web site general terms, conditions and disclaimers

... In no event shall Capital Financial Group, Inc. be liable for any damages (including without limitation any direct, indirect, special, incidental, or consequential damages), losses or expenses arising in connection with the Web site, the use of the Web site, or the inability of anyone to use the Web ...

... In no event shall Capital Financial Group, Inc. be liable for any damages (including without limitation any direct, indirect, special, incidental, or consequential damages), losses or expenses arising in connection with the Web site, the use of the Web site, or the inability of anyone to use the Web ...

Brexit Vote: The Market Impact

... economies and their respective f inancial markets. While in the United States, however, internally driven economic growth should provide some insulation f or domestic stock and bond investments. Lower yields produced by central bank liquidity ef f orts should also translate into global interest in ...

... economies and their respective f inancial markets. While in the United States, however, internally driven economic growth should provide some insulation f or domestic stock and bond investments. Lower yields produced by central bank liquidity ef f orts should also translate into global interest in ...

towards more responsibility and competitiveness in the european

... probability that companies or governments will be able to repay their debt. The crisis showed that often CRAs failed to produce sufficiently reliable ratings. This could be because of conflicts of interest where they were being paid by the organisations they rated. This, combined with a trusting app ...

... probability that companies or governments will be able to repay their debt. The crisis showed that often CRAs failed to produce sufficiently reliable ratings. This could be because of conflicts of interest where they were being paid by the organisations they rated. This, combined with a trusting app ...

Day 1 — Wednesday, 10 April 2013 - Asia Pacific Financial Market

... This session will identify the key characteristics of, and differences between, financial markets in the Asia-Pacific. It will focus on market developments in China, Japan, Indonesia, South Korea, Hong Kong, Singapore and other markets in the region. It will also discuss the current state of cross-b ...

... This session will identify the key characteristics of, and differences between, financial markets in the Asia-Pacific. It will focus on market developments in China, Japan, Indonesia, South Korea, Hong Kong, Singapore and other markets in the region. It will also discuss the current state of cross-b ...

third quarter 2015 update 10/15/16

... a sharp upturn. Average hourly earnings increases have improved to 2.2% year-over-year and the unemployment rate is down to 5.1%, placing consumers, who account for 71% of GDP, in a position to spend. Low oil and energy prices are a boon for the consumer and should continue to fuel economic growth h ...

... a sharp upturn. Average hourly earnings increases have improved to 2.2% year-over-year and the unemployment rate is down to 5.1%, placing consumers, who account for 71% of GDP, in a position to spend. Low oil and energy prices are a boon for the consumer and should continue to fuel economic growth h ...

FIN 331 Chapter 1

... A. Market for ownership claims to RE assets B. Buyers/owners receive rights to cash flows generated by leasing space to tenants C. Demand (supply) side of property market is made up of investors wanting to buy (sell) property D. Property market is integrated, not ...

... A. Market for ownership claims to RE assets B. Buyers/owners receive rights to cash flows generated by leasing space to tenants C. Demand (supply) side of property market is made up of investors wanting to buy (sell) property D. Property market is integrated, not ...

Capital Flows, Interest Rates and Precautionary Behaviour: a model of

... – remark: if the insurer was risk-neutral (and competitive) no imbalance – the insurer is risk-averse-> modest imbalance.[<0.2% of GDP] • Self-insurance – incomplete market: accumulates risk-free asset government bonds – higher demand for US government bonds (lower interest rate) – but (still) mod ...

... – remark: if the insurer was risk-neutral (and competitive) no imbalance – the insurer is risk-averse-> modest imbalance.[<0.2% of GDP] • Self-insurance – incomplete market: accumulates risk-free asset government bonds – higher demand for US government bonds (lower interest rate) – but (still) mod ...

Speech by Mr. Ivan Iskrov, Governor of the BNB, at the spring

... 2007 these purchases reached a record level of Euro 2.5 billion (8.6% of GDP). This trend continued in the first four months of the year 2008. The banks operating in the country still have access to international financial markets. From August 2007 to March 2008 they increased their loans from abroa ...

... 2007 these purchases reached a record level of Euro 2.5 billion (8.6% of GDP). This trend continued in the first four months of the year 2008. The banks operating in the country still have access to international financial markets. From August 2007 to March 2008 they increased their loans from abroa ...

