S-Network Launches Suite of Responsible Indexes for Calvert

... Said S-Network CEO Joseph LaCorte, “These indexes offer the very high responsible investment standards that have become synonymous with the Calvert Investments brand, together with solid index methodologies that emphasize diversification and sound investment principles.” The indexes are used as unde ...

... Said S-Network CEO Joseph LaCorte, “These indexes offer the very high responsible investment standards that have become synonymous with the Calvert Investments brand, together with solid index methodologies that emphasize diversification and sound investment principles.” The indexes are used as unde ...

Comparison of regulatory capital and economic

... large amount of capital as companies can have alternative use of the fund to engage in risk-taking business initiative(s) with a view to create profits. Also, raising capital dilutes the return for existing shareholders and senior management of companies who have share options. This can create disin ...

... large amount of capital as companies can have alternative use of the fund to engage in risk-taking business initiative(s) with a view to create profits. Also, raising capital dilutes the return for existing shareholders and senior management of companies who have share options. This can create disin ...

Collective investment schemes regulations

... exclusively for the collective investment and reinvestment of money contributed to the fund by the bank, or by one or more affiliated banks, in its capacity as trustee, executor, administrator, guardian, or custodian. This type of fund is generally referred to as an A1 fund. The industry generally u ...

... exclusively for the collective investment and reinvestment of money contributed to the fund by the bank, or by one or more affiliated banks, in its capacity as trustee, executor, administrator, guardian, or custodian. This type of fund is generally referred to as an A1 fund. The industry generally u ...

Measures of Volatility and Aggregate Investment

... higher volatility of ∆bt will, itself, also imply a higher threshold. In order to prevent a spurious conclusion of a positive significant coefficient in front of the volatility term, as support for the model, another set of proxies are obtained for the threshold. We collect the values of bt that co ...

... higher volatility of ∆bt will, itself, also imply a higher threshold. In order to prevent a spurious conclusion of a positive significant coefficient in front of the volatility term, as support for the model, another set of proxies are obtained for the threshold. We collect the values of bt that co ...

Short-term Expectations in Listed Firms: The Effects of Different

... Institutional owners include banks, insurance companies, private and public pension funds, investment companies, mutual funds as well as activist funds. Only a few studies have looked in more detail at how specific owner types among the category of institutional owners influence corporate myopia. By ...

... Institutional owners include banks, insurance companies, private and public pension funds, investment companies, mutual funds as well as activist funds. Only a few studies have looked in more detail at how specific owner types among the category of institutional owners influence corporate myopia. By ...

WORKING CAPITAL FINANCING PREFERENCES: THE CASE OF

... financing for the less profitable firms. The less profitable an SME is, and therefore the less self-sufficient it is through the reinvestment of profits, the more likely that it will need to depend upon short-term debt financing for its assets and activities. The authors also observed that growth in ...

... financing for the less profitable firms. The less profitable an SME is, and therefore the less self-sufficient it is through the reinvestment of profits, the more likely that it will need to depend upon short-term debt financing for its assets and activities. The authors also observed that growth in ...

THE SEARCH FOR HIGHER RETURNS

... Investment Research strategy. The positive and negative alphas from our hypothetical credit decisions in the last 10 years would have been 14.6% and -9.9%, respectively. CONCLUSION The recent proliferation of innovative fixed income securities specifically designed for cash investors creates more o ...

... Investment Research strategy. The positive and negative alphas from our hypothetical credit decisions in the last 10 years would have been 14.6% and -9.9%, respectively. CONCLUSION The recent proliferation of innovative fixed income securities specifically designed for cash investors creates more o ...

Can mutual funds successfully adopt factor investing strategies?

... of academic knowledge gain excess returns, or under which circumstances application of this knowledge is successful. The aim of our study is to fill this gap in the literature. We restrict ourselves to factor investing strategies, as their application can reliably be measured. ...

... of academic knowledge gain excess returns, or under which circumstances application of this knowledge is successful. The aim of our study is to fill this gap in the literature. We restrict ourselves to factor investing strategies, as their application can reliably be measured. ...

Merritt 7 Corporate Park in Norwalk Leases 31,217 Square Feet to

... leasing for Merritt 7. “This transaction once again highlights Merritt 7’s ability to attract leading corporations in a competitive leasing market.” Jarden Corporation is a leading provider of a diverse range of consumer products with a portfolio of over 120 global brands sold globally and operated ...

