Financial Reform and Vulnerability:How to Open but Remain Safe?

... Under any pegged rate regime, capital outflows affect the financial system through an expansion or contraction of bank balance sheets; they can lead to instability in the banking sector. A flexible exchange rate may also create problems An abrupt outflow of capital can lead to a sharp depreciation o ...

... Under any pegged rate regime, capital outflows affect the financial system through an expansion or contraction of bank balance sheets; they can lead to instability in the banking sector. A flexible exchange rate may also create problems An abrupt outflow of capital can lead to a sharp depreciation o ...

Presentation to the CFA Hawaii Seventh Annual Economic Forecast Dinner

... In addition, we’ve publicly announced that we expect to keep the federal funds rate exceptionally low at least through late 2014. This guidance tells investors that short-term interest rates are likely to stay low for a long time, which then gets passed through to longer-term rates. Of course, our ...

... In addition, we’ve publicly announced that we expect to keep the federal funds rate exceptionally low at least through late 2014. This guidance tells investors that short-term interest rates are likely to stay low for a long time, which then gets passed through to longer-term rates. Of course, our ...

here

... I. Historical Background: Two components of the financial collapse A) Failure of Financial Institutions ...

... I. Historical Background: Two components of the financial collapse A) Failure of Financial Institutions ...

Global Asset Class: Cash and Fixed Interest

... Government bonds yields historically low – Any downside protection? – High possibility of capital losses ...

... Government bonds yields historically low – Any downside protection? – High possibility of capital losses ...

Slide 1 - World Bank

... Save fiscal resources in boom times Lean against the wind of excessive capital inflows Keep banks liquid, well capitalized and on a short leash Behave in a credible manner ...

... Save fiscal resources in boom times Lean against the wind of excessive capital inflows Keep banks liquid, well capitalized and on a short leash Behave in a credible manner ...

JohnMuellbauer

... shows housing wealth had zero or negative effect on (conventional national accounts) consumption before credit market liberalisation in US, UK, Australia and South Africa (and remains negative in Japan). With low LTVs in 1920s US, aggregate effect would have been negative as potential first time buy ...

... shows housing wealth had zero or negative effect on (conventional national accounts) consumption before credit market liberalisation in US, UK, Australia and South Africa (and remains negative in Japan). With low LTVs in 1920s US, aggregate effect would have been negative as potential first time buy ...

THE FIRST-WORLD DEBT CRISIS IN GLOBAL PERSPECTIVE

... Robert Wade, “A new financial architecture?”, New Left Review July/Aug 07 • Tighter regulation can be effective despite “globalization”: anti-money laundering technology; “negative enforcement” • Be cautious about fin. liberalization • Aim for “positively correlated” capital structures: GPD-linked b ...

... Robert Wade, “A new financial architecture?”, New Left Review July/Aug 07 • Tighter regulation can be effective despite “globalization”: anti-money laundering technology; “negative enforcement” • Be cautious about fin. liberalization • Aim for “positively correlated” capital structures: GPD-linked b ...

Course Content Form - Pima Community College

... Information: Prerequisites or consent of instructor is required before enrolling in this course. May be taken four times for a maximum of four credit hours. ...

... Information: Prerequisites or consent of instructor is required before enrolling in this course. May be taken four times for a maximum of four credit hours. ...

Short-Dated New Crop Options White Paper

... Short-Dated New Crop Corn, Wheat and Soybean options are listed with and subject to the rules and regulations of the CBOT. CME Group is a trademark of CME Group Inc. The Globe logo, CME, Chicago Mercantile Exchange, Globex, and CME Direct are trademarks of Chicago Mercantile Exchange Inc. ClearPort, ...

... Short-Dated New Crop Corn, Wheat and Soybean options are listed with and subject to the rules and regulations of the CBOT. CME Group is a trademark of CME Group Inc. The Globe logo, CME, Chicago Mercantile Exchange, Globex, and CME Direct are trademarks of Chicago Mercantile Exchange Inc. ClearPort, ...

Banks and Interest

... increasing the economy’s ability to produce in the future Production depends on saving because production of both consumer goods and capital goods takes time ...

... increasing the economy’s ability to produce in the future Production depends on saving because production of both consumer goods and capital goods takes time ...

The Origins of the U.S. Financial and Economic Crises

... more money. ''You have a group of people growing richer by leaps and bounds," said Peter Rodriguez, an economist at the University of Virginia. "And they liked the idea of parking some cash in the biggest, safest economy in the world." Enter the second trend, mortgage-backed securities. Wall Street ...

... more money. ''You have a group of people growing richer by leaps and bounds," said Peter Rodriguez, an economist at the University of Virginia. "And they liked the idea of parking some cash in the biggest, safest economy in the world." Enter the second trend, mortgage-backed securities. Wall Street ...

