The UK real estate market

... The general view for the whole UK market is that 2015 will see a continuation of the recent upward trends in both investment activity and returns. Whilst there is an apparent consensus that the market will enjoy double-digit total returns, during the course of this year, we have noted a wide spread ...

... The general view for the whole UK market is that 2015 will see a continuation of the recent upward trends in both investment activity and returns. Whilst there is an apparent consensus that the market will enjoy double-digit total returns, during the course of this year, we have noted a wide spread ...

presentation - Kinetics Mutual Funds

... This presentation is for informational purposes only, is not a solicitation to purchase shares, does not constitute investment or tax advice and is not a public or private offering or recommendation of any kind. This document and its content are the property of Kinetics Asset Management LLC (“Kineti ...

... This presentation is for informational purposes only, is not a solicitation to purchase shares, does not constitute investment or tax advice and is not a public or private offering or recommendation of any kind. This document and its content are the property of Kinetics Asset Management LLC (“Kineti ...

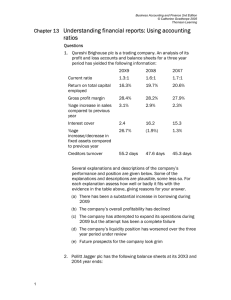

Chapter 13 Understanding financial reports: Using accounting ratios

... Bretherton seems less risky than an investment in either of the other two companies (because of their high level of gearing). ...

... Bretherton seems less risky than an investment in either of the other two companies (because of their high level of gearing). ...

INTRODUCTION HIGHLIGHTS Regulatory Issues Market

... Limited was appointed to undertake the study whose objectives include guiding regional securities regulators on: a suitable risk based model for EAC market intermediaries; identification of optimal Risk Based Capital Adequacy (RBCA) requirements for the region; a suitable automated system for implem ...

... Limited was appointed to undertake the study whose objectives include guiding regional securities regulators on: a suitable risk based model for EAC market intermediaries; identification of optimal Risk Based Capital Adequacy (RBCA) requirements for the region; a suitable automated system for implem ...

Passive Global Equity (inc. UK) Fund

... The fund is forward priced, which means that the member gets the next available price after they invest. The fund has a dealing cycle of T + 0. This means that the money received on day T buys units at the valuation date price applicable at close of business on the same day. Who is this factsheet fo ...

... The fund is forward priced, which means that the member gets the next available price after they invest. The fund has a dealing cycle of T + 0. This means that the money received on day T buys units at the valuation date price applicable at close of business on the same day. Who is this factsheet fo ...

Impact on SAA - Insurance Top 10 Australia

... the geopolitical environment that occurred over 2016, there is little doubt that a sea change has occurred. For financial markets, this has led to periodic bouts of volatility following events such as the United Kingdom’s vote to leave the European Union and the election of Donald Trump as the next ...

... the geopolitical environment that occurred over 2016, there is little doubt that a sea change has occurred. For financial markets, this has led to periodic bouts of volatility following events such as the United Kingdom’s vote to leave the European Union and the election of Donald Trump as the next ...

OUR INVESTMENT PROCESS - RBC Wealth Management

... of top-down economic analysis and bottom-up company screening. Sector Allocation Every quarter, and in some cases more frequently, the RBC Investments Strategy Committee, comprised of senior investment professionals, forecasts key macroeconomic variables, such as expected interest rate moves, econom ...

... of top-down economic analysis and bottom-up company screening. Sector Allocation Every quarter, and in some cases more frequently, the RBC Investments Strategy Committee, comprised of senior investment professionals, forecasts key macroeconomic variables, such as expected interest rate moves, econom ...

STANLIB Index Fund

... calculated over a rolling three years (where applicable) and annualised to the most recently completed quarter. A higher TER does not necessarily imply a poor return, nor does a low TER imply a good return. The current TER cannot be regarded as an indication of future TERs. Transaction Costs (TC): T ...

... calculated over a rolling three years (where applicable) and annualised to the most recently completed quarter. A higher TER does not necessarily imply a poor return, nor does a low TER imply a good return. The current TER cannot be regarded as an indication of future TERs. Transaction Costs (TC): T ...

Reitway Global`s Investment Process

... 20. Technical indicators assist with planning the daily trading strategy. 21. Limit orders are typically used to provide price-certainty, but market orders are used if warranted by market conditions/liquidity constraints. 22. Buy and sell orders are placed through brokerage firms responsible for pro ...

... 20. Technical indicators assist with planning the daily trading strategy. 21. Limit orders are typically used to provide price-certainty, but market orders are used if warranted by market conditions/liquidity constraints. 22. Buy and sell orders are placed through brokerage firms responsible for pro ...

Key Investor Information Document

... and periodic reports are prepared for the entire umbrella fund. To protect investors, the assets and liabilities of each compartment are segregated by law from those of other compartments. Switches: Subject to conditions, you may apply to switch your investment into another share class within this f ...

... and periodic reports are prepared for the entire umbrella fund. To protect investors, the assets and liabilities of each compartment are segregated by law from those of other compartments. Switches: Subject to conditions, you may apply to switch your investment into another share class within this f ...

Our Beliefs About Investing

... While academically correct to consider these as a single, comprehensive concept, to ensure a complete understanding of the power of portfolio efficiency, it is important to eliminate naiveté by understanding the possible distinctions between these concepts. Diversification is analogous simply to the ...

... While academically correct to consider these as a single, comprehensive concept, to ensure a complete understanding of the power of portfolio efficiency, it is important to eliminate naiveté by understanding the possible distinctions between these concepts. Diversification is analogous simply to the ...

