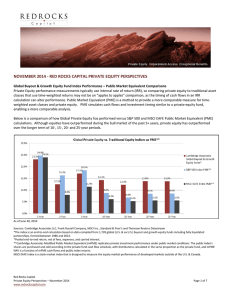

NOVEMBER 2014 - RED ROCKS CAPITAL PRIVATE EQUITY PERSPECTIVES

... KKR & Co, which earlier this year invested in Ethiopian flower company Afriflora, is one of a number of global investment managers capitalizing on growth prospects in Africa. Investment by international shops more than doubled in the first half of the year to $1.5 billion compared with $621 million ...

... KKR & Co, which earlier this year invested in Ethiopian flower company Afriflora, is one of a number of global investment managers capitalizing on growth prospects in Africa. Investment by international shops more than doubled in the first half of the year to $1.5 billion compared with $621 million ...

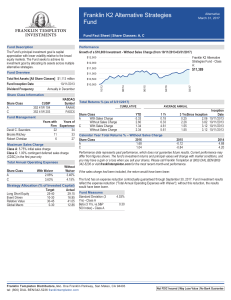

Franklin K2 Alternative Strategies Fund Fact Sheet

... involve greater credit risk, including the possibility of default or bankruptcy. Currency management strategies could result in losses to the Fund if currencies do not perform as the investment manager or sub-advisor expects. The Fund may make short sales of securities, which involves the risk that ...

... involve greater credit risk, including the possibility of default or bankruptcy. Currency management strategies could result in losses to the Fund if currencies do not perform as the investment manager or sub-advisor expects. The Fund may make short sales of securities, which involves the risk that ...

Taxes and Bankruptcy Costs

... Jensen and Meckling ― An agency relationship is a contract under which one or more persons (the principal) engage another person (the agent) to perform some service on their behalf which involves delegating some decision making authority to the agent. ― Often there is a blurred distinction between ...

... Jensen and Meckling ― An agency relationship is a contract under which one or more persons (the principal) engage another person (the agent) to perform some service on their behalf which involves delegating some decision making authority to the agent. ― Often there is a blurred distinction between ...

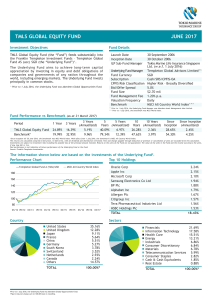

tmls global equity fund june 2017

... • From a regional standpoint, stock-specific weakness in Europe (in which the portfolio was overweight) and the US detracted from relative performance. We believe European equities discount a level of pessimism inconsistent with improving fundamentals. An overweight and stock selection in South Kor ...

... • From a regional standpoint, stock-specific weakness in Europe (in which the portfolio was overweight) and the US detracted from relative performance. We believe European equities discount a level of pessimism inconsistent with improving fundamentals. An overweight and stock selection in South Kor ...

Franklin Euro High Yield Fund - A (Ydis) EUR

... Copyright© 2017. Franklin Templeton Investments. All Rights Reserved. Issued by Templeton Asset Management Ltd. Registration No.(UEN) 199205211E. This document is for information only and does not constitute investment advice or a recommendation and was prepared without regard to the specific object ...

... Copyright© 2017. Franklin Templeton Investments. All Rights Reserved. Issued by Templeton Asset Management Ltd. Registration No.(UEN) 199205211E. This document is for information only and does not constitute investment advice or a recommendation and was prepared without regard to the specific object ...

Decision Criteria for New Technology Investment

... 1. Economic theory identifies the importance of a number of drivers of corporate capital investment demand, including the output of the company’s goods and services, the cost of capital (generally defined as a weighted average of the cost of equity and debt financing of capital), the expected reven ...

... 1. Economic theory identifies the importance of a number of drivers of corporate capital investment demand, including the output of the company’s goods and services, the cost of capital (generally defined as a weighted average of the cost of equity and debt financing of capital), the expected reven ...

MBS Total Return Fund

... (1) Year To Date (2) The 30 Day SEC Yield is a standardized yield which is calculated based on a 30-day period ending on the last day of the previous month. It is computed by dividing the net investment income per share earned during the period by the maximum offering price per share on the last day ...

