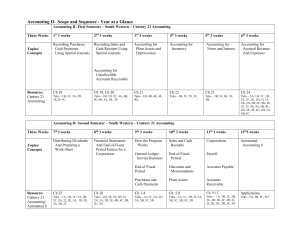

Accounting II Scope and Sequence

... The student analyzes forms of business organizations. The student applies the basic accounting concepts to perform advanced accounting procedures. The student applies accounting knowledge when making business decisions. The student identifies and researches career opportunities in accounting. The st ...

... The student analyzes forms of business organizations. The student applies the basic accounting concepts to perform advanced accounting procedures. The student applies accounting knowledge when making business decisions. The student identifies and researches career opportunities in accounting. The st ...

Fund Financial Statements - Minnesota Board of Water and Soil

... technical and financial assistance to individuals, groups, organizations, and governments in reducing costly waste of soil and water resulting from soil erosion, sedimentation, pollution, and improper land use. Each fiscal year the District develops a work plan that is used as a guide in using resou ...

... technical and financial assistance to individuals, groups, organizations, and governments in reducing costly waste of soil and water resulting from soil erosion, sedimentation, pollution, and improper land use. Each fiscal year the District develops a work plan that is used as a guide in using resou ...

What You Need To Know

... other guidance that represents good practice that public sector entities are encouraged to follow, and resources for use by public sector entities around the world. The IPSASB aims specifically to enhance the quality and transparency of public financial reporting by: i. Establishing high-quality acc ...

... other guidance that represents good practice that public sector entities are encouraged to follow, and resources for use by public sector entities around the world. The IPSASB aims specifically to enhance the quality and transparency of public financial reporting by: i. Establishing high-quality acc ...

Transparency, accountability and economic policy for governments

... suggest it is the most critical element.1 The International Monetary Fund (IMF) has stressed the importance of strengthening sovereign balance sheets; in contrast, no recommendations on improving the quality of government accounting have been forthcoming from the Group of Twenty (G20) as it discusse ...

... suggest it is the most critical element.1 The International Monetary Fund (IMF) has stressed the importance of strengthening sovereign balance sheets; in contrast, no recommendations on improving the quality of government accounting have been forthcoming from the Group of Twenty (G20) as it discusse ...

Module 5 – Understanding the Basic Elements of School Board

... To recommend, to the Board of Trustees, the approval of the annual audited financial statements ...

... To recommend, to the Board of Trustees, the approval of the annual audited financial statements ...

Accounting I - Mr. K`s Pages

... EVALUATION: Each assignment and periodic exam will be assigned points. Students will not be allowed references on exams. The points will be converted into a final grade. The final grading scale is as follows: 100% - 90% = A 89% - 80% = B 79% - 70% = C 69% - 60% = D Below 59% = F These comp ...

... EVALUATION: Each assignment and periodic exam will be assigned points. Students will not be allowed references on exams. The points will be converted into a final grade. The final grading scale is as follows: 100% - 90% = A 89% - 80% = B 79% - 70% = C 69% - 60% = D Below 59% = F These comp ...

Presentation Title - Financial Management Services

... • General auxiliary organization/account structure • Operating 60* and/or 66* accounts • R&R 92* account • Plant 95* account ...

... • General auxiliary organization/account structure • Operating 60* and/or 66* accounts • R&R 92* account • Plant 95* account ...

Unit F011 - Accounting principles - Scheme of work and

... the support materials to inspire teachers and facilitate different ideas and teaching practices. Each Scheme of Work and set of sample Lesson Plans is provided in: ...

... the support materials to inspire teachers and facilitate different ideas and teaching practices. Each Scheme of Work and set of sample Lesson Plans is provided in: ...

Basics Of Accounting

... After we getting to know the basic Accounting terms, we move further in increasing our knowledge & getting deeper in our study, to know all about this powerful 8letter word ‘A C C O U N T S’ There are 3 RULES OF ACCOUNTING on which entire accounts depends upon. Understanding the rules of Accounting ...

... After we getting to know the basic Accounting terms, we move further in increasing our knowledge & getting deeper in our study, to know all about this powerful 8letter word ‘A C C O U N T S’ There are 3 RULES OF ACCOUNTING on which entire accounts depends upon. Understanding the rules of Accounting ...

Role of a Board Member in Financial Oversight

... • Statement that no goods or services were provided by the organization, if that is the case • Description and good faith estimate of the value of goods or services, if any, that the organization provided in return for the contribution • Statement that goods or services, if any, that the organizatio ...

