* Your assessment is very important for improving the work of artificial intelligence, which forms the content of this project

Download PROFIT REPORTING SEASON

Survey

Document related concepts

Transcript

9 February 2017

PROFIT REPORTING SEASON

SUNCORP GROUP (SUN)

RESULTS

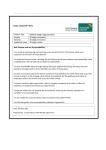

Half Year 2017 Half Year 2016 CHANGE

Revenue ($m)

8,638.0

7,797.0

+10.8%

General Insurance (Aus) NPAT ($m) 358.0

236.0

+51.7%

Bank Net Profit (NPAT) ($m)

203.0

194.0

+4.6%

New Zealand NPAT ($m)

36.0

78.0

-53.8%

Group NPAT ($m)

537.0

530.0

+1.3%

Bloomberg ($m) Consensus

598.0

Interim Dividend ($)

0.33

0.30

+10%

Suncorp (SUN) profits boosted by insurance but held back by NZ business

Queensland based financial services group, Suncorp (SUN) has posted a softer than hoped 1.3% lift in net profit to

$537m for the six months ended 31 Dec 16. The result w as driven by a strong performance from its General Insurance

(GI) division, steady operating costs but w as held back by a more than 50% slide in profits in its New Zealand business.

Profits from its GI arm (includes AAMI, APIA, Bingle and GIO brands) rose strongly by 51.7% to $358m. Gross

Written Premiums (sale of insurance policies) lifted 6.2% and w ere driven by its CTP portfolio (+27.3%) follow ing SUN’s

entry into the SA market and grow th in NSW. Commercial, Home and Motor insurance sales all edged higher but at a

much more modest pace. Its turnaround program on reducing claims in Home and Motor has had some success. Natural

hazard costs w ere $319M ($19m over allow ance), $107m of w hich w ere from the SA & VIC storms in Nov & Dec.

Its Banking & Wealth profit edged higher by just $1m on the prior corresponding period to $208m. Bad debts how ever

w ere very low (just $1m & <1% of total loans) w hile costs w ere kept under control. Lending grow th w as a modest 2.5%

and its Net Interest Margin (difference betw een interest income earned and interest paid out) fell to 1.78% (HY16: 1.85%)

due to regulatory and economic factors together w ith a cut to the RBA cash rate. Generally, low er interest rates squeeze

a bank’s margins. Its combined Life & Wealth profit of $33m w as slightly ahead of consensus. Its New Zealand

business w as the w orst pe rformer due to a sharp lift in claims w hich kept insurance profit under pressure. The

Kaikoura earthquake cost $28m and continued to receive claims from the 2010/11 Canterbury earthquake.

SUN w ill be paying out a fully franked 33c dividend to investors on 3 April 2017. This marks a 3c or 10% lift on Feb

2016 and is a 72% payout ratio from cash earnings. The all-important ex-dividend date is 21 Feb 2017. SUN has a ~5.2%

dividend yield. Looking ahead, across its portfolio, SUN w ill be focusing on m argin grow th and seems confident on a

stronger 2H. Grow th in premiums and a strong focus on claims management is expected to boost its Insurance Trading

Result (ITR). ITR is a preferred measure of financial performance for insurance companies. It expects its recent increase

in mortgage rates and less aggressive competitor behaviour to deliver an improved second half NIM (margins). SUN

expects margins to remain stable in its Life business. SUN shares are dow n ~3% Year-to-Date.

Commonwealth Securities Limited ABN 60 067 254 399 AFSL 238814 ("CommSec") is a wholly owned, but non-guaranteed, subsidiary of the Commonwealth Bank of Australia ABN 48 123 123 124 AFSL

234945 ("the Bank") and both entities are incorporated in Australia with limited liability.

This information is directed and available to and for the benefit of Australian residents only and is not a recommendation or forecast. This information has been prepared without taking account of the

objectives, needs, financial and taxation situation of any particular individual. For this reason, any individual should, before acting on the information on this site, consider the appropriateness of the

information, having regards to their own objectives, needs, financial and taxation situation, and, if necessary, seek appropriate independent financial, foreign exchange and taxation advice. CommSec,

and its related bodies corporate, do not accept any liability for any loss or damage arising out of the use of all or any par t of this information. We believe that this information is correct as at the time of its

compilation, but no warranty is made as to its accuracy, reliability or completeness

commsec.com.au/reportingseason

Twitter: @commsec