Chapter 1 - Pearson Schools and FE Colleges

... and Republic of Ireland there is also an international organisation that issues accounting standards. The International Accounting Standards Committee (IASC) was established in 1973 and in 2000 this committee changed its name to the International Accounting Standards Board (IASB). The IASB is an ind ...

... and Republic of Ireland there is also an international organisation that issues accounting standards. The International Accounting Standards Committee (IASC) was established in 1973 and in 2000 this committee changed its name to the International Accounting Standards Board (IASB). The IASB is an ind ...

Wynalda Litho, a leading folding carton manufacturer located in

... * Enter estimated and actual mark-ups into computer system upon completion of jobs * Review lists of open jobs on a regular basis to ensure all shipped jobs have been invoiced * Send invoices to customers via EDI, e-mail or regular mail * Obtain proofs of delivery of account to customers CREDIT & CO ...

... * Enter estimated and actual mark-ups into computer system upon completion of jobs * Review lists of open jobs on a regular basis to ensure all shipped jobs have been invoiced * Send invoices to customers via EDI, e-mail or regular mail * Obtain proofs of delivery of account to customers CREDIT & CO ...

Double-Entry Accounting

... An accounting period is the time frame included in the financial transaction summaries prepared by a business. Regardless of the time frame involved, each of these accounting summaries will consist of common components that make up a complete hospitality business cycle (see Figure 2.13). Business cy ...

... An accounting period is the time frame included in the financial transaction summaries prepared by a business. Regardless of the time frame involved, each of these accounting summaries will consist of common components that make up a complete hospitality business cycle (see Figure 2.13). Business cy ...

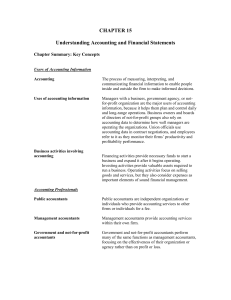

CHAPTER 15 Understanding Accounting and Financial

... Typically, budgets are prepared on a daily basis. ...

... Typically, budgets are prepared on a daily basis. ...

AT1- 1 Achievement Test 1 Achievement Test 1: Chapters 1 and 2

... a. Totaling, auditing, and budgeting b. Budgeting, recording, and communicating c. Recording, totaling, and auditing d. Identifying, recording, and communicating ____ 7. The process of transferring transaction effects into the appropriate accounts is referred to as a. closing. b. journalizing. c. re ...

... a. Totaling, auditing, and budgeting b. Budgeting, recording, and communicating c. Recording, totaling, and auditing d. Identifying, recording, and communicating ____ 7. The process of transferring transaction effects into the appropriate accounts is referred to as a. closing. b. journalizing. c. re ...

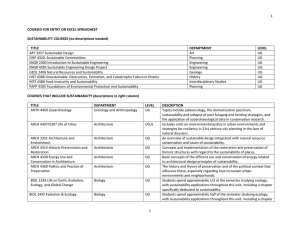

Abstract

... organisations1 wish to make ambitious agreements with the new Government on the various aspects of sustainability within different sectors of the economy, based on a coherent and consistent long-term perspective provided by government and within the social and economic context. Sustainable developme ...

... organisations1 wish to make ambitious agreements with the new Government on the various aspects of sustainability within different sectors of the economy, based on a coherent and consistent long-term perspective provided by government and within the social and economic context. Sustainable developme ...

Financial Accounting and Accounting Standards

... Third Level: Constraints Brief Exercise 2-6 What accounting constraints are illustrated by the items below? (a) Zip’s Farms, Inc. reports agricultural crops on its balance sheet at market value. ...

... Third Level: Constraints Brief Exercise 2-6 What accounting constraints are illustrated by the items below? (a) Zip’s Farms, Inc. reports agricultural crops on its balance sheet at market value. ...

