Financial Reporting Council

... These amendments result from proposals that were contained in the Exposure Draft for proposed amendments to IFRS, Annual Improvements to IFRSs 2012– 2014 Cycle, published in December 2013. The IASB uses the Annual Improvements process to make necessary, but nonurgent, amendments to IFRSs if those am ...

... These amendments result from proposals that were contained in the Exposure Draft for proposed amendments to IFRS, Annual Improvements to IFRSs 2012– 2014 Cycle, published in December 2013. The IASB uses the Annual Improvements process to make necessary, but nonurgent, amendments to IFRSs if those am ...

FSA Consultation Paper 190 - enhanced capital requirements and

... 1 January 2004, on the implementation of the Solvency 2 Directive. ECR and ICG will be introduced with the PSB later in 2004. Initially ECR will need to be calculated and provided privately to FSA only as part of the requirement to consider an individual capital assessment. FSA will then use this an ...

... 1 January 2004, on the implementation of the Solvency 2 Directive. ECR and ICG will be introduced with the PSB later in 2004. Initially ECR will need to be calculated and provided privately to FSA only as part of the requirement to consider an individual capital assessment. FSA will then use this an ...

Russell Investments` 2012 Global Survey on Alternative Investing

... Introduction In recent years, alternatives have become an even more prevalent aspect of multi-asset investing. Because we believe alternatives can play a unique role in helping organizations achieve their desired investment outcomes, we expect this trend to continue. The purpose of the Russell Inves ...

... Introduction In recent years, alternatives have become an even more prevalent aspect of multi-asset investing. Because we believe alternatives can play a unique role in helping organizations achieve their desired investment outcomes, we expect this trend to continue. The purpose of the Russell Inves ...

USING VARIABLE LIFE INSURANCE AS AN INVESTMENT

... is clearly a better choice, especially if results average better than 7%. The advantage of using variable life does not depend on net zero loans, because all withdrawals will probably produce better results than the term/mutual fund alternative. The third section of Table 1 shows the results if an a ...

... is clearly a better choice, especially if results average better than 7%. The advantage of using variable life does not depend on net zero loans, because all withdrawals will probably produce better results than the term/mutual fund alternative. The third section of Table 1 shows the results if an a ...

Revenue - Employment and Investment Incentive

... relief incentive scheme that provides tax relief for investment in certain corporate trades. ...

... relief incentive scheme that provides tax relief for investment in certain corporate trades. ...

Sample Glossary of Investment-Related Terms for

... Lifestyle Fund: A fund that maintains a predetermined risk level and generally uses words such as “conservative,” “moderate,” or “aggressive” in its name to indicate the fund’s risk level. Used interchangeably with “target risk fund.” Lipper: A leading mutual fund research and tracking firm. Lipper ...

... Lifestyle Fund: A fund that maintains a predetermined risk level and generally uses words such as “conservative,” “moderate,” or “aggressive” in its name to indicate the fund’s risk level. Used interchangeably with “target risk fund.” Lipper: A leading mutual fund research and tracking firm. Lipper ...

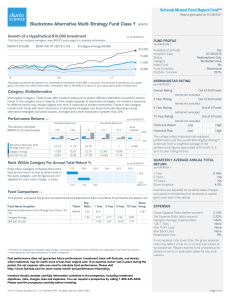

Blackstone Alternative Multi-Strategy Fund Class Y BXMYX

... managed product's monthly excess performance, placing more emphasis on downward variations and rewarding consistent performance. The top 10% of products in each product category receive 5 stars, the next 22.5% receive 4 stars, the next 35% receive 3 stars, the next 22.5% receive 2 stars, and the bot ...

... managed product's monthly excess performance, placing more emphasis on downward variations and rewarding consistent performance. The top 10% of products in each product category receive 5 stars, the next 22.5% receive 4 stars, the next 35% receive 3 stars, the next 22.5% receive 2 stars, and the bot ...

Oversight Policy for Deferred Compensation

... Deferred Compensation Program and agrees to all terms and conditions that apply. Passively Managed Product (Index Fund) – An investment strategy that produces the same level and pattern of financial returns generated by a market benchmark index. Performance Benchmark – A market benchmark index that ...

