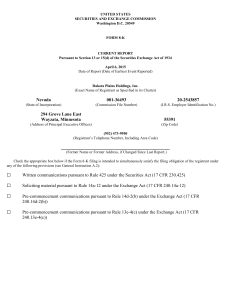

DAKOTA PLAINS HOLDINGS, INC. (Form: 8

... for re-election as the Company’s independent registered accounting firm for the fiscal year ending December 31, 2015. BDO’s reports on the Company’s consolidated financial statements for the fiscal years ended December 31, 2014 and 2013 do not contain an adverse opinion or a disclaimer of opinion, n ...

... for re-election as the Company’s independent registered accounting firm for the fiscal year ending December 31, 2015. BDO’s reports on the Company’s consolidated financial statements for the fiscal years ended December 31, 2014 and 2013 do not contain an adverse opinion or a disclaimer of opinion, n ...

PUBLIC SECTOR ACCOUNTING REFORM Tatjana Jovanović

... accounts. And businesses need it for their strategy planning. Overall, public sector accounting and budgeting systems can either strengthen or weaken the trust which underpins relations in a society. If ever it is now clear that it is the time to unconditionally establish requirements for greater tr ...

... accounts. And businesses need it for their strategy planning. Overall, public sector accounting and budgeting systems can either strengthen or weaken the trust which underpins relations in a society. If ever it is now clear that it is the time to unconditionally establish requirements for greater tr ...

Understanding Financ.. - Loughborough University

... These are used where forecast demand and actual demand are different. By ‘flexing’ the budget, it is possible to get a much more realistic analysis of budgetary performance. The purpose of a flexed budget, therefore, is to account for changes in the budget variables and, consequently, to assess re ...

... These are used where forecast demand and actual demand are different. By ‘flexing’ the budget, it is possible to get a much more realistic analysis of budgetary performance. The purpose of a flexed budget, therefore, is to account for changes in the budget variables and, consequently, to assess re ...

Weygandt_FinMan_PowerPoint_Review_Ch15

... Indicate whether the following statements are true or false. 4. Managers’ activities and responsibilities can be classified False ...

... Indicate whether the following statements are true or false. 4. Managers’ activities and responsibilities can be classified False ...

CJAR Fundamentalist Perspective on Accounting Jiang

... Accounting academics are involved in a variety of research, but one mission is paramount: to develop sound accounting principles. Accounting is so important to society, whether it be managerial accounting for a firm, government accounting to its citizens, or financial accounting for investors of cap ...

... Accounting academics are involved in a variety of research, but one mission is paramount: to develop sound accounting principles. Accounting is so important to society, whether it be managerial accounting for a firm, government accounting to its citizens, or financial accounting for investors of cap ...

The Role of Accounting in a Society

... (Arnold, 2009; Neu & Taylor, 1996; Tinker, 1991). These approaches to the accounting research are all characterized by a more critical, often reformist thinking about its role, significance, and functioning in society (see, for example, critical accounting or radical accounting).1 They are based on ...

... (Arnold, 2009; Neu & Taylor, 1996; Tinker, 1991). These approaches to the accounting research are all characterized by a more critical, often reformist thinking about its role, significance, and functioning in society (see, for example, critical accounting or radical accounting).1 They are based on ...

The Income Statement and the Statement of Stockholders` Equity

... Income Statement - Earnings per Share Earnings per share of common stock (20,000 shares outstanding): Income from continuous operations Income from discontinued operations Income before extraordinary item and cumulative effect of change in depreciation method Extraordinary loss Cumulative effect of ...

... Income Statement - Earnings per Share Earnings per share of common stock (20,000 shares outstanding): Income from continuous operations Income from discontinued operations Income before extraordinary item and cumulative effect of change in depreciation method Extraordinary loss Cumulative effect of ...

Chapter Summary (continued) Purchases returns and allowances

... © 2006 The McGraw-Hill Companies, Inc., All Rights Reserved. ...

... © 2006 The McGraw-Hill Companies, Inc., All Rights Reserved. ...

Download attachment

... Apart from its unique characteristics, Islamic accounting shares with their conventional counterparts the same processes of recognition, measurement and recording of transactions and fair presentation of rights and obligation, but the crux of the matter is how to apply these concepts to Islamic fin ...

