Bank of England governor Mervyn King faced a flurry of questions

... otherwise have done and it may start to rise now we'll see. But I think the action will make a difference to the amount of lending, but it certainly doesn't guarantee that lending to the real economy is positive." ...

... otherwise have done and it may start to rise now we'll see. But I think the action will make a difference to the amount of lending, but it certainly doesn't guarantee that lending to the real economy is positive." ...

PROFIT REPORTING SEASON

... Commonwealth Securities Limited ABN 60 067 254 399 AFSL 238814 ("CommSec") is a wholly owned, but non-guaranteed, subsidiary of the Commonwealth Bank of Australia ABN 48 123 123 124 AFSL 234945 ("the Bank") and both entities are incorporated in Australia with limited liability. This information is d ...

... Commonwealth Securities Limited ABN 60 067 254 399 AFSL 238814 ("CommSec") is a wholly owned, but non-guaranteed, subsidiary of the Commonwealth Bank of Australia ABN 48 123 123 124 AFSL 234945 ("the Bank") and both entities are incorporated in Australia with limited liability. This information is d ...

EMW09_Vincent

... financial services firm focused on select, niche international markets. By using its capital and expertise, INTL seeks to facilitate wholesale, cross-border financial flows through market making and trading of international financial instruments. ...

... financial services firm focused on select, niche international markets. By using its capital and expertise, INTL seeks to facilitate wholesale, cross-border financial flows through market making and trading of international financial instruments. ...

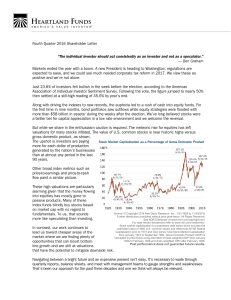

US election outcome favors US credit markets

... Fixed income investments are subject to credit risk of the issuer and the effects of changing interest rates. Interest rate risk refers to the risk that bond prices generally fall as interest rates rise and vice versa. An issuer may be unable to meet interest and/or principal payments, thereby causi ...

... Fixed income investments are subject to credit risk of the issuer and the effects of changing interest rates. Interest rate risk refers to the risk that bond prices generally fall as interest rates rise and vice versa. An issuer may be unable to meet interest and/or principal payments, thereby causi ...

Biggest Player

... - Provides credit analysis services for corporates, project finances, public financings and financial service companies. ...

... - Provides credit analysis services for corporates, project finances, public financings and financial service companies. ...

8 III. Audit expectations gap What has happened

... Bookmarker Average price/book ratio of the S&P 500 companies ...

... Bookmarker Average price/book ratio of the S&P 500 companies ...

Exam 1 - UTA.edu

... 17) The evolution of the payments system from barter to precious metals, then to fiat money, then to checks can best be understood as a consequence of A) government regulations designed to improve the efficiency of the payments system. B) competition among firms to make it easier for customers to pu ...

... 17) The evolution of the payments system from barter to precious metals, then to fiat money, then to checks can best be understood as a consequence of A) government regulations designed to improve the efficiency of the payments system. B) competition among firms to make it easier for customers to pu ...

Anarchy in the UK / I`m So Bored with the USA

... referendum on EU membership. However, the decision to leave the European Union is not a Lehmantype event. A full-blown panic is unlikely and we should see the U.S. market settle down early this week. The outlook for the U.K. economy is not good. Meanwhile, back at home, investors will look to the ca ...

... referendum on EU membership. However, the decision to leave the European Union is not a Lehmantype event. A full-blown panic is unlikely and we should see the U.S. market settle down early this week. The outlook for the U.K. economy is not good. Meanwhile, back at home, investors will look to the ca ...

Past performance does not guarantee future results.

... without notice. The opinions expressed are for general information only and are not intended to provide specific advice or recommendations for any individual. Any forecasts may not prove to be true. Economic predictions are based on estimates and are subject to change. Definitions: American Associat ...

... without notice. The opinions expressed are for general information only and are not intended to provide specific advice or recommendations for any individual. Any forecasts may not prove to be true. Economic predictions are based on estimates and are subject to change. Definitions: American Associat ...

Nigeria`s financial services industry is booming

... "The democratically elected government set in motion a series of reforms that led to macroeconomic stability," said Okey Enelamah, chief executive of African Capital Alliance, a private-equity and alternative-investment firm in Lagos that manages $178 million in assets. These reforms include intern ...

... "The democratically elected government set in motion a series of reforms that led to macroeconomic stability," said Okey Enelamah, chief executive of African Capital Alliance, a private-equity and alternative-investment firm in Lagos that manages $178 million in assets. These reforms include intern ...

