REVIEW OF ILLUSTRATIVE FINANCIAL STATEMENTS IN

... amortized historical cost and fair value. In most cases the standard specifies which measurement must be used in different sections. ...

... amortized historical cost and fair value. In most cases the standard specifies which measurement must be used in different sections. ...

1. The primary function of financial accounting is

... C The unrealistic balance sheet assets that would be created if firms were required to use the purchase . method of accounting for the combination. D The unrealistic balance sheet assets that would be created if firms were required to use the pooling . method of accounting for the combination. 55. T ...

... C The unrealistic balance sheet assets that would be created if firms were required to use the purchase . method of accounting for the combination. D The unrealistic balance sheet assets that would be created if firms were required to use the pooling . method of accounting for the combination. 55. T ...

Green Accounting and Material Flow Analysis

... environmental impacts and welfare effects are to be captured in this manner. In this manner, a precautionary approach is applied which permits anticipating potentially disastrous and largely unknown environmental effects.10 In contrast, economic accounting does not deal with uncertainty. It is a sta ...

... environmental impacts and welfare effects are to be captured in this manner. In this manner, a precautionary approach is applied which permits anticipating potentially disastrous and largely unknown environmental effects.10 In contrast, economic accounting does not deal with uncertainty. It is a sta ...

Financial Accounting

... A sole proprietor’s owner’s equity balance was $10,000 at the beginning of the year and was $22,000 at the end of the year. During the year the owner invested $5,000 in the business and had withdrawn $24,000 for personal use. The sole proprietorship’s net income for the year was $ ...

... A sole proprietor’s owner’s equity balance was $10,000 at the beginning of the year and was $22,000 at the end of the year. During the year the owner invested $5,000 in the business and had withdrawn $24,000 for personal use. The sole proprietorship’s net income for the year was $ ...

Business Administration

... Financial Statement Analysis....................... 4.0........ 6938 ...

... Financial Statement Analysis....................... 4.0........ 6938 ...

Managing Financial Aspects of a Business

... To be useful, financial information must not only represent relevant phenomena, but it must also faithfully represent the phenomena that it purports to represent. To be a perfectly faithful representation, a depiction would have three characteristics. It would be complete, neutral and free from er ...

... To be useful, financial information must not only represent relevant phenomena, but it must also faithfully represent the phenomena that it purports to represent. To be a perfectly faithful representation, a depiction would have three characteristics. It would be complete, neutral and free from er ...

Chapter 1

... financial position and results of operations and their conformance with generally accepted accounting standards. ...

... financial position and results of operations and their conformance with generally accepted accounting standards. ...

Financial Accounting and Accounting Standards

... financial position and results of operations and their conformance with generally accepted accounting standards. ...

... financial position and results of operations and their conformance with generally accepted accounting standards. ...

Journal Entries - University of South Florida

... Accounting and Auditing Generally spending is allowed from any of the expense account code categories unless specifically addressed in Florida Statute or USF guidelines State and USF negotiated contracts with vendors must be observed ...

... Accounting and Auditing Generally spending is allowed from any of the expense account code categories unless specifically addressed in Florida Statute or USF guidelines State and USF negotiated contracts with vendors must be observed ...

FREE Sample Here

... Which of these events cannot be quantified into dollars and cents and recorded as an accounting transaction? Learning Objective 1.8 Explain the meaning of the monetary unit assumption and the economic entity assumption *a. The appointment of a new accounting firm to perform an audit. b. The purchase ...

... Which of these events cannot be quantified into dollars and cents and recorded as an accounting transaction? Learning Objective 1.8 Explain the meaning of the monetary unit assumption and the economic entity assumption *a. The appointment of a new accounting firm to perform an audit. b. The purchase ...

5 ACCOUNTING FOR

... continue to change. The financial world is experiencing unparalleled challenges, such as globalization, deregulation, and the widespread use of the World Wide Web. In the midst of these changes is the accounting profession that must provide reliable and relevant information to users. This chapter in ...

... continue to change. The financial world is experiencing unparalleled challenges, such as globalization, deregulation, and the widespread use of the World Wide Web. In the midst of these changes is the accounting profession that must provide reliable and relevant information to users. This chapter in ...

What is Accounting? - masif-emba-fais-s12

... The Building Blocks of Accounting Cost Principle (Historical) – dictates that companies record assets at their cost. Issues: Reported at cost when purchased and also over the time the asset is held. Cost easily verified, whereas market value is often subjective. ...

... The Building Blocks of Accounting Cost Principle (Historical) – dictates that companies record assets at their cost. Issues: Reported at cost when purchased and also over the time the asset is held. Cost easily verified, whereas market value is often subjective. ...

chapter 2

... Internal/External Use of Accounting Information Accounting data is used inside and outside the company. Company managers use accounting information to determine such things as which product lines to expand or discontinue, while investors use accounting data to decide whether to invest in a certain c ...

... Internal/External Use of Accounting Information Accounting data is used inside and outside the company. Company managers use accounting information to determine such things as which product lines to expand or discontinue, while investors use accounting data to decide whether to invest in a certain c ...

It is recommended that you use a direct internet connection when

... Office Hours: 9:00 to 12:30 Tuesdays and Thursdays Phone: ...

