Presentation to the Phoenix Chapter of Lambda Alpha International Phoenix, AZ

... Meanwhile, developers and their creditors have been caught with excess raw land, lots that are partially completed, or completed but still vacant. Values for finished but vacant lots across the country are reported to be off about 50 percent from their peak, with some hard-hit regions in the West d ...

... Meanwhile, developers and their creditors have been caught with excess raw land, lots that are partially completed, or completed but still vacant. Values for finished but vacant lots across the country are reported to be off about 50 percent from their peak, with some hard-hit regions in the West d ...

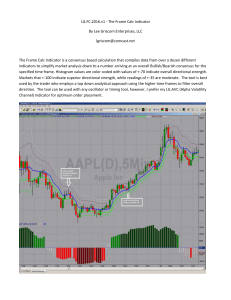

LG.FC.2016.v1

... specified time frame. Histogram values are color coded with values of +-70 indicate overall directional strength. Markets that +-100 indicate superior directional strength, while readings of +-35 are moderate. The tool is best used by the trader who employs a top down analytical approach using the h ...

... specified time frame. Histogram values are color coded with values of +-70 indicate overall directional strength. Markets that +-100 indicate superior directional strength, while readings of +-35 are moderate. The tool is best used by the trader who employs a top down analytical approach using the h ...

Costa_Rica_en.pdf

... to increased imports of intermediate goods (industrial components and inputs, including fuels) at a time when international prices are higher and the manufacturing industry is recovering. Goods exports are projected to grow by an annual rate of 10.1%, particularly on the strength of the increased vo ...

... to increased imports of intermediate goods (industrial components and inputs, including fuels) at a time when international prices are higher and the manufacturing industry is recovering. Goods exports are projected to grow by an annual rate of 10.1%, particularly on the strength of the increased vo ...

building the new regulatory framework: challenges ahead

... macroprudential risk: example, LTV or DTI vs. countercyclical buffers in bubbles prevention. ...

... macroprudential risk: example, LTV or DTI vs. countercyclical buffers in bubbles prevention. ...

WSJ: Hitting the Limits of Monetary Policy

... This should come as no surprise. Interest rates at zero or below, combined with an expanded central-bank balance sheet through QE, has been a strategy employed by central banks in the eurozone, U.K., Japan and the U.S. to increase liquidity and raise both market expectations of inflation as well as ...

... This should come as no surprise. Interest rates at zero or below, combined with an expanded central-bank balance sheet through QE, has been a strategy employed by central banks in the eurozone, U.K., Japan and the U.S. to increase liquidity and raise both market expectations of inflation as well as ...

Discussion of External Constraints on Monetary Policy and the Financial Accelerator

... (i) Scope of Regime Comparisons in This Paper Paper compares fixed rates with one particular form of flexible rates under two specific shocks. This is a little narrow: • The form of flexibility can matter a lot: E.g. money ...

... (i) Scope of Regime Comparisons in This Paper Paper compares fixed rates with one particular form of flexible rates under two specific shocks. This is a little narrow: • The form of flexibility can matter a lot: E.g. money ...

Slide 1

... structures and altering forms of provision – Banks and finance becoming less special; increasingly more substitutes available; more remote delivery possible; local markets less relevant; lines between products and financial institutions blurring – Globalization accelerating: increased (gross) capita ...

... structures and altering forms of provision – Banks and finance becoming less special; increasingly more substitutes available; more remote delivery possible; local markets less relevant; lines between products and financial institutions blurring – Globalization accelerating: increased (gross) capita ...

Competition Policy in Banking and Financial Services

... Economies of scale and scope It is generally accepted that there exist economies of scale in banking (and other parts of the financial sector), such that average costs fall with increasing output, at least up to moderate size levels. Levels of concentration in banking (except in countries such as t ...

... Economies of scale and scope It is generally accepted that there exist economies of scale in banking (and other parts of the financial sector), such that average costs fall with increasing output, at least up to moderate size levels. Levels of concentration in banking (except in countries such as t ...