Balance of Payments Statistics And International Investment Position

... that systematically summarizes for a specific time period, economic transactions of an economy with the rest of the world ” It helps monitor all international monetary transactions for a specific time period. In the increasingly interdependent world economy,aspects such as payments imbalances an ...

... that systematically summarizes for a specific time period, economic transactions of an economy with the rest of the world ” It helps monitor all international monetary transactions for a specific time period. In the increasingly interdependent world economy,aspects such as payments imbalances an ...

10 Min Options Strategy Handout - MarketClub

... All trades, patterns, charts, systems, etc., discussed in this advertisement and the product materials are for illustrative purposes only and not to be construed as specific advisory recommendations. All ideas and material presented are entirely those of the author and do not necessarily reflect tho ...

... All trades, patterns, charts, systems, etc., discussed in this advertisement and the product materials are for illustrative purposes only and not to be construed as specific advisory recommendations. All ideas and material presented are entirely those of the author and do not necessarily reflect tho ...

Lecture 11: Real Estate

... – Debt is incurred a little at a time – Payment schedules are different, can become ever more indebted while paying the minimum amount each month. ...

... – Debt is incurred a little at a time – Payment schedules are different, can become ever more indebted while paying the minimum amount each month. ...

Microcredit in Burkina Faso

... Average loan amount between 7 and 500 USD 6-12 months • Medium or Long term individual credit Average loan amount between 400-4000 USD >12 months ...

... Average loan amount between 7 and 500 USD 6-12 months • Medium or Long term individual credit Average loan amount between 400-4000 USD >12 months ...

IOOF Investments BREXIT – tea break or earthquake?

... nature and inherent to capitalism) then I suggest investors go back to first principles. In terms of stocks – if good quality stocks that have little to do with BREXIT are hit then it is probably a buying opportunity – because the longer term prices will be decided by earnings, yield, cash flow and ...

... nature and inherent to capitalism) then I suggest investors go back to first principles. In terms of stocks – if good quality stocks that have little to do with BREXIT are hit then it is probably a buying opportunity – because the longer term prices will be decided by earnings, yield, cash flow and ...

Investment Weekly

... numbers are probably more significant, since the US Federal Reserve (Fed) pays close attention to these on the theory that as more people find work, wages will bid up, resulting in inflation. More recently, the Fed has also looked at job growth as a sign that the economy is healthy while other indic ...

... numbers are probably more significant, since the US Federal Reserve (Fed) pays close attention to these on the theory that as more people find work, wages will bid up, resulting in inflation. More recently, the Fed has also looked at job growth as a sign that the economy is healthy while other indic ...

European Cross-Border Cooperation to Safeguard Stability

... Sustainable public finances are mainly a national interest and obligation. But much needs to be done at the European level as well: Re-coupling fiscal policy and it’s underlying decisions. Stronger role of the ECOFIN. Stronger differentiation of fiscal policy advice. Take current account imbal ...

... Sustainable public finances are mainly a national interest and obligation. But much needs to be done at the European level as well: Re-coupling fiscal policy and it’s underlying decisions. Stronger role of the ECOFIN. Stronger differentiation of fiscal policy advice. Take current account imbal ...

Ecuador_en.pdf

... guaraníes) showed a marginally higher increase than loans in local currency. Although this still denotes risk aversion, the increase in lending is indicative of greater confidence in the financial system and in the economy in general; moreover, it is consistent with the decline in lending rates. As ...

... guaraníes) showed a marginally higher increase than loans in local currency. Although this still denotes risk aversion, the increase in lending is indicative of greater confidence in the financial system and in the economy in general; moreover, it is consistent with the decline in lending rates. As ...

Financialization

Financialization is a term sometimes used in discussions of the financial capitalism that has developed over the decades between 1980 and 2010, in which financial leverage tended to override capital (equity), and financial markets tended to dominate over the traditional industrial economy and agricultural economics.Financialization describes an economic system or process that attempts to reduce all value that is exchanged (whether tangible or intangible, future or present promises, etc.) into a financial instrument. The intent of financialization is to be able to reduce any work product or service to an exchangeable financial instrument, like currency, and thus make it easier for people to trade these financial instruments.Workers, through a financial instrument such as a mortgage, may trade their promise of future work or wages for a home. The financialization of risk sharing is what makes possible all insurance. The financialization of a government's promises (e.g., US government bonds) is what makes possible all government deficit spending. Financialization also makes economic rents possible.