... Office Hours: 9:00 to 12:30 Tuesdays and Thursdays Phone: ...

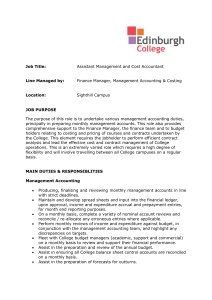

line management

... To support departmental managers in the costing and pricing of more specialist contracts and bids. Where issues are identified in relation to the service the Finance Department provides to all stakeholders, to work with the affected parties towards satisfactory solutions. To promote an understanding ...

... To support departmental managers in the costing and pricing of more specialist contracts and bids. Where issues are identified in relation to the service the Finance Department provides to all stakeholders, to work with the affected parties towards satisfactory solutions. To promote an understanding ...

LO 5 - Test Banks Shop

... rely on the financial statements to make important decisions Accountants must make subjective judgments about what information to present and how to present it- this is why accounting is a profession. The Changing Face of the Accounting Profession Examples of some the companies involved in financi ...

... rely on the financial statements to make important decisions Accountants must make subjective judgments about what information to present and how to present it- this is why accounting is a profession. The Changing Face of the Accounting Profession Examples of some the companies involved in financi ...

AMEDICA Corp (Form: 8-K, Received: 07/22/2016 17

... During the Company’s fiscal years ended December 31, 2015 and 2014 and through July 19, 2016, there were no disagreements between the Company and Mantyla on any matter of accounting principles or practices, financial statement disclosure, or auditing scope or procedure, which disagreements, if not r ...

... During the Company’s fiscal years ended December 31, 2015 and 2014 and through July 19, 2016, there were no disagreements between the Company and Mantyla on any matter of accounting principles or practices, financial statement disclosure, or auditing scope or procedure, which disagreements, if not r ...

Villegas y Villegas Mexico Joins Alliott Group Press Release

... Currently the focus of Villegas y Villegas main clients’ is the position within a global market for which Villegas y Villegas is now establishing a strong presence within the global community. “We felt like we had to join a global alliance of accounting firms so we could start with our quest for an ...

... Currently the focus of Villegas y Villegas main clients’ is the position within a global market for which Villegas y Villegas is now establishing a strong presence within the global community. “We felt like we had to join a global alliance of accounting firms so we could start with our quest for an ...

the relevance of auditing in a computerized accounting system

... 1954 to the mid -1960s, the auditing profession was still auditing around the computer. At this time only mainframe computers were used and few people had the skills and abilities to program computers. This began to change in the mid-1960s with the introduction of new, smaller and less expensive mac ...

... 1954 to the mid -1960s, the auditing profession was still auditing around the computer. At this time only mainframe computers were used and few people had the skills and abilities to program computers. This began to change in the mid-1960s with the introduction of new, smaller and less expensive mac ...

Document

... At the end-term exam students are examined for their knowledge of the accounting theory covered at lectures and their ability to solve related exercises. Obtaining a total score of 50% at the end-term exam and for the assigned work (jointly) is a minimal requirement for a pass grade. ...

... At the end-term exam students are examined for their knowledge of the accounting theory covered at lectures and their ability to solve related exercises. Obtaining a total score of 50% at the end-term exam and for the assigned work (jointly) is a minimal requirement for a pass grade. ...

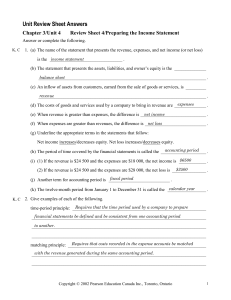

Chapter 3/Unit 4 Review Sheet 4/Preparing the Income Statement

... 1. (a) The name of the statement that presents the revenue, expenses, and net income (or net loss) income statement is the ________________________________ ...

... 1. (a) The name of the statement that presents the revenue, expenses, and net income (or net loss) income statement is the ________________________________ ...

Dankiv Y.Y., Ostapyuk M.Y., Ostapyuk P.Y., ENVIRONMENTAL

... policy is the failure to provide the company management with reliable and timely information on the costs associated with environmental protection management. Accounting should reflect the ecological costs of the enterprise in monetary terms. Within the accounting of production costs there must be a ...

... policy is the failure to provide the company management with reliable and timely information on the costs associated with environmental protection management. Accounting should reflect the ecological costs of the enterprise in monetary terms. Within the accounting of production costs there must be a ...

The Impact Of Switching To International Financial Reporting

... system. Policymakers and committee members who work on the IASB will come from many different countries. While the United States will have representation, the United States goals will only be a part of the whole determining body. If companies switch to an international set of rules, then current way ...

... system. Policymakers and committee members who work on the IASB will come from many different countries. While the United States will have representation, the United States goals will only be a part of the whole determining body. If companies switch to an international set of rules, then current way ...

LESSON ONE

... with inter-firm comparisons is the requirements to disclose additional information when a ‘by function’ format is used. The standard states that “Enterprises classifying expenses by function should disclose additional information on the nature of expenses, including depreciation and amortisation exp ...

... with inter-firm comparisons is the requirements to disclose additional information when a ‘by function’ format is used. The standard states that “Enterprises classifying expenses by function should disclose additional information on the nature of expenses, including depreciation and amortisation exp ...