... (1) Year To Date (2) The 30 Day SEC Yield is a standardized yield which is calculated based on a 30-day period ending on the last day of the previous month. It is computed by dividing the net investment income per share earned during the period by the maximum offering price per share on the last day ...

1 CORPORATE GOVERNANCE PATTERNS IN OECD

... themselves (by) preferring policies that justify paying them a higher salary, or divert company resources for their personal benefit or simply refuse to give up their jobs in the face of poor profit performance .... Large shareholders with a controlling interest in the firm would, if they could, inc ...

... themselves (by) preferring policies that justify paying them a higher salary, or divert company resources for their personal benefit or simply refuse to give up their jobs in the face of poor profit performance .... Large shareholders with a controlling interest in the firm would, if they could, inc ...

Niskanen Accounting for risk in dairy farms

... • The key advantage of hypothetical decoupled investment support increases motivation to cost-efficient construction because the subsidy is not dependent on investment cost • Margin insurance as an investment subsidy tool could reduce investment risk, but would also require long-term commitments whi ...

... • The key advantage of hypothetical decoupled investment support increases motivation to cost-efficient construction because the subsidy is not dependent on investment cost • Margin insurance as an investment subsidy tool could reduce investment risk, but would also require long-term commitments whi ...

What have the Capital Markets ever done for us?

... it can be most effectively deployed. The capital markets industry is large and complex, and can be confusing. While the industry is often described collectively as ‘bankers’ or ‘the City’, different market participants play very different roles. Fig.1 is a simplified diagram of the main participants ...

... it can be most effectively deployed. The capital markets industry is large and complex, and can be confusing. While the industry is often described collectively as ‘bankers’ or ‘the City’, different market participants play very different roles. Fig.1 is a simplified diagram of the main participants ...

JBWere SMA Listed Fixed Income Portfolio

... contained in this document are reasonably held or made as at the time of compilation. However, no warranty is made as to the accuracy or reliability of any estimates, opinions, conclusions, recommendations (which may change without notice) or other information contained in this document and, to the ...

... contained in this document are reasonably held or made as at the time of compilation. However, no warranty is made as to the accuracy or reliability of any estimates, opinions, conclusions, recommendations (which may change without notice) or other information contained in this document and, to the ...

The hidden risks of going passive

... One of the reasons for the underperformance of market cap-weighted indices is that they can force investors to buy stocks with expensive valuations and sell cheap ones, in other words, buy high and sell low. This is contrary to many well-tried investment strategies, such as those used by the celebra ...

... One of the reasons for the underperformance of market cap-weighted indices is that they can force investors to buy stocks with expensive valuations and sell cheap ones, in other words, buy high and sell low. This is contrary to many well-tried investment strategies, such as those used by the celebra ...

VECTOR CAPITAL SELLS GERBER TECHNOLOGY TO AMERICAN

... manufacturing operations, and significantly expanding its international presence. Commenting on the strategy, Michael Elia, CEO of Gerber Technology, said “With the full support of Vector, we have invested to broaden our product offerings and expand our global reach to provide customers with automat ...

... manufacturing operations, and significantly expanding its international presence. Commenting on the strategy, Michael Elia, CEO of Gerber Technology, said “With the full support of Vector, we have invested to broaden our product offerings and expand our global reach to provide customers with automat ...

Chapter 1 Handbook requirements for service

... This special guide is for service companies. Its purpose is to help service companies find their way around the Handbook by setting out which parts of it apply to them. ...

... This special guide is for service companies. Its purpose is to help service companies find their way around the Handbook by setting out which parts of it apply to them. ...

Syndication Partner Choice by Foreign Venture Capital Firms in China

... knowledge of local legal requirements that local VC firms possess (Mäkelä and Maula, 2006), and their experience in the domestic market (Wright et al., 2005). Not surprisingly, previous research on cross-border co-investment found that foreign firms do co-invest with local investors as this reduces ...

... knowledge of local legal requirements that local VC firms possess (Mäkelä and Maula, 2006), and their experience in the domestic market (Wright et al., 2005). Not surprisingly, previous research on cross-border co-investment found that foreign firms do co-invest with local investors as this reduces ...