... leasing for Merritt 7. “This transaction once again highlights Merritt 7’s ability to attract leading corporations in a competitive leasing market.” Jarden Corporation is a leading provider of a diverse range of consumer products with a portfolio of over 120 global brands sold globally and operated ...

Investments and mortgages supplement

... apply. It is important you consider the prudential category or categories carefully. The category will determine minimum capital and other risk management standards and aims to ensure the applicant firm is able to meet its liabilities and commitments at all times. Please note that when determining t ...

... apply. It is important you consider the prudential category or categories carefully. The category will determine minimum capital and other risk management standards and aims to ensure the applicant firm is able to meet its liabilities and commitments at all times. Please note that when determining t ...

INVESTMENT-CASH FLOW SENSITIVITY IN SMALL AND MEDIUM

... José Martí Pellón (Universidad Complutense de Madrid) y María Alejandra Ferrer (Universidad Complutense de Madrid) ...

... José Martí Pellón (Universidad Complutense de Madrid) y María Alejandra Ferrer (Universidad Complutense de Madrid) ...

American Funds® IS US Govt/AAA

... Each investment option has varying degrees of risk depending on the investments and investment strategies used. See the applicable underlying fund prospectus for more complete information regarding investment risks. Active Management The investment is actively managed and subject to the risk that th ...

... Each investment option has varying degrees of risk depending on the investments and investment strategies used. See the applicable underlying fund prospectus for more complete information regarding investment risks. Active Management The investment is actively managed and subject to the risk that th ...

fiduciary duty in the - Principles for Responsible Investment

... At the heart of the existing system is the pension promise, which in Germany currently takes the form of a defined benefit or hybrid scheme. Employers may choose from five possible vehicles to help fund the promise. German pension funds do not have trustees12 – the relationship between the employer ...

... At the heart of the existing system is the pension promise, which in Germany currently takes the form of a defined benefit or hybrid scheme. Employers may choose from five possible vehicles to help fund the promise. German pension funds do not have trustees12 – the relationship between the employer ...

Pensions Statement of Investment Principles

... sufficient investment return to improve the funding position over time. The balance between Growth and Matching assets, and the level of hedging protection provided by the Matching portfolio, will be adjusted over time to reduce risk as the Scheme's funding position improves. The Growth component co ...

... sufficient investment return to improve the funding position over time. The balance between Growth and Matching assets, and the level of hedging protection provided by the Matching portfolio, will be adjusted over time to reduce risk as the Scheme's funding position improves. The Growth component co ...

Finding Value in the Environment Private equity firms are

... of their portfolio company investments. From capital structure and strategy optimisation to streamlining operations and costs, their mission has long been identified with maximising returns for their investors (limited partners or LPs). In doing so, private equity fund managers (general partners or ...

... of their portfolio company investments. From capital structure and strategy optimisation to streamlining operations and costs, their mission has long been identified with maximising returns for their investors (limited partners or LPs). In doing so, private equity fund managers (general partners or ...

4 mei 2017 AXA Investment Managers divests from

... approximately €165 million of fixed income portfolios and €12 million of equities portfolios. All portfolio managers will be working closely with AXA IM’s Responsible Investment team to ensure that all funds are in line with the coal policy and all clients impacted have a smooth transition in their ...

... approximately €165 million of fixed income portfolios and €12 million of equities portfolios. All portfolio managers will be working closely with AXA IM’s Responsible Investment team to ensure that all funds are in line with the coal policy and all clients impacted have a smooth transition in their ...

One Hat Too Many? Investment Desegregation in Private Equity

... I. FUND FORMATION IN THE PRIVATE EQUITY INDUSTRY Private equity investment typically begins with a group of individuals deciding to offer their labor (and often their money) as asset managers through an investment advisory entity that will raise funds, identify investment opportunities, and subseque ...

... I. FUND FORMATION IN THE PRIVATE EQUITY INDUSTRY Private equity investment typically begins with a group of individuals deciding to offer their labor (and often their money) as asset managers through an investment advisory entity that will raise funds, identify investment opportunities, and subseque ...

