The impact of Agency Problem in Firm value and the Greek Stock

... celebrated and used theoretical framework for examining the conflicts that arise during the operation process of a firm and the management decision process is agency theory. Corporate Governance mechanisms are held responsible for establishing a sound and strong framework for protecting investors an ...

... celebrated and used theoretical framework for examining the conflicts that arise during the operation process of a firm and the management decision process is agency theory. Corporate Governance mechanisms are held responsible for establishing a sound and strong framework for protecting investors an ...

DOES FINANCIAL LEVERAGE INFLUENCE INVESTMENT

... Aivazian et al. (2005) found the negative but significantly strong relationship between leverage and investment for firms having low growth opportunities as compare to high growth opportunity firms. Campello (2006) argued that market gains could be increased by moderate debt taking but sales could b ...

... Aivazian et al. (2005) found the negative but significantly strong relationship between leverage and investment for firms having low growth opportunities as compare to high growth opportunity firms. Campello (2006) argued that market gains could be increased by moderate debt taking but sales could b ...

full press release. - Punter Southall Transaction Services

... since 2009 helping Nortel Networks Inc. deal with its US and UK pension issues whilst it progresses through the Chapter 11 bankruptcy process. John Spencer, Head of Palisades Capital Advisors, said: “When looking for a permanent best-in-class platform with which to grow our business our immediate th ...

... since 2009 helping Nortel Networks Inc. deal with its US and UK pension issues whilst it progresses through the Chapter 11 bankruptcy process. John Spencer, Head of Palisades Capital Advisors, said: “When looking for a permanent best-in-class platform with which to grow our business our immediate th ...

CHAPTER 11: Input Demand: The Capital Market and the

... households supply their savings to firms that demand funds to buy capital goods. The funds that firms use to buy capital goods come, directly or indirectly, from households. When a household decides not to consume a portion of its income, it saves. Investment by firms is the demand for capital. Savi ...

... households supply their savings to firms that demand funds to buy capital goods. The funds that firms use to buy capital goods come, directly or indirectly, from households. When a household decides not to consume a portion of its income, it saves. Investment by firms is the demand for capital. Savi ...

Power of Dividends - Investing in global dividend

... move in tandem with each other over the long term. While one or more foreign markets may, at any time, be heading in the same direction as Canada, longer-term correlations are low, thus providing some counterbalance to your portfolio. ...

... move in tandem with each other over the long term. While one or more foreign markets may, at any time, be heading in the same direction as Canada, longer-term correlations are low, thus providing some counterbalance to your portfolio. ...

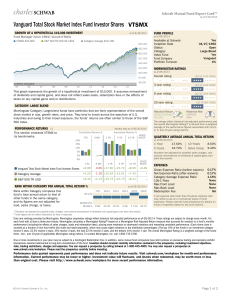

Vanguard Total Stock Market Index Fund Investor Shares

... Sector weightings for fund portfolios are determined using the Global Industry Classification Standard (GICS). GICS was developed by and is the exclusive property of Morgan Stanley Capital International Inc. and Standard & Poor's. GICS is a service mark of MSCI and S&P and has been licensed for use ...

... Sector weightings for fund portfolios are determined using the Global Industry Classification Standard (GICS). GICS was developed by and is the exclusive property of Morgan Stanley Capital International Inc. and Standard & Poor's. GICS is a service mark of MSCI and S&P and has been licensed for use ...

Factors behind Japan`s sluggish capital investment growth

... capital investment in nominal terms in the latest available FY2014 figures stood at 68.4 trillion yen, which was down over 10% from 76.8 trillion yen recorded in FY2007. Even though capital investment should reach the FY2015 70 trillion yen target in the Japan Revitalization Strategy, this would sti ...

... capital investment in nominal terms in the latest available FY2014 figures stood at 68.4 trillion yen, which was down over 10% from 76.8 trillion yen recorded in FY2007. Even though capital investment should reach the FY2015 70 trillion yen target in the Japan Revitalization Strategy, this would sti ...

East African Community Common Market Protocol

... mobilize additional capital, raise the amount and productivity of investment, bolster competition in the financial sector, facilitate information flows and improve corporate governance. Specifically, Article 24 of the protocol requires the elimination of restrictions on the free movement of capital. ...

... mobilize additional capital, raise the amount and productivity of investment, bolster competition in the financial sector, facilitate information flows and improve corporate governance. Specifically, Article 24 of the protocol requires the elimination of restrictions on the free movement of capital. ...