L21-23. - Harvard Kennedy School

... emerging markets than they could domestically. • Households can smooth consumption over time. • In the presence of uncertainty, investors can diversify away some risks. ...

... emerging markets than they could domestically. • Households can smooth consumption over time. • In the presence of uncertainty, investors can diversify away some risks. ...

Natural Selection - Rain Capital Management

... particularly solid during the volatility in asset prices that ...

... particularly solid during the volatility in asset prices that ...

Real Estate Investment

... Returns same as managing investor Count on managing investor to provide investment alternatives Invest through Partnerships, corporations, REITS etc. Many institutional investors must invest as passive investors to maintain legal status (ie pension funds and foundations) ...

... Returns same as managing investor Count on managing investor to provide investment alternatives Invest through Partnerships, corporations, REITS etc. Many institutional investors must invest as passive investors to maintain legal status (ie pension funds and foundations) ...

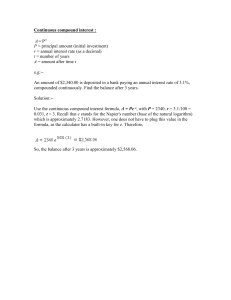

Continuous compound interest

... A Pr t P = principal amount (initial investment) r = annual interest rate (as a decimal) t = number of years A = amount after time t e.g:-An amount of $2,340.00 is deposited in a bank paying an annual interest rate of 3.1%, compounded continuously. Find the balance after 3 years. Solution:-Use the ...

... A Pr t P = principal amount (initial investment) r = annual interest rate (as a decimal) t = number of years A = amount after time t e.g:-An amount of $2,340.00 is deposited in a bank paying an annual interest rate of 3.1%, compounded continuously. Find the balance after 3 years. Solution:-Use the ...

Calendar year 2012 was characterized by another year of slow

... counter the negative effects of the past recession, the U.S. Federal Reserve pursued an aggressive monetary policy starting way back in 2008 to help stimulate the economy. At this point in time, economic growth and employment data are still not improving enough to ...

... counter the negative effects of the past recession, the U.S. Federal Reserve pursued an aggressive monetary policy starting way back in 2008 to help stimulate the economy. At this point in time, economic growth and employment data are still not improving enough to ...

The fundamentals that have been driving the price of gold are still

... driving the prices higher, are still in place. These forces include a generally-weak U.S. dollar, a potential default in Greece as well as with some European banks, a more “accommodative easing” from the ECB that will result in a further decline in the euro, more stimulus from the US Federal Reserve ...

... driving the prices higher, are still in place. These forces include a generally-weak U.S. dollar, a potential default in Greece as well as with some European banks, a more “accommodative easing” from the ECB that will result in a further decline in the euro, more stimulus from the US Federal Reserve ...

FRBSF E L CONOMIC ETTER

... Indeed, the higher costs are particularly evident for instruments related to mortgages, with lowerrated instruments seeing especially big increases. To some extent, this development may reflect heightened anxiety among market participants about downside risks to economic activity, particularly housi ...

... Indeed, the higher costs are particularly evident for instruments related to mortgages, with lowerrated instruments seeing especially big increases. To some extent, this development may reflect heightened anxiety among market participants about downside risks to economic activity, particularly housi ...

World economic growth slowing but firm

... Investors appetite towards risk is a dominant driver of the AUD. Interest-rate differentials are also in the AUD’s favour. ...

... Investors appetite towards risk is a dominant driver of the AUD. Interest-rate differentials are also in the AUD’s favour. ...

New Logo Newsletter 114.pub - Lodestar Investment Counsel

... once the weather improves, with any strength flowing through to corporate earnings? Will the Federal Reserve finish tapering its bond purchases by ...

... once the weather improves, with any strength flowing through to corporate earnings? Will the Federal Reserve finish tapering its bond purchases by ...

Financialization

Financialization is a term sometimes used in discussions of the financial capitalism that has developed over the decades between 1980 and 2010, in which financial leverage tended to override capital (equity), and financial markets tended to dominate over the traditional industrial economy and agricultural economics.Financialization describes an economic system or process that attempts to reduce all value that is exchanged (whether tangible or intangible, future or present promises, etc.) into a financial instrument. The intent of financialization is to be able to reduce any work product or service to an exchangeable financial instrument, like currency, and thus make it easier for people to trade these financial instruments.Workers, through a financial instrument such as a mortgage, may trade their promise of future work or wages for a home. The financialization of risk sharing is what makes possible all insurance. The financialization of a government's promises (e.g., US government bonds) is what makes possible all government deficit spending. Financialization also makes economic rents possible.