Establishing China`s Green Financial System Detailed

... (I) Definition of green industry funds Green industry funds come in various types. In terms of the level of government participation, green funds can be divided into government-‐backed environmental protecti ...

... (I) Definition of green industry funds Green industry funds come in various types. In terms of the level of government participation, green funds can be divided into government-‐backed environmental protecti ...

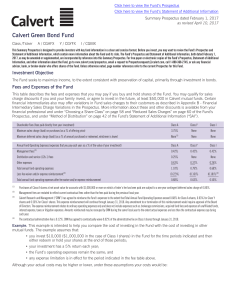

Calvert Green Bond Fund

... Fixed income markets have recently experienced a period of relatively high volatility due to rising U.S. treasury yields which, in part, reflect the market’s expectations for higher U.S. economic growth and inflation. As a result of the Federal Reserve’s recent decision to raise the target fed funds ...

... Fixed income markets have recently experienced a period of relatively high volatility due to rising U.S. treasury yields which, in part, reflect the market’s expectations for higher U.S. economic growth and inflation. As a result of the Federal Reserve’s recent decision to raise the target fed funds ...

Why it pays to be diversified

... different managers in portfolios of primary funds, it is interesting to note that manager diversification in co-investment funds does not reduce the variance of the return distribution. Therefore, manager diversification does not reduce the potential for extraordinary returns. In fact, co-investment p ...

... different managers in portfolios of primary funds, it is interesting to note that manager diversification in co-investment funds does not reduce the variance of the return distribution. Therefore, manager diversification does not reduce the potential for extraordinary returns. In fact, co-investment p ...

Chapter Fifteen

... Funds with a Growth and Income Objective • Growth and Income Fund – objective is a combination of growth and income; invests in companies expected to show average or better growth and to pay steady or rising dividends. • Life-Cycle Funds – create a diversified, all-in-one portfolio for those indivi ...

... Funds with a Growth and Income Objective • Growth and Income Fund – objective is a combination of growth and income; invests in companies expected to show average or better growth and to pay steady or rising dividends. • Life-Cycle Funds – create a diversified, all-in-one portfolio for those indivi ...

Margin Agreement - RBC Direct Investing

... Interpretation: In this agreement, "Account(s)" means (each of ) my account(s) with RBC Direct Investing®; "RBC Direct Investing" means RBC Direct Investing Inc.; "I", "me" and "my" mean each investor; "securities" includes all stocks, bonds, debentures investment certificates or other similar prope ...

... Interpretation: In this agreement, "Account(s)" means (each of ) my account(s) with RBC Direct Investing®; "RBC Direct Investing" means RBC Direct Investing Inc.; "I", "me" and "my" mean each investor; "securities" includes all stocks, bonds, debentures investment certificates or other similar prope ...

Office of Government Ethics Guidance on Hedge Fund and Other

... OGE updated its guidance in 2014 to loosen the rules on reporting hedge funds and other pooled investment funds. OGE recognized that many investors do not have access to information about the underlying assets in such funds, which effectively mitigates concerns about conflicts of interest arising ou ...

... OGE updated its guidance in 2014 to loosen the rules on reporting hedge funds and other pooled investment funds. OGE recognized that many investors do not have access to information about the underlying assets in such funds, which effectively mitigates concerns about conflicts of interest arising ou ...

Mutual Funds Sharekhan`s Top Equity Fund Picks

... Past performance of any scheme of the Mutual fund do not indicate the future performance of the Schemes of the Mutual Fund. Sharekhan shall not responsible or liable for any loss or shortfall incurred by the investors. ...

... Past performance of any scheme of the Mutual fund do not indicate the future performance of the Schemes of the Mutual Fund. Sharekhan shall not responsible or liable for any loss or shortfall incurred by the investors. ...

Endowment Investment Policy

... preservation of principal in the overall portfolio. The risk of loss shall be controlled by investing only in authorized securities as defined in this Policy, by qualifying the financial institutions with whom Texas Southern University will transact, and by portfolio diversification. Safety is defin ...

... preservation of principal in the overall portfolio. The risk of loss shall be controlled by investing only in authorized securities as defined in this Policy, by qualifying the financial institutions with whom Texas Southern University will transact, and by portfolio diversification. Safety is defin ...