PF 8.01

... • How are saving and investing similar and how are they different? • Why do some people find it so difficult to save and invest? • What “rules” can help build smart saving and investing habits? • What factors should be considered when selecting saving and investing options. ...

... • How are saving and investing similar and how are they different? • Why do some people find it so difficult to save and invest? • What “rules” can help build smart saving and investing habits? • What factors should be considered when selecting saving and investing options. ...

Guide to listing on AIM for Indian companies

... for a straightforward AIM IPO would normally be in the region of £400,000 - £500,000 (amounting to approximately INR 33,606,000 - 42,605,000 based on a conversion rate of £1= INR 84.02). On top of these fees, the company will need to pay the broker’s fees for raising funds which may range between 3% ...

... for a straightforward AIM IPO would normally be in the region of £400,000 - £500,000 (amounting to approximately INR 33,606,000 - 42,605,000 based on a conversion rate of £1= INR 84.02). On top of these fees, the company will need to pay the broker’s fees for raising funds which may range between 3% ...

Valuation of Strategic Investments Using Real

... Course Information • Instructor: Dr Shahab Q Khokhar • Email: [email protected] • Pre-requisite: Principles of Finance ...

... Course Information • Instructor: Dr Shahab Q Khokhar • Email: [email protected] • Pre-requisite: Principles of Finance ...

Fidelity Convertible Securities Investment Trust

... Fidelity’s mutual funds are sold by registered Investment Professionals. Each Fund has a simplified prospectus, which contains important information on the Fund, including its investment objective, purchase options, and applicable charges. Please obtain a copy of the prospectus, read it carefully, a ...

... Fidelity’s mutual funds are sold by registered Investment Professionals. Each Fund has a simplified prospectus, which contains important information on the Fund, including its investment objective, purchase options, and applicable charges. Please obtain a copy of the prospectus, read it carefully, a ...

Chapter 2: The Data of Macroeconomics

... • But, legal definition uses the historical price of capital. • If PK rises over time, then the legal definition understates the true cost and overstates profit, so firms could be taxed even if their true economic profit is zero. • Thus, corporate income tax discourages investment. CHAPTER 17 ...

... • But, legal definition uses the historical price of capital. • If PK rises over time, then the legal definition understates the true cost and overstates profit, so firms could be taxed even if their true economic profit is zero. • Thus, corporate income tax discourages investment. CHAPTER 17 ...

Transamerica ONE and Transamerica ALPHA Digital

... Transamerica Financial Advisors (TFA) Investment Advisor Representative (IAR) can offer you. Through the Transamerica® ONE Wealth Management Platform or the Transamerica ALPHA Digital Investment Program (Transamerica ALPHA), a wealth of financial tools are at your and your TFA Representative’s dispo ...

... Transamerica Financial Advisors (TFA) Investment Advisor Representative (IAR) can offer you. Through the Transamerica® ONE Wealth Management Platform or the Transamerica ALPHA Digital Investment Program (Transamerica ALPHA), a wealth of financial tools are at your and your TFA Representative’s dispo ...

Corporate Governance and Its Effect on the Corporate Financial

... interest of loan is the acceptable tax cost and this reduces the effective cost of loan especially if the rate of return resulted from these sources is higher than the cost rate of financing. Second, lenders cannot vote and shareholders can have more control of the larger companies with less money. ...

... interest of loan is the acceptable tax cost and this reduces the effective cost of loan especially if the rate of return resulted from these sources is higher than the cost rate of financing. Second, lenders cannot vote and shareholders can have more control of the larger companies with less money. ...

INVESTORLIT Research Private Equity vs. Public Equity

... produced superior returns vs. public equities. While the studies also note that premium returns can be earned, “...investors should be leery of accepting the endowment model’s past periods of high returns as a simplistic template for the future. Many of the more notable early successes were achieved ...

... produced superior returns vs. public equities. While the studies also note that premium returns can be earned, “...investors should be leery of accepting the endowment model’s past periods of high returns as a simplistic template for the future. Many of the more notable early successes were achieved ...

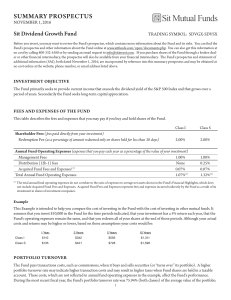

summary prospectus

... paying stocks it is anticipated that the holdings will tend to be in large to medium-sized companies (companies with market capitalizations in excess of $2 billion). The Adviser considers several factors in its evaluation of a company’s potential for above average long-term earnings, revenue, and di ...

