Valuation of Venture Capital Securities: An

... equity given up, are all interrelated and disputed during fund raising negotiations. The “Venture Capital Method” is used as a framework for this analysis. Given the expected sale/IPO (Initial Public Offering) year, the expected sale/IPO value, the required rate of return (to compensate the venture ...

... equity given up, are all interrelated and disputed during fund raising negotiations. The “Venture Capital Method” is used as a framework for this analysis. Given the expected sale/IPO (Initial Public Offering) year, the expected sale/IPO value, the required rate of return (to compensate the venture ...

newsletter - New York State Deferred Compensation Plan

... investor plans to retire (assumed to be age 65) and likely stop making new investments in the Trust. If an investor plans to retire significantly earlier or later than age 65, the Trusts may not be an appropriate investment even if the investor is retiring on or near the target date. The Trusts’ all ...

... investor plans to retire (assumed to be age 65) and likely stop making new investments in the Trust. If an investor plans to retire significantly earlier or later than age 65, the Trusts may not be an appropriate investment even if the investor is retiring on or near the target date. The Trusts’ all ...

Opportunistic Deep-Value Investing: A Multi-Asset Class

... We expect deep-value investments to exhibit higher absolute volatility than broad market indices because of concentration, added business risks, and potentially greater economic sensitivity. How to manage the potentially high volatility of deep-value investments is a question that must be addressed ...

... We expect deep-value investments to exhibit higher absolute volatility than broad market indices because of concentration, added business risks, and potentially greater economic sensitivity. How to manage the potentially high volatility of deep-value investments is a question that must be addressed ...

Invest globally - Putnam Investments

... Consider these risks before investing: International investing involves certain risks, such as currency fluctuations, economic instability, and political developments. Additional risks may be associated with emerging-market securities, including illiquidity and volatility. Diversification does not g ...

... Consider these risks before investing: International investing involves certain risks, such as currency fluctuations, economic instability, and political developments. Additional risks may be associated with emerging-market securities, including illiquidity and volatility. Diversification does not g ...

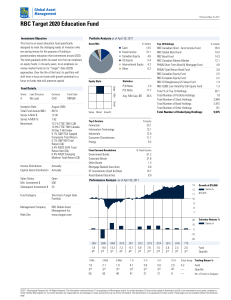

RBC Target 2020 Education Fund

... subject to change without notice and are provided in good faith but without legal responsibility. The Top Ten/25 Holdings may change due to ongoing portfolio transactions within the fund. The Prospectus and other information about the underlying investment funds are available at www.sedar.com. MER ( ...

... subject to change without notice and are provided in good faith but without legal responsibility. The Top Ten/25 Holdings may change due to ongoing portfolio transactions within the fund. The Prospectus and other information about the underlying investment funds are available at www.sedar.com. MER ( ...

Audited Financial Statements June 30, 2010

... The Corporation’s annual financial statements include a Management’s Discussion and Analysis (MD&A) section and basic financial statements. The basic financial statements include a Governmental Funds Balance Sheet / Statement of Net Assets, a Statement of Governmental Fund Revenues, Expenditures and ...

... The Corporation’s annual financial statements include a Management’s Discussion and Analysis (MD&A) section and basic financial statements. The basic financial statements include a Governmental Funds Balance Sheet / Statement of Net Assets, a Statement of Governmental Fund Revenues, Expenditures and ...

PDF article file - Krungsri Asset Management

... Investors should carefully study fund features, performance, and risk before making an investment decision. Past performance is not a guarantee of future results. For KF-HUSINDX and KF-HJPINDX 1. KF-HUSINDX allocates at least 80% of NAV in each accounting year in a foreign fund titled iShares Cor ...

... Investors should carefully study fund features, performance, and risk before making an investment decision. Past performance is not a guarantee of future results. For KF-HUSINDX and KF-HJPINDX 1. KF-HUSINDX allocates at least 80% of NAV in each accounting year in a foreign fund titled iShares Cor ...

The Diversified Portfolio Index

... After 40 years of working in Wall Street, absorbing all the data and information I could consume on the subject of investing, I found that it did not provide me with the knowledge required to be a successful long-term investor. The anticipated wisdom from the acquisition of all this knowledge and da ...

... After 40 years of working in Wall Street, absorbing all the data and information I could consume on the subject of investing, I found that it did not provide me with the knowledge required to be a successful long-term investor. The anticipated wisdom from the acquisition of all this knowledge and da ...

Financial Report 2005

... banking and investment sector on increase of 27 per cent while the service sector recorded a gain of 19 per cent. The up move in the current quarter was also driven by volumes from GCC bigwigs who consider Oman to be cheaper than other GCC markets. Broad Money supply in January 2005 increased 3 per ...

... banking and investment sector on increase of 27 per cent while the service sector recorded a gain of 19 per cent. The up move in the current quarter was also driven by volumes from GCC bigwigs who consider Oman to be cheaper than other GCC markets. Broad Money supply in January 2005 increased 3 per ...

Download817 KB - Long

... too uncertain for businesses that value their security (with a high level of liquidity) to the detriment of investments bringing down growth in the medium term. Finally, it is worth mentioning a sovereignty issue: the substantial level of ownership of the capital of so-called “French champions” by n ...

... too uncertain for businesses that value their security (with a high level of liquidity) to the detriment of investments bringing down growth in the medium term. Finally, it is worth mentioning a sovereignty issue: the substantial level of ownership of the capital of so-called “French champions” by n ...

Advanced Accounting by Hoyle et al, 6th Edition

... an Equity Investment If part of an investment is sold during the period . . . The equity method continues to be applied up to the date of the ...

