ...

... has remained predominantly national in scope. This may hinder the single market for financial services and increase the chances that financial risks related to the EU–wide activities of systemically important cross–border institutions will not be detected and acted upon. It also complicates financia ...

The Impact of AI and Technology on Financial Services

... the financial services industry. This piece of AI will arguably provide more accurate advice than human financial advisers and do so at a lower cost. While some may perceive this as a threat, roboadvice could be the solution to providing advice to clients with fewer total assets. Traditionally, asse ...

... the financial services industry. This piece of AI will arguably provide more accurate advice than human financial advisers and do so at a lower cost. While some may perceive this as a threat, roboadvice could be the solution to providing advice to clients with fewer total assets. Traditionally, asse ...

Financial Deepening and Economic

... present value of foreign exchange, PVPFX t ; rental rate of capital for each sector, r1k : R+ R, and sequence of gross output, Yi ,t ; total supply of commodities, Ai ,t ; sectoral capital stock, K i ,t ; sectoral investment, I i ,t ; exports, X i ,t ; government services, GOVt ; level of household ...

... present value of foreign exchange, PVPFX t ; rental rate of capital for each sector, r1k : R+ R, and sequence of gross output, Yi ,t ; total supply of commodities, Ai ,t ; sectoral capital stock, K i ,t ; sectoral investment, I i ,t ; exports, X i ,t ; government services, GOVt ; level of household ...

Capital Structure Decision

... Financial distress Costs of Financial Distress - Costs arising from bankruptcy or distorted business decisions before bankruptcy. Market Value = Value if all Equity Financed + PV Tax Shield - PV Costs of Financial ...

... Financial distress Costs of Financial Distress - Costs arising from bankruptcy or distorted business decisions before bankruptcy. Market Value = Value if all Equity Financed + PV Tax Shield - PV Costs of Financial ...

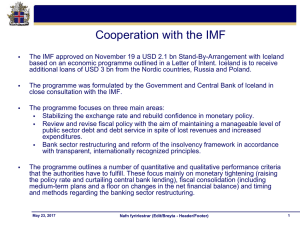

DAGSKRÁ

... Work in progress to establish and Asset Management Company that will take over companies facing restructuring by the banks of special social or economic importance to Iceland. Work on medium-term fiscal consolidation in train to be approved by mid-2009. ...

... Work in progress to establish and Asset Management Company that will take over companies facing restructuring by the banks of special social or economic importance to Iceland. Work on medium-term fiscal consolidation in train to be approved by mid-2009. ...

Mr. Lawrence Eagles, Global President-Oil

... J.P. Morgan is the marketing name for JPMorgan Chase and its subsidiaries and affiliates worldwide. The JPMorgan Chase Bank, N.A. is a member of the FDIC. J.P. Morgan Securities Inc. ("JPMSI") and J.P. Morgan Clearing Corp. (“JPMCC”) are separately registered broker-dealer subsidiaries of JPMorgan C ...

... J.P. Morgan is the marketing name for JPMorgan Chase and its subsidiaries and affiliates worldwide. The JPMorgan Chase Bank, N.A. is a member of the FDIC. J.P. Morgan Securities Inc. ("JPMSI") and J.P. Morgan Clearing Corp. (“JPMCC”) are separately registered broker-dealer subsidiaries of JPMorgan C ...

O 2 MS-423 MS-423 : MARKETING OF FINANCIAL

... Explain the important stages in the life - span of a product and discuss as to how it helps in the marketing of banking products. ...

... Explain the important stages in the life - span of a product and discuss as to how it helps in the marketing of banking products. ...

AOF Brochure

... What is the National Academy Foundation? Established in 1982 by the former CEO of Citigroup, the Academy of Finance introduces students to the broad career opportunities in the financial services industry. ...

... What is the National Academy Foundation? Established in 1982 by the former CEO of Citigroup, the Academy of Finance introduces students to the broad career opportunities in the financial services industry. ...

Chapter 12

... • The Fed prepares several indexes of the tradeweighted average of the dollar. The major distinctions are: • Nominal or real • Major-country index or broad index • The real index accounts for differential rates of inflation. This is particularly important for countries where the inflation rate is ve ...

... • The Fed prepares several indexes of the tradeweighted average of the dollar. The major distinctions are: • Nominal or real • Major-country index or broad index • The real index accounts for differential rates of inflation. This is particularly important for countries where the inflation rate is ve ...

Financialization

Financialization is a term sometimes used in discussions of the financial capitalism that has developed over the decades between 1980 and 2010, in which financial leverage tended to override capital (equity), and financial markets tended to dominate over the traditional industrial economy and agricultural economics.Financialization describes an economic system or process that attempts to reduce all value that is exchanged (whether tangible or intangible, future or present promises, etc.) into a financial instrument. The intent of financialization is to be able to reduce any work product or service to an exchangeable financial instrument, like currency, and thus make it easier for people to trade these financial instruments.Workers, through a financial instrument such as a mortgage, may trade their promise of future work or wages for a home. The financialization of risk sharing is what makes possible all insurance. The financialization of a government's promises (e.g., US government bonds) is what makes possible all government deficit spending. Financialization also makes economic rents possible.