... paying stocks it is anticipated that the holdings will tend to be in large to medium-sized companies (companies with market capitalizations in excess of $2 billion). The Adviser considers several factors in its evaluation of a company’s potential for above average long-term earnings, revenue, and di ...

SECURITIES AND EXCHANGE COMMISSION Washington, D.C.

... Each of the Outlook Funds, (Outlook 2010, Outlook 2020, Outlook 2030 and Outlook 2040), are pre-mixed funds, investing in various blends of stocks, bonds, and money market instruments seeking to produce competitive returns over a set period of time. These funds seek higher returns initially and then ...

... Each of the Outlook Funds, (Outlook 2010, Outlook 2020, Outlook 2030 and Outlook 2040), are pre-mixed funds, investing in various blends of stocks, bonds, and money market instruments seeking to produce competitive returns over a set period of time. These funds seek higher returns initially and then ...

The TAMRIS Consultancy - Money Managed Properly

... market and security valuations change. Additionally, there is insufficient expertise in the industry for each portfolio to be personally managed, let alone constructed, planned and managed to meet personal financial needs over time. In order to be able to deliver asset management services and produc ...

... market and security valuations change. Additionally, there is insufficient expertise in the industry for each portfolio to be personally managed, let alone constructed, planned and managed to meet personal financial needs over time. In order to be able to deliver asset management services and produc ...

Stimulating Investment in Emerging-Market SMEs

... Business Partners has been a pioneer in the use of royalties (a percentage of sales) in emerging-market risk capital investments. In most of its deals, royalties are based on actual sales or the company’s sales projections, whichever are greater, allowing the firm to maintain a steady income stream ...

... Business Partners has been a pioneer in the use of royalties (a percentage of sales) in emerging-market risk capital investments. In most of its deals, royalties are based on actual sales or the company’s sales projections, whichever are greater, allowing the firm to maintain a steady income stream ...

Raczka - European Commission

... However, the latter solution can be applied upon two conditions: (1) plots are large (at least 2000 m2), (2) a house is connected to a water network. The first condition constraints applicability of domestic sewage treatment plants. Table 2. Grudziadz – sewerage in comparison to alternatives ...

... However, the latter solution can be applied upon two conditions: (1) plots are large (at least 2000 m2), (2) a house is connected to a water network. The first condition constraints applicability of domestic sewage treatment plants. Table 2. Grudziadz – sewerage in comparison to alternatives ...

Slide 1 - Saracen Fund Managers

... This document contains information relating to Saracen Fund Managers Ltd and Saracen Investment Funds ICVC (‘the Company’). Saracen Fund Managers Ltd is authorised and regulated by the Financial Services Authority (‘FSA’). This document is issued and approved by Saracen Fund Managers Ltd (‘SFM’) for ...

... This document contains information relating to Saracen Fund Managers Ltd and Saracen Investment Funds ICVC (‘the Company’). Saracen Fund Managers Ltd is authorised and regulated by the Financial Services Authority (‘FSA’). This document is issued and approved by Saracen Fund Managers Ltd (‘SFM’) for ...

$doc.title

... Estimates of the value of some of these assets are reported by the U.S. government. The Commerce Department’s Bureau of Economic Analysis (BEA) provides estimates of the value of tangible corporate assets located in the United States. In the 1990s, the estimate is slightly above 1.0 GNP. However the ...

... Estimates of the value of some of these assets are reported by the U.S. government. The Commerce Department’s Bureau of Economic Analysis (BEA) provides estimates of the value of tangible corporate assets located in the United States. In the 1990s, the estimate is slightly above 1.0 GNP. However the ...

Long-Term Investment Policy - American Speech

... modifications or exceptions (temporary or otherwise) in writing to the FPB when they deem it appropriate. Only the FPB may approve such requests. 11. The FPB will report to the Board at least annually on the status of the Fund. ...

... modifications or exceptions (temporary or otherwise) in writing to the FPB when they deem it appropriate. Only the FPB may approve such requests. 11. The FPB will report to the Board at least annually on the status of the Fund. ...

Chapter 2 - Economics

... • But, legal definition uses the historical price of capital. • If PK rises over time, then the legal definition understates the true cost and overstates profit, so firms could be taxed even if their true economic profit is zero. • Thus, corporate income tax discourages investment. CHAPTER 17 ...

... • But, legal definition uses the historical price of capital. • If PK rises over time, then the legal definition understates the true cost and overstates profit, so firms could be taxed even if their true economic profit is zero. • Thus, corporate income tax discourages investment. CHAPTER 17 ...