... Deferred Compensation Program and agrees to all terms and conditions that apply. Passively Managed Product (Index Fund) – An investment strategy that produces the same level and pattern of financial returns generated by a market benchmark index. Performance Benchmark – A market benchmark index that ...

Chapter 1: An Introduction to Corporate Finance

... dedicated to capital investments in any one year • It is academically illogical: why would a manager not invest in a project that will offer a greater return than the cost of capital used to finance it? • In the long-run, it could threaten a firm’s continuing existence through the erosion of its com ...

... dedicated to capital investments in any one year • It is academically illogical: why would a manager not invest in a project that will offer a greater return than the cost of capital used to finance it? • In the long-run, it could threaten a firm’s continuing existence through the erosion of its com ...

Will high-tech CFOs adapt to slower growth

... information systems they set up as recently as five to seven years ago may no longer provide relevant data. They have also been through more mergers and acquisitions than most companies, and though you might expect tech-savvy management teams to have experience successfully integrating IT systems, f ...

... information systems they set up as recently as five to seven years ago may no longer provide relevant data. They have also been through more mergers and acquisitions than most companies, and though you might expect tech-savvy management teams to have experience successfully integrating IT systems, f ...

ESG: How not to tick the box in 401(k)

... ESG return premium, is even more difficult. A recent study by MSCI4 into passive ESG tilted and momentum strategies showed that these had added value of 1.1% p.a. and 2.2% p.a. respectively, although this was over a fairly short time period. Similar conclusions are corroborated in a paper5 supported ...

... ESG return premium, is even more difficult. A recent study by MSCI4 into passive ESG tilted and momentum strategies showed that these had added value of 1.1% p.a. and 2.2% p.a. respectively, although this was over a fairly short time period. Similar conclusions are corroborated in a paper5 supported ...

st. James`s Place investment Bond

... Your investment provides a range of options to meet the need for regular payments to supplement your income. • You can take a quarterly income, based on the income generated by the assets in the funds. • If you need a regular and predictable level of income, you can specify the amount you need, paya ...

... Your investment provides a range of options to meet the need for regular payments to supplement your income. • You can take a quarterly income, based on the income generated by the assets in the funds. • If you need a regular and predictable level of income, you can specify the amount you need, paya ...

Appetite for co-investment opportunities has never been greater

... organized by the sponsor of the primary fund to participate in one or more co-investment opportunities. LPs are seeking sidecar investment opportunities for several reasons. First, these opportunities can improve net investment returns to the LPs who participate in the sidecar because the economic t ...

... organized by the sponsor of the primary fund to participate in one or more co-investment opportunities. LPs are seeking sidecar investment opportunities for several reasons. First, these opportunities can improve net investment returns to the LPs who participate in the sidecar because the economic t ...

Harnessing FDI for Sustainable Development

... Sections on other policy areas geared towards overall sustainable development objectives to ensure coherence with investment policy ...

... Sections on other policy areas geared towards overall sustainable development objectives to ensure coherence with investment policy ...

PPT_Mic9e_one_click_ch11

... The Demand for New Capital and the Investment Decision Comparing Costs and Expected Return The Expected Rate of Return and the Marginal Revenue Product of Capital A perfectly competitive profit-maximizing firm will keep investing in new capital up to the point at which the expected rate of return is ...

... The Demand for New Capital and the Investment Decision Comparing Costs and Expected Return The Expected Rate of Return and the Marginal Revenue Product of Capital A perfectly competitive profit-maximizing firm will keep investing in new capital up to the point at which the expected rate of return is ...

ECOWAS - Investment Policy and Promotion

... foreign direct investment (FDI), in particular, helps to link a country’s domestic economy to global value chains in key sectors. FDI brings not only investment and jobs, but also increased exports, supply chain spillovers, and new technologies and business practices. These potential benefits requir ...

... foreign direct investment (FDI), in particular, helps to link a country’s domestic economy to global value chains in key sectors. FDI brings not only investment and jobs, but also increased exports, supply chain spillovers, and new technologies and business practices. These potential benefits requir ...

deed of undertaking - Living in the Philippines

... b) Location Plan/Vicinity Map of the place of business of the Corporation where investment was made. Investment in new corporation – a) Certified true copies of Securities and Exchange Commission (SEC) registration, Articles of Incorporation and By-laws; b) Sworn Certification of Corporate Secretary ...