... • Statement that no goods or services were provided by the organization, if that is the case • Description and good faith estimate of the value of goods or services, if any, that the organization provided in return for the contribution • Statement that goods or services, if any, that the organizatio ...

2015-230 Presentation of Financial Statements of Not-for

... b. Composition of net assets with donor restrictions at the end of the period and how the restrictions affect the use of resources. Disagree in part – narrative about how the composition affects the use of resources is subjective, may be duplicative of information already in the financials and adds ...

... b. Composition of net assets with donor restrictions at the end of the period and how the restrictions affect the use of resources. Disagree in part – narrative about how the composition affects the use of resources is subjective, may be duplicative of information already in the financials and adds ...

Materials Management System

... • Materials Management Warehouse and Inventory Accounting ◦◦ Monitors the physical movement of inventory. ◦◦ Determines stock availability across all locations. ◦◦ Tracks receipts, returns, sales and material transfers. ◦◦ Records quantity and item value adjustments. ◦◦ Defines minimum and maximum ...

... • Materials Management Warehouse and Inventory Accounting ◦◦ Monitors the physical movement of inventory. ◦◦ Determines stock availability across all locations. ◦◦ Tracks receipts, returns, sales and material transfers. ◦◦ Records quantity and item value adjustments. ◦◦ Defines minimum and maximum ...

Chapter 11

... method, such as double-declining-balance. In your answer address the following issues: Does the type of company or industry have anything to do with the choice of depreciation method selected? What effect does matching have on the decision to use doubledeclining-balance depreciation versus straight- ...

... method, such as double-declining-balance. In your answer address the following issues: Does the type of company or industry have anything to do with the choice of depreciation method selected? What effect does matching have on the decision to use doubledeclining-balance depreciation versus straight- ...

Chapter 1 - Class notes file from textbook

... Governmental not-for-profits: ex. University of Houston FASAB – Federal Accounting Standards Advisory Board Federal Government and its agencies Ex. Department of Agriculture, Department of Transportation, Department of Energy, Department of Education, Department of Defense, HUD, HHS and others ...

... Governmental not-for-profits: ex. University of Houston FASAB – Federal Accounting Standards Advisory Board Federal Government and its agencies Ex. Department of Agriculture, Department of Transportation, Department of Energy, Department of Education, Department of Defense, HUD, HHS and others ...

Providing leadership in a digital world Introduction Summary

... new technology to serve people and businesses better. But of course, there are other possible paths. For example, some fear growing marginalisation and reduced relevance as the business environment changes radically. There are fears about the future role of accountants as artificial intelligence ste ...

... new technology to serve people and businesses better. But of course, there are other possible paths. For example, some fear growing marginalisation and reduced relevance as the business environment changes radically. There are fears about the future role of accountants as artificial intelligence ste ...

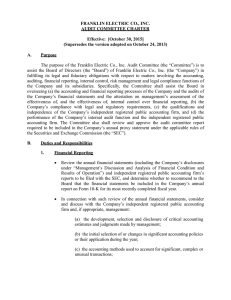

FRANKLIN ELECTRIC CO., INC. AUDIT COMMITTEE CHARTER

... completeness and accuracy of the financial statements rests with the Company’s management. The responsibility of the Company’s independent registered public accounting firm is to perform an audit of the Company’s financial statements and to express an opinion on (i) the conformity of the Company’s a ...

... completeness and accuracy of the financial statements rests with the Company’s management. The responsibility of the Company’s independent registered public accounting firm is to perform an audit of the Company’s financial statements and to express an opinion on (i) the conformity of the Company’s a ...

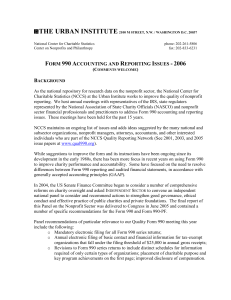

Line 43a – Other Consulting and Contract

... NCCS maintains an ongoing list of issues and adds ideas suggested by the many national and subsector organizations, nonprofit managers, attorneys, accountants, and other interested individuals who are part of the NCCS Quality Reporting Network (See 2001, 2003, and 2005 issue papers at www.qual990.or ...

... NCCS maintains an ongoing list of issues and adds ideas suggested by the many national and subsector organizations, nonprofit managers, attorneys, accountants, and other interested individuals who are part of the NCCS Quality Reporting Network (See 2001, 2003, and 2005 issue papers at www.qual990.or ...