To view this press release as a file

... Total trading volume increased, in parallel with an increase in nonresidents’ relative share of total trading volume. Total trading volume in foreign currency in November was about $160 billion, compared with about $107 billion in October. Average daily trading volume increased by about 2 percent, t ...

... Total trading volume increased, in parallel with an increase in nonresidents’ relative share of total trading volume. Total trading volume in foreign currency in November was about $160 billion, compared with about $107 billion in October. Average daily trading volume increased by about 2 percent, t ...

Form of Press Releases to be issued via the primary

... CHARLOTTE, N.C.– (BUSINESS WIRE) – January 19, 2016 – Bank of America Company (the "Corporation") informed its securities holders that it has filed a Current Report on Form 8-K with the U.S. Securities and Exchange Commission ("SEC") on January 19, 2016, announcing financial results for the fourth q ...

... CHARLOTTE, N.C.– (BUSINESS WIRE) – January 19, 2016 – Bank of America Company (the "Corporation") informed its securities holders that it has filed a Current Report on Form 8-K with the U.S. Securities and Exchange Commission ("SEC") on January 19, 2016, announcing financial results for the fourth q ...

Financial Crisis In US

... deposit system to handle multiple currency, later improved by Dutch and British, imported to American colonies Growing pains through a period of minimal regulation, legislation during Civil War: entire US banking system under federal regulation ...

... deposit system to handle multiple currency, later improved by Dutch and British, imported to American colonies Growing pains through a period of minimal regulation, legislation during Civil War: entire US banking system under federal regulation ...

Money Management Letter - Campbell Capital Management

... investors were betting that the Federal Reserve would be lowering interest rates in the first quarter of 2007 to offset slowing economic growth. With just two weeks into the new year, there’s been a complete reversal of opinion regarding the chance of lower interest rates. A stronger economy is now ...

... investors were betting that the Federal Reserve would be lowering interest rates in the first quarter of 2007 to offset slowing economic growth. With just two weeks into the new year, there’s been a complete reversal of opinion regarding the chance of lower interest rates. A stronger economy is now ...

Honduras_en.pdf

... remittances and the conditional transfers programme) and a 2.1% increase in government consumption. Having plunged 45.7% in 2009, gross capital formation grew by 18.8% in 2010. A major contributory factor was the recovery of public investment as multilateral organizations reopened credit lines. Incr ...

... remittances and the conditional transfers programme) and a 2.1% increase in government consumption. Having plunged 45.7% in 2009, gross capital formation grew by 18.8% in 2010. A major contributory factor was the recovery of public investment as multilateral organizations reopened credit lines. Incr ...

Great Unwinding - International eChem

... long. Nor can we rule out a further massive stimulus effort by the central banks at some point. But ‘technical trading’ logic would suggest they will fall to at least the 200-day exponential moving average, currently around $70/bbl, and probably lower (red line). Equally, if price discovery does sta ...

... long. Nor can we rule out a further massive stimulus effort by the central banks at some point. But ‘technical trading’ logic would suggest they will fall to at least the 200-day exponential moving average, currently around $70/bbl, and probably lower (red line). Equally, if price discovery does sta ...

Financialization

Financialization is a term sometimes used in discussions of the financial capitalism that has developed over the decades between 1980 and 2010, in which financial leverage tended to override capital (equity), and financial markets tended to dominate over the traditional industrial economy and agricultural economics.Financialization describes an economic system or process that attempts to reduce all value that is exchanged (whether tangible or intangible, future or present promises, etc.) into a financial instrument. The intent of financialization is to be able to reduce any work product or service to an exchangeable financial instrument, like currency, and thus make it easier for people to trade these financial instruments.Workers, through a financial instrument such as a mortgage, may trade their promise of future work or wages for a home. The financialization of risk sharing is what makes possible all insurance. The financialization of a government's promises (e.g., US government bonds) is what makes possible all government deficit spending. Financialization also makes economic rents possible.