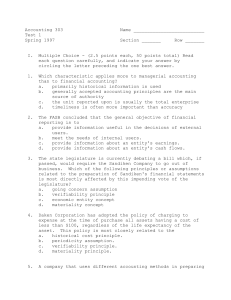

Test 1, Spring 1997 - College of Business Administration

... (12 points) This problem contains matching questions and consists of two unrelated parts. Match the letter preceding the answer choices with the questions, and record your answer in the space provided. An answer may be used once, more than once, or not at all. Answer Choices: A. AAA E. FASB B. AICPA ...

... (12 points) This problem contains matching questions and consists of two unrelated parts. Match the letter preceding the answer choices with the questions, and record your answer in the space provided. An answer may be used once, more than once, or not at all. Answer Choices: A. AAA E. FASB B. AICPA ...

Financial Accounting and Accounting Standards

... Third Level: Constraints Brief Exercise 2-6 What accounting constraints are illustrated by the items below? (a) Zip’s Farms, Inc. reports agricultural crops on its balance sheet at market value. ...

... Third Level: Constraints Brief Exercise 2-6 What accounting constraints are illustrated by the items below? (a) Zip’s Farms, Inc. reports agricultural crops on its balance sheet at market value. ...

Financial Accounting and Accounting Standards

... Third Level: Principles Exercise Identify which basic principle of accounting is best described in each item below. (a) Norfolk Southern Corporation reports revenue in its income statement when it is earned instead of when the cash is collected. ...

... Third Level: Principles Exercise Identify which basic principle of accounting is best described in each item below. (a) Norfolk Southern Corporation reports revenue in its income statement when it is earned instead of when the cash is collected. ...

Book Keeping

... are a combination of authoritative standards (set by policy boards) and simply the commonly accepted ways of recording and reporting accounting information. ...

... are a combination of authoritative standards (set by policy boards) and simply the commonly accepted ways of recording and reporting accounting information. ...

Elements of the Income Statement

... BALANCE SHEET – reports the amount of assets, liabilities, and stockholders’ equity of an accounting entity at a point in time. INCOME STATEMENT – reports the revenues less the expenses of the accounting period. STATEMENT OF STOCKHOLDERS’ EQUITY – reports the changes in each of the company’s stockho ...

... BALANCE SHEET – reports the amount of assets, liabilities, and stockholders’ equity of an accounting entity at a point in time. INCOME STATEMENT – reports the revenues less the expenses of the accounting period. STATEMENT OF STOCKHOLDERS’ EQUITY – reports the changes in each of the company’s stockho ...

THE IMPORTANCE OF ACCOUNTING INFORMATION IN CRISIS TIMES

... this financial crisis brought a growth of the costs of capital. As more companies lack liquidity, economic analysis of these two categories is absolutely necessary, as a company’s incapability of payment may lead to chain collapse of several companies in economic relations with the former. Another f ...

... this financial crisis brought a growth of the costs of capital. As more companies lack liquidity, economic analysis of these two categories is absolutely necessary, as a company’s incapability of payment may lead to chain collapse of several companies in economic relations with the former. Another f ...

Accounting Methods - Cash Basis and Accrual Basis

... accessibility of financial data. Financial transactions should be recorded in such a way that a bookkeeper or successor treasurer will be able to both understand historical data and consistently process new transactions. Additionally, financial statements should be presented in such a way that they ...

... accessibility of financial data. Financial transactions should be recorded in such a way that a bookkeeper or successor treasurer will be able to both understand historical data and consistently process new transactions. Additionally, financial statements should be presented in such a way that they ...

UNIT 3 ACCOUNTING HOLIDAY HOMEWORK DUE 29/1/2015

... customer’s specifications. His supplier makes deliveries direct to each customer’s surgery. Bill works from the spare room in his home, and the firm’s only assets are a chair, desk and laptop computer. These cost a total of $8 000. Bill has a monthly gross profit of around $15 000. All customers pay ...

... customer’s specifications. His supplier makes deliveries direct to each customer’s surgery. Bill works from the spare room in his home, and the firm’s only assets are a chair, desk and laptop computer. These cost a total of $8 000. Bill has a monthly gross profit of around $15 000. All customers pay ...