Organizational Decision-Making and Information: Angel Investments

... In the setting of entrepreneurial finance, optimally aggregating information is especially crucial for financial intermediaries because information is low and at a premium. Entrepreneurial ventures lack any of the capital assets or organizational infrastructure present in larger incumbent firms, and ...

... In the setting of entrepreneurial finance, optimally aggregating information is especially crucial for financial intermediaries because information is low and at a premium. Entrepreneurial ventures lack any of the capital assets or organizational infrastructure present in larger incumbent firms, and ...

2050 Retirement Strategy Fund

... The Retirement Strategy Funds’ underlying investments include international companies, which involve such risks as currency fluctuations, economic instability and political developments. The portfolios also invest some of their assets in small and midsize companies. Such investments increase the ris ...

... The Retirement Strategy Funds’ underlying investments include international companies, which involve such risks as currency fluctuations, economic instability and political developments. The portfolios also invest some of their assets in small and midsize companies. Such investments increase the ris ...

Investment Philosophy - St. Croix Valley Foundation

... use techniques such as short selling, index futures and options, foreign currency contracts, synthetic securities and other types of investments. The use of Stock Options, Short Sales or Margin Transactions will not be used in the management of individual issues and a mutual fund broadly using these ...

... use techniques such as short selling, index futures and options, foreign currency contracts, synthetic securities and other types of investments. The use of Stock Options, Short Sales or Margin Transactions will not be used in the management of individual issues and a mutual fund broadly using these ...

Evaluating information technology investments

... IT investments have had a tremendous impact on firms by reducing costs, improving product quality and increasing value to customers, thus enabling the firms to gain competitive advantage. Griffiths and Remenyi (2003) found that among firms in financial services, information technology expenditure co ...

... IT investments have had a tremendous impact on firms by reducing costs, improving product quality and increasing value to customers, thus enabling the firms to gain competitive advantage. Griffiths and Remenyi (2003) found that among firms in financial services, information technology expenditure co ...

THE MINORITY RECAPITALIZATION

... A Minority Recapitalization (Recap) is a viable liquidity alternative for company owners. However, Cyprium has frequently observed that business owners lack the market awareness that would enable them to develop an appreciation for the prospective benefits of a Minority Recap option. Just as importa ...

... A Minority Recapitalization (Recap) is a viable liquidity alternative for company owners. However, Cyprium has frequently observed that business owners lack the market awareness that would enable them to develop an appreciation for the prospective benefits of a Minority Recap option. Just as importa ...

5 key facts to consider- Ideall Absolute Return Strategies Fund (7652)

... Insurance Contract and the guarantor of any provisions therein. A description of the key features and the terms and conditions of Manulife’s Ideal Segregated Funds Signature 20 is contained in the Information Folder and Contract. The information has been simplified for the purposes of this document ...

... Insurance Contract and the guarantor of any provisions therein. A description of the key features and the terms and conditions of Manulife’s Ideal Segregated Funds Signature 20 is contained in the Information Folder and Contract. The information has been simplified for the purposes of this document ...

Entrepreneurial Dynamism and the Success of

... Consider the enormous “churning” that occurs in jobs and businesses. About 10 percent of U.S. jobs disappear annually due to business closures and contractions.8 As a result, about 13 million new jobs must be created every year in order to maintain a healthy job market. These jobs are created in hig ...

... Consider the enormous “churning” that occurs in jobs and businesses. About 10 percent of U.S. jobs disappear annually due to business closures and contractions.8 As a result, about 13 million new jobs must be created every year in order to maintain a healthy job market. These jobs are created in hig ...

Impact of New Capital Rule on Community Banks

... FDIC) adopted significant changes to the US regulatory capital framework. It is being referred to as the “New Capital Rule” or “new rule”. The new rule is effective January 1, 2015 for financial institutions with total consolidated assets of less than $250 billion. Many of the provisions will phase ...

... FDIC) adopted significant changes to the US regulatory capital framework. It is being referred to as the “New Capital Rule” or “new rule”. The new rule is effective January 1, 2015 for financial institutions with total consolidated assets of less than $250 billion. Many of the provisions will phase ...

Why a new investment proposition?

... The cost to arrange the investment is usually a percentage of the amount invested. This is typically 4% of the amount invested for investments up to £100,000, 3.5% for amounts up to £150,000, 3.25% up to £250,000 and 3.00% for amounts over that sum up to a maximum fee of £10,000. Annual costs- there ...

... The cost to arrange the investment is usually a percentage of the amount invested. This is typically 4% of the amount invested for investments up to £100,000, 3.5% for amounts up to £150,000, 3.25% up to £250,000 and 3.00% for amounts over that sum up to a maximum fee of £10,000. Annual costs- there ...

Meet Dave - Allegis Financial Partners

... *It’s important to note that CDs are insured by the Federal Deposit Insurance Corporation (FDIC) for up to $250,000 and offer a fixed rate of return, whereas fund shares are not insured and are subject to loss. The S&P 500 Index is considered representative of the U.S. stock market and returns do no ...

... *It’s important to note that CDs are insured by the Federal Deposit Insurance Corporation (FDIC) for up to $250,000 and offer a fixed rate of return, whereas fund shares are not insured and are subject to loss. The S&P 500 Index is considered representative of the U.S. stock market and returns do no ...

CMAA Investment Policy - Construction Management Association of

... along with any recommended changes they deem necessary. ...

... along with any recommended changes they deem necessary. ...