... Apart from its unique characteristics, Islamic accounting shares with their conventional counterparts the same processes of recognition, measurement and recording of transactions and fair presentation of rights and obligation, but the crux of the matter is how to apply these concepts to Islamic fin ...

GAAP

... concept is based on the accounting period concept. It is widely accepted that desire of making profit is the most important motivation to keep the proprietors engaged in business activities. By `matching’ we mean appropriate association of related revenues and expenses pertaining to a particular a ...

... concept is based on the accounting period concept. It is widely accepted that desire of making profit is the most important motivation to keep the proprietors engaged in business activities. By `matching’ we mean appropriate association of related revenues and expenses pertaining to a particular a ...

PowerPoint

... a possible complete integration between (natural) ecosystem accounting and economic accounting Clarifying this issue is essential, not only for national accountants, statisticians and economists, but also for the scientific community at large, and more widely various groups of the whole society If t ...

... a possible complete integration between (natural) ecosystem accounting and economic accounting Clarifying this issue is essential, not only for national accountants, statisticians and economists, but also for the scientific community at large, and more widely various groups of the whole society If t ...

Accounting Basics - FSU Controller`s Office

... At the end of one accounting year, all the income and expense accounts are netted against one another, and a single number is moved into the equity account. The income and expense accounts go to zero. That's how we're able to begin the new year with a clean slate against which to track income and ex ...

... At the end of one accounting year, all the income and expense accounts are netted against one another, and a single number is moved into the equity account. The income and expense accounts go to zero. That's how we're able to begin the new year with a clean slate against which to track income and ex ...

2011 Financials

... Our responsibility is to express an opinion on these financial statements based on our audit. We conducted our audit in accordance with Canadian generally accepted auditing standards. Those standards require that we comply with ethical requirements and plan and perform an audit to obtain reasonable ...

... Our responsibility is to express an opinion on these financial statements based on our audit. We conducted our audit in accordance with Canadian generally accepted auditing standards. Those standards require that we comply with ethical requirements and plan and perform an audit to obtain reasonable ...

CHAPTER 4 Outline

... An adjusting entry for prepaid expenses will result in an increase or a debit to an expense account and a decrease or a credit to an asset account. An adjusting entry for unearned revenues will result in a decrease or a debit to a liability account and an increase or a credit to a revenue accoun ...

... An adjusting entry for prepaid expenses will result in an increase or a debit to an expense account and a decrease or a credit to an asset account. An adjusting entry for unearned revenues will result in a decrease or a debit to a liability account and an increase or a credit to a revenue accoun ...

10710 Accounting Eng 30 6 16 - Gauteng Department of Education

... the year ended 29 February 2016. These financial statements are the responsibility of the company's directors. Basis for Disclaimer of Opinion During the course of our audit we have established that the valuation of fixed assets and inventories were materially overstated by an amount of R12 m. Audit ...

... the year ended 29 February 2016. These financial statements are the responsibility of the company's directors. Basis for Disclaimer of Opinion During the course of our audit we have established that the valuation of fixed assets and inventories were materially overstated by an amount of R12 m. Audit ...

Accounting and Neoliberalism: A Critical - Research Online

... investing financed by junk commercial papers are regarded as market efficiency improvements, which, according to many economists (see e.g. Morin and Jarrell 2001; Palley 2005; van Treeck 2009), not only contribute suspicious value to real income flows and physical investment at the macroeconomic lev ...

... investing financed by junk commercial papers are regarded as market efficiency improvements, which, according to many economists (see e.g. Morin and Jarrell 2001; Palley 2005; van Treeck 2009), not only contribute suspicious value to real income flows and physical investment at the macroeconomic lev ...

III Local audit of project accounts

... auditor and, if possible, draw attention to this in his audit report (if necessary, mentioning the scope). The auditor is obliged to obtain a comprehensive picture of the local accounting organisation, the existence and the quality of the ICS, the accounting and valuation principles applied and the ...

... auditor and, if possible, draw attention to this in his audit report (if necessary, mentioning the scope). The auditor is obliged to obtain a comprehensive picture of the local accounting organisation, the existence and the quality of the ICS, the accounting and valuation principles applied and the ...