... b) Location Plan/Vicinity Map of the place of business of the Corporation where investment was made. Investment in new corporation – a) Certified true copies of Securities and Exchange Commission (SEC) registration, Articles of Incorporation and By-laws; b) Sworn Certification of Corporate Secretary ...

Goldman Sachs India Equity Portfolio

... countries). Therefore, the shares of the fund must not be marketed or offered in or to residents of any such jurisdictions unless such marketing or offering is made in compliance with applicable exemptions for the private placement of collective investment schemes and other applicable jurisdictional ...

... countries). Therefore, the shares of the fund must not be marketed or offered in or to residents of any such jurisdictions unless such marketing or offering is made in compliance with applicable exemptions for the private placement of collective investment schemes and other applicable jurisdictional ...

Direct Investing in Private Equity

... In addition, direct investments might give investors a better ability to time the market. This is valuable because private equity funds’ performance is highly cyclical (Axelson, et al., 2013b; Kaplan and Schoar, 2005). According to the theories on delegated investing, a principalagency problem may a ...

... In addition, direct investments might give investors a better ability to time the market. This is valuable because private equity funds’ performance is highly cyclical (Axelson, et al., 2013b; Kaplan and Schoar, 2005). According to the theories on delegated investing, a principalagency problem may a ...

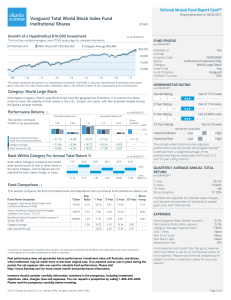

Vanguard Total World Stock Index Fund Institutional Shares

... BlackRock Global Dividend Portfolio Investor A Shares (04/08) ...

... BlackRock Global Dividend Portfolio Investor A Shares (04/08) ...

BlackRock US Corporate Bond Index Fund

... (i.e. meet a specified level of credit worthiness) at the time of purchase. If the credit rating of a FI security is downgraded, the Fund may continue to hold this, until it is practicable to sell the position. The benchmark index measures the performance of USD denominated government, supranational ...

... (i.e. meet a specified level of credit worthiness) at the time of purchase. If the credit rating of a FI security is downgraded, the Fund may continue to hold this, until it is practicable to sell the position. The benchmark index measures the performance of USD denominated government, supranational ...

Supplement - Causeway Capital Management

... Separate from the expenses borne by the Company and the Fund, financial institutions through whom Shares are purchased may charge fees for services provided which may be related to the ownership of Shares. This Supplement and the Prospectus should, therefore, be read together with any agreement betw ...

... Separate from the expenses borne by the Company and the Fund, financial institutions through whom Shares are purchased may charge fees for services provided which may be related to the ownership of Shares. This Supplement and the Prospectus should, therefore, be read together with any agreement betw ...

AMENDMENT NO. 1 DATED JULY 21, 2016 TO

... The Fund may invest, directly or indirectly through the use of derivatives, a portion or even all of its assets in units of other mutual funds, including funds managed by us. The Portfolio Manager will only invest in units of other funds where such investment is compatible with the investment object ...

... The Fund may invest, directly or indirectly through the use of derivatives, a portion or even all of its assets in units of other mutual funds, including funds managed by us. The Portfolio Manager will only invest in units of other funds where such investment is compatible with the investment object ...

SAVINGS, INVESTMENT AND CAPITAL FLOWS: AN EMPIRICAL

... by productive activities transformed effectively from the increased domestic resources and the mobilized international resources in the forms of foreign capital inflow and foreign direct investment. The increase in investment enhanced aggregate output and national income, which in turn induce furthe ...

... by productive activities transformed effectively from the increased domestic resources and the mobilized international resources in the forms of foreign capital inflow and foreign direct investment. The increase in investment enhanced aggregate output and national income, which in turn induce furthe ...

Investment

... stocks and investing capital in such activities which yield income. But Keynes defines investment differently ...

... stocks and investing capital in such activities which yield income. But Keynes defines investment differently ...