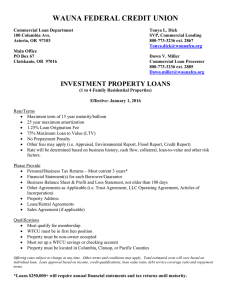

Investment - Wauna Federal Credit Union

... • Other fees may apply (i.e. Appraisal, Environmental Report, Flood Report, Credit Report) • Rate will be determined based on business history, cash flow, collateral, loan-to-value and other risk factors. Please Provide • Personal/Business Tax Returns – Most current 3 years* • Financial Statement(s) ...

... • Other fees may apply (i.e. Appraisal, Environmental Report, Flood Report, Credit Report) • Rate will be determined based on business history, cash flow, collateral, loan-to-value and other risk factors. Please Provide • Personal/Business Tax Returns – Most current 3 years* • Financial Statement(s) ...

Early US Struggles with Fiscal Federalism: Lessons for Europe?

... • Hamilton’s plan for the Bank of the United States (2) --BUS to have 25 directors, one to be president --’Prudent mean’ voting rights—no shareholder to have more than 30 votes, regardless of no. of shares owned --BUS bills and notes receivable in all payments to US --Branch offices of ‘discount and ...

... • Hamilton’s plan for the Bank of the United States (2) --BUS to have 25 directors, one to be president --’Prudent mean’ voting rights—no shareholder to have more than 30 votes, regardless of no. of shares owned --BUS bills and notes receivable in all payments to US --Branch offices of ‘discount and ...

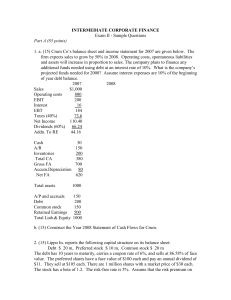

A corporate bond maturing in 5 years carries a 10% coupon rate and

... the market portfolio is 6%. The tax rate is 40%. (Assume that flotation costs are negligible.) a. What is the after-tax cost of debt, preferred stock and common stock? b. What is the weighted average cost of capital for the firm, if the current capital structure based on market values is the optima ...

... the market portfolio is 6%. The tax rate is 40%. (Assume that flotation costs are negligible.) a. What is the after-tax cost of debt, preferred stock and common stock? b. What is the weighted average cost of capital for the firm, if the current capital structure based on market values is the optima ...

US Subprime Credit Crisis

... Business close out or lose money (banks, builders etc.) Weak financial market Low consumer spending Lose jobs ...

... Business close out or lose money (banks, builders etc.) Weak financial market Low consumer spending Lose jobs ...

Download Document

... A research paper by Brown, Harlow, Tinic (1988) argues for a third component to discount rates. This work argues that investors set higher discount rates for investments they believe they understand poorly and set lower discount rates for investments they believe are well understood. This component ...

... A research paper by Brown, Harlow, Tinic (1988) argues for a third component to discount rates. This work argues that investors set higher discount rates for investments they believe they understand poorly and set lower discount rates for investments they believe are well understood. This component ...

Introduction - Princeton University Press

... Germany and the oil rich countries, would be available to fund that spending. ...

... Germany and the oil rich countries, would be available to fund that spending. ...

The price of gold falls below $1600 an ounce.

... In another sign of continued weakness in the financial system, European banks plan to repay less than half the expected amount of low-interest loans they took from the European Central Bank. The central bank lent more than 1 trillion euros ($1.33 trillion) in two operations in December 2011 and Febr ...

... In another sign of continued weakness in the financial system, European banks plan to repay less than half the expected amount of low-interest loans they took from the European Central Bank. The central bank lent more than 1 trillion euros ($1.33 trillion) in two operations in December 2011 and Febr ...

Download pdf | 172 KB |

... Economic forecasters began to gradually raise their estimates of the probability of a recession; today Intrade puts the odds of a recession at 70%. The credit markets are even more dramatically signaling recession. ...

... Economic forecasters began to gradually raise their estimates of the probability of a recession; today Intrade puts the odds of a recession at 70%. The credit markets are even more dramatically signaling recession. ...

Financialization

Financialization is a term sometimes used in discussions of the financial capitalism that has developed over the decades between 1980 and 2010, in which financial leverage tended to override capital (equity), and financial markets tended to dominate over the traditional industrial economy and agricultural economics.Financialization describes an economic system or process that attempts to reduce all value that is exchanged (whether tangible or intangible, future or present promises, etc.) into a financial instrument. The intent of financialization is to be able to reduce any work product or service to an exchangeable financial instrument, like currency, and thus make it easier for people to trade these financial instruments.Workers, through a financial instrument such as a mortgage, may trade their promise of future work or wages for a home. The financialization of risk sharing is what makes possible all insurance. The financialization of a government's promises (e.g., US government bonds) is what makes possible all government deficit spending. Financialization also makes economic rents possible.