The purposes of accounting

... This assumption allows you to defer the recognition of some expenses to later periods (such as depreciation), when a business will presumably still be in operation. Bankruptcy values may be lower ...

... This assumption allows you to defer the recognition of some expenses to later periods (such as depreciation), when a business will presumably still be in operation. Bankruptcy values may be lower ...

Honors Accounting - Rutherford Public Schools

... 3. State the rules of debit and credit 4. Record business transactions in a two-column journal 5. Post journal entries to ledger accounts 6. Prepare a trial balance and explain its uses and limitations Measuring business income 1. Define revenue and expenses 2. Define temporary and permanent account ...

... 3. State the rules of debit and credit 4. Record business transactions in a two-column journal 5. Post journal entries to ledger accounts 6. Prepare a trial balance and explain its uses and limitations Measuring business income 1. Define revenue and expenses 2. Define temporary and permanent account ...

FREE Sample Here

... Scott’s next important work was a response to the American Accounting Association’s “A Tentative Statement of Principles Underlying Corporate Financial Statements” (discussed later in the chapter). Scott criticized the AAA monograph as having a too narrow view of accounting in that it addressed only ...

... Scott’s next important work was a response to the American Accounting Association’s “A Tentative Statement of Principles Underlying Corporate Financial Statements” (discussed later in the chapter). Scott criticized the AAA monograph as having a too narrow view of accounting in that it addressed only ...

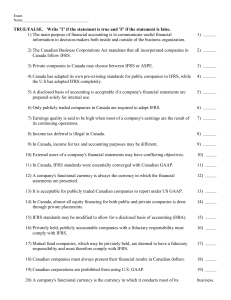

Exam Name___________________________________ TRUE

... accounting practices for financial reporting purposes as for tax reporting. 75) The International Accounting Standards Committee (IASC), established in 1973 has the objective to promote the worldwide harmonization of accounting principles. Is this harmonization necessary to allow movement of capital ...

... accounting practices for financial reporting purposes as for tax reporting. 75) The International Accounting Standards Committee (IASC), established in 1973 has the objective to promote the worldwide harmonization of accounting principles. Is this harmonization necessary to allow movement of capital ...

Accounting Theory Defined

... activities recorded on the income statement Comprehensive income: Changes in equity from all non-owner sources ...

... activities recorded on the income statement Comprehensive income: Changes in equity from all non-owner sources ...

Accounting Processes

... required and/or if documentation has been received. b. If required, Accounting will contact the user asking him/her to make changes/corrections to the journal prior to posting. 2. In addition to reviewing and posting journal entries entered by users, Accounting staff post all system-generated journa ...

... required and/or if documentation has been received. b. If required, Accounting will contact the user asking him/her to make changes/corrections to the journal prior to posting. 2. In addition to reviewing and posting journal entries entered by users, Accounting staff post all system-generated journa ...

accounting theory: text and readings

... Must identify those circumstances in which such principles have not been consistently observed in the current period in relation to the preceding period. Informative disclosures in the financial statements are to be regarded as reasonably adequate unless otherwise stated in the report. The rep ...

... Must identify those circumstances in which such principles have not been consistently observed in the current period in relation to the preceding period. Informative disclosures in the financial statements are to be regarded as reasonably adequate unless otherwise stated in the report. The rep ...

download

... GAAP earnings number with some revenues, expenses, gains, and losses excluded. • The concern with pro forma earnings is that companies can report pro forma earnings merely in an effort to make their results seem better than they actual were. ...

... GAAP earnings number with some revenues, expenses, gains, and losses excluded. • The concern with pro forma earnings is that companies can report pro forma earnings merely in an effort to make their results seem better than they actual were. ...

India

... Despoilers of environment will not find it economically viable if an economic value is put on the goods and services provided by the ecosystem. In India, natural resource accounting systems are likely to play an important role in decisionmaking and resource allocation in the future. However, such sy ...

... Despoilers of environment will not find it economically viable if an economic value is put on the goods and services provided by the ecosystem. In India, natural resource accounting systems are likely to play an important role in decisionmaking and resource allocation in the future. However, such sy ...