Opportunities Abound… Trading Is The Key!

... separate fees assessed directly by each unaffiliated mutual fund and exchange traded fund holding that comprised each account, and the maximum investment advisory fee that the accounts would have incurred (by applying the Heritage’s current investment advisory ...

... separate fees assessed directly by each unaffiliated mutual fund and exchange traded fund holding that comprised each account, and the maximum investment advisory fee that the accounts would have incurred (by applying the Heritage’s current investment advisory ...

Impact Investing: How does it make a difference?

... For many years SRI has been tainted by the common misconception that it was difficult to make a decent financial return for the risk involved, but as the Clean Drinking Water fund has proved, impact investing can deliver above market rate returns. A study by US investment bank JP Morgan found that t ...

... For many years SRI has been tainted by the common misconception that it was difficult to make a decent financial return for the risk involved, but as the Clean Drinking Water fund has proved, impact investing can deliver above market rate returns. A study by US investment bank JP Morgan found that t ...

Macro-economics of Innovation 1

... specific product or process technologies and affect the input cost structure, and conditions of production and distribution through out the system. • Source: Freeman and Perez (1988). ...

... specific product or process technologies and affect the input cost structure, and conditions of production and distribution through out the system. • Source: Freeman and Perez (1988). ...

Related Party Transactions

... more than two layers of investment companies. Investment Company means a company whose principal business is the acquisition of shares debentures or other securities What does the Principal Business means? The commercial activities undertaken by the Company As per object clause of the Company ...

... more than two layers of investment companies. Investment Company means a company whose principal business is the acquisition of shares debentures or other securities What does the Principal Business means? The commercial activities undertaken by the Company As per object clause of the Company ...

Position Description – Director of Member Marketing

... Possesses highest integrity, ethics, and good judgment. Has high energy, strong work ethic and motivation. Possesses a positive “can do” attitude. Collaborative team player. Maintains professional rapport with all members of the IAA staff and external contacts. ...

... Possesses highest integrity, ethics, and good judgment. Has high energy, strong work ethic and motivation. Possesses a positive “can do” attitude. Collaborative team player. Maintains professional rapport with all members of the IAA staff and external contacts. ...

RTF format

... 12. The products offered by either of the firms in the Acquiring Group cannot be considered reasonably interchangeable to those offered by the target firm. ...

... 12. The products offered by either of the firms in the Acquiring Group cannot be considered reasonably interchangeable to those offered by the target firm. ...

Help satisfy participant investment needs

... or use a particular account type. It does not take into account the specific investment objectives, tax and financial condition, or particular needs of any specific person. Investors should work with their financial professional to discuss their specific situation. Options offered in Fund Window may ...

... or use a particular account type. It does not take into account the specific investment objectives, tax and financial condition, or particular needs of any specific person. Investors should work with their financial professional to discuss their specific situation. Options offered in Fund Window may ...

Why Do Companies Go Public? Evidence From

... offer if properly executed has the potential of raising large sums that would otherw ise not be possible through borrowing. Going public offers a relatively cheap source of capital for investment and working capital requirements compared to the traditional sources of funds like retained earnings and ...

... offer if properly executed has the potential of raising large sums that would otherw ise not be possible through borrowing. Going public offers a relatively cheap source of capital for investment and working capital requirements compared to the traditional sources of funds like retained earnings and ...

Ross Template

... A limit or constraint on the amount of funds that can be invested Can rank investments based on their NPVs. Those with positive NPVs ...

... A limit or constraint on the amount of funds that can be invested Can rank investments based on their NPVs. Those with positive NPVs ...

Investment environment and its INFORMATION DISPLAY A

... Formation of a favorable investment environment the company needs to ensure product competitiveness and improving its quality, restructuring of production, creation of necessary raw materials for the effective functioning of enterprises, solve social and environmental problems, investments necessary ...

... Formation of a favorable investment environment the company needs to ensure product competitiveness and improving its quality, restructuring of production, creation of necessary raw materials for the effective functioning of enterprises, solve social and environmental problems, investments necessary ...