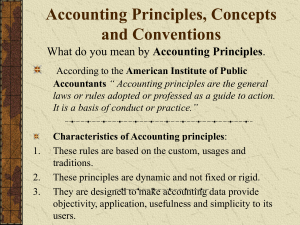

Accounting Principles, Concepts and Conventions

... financial results with the help of Trial Balance. 3. To know the progress of the business at the end of each accounting period. 4. To check and control misappropriation and defalcation by employees. 5. To have proper and systematic record of business for future reference. ...

... financial results with the help of Trial Balance. 3. To know the progress of the business at the end of each accounting period. 4. To check and control misappropriation and defalcation by employees. 5. To have proper and systematic record of business for future reference. ...

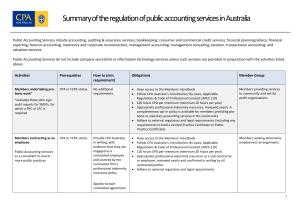

Australia

... Certificate or Public Practice Certificate. Subject to the defined thresholds in law and ...

... Certificate or Public Practice Certificate. Subject to the defined thresholds in law and ...

LO1 - McGraw-Hill Education Canada

... • The income statement summarizes the financial impact of operating activities undertaken by the company during the accounting period. • Operating activities are the primary source of revenues and expenses. • The time period assumption divides the long life of a company into shorter periods, such as ...

... • The income statement summarizes the financial impact of operating activities undertaken by the company during the accounting period. • Operating activities are the primary source of revenues and expenses. • The time period assumption divides the long life of a company into shorter periods, such as ...

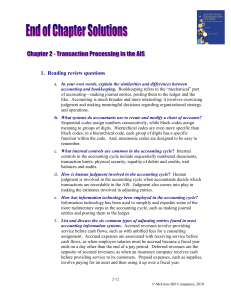

Opening vignette

... closely resembles bookkeeping than accounting. It is focused on the mechanics of transaction processing, rather than on using the information for decisions. b. Use EDGAR to find the Form 10-K that VISA Inc. filed with the SEC on 21 November 2008. What AIS outputs are included in that filing? The 10 ...

... closely resembles bookkeeping than accounting. It is focused on the mechanics of transaction processing, rather than on using the information for decisions. b. Use EDGAR to find the Form 10-K that VISA Inc. filed with the SEC on 21 November 2008. What AIS outputs are included in that filing? The 10 ...

Jonathan Heller ED 605 Unit Plan PATHWAY: Financial

... QuickBooks when teaching Principles of Accounting because QuickBooks is designed for use among non-=accountants and does not always follow GAAP. It is strongly advised that students complete at least one computerized accounting cycle problem during this unit. It may be useful to have students compl ...

... QuickBooks when teaching Principles of Accounting because QuickBooks is designed for use among non-=accountants and does not always follow GAAP. It is strongly advised that students complete at least one computerized accounting cycle problem during this unit. It may be useful to have students compl ...

Chapter 5 The Time Value of Money

... The establishment of a Public Company Accounting Oversight Board to register and inspect public accounting firms and establish audit standards. The separation of audit functions from other services, such as consulting, provided by the big accounting firms, with the auditors rotating every 5 years so ...

... The establishment of a Public Company Accounting Oversight Board to register and inspect public accounting firms and establish audit standards. The separation of audit functions from other services, such as consulting, provided by the big accounting firms, with the auditors rotating every 5 years so ...

Financial Accounting and Accounting Standards

... 3. Which product line is most profitable? 4. Is cash sufficient to pay dividends to the stockholders? 5. What price for our product will maximize net income? 6. Will the company be able to pay its short-term debts? Chapter ...

... 3. Which product line is most profitable? 4. Is cash sufficient to pay dividends to the stockholders? 5. What price for our product will maximize net income? 6. Will the company be able to pay its short-term debts? Chapter ...

FAR Change Alerts - I Pass the CPA Exam!

... government’s most advantageous market in the absence of a principal market, under the assumption that general market participants would act in their economic best interest. For a nonfinancial asset, fair value measurements assume the highest and best use of the asset. For liabilities, measurement as ...

... government’s most advantageous market in the absence of a principal market, under the assumption that general market participants would act in their economic best interest. For a nonfinancial asset, fair value measurements assume the highest and best use of the asset. For liabilities, measurement as ...