APES 205 Conformity with Accounting Standards

... Client means an individual, firm, entity or organisation to whom or to which Professional Activities are provided by a Member in Public Practice in respect of Engagements of either a recurring or demand nature. Code means APES 110 Code of Ethics for Professional Accountants. Compliance Framework mea ...

... Client means an individual, firm, entity or organisation to whom or to which Professional Activities are provided by a Member in Public Practice in respect of Engagements of either a recurring or demand nature. Code means APES 110 Code of Ethics for Professional Accountants. Compliance Framework mea ...

Slide 1 - Cengage

... There are two options available to view the HOME page: The CLASSIC or ENHANCED View. Study the Sage 50 Accounting Home window in CLASSIC view below. Notice that all the modules are displayed. As in any other Windows applications, the Sage 50 Accounting window has a title bar, a main menu bar, and a ...

... There are two options available to view the HOME page: The CLASSIC or ENHANCED View. Study the Sage 50 Accounting Home window in CLASSIC view below. Notice that all the modules are displayed. As in any other Windows applications, the Sage 50 Accounting window has a title bar, a main menu bar, and a ...

Adjusting Entries

... Compare this to how revenue might be recorded for a small convenience store. ...

... Compare this to how revenue might be recorded for a small convenience store. ...

Computerised Accounting System

... Automated Document Production : Most of the computerised accounting systems have standardised, user defined format of accounting reports that are generated automatically. The accounting reports such as Cash book, Trial balance, Statement of accounts are obtained just by click of a mouse in a compute ...

... Automated Document Production : Most of the computerised accounting systems have standardised, user defined format of accounting reports that are generated automatically. The accounting reports such as Cash book, Trial balance, Statement of accounts are obtained just by click of a mouse in a compute ...

sample final exam MBA_607___final_exam_APRIL 2012 (1)

... tangible operational assets because: A) It helps a company decide whether to use straight-line amortization or an accelerated amortization method. B) It justifies amortizing the asset over its expected useful life, without anticipating that the business will liquidate in the near future. C) It provi ...

... tangible operational assets because: A) It helps a company decide whether to use straight-line amortization or an accelerated amortization method. B) It justifies amortizing the asset over its expected useful life, without anticipating that the business will liquidate in the near future. C) It provi ...

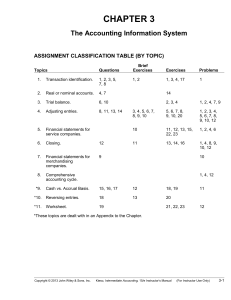

chap.3 - HCC Learning Web

... Depending on time constraints and students’ accounting course background, Chapter 3 can be approached in several different ways: (1) Spend 2-3 class sessions reviewing the chapter and Appendices 3-A through 3-C. (2) Spend 1-2 class sessions reviewing selected portions of the chapter and Appendix 3-A ...

... Depending on time constraints and students’ accounting course background, Chapter 3 can be approached in several different ways: (1) Spend 2-3 class sessions reviewing the chapter and Appendices 3-A through 3-C. (2) Spend 1-2 class sessions reviewing selected portions of the chapter and Appendix 3-A ...

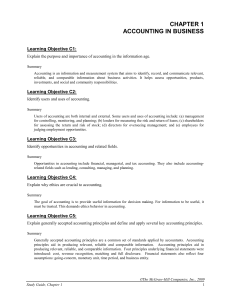

Sample Study Guide - McGraw Hill Higher Education

... serving external users by providing them with generalpurpose financial statements. b. General-Purpose Financial Statement—statements that have broad range of purposes which external users rely on. 2. Internal Information Users—those directly involved in managing and operating an organization. a. Man ...

... serving external users by providing them with generalpurpose financial statements. b. General-Purpose Financial Statement—statements that have broad range of purposes which external users rely on. 2. Internal Information Users—those directly involved in managing and operating an organization. a. Man ...

Accounting for Government and Society

... years are the role of accounting in macro economic management and in environmental issues and climate change. This then will be our focus, although there are many other areas where it is being recognized that accounting has an impact. Some of these are obvious and been well known for a long time. We ...

... years are the role of accounting in macro economic management and in environmental issues and climate change. This then will be our focus, although there are many other areas where it is being recognized that accounting has an impact. Some of these are obvious and been well known for a long time. We ...