... an Equity Investment If part of an investment is sold during the period . . . The equity method continues to be applied up to the date of the ...

Financial Statements Dartmouth General Hospital Charitable

... When a capital asset no longer has any long term service potential to the Foundation, the excess of its net carrying amount over any residual value is recognized as an expense in the statement of operations. Any write-downs recognized are not reversed. Contributed services and materials Volunteers c ...

... When a capital asset no longer has any long term service potential to the Foundation, the excess of its net carrying amount over any residual value is recognized as an expense in the statement of operations. Any write-downs recognized are not reversed. Contributed services and materials Volunteers c ...

portfolio objective

... The portfolio aims to achieve long term capital appreciation by investing 80% into fixed income funds and 20% into equity funds. This target allocation may change with our views on financial markets. The portfolio takes the form of a monthly RSP, with the aim of addressing the needs of “newbie” inve ...

... The portfolio aims to achieve long term capital appreciation by investing 80% into fixed income funds and 20% into equity funds. This target allocation may change with our views on financial markets. The portfolio takes the form of a monthly RSP, with the aim of addressing the needs of “newbie” inve ...

Energizing High Yield Bond Investors

... Responsible borrowing. “Issuers have not used the low rate environment of the last few years to engage in reckless corporate financing,” said Kirkpatrick. For example, leveraged buyouts (LBO), and the debt that goes along with them, have dropped as a percentage of issuance. In 2014, LBO debt made u ...

... Responsible borrowing. “Issuers have not used the low rate environment of the last few years to engage in reckless corporate financing,” said Kirkpatrick. For example, leveraged buyouts (LBO), and the debt that goes along with them, have dropped as a percentage of issuance. In 2014, LBO debt made u ...

Assessing the Startup Bandwagon Effect

... as well, suggesting that better market conditions do lead to more capital raised. Controlling for the round we are looking at, we see a result mirroring the trend exhibited in our summary statistics of gradually increasing funds raised as firms go into later rounds and as more investors participate. ...

... as well, suggesting that better market conditions do lead to more capital raised. Controlling for the round we are looking at, we see a result mirroring the trend exhibited in our summary statistics of gradually increasing funds raised as firms go into later rounds and as more investors participate. ...

Teachers Guide Lesson Twelve

... market accounts, and certificates of deposit (CD). Then, students will analyze factors to consider when selecting a savings account. These include interest rates, fees, balance requirements, and deposit insurance. Investing takes saving one step further in a person’s financial plan. Bonds, stocks, m ...

... market accounts, and certificates of deposit (CD). Then, students will analyze factors to consider when selecting a savings account. These include interest rates, fees, balance requirements, and deposit insurance. Investing takes saving one step further in a person’s financial plan. Bonds, stocks, m ...

Portfolio Management

... fees, distribution costs and compliance costs. • Another trend in recent years has been the growth of alternative investments such as hedge funds, exchange traded fund (ETF), private equity… ...

... fees, distribution costs and compliance costs. • Another trend in recent years has been the growth of alternative investments such as hedge funds, exchange traded fund (ETF), private equity… ...

South Africa - CUTS International

... as an alternative to the domestic investment deficit in the SA economy. Domestic investment, particularly by the private sector, is critical for stimulating economic growth, enhancing capital, generating jobs and promoting social development. The private sector however appears to be awaiting its cue ...

... as an alternative to the domestic investment deficit in the SA economy. Domestic investment, particularly by the private sector, is critical for stimulating economic growth, enhancing capital, generating jobs and promoting social development. The private sector however appears to be awaiting its cue ...

Recommendations

... The investment bank must have guidelines specifying when employees outside Corporate Finance and Debt Capital may be involved in actual corporate finance and debt capital activities. Moreover, the investment bank must have guidelines specifying how employees should act if they obtain inside informat ...

... The investment bank must have guidelines specifying when employees outside Corporate Finance and Debt Capital may be involved in actual corporate finance and debt capital activities. Moreover, the investment bank must have guidelines specifying how employees should act if they obtain inside informat ...

Annual News Conference 2011

... • address market failures or sub-optimal investment situations • could not / to same extent have been carried out in the period without EFSI • higher risk profile: typically EFSI operations, as well as EFSI portfolio • Additionality considered if risk corresponding to EIB Special Activities General ...

... • address market failures or sub-optimal investment situations • could not / to same extent have been carried out in the period without EFSI • higher risk profile: typically EFSI operations, as well as EFSI portfolio • Additionality considered if risk corresponding to EIB Special Activities General ...

Enhanced practice management

... of a mutual fund’s underperformance versus common market indexes. ...

... of a mutual fund’s underperformance versus common market indexes. ...

Competitive Pressures - Morowitz Gaming Advisors

... generated an industry-leading EBITDA of approximately $245 million and the highest returns on investment in the market (over 20 percent EBITDA return, excluding construction in progress). The Borgata essentially carved out a space that did not previously exist in Atlantic City. Borgata eschewed the ...

... generated an industry-leading EBITDA of approximately $245 million and the highest returns on investment in the market (over 20 percent EBITDA return, excluding construction in progress). The Borgata essentially carved out a space that did not previously exist in Atlantic City. Borgata eschewed the ...

Chapter 19 - Aufinance

... compared to the markets for other long-term securities like common stock and municipal bonds. • The number of active individual investors is small and institutional investors tend to follow a buy and hold strategy. • Recently however, many institutions are looking at total performance and have becom ...

... compared to the markets for other long-term securities like common stock and municipal bonds. • The number of active individual investors is small and institutional investors tend to follow a buy and hold strategy. • Recently however, many institutions are looking at total performance and have becom ...