Private Equity Investment in India: Efficiency vs Expansion

... investment. The exact timing of the deals is arguably arbitrary because PE investors are unable to compare internal financial data across all prospective investees at the same time. Rather, they request and analyze internal financial data over time. For a second identification strategy, I have obtai ...

... investment. The exact timing of the deals is arguably arbitrary because PE investors are unable to compare internal financial data across all prospective investees at the same time. Rather, they request and analyze internal financial data over time. For a second identification strategy, I have obtai ...

Gold ETF - Sangai Investments

... Thus, the nominee* would be able to continue in the scheme without having to make any further contribution. Investor’s long term financial planning and objective of investing through SIP could still be fulfilled as per the targeted time horizon, even if he/she dies prematurely. ...

... Thus, the nominee* would be able to continue in the scheme without having to make any further contribution. Investor’s long term financial planning and objective of investing through SIP could still be fulfilled as per the targeted time horizon, even if he/she dies prematurely. ...

Real estate has a place in a well-diversified investment

... have a finite life and may not make distributions until later years when properties are sold. The same is true of limited partnerships that typically invest clients’ assets over a multiple-year investing period before making distributions halfway through a ten-year life. Any of the established real ...

... have a finite life and may not make distributions until later years when properties are sold. The same is true of limited partnerships that typically invest clients’ assets over a multiple-year investing period before making distributions halfway through a ten-year life. Any of the established real ...

Statutory Accounting Principles Working Group

... Questions have been received on whether the ownership percentage in an exchange-traded fund (ETF) could result with the investment being within scope of SSAP No. 97—Investments in Subsidiary, Affiliated and Controlled Entities (SSAP No. 97). This agenda item proposes clarifying guidance to SSAP No. ...

... Questions have been received on whether the ownership percentage in an exchange-traded fund (ETF) could result with the investment being within scope of SSAP No. 97—Investments in Subsidiary, Affiliated and Controlled Entities (SSAP No. 97). This agenda item proposes clarifying guidance to SSAP No. ...

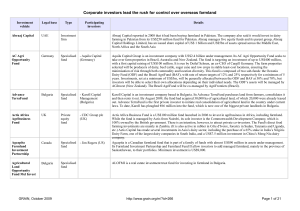

The new farm owners table

... the entire Veluwe region of the Netherlands. That’s tens of thoUSnds of ha. We’re active in Uruguay, Paraguay, Brazil and Argentina. They’re the agricultural heartland of the future. We also have farms in Australia, and we’re now looking at other ...

... the entire Veluwe region of the Netherlands. That’s tens of thoUSnds of ha. We’re active in Uruguay, Paraguay, Brazil and Argentina. They’re the agricultural heartland of the future. We also have farms in Australia, and we’re now looking at other ...

Study on Obstacles and Solutions to China’s Low-Carbon Industrial Investment Fund

... China's development of industrial investment funds has been basically mature. We can use the tool of industrial investment fund to integrate money, and organize it by expert management. In this way, the Chinese economy can be activated, so that the use of funds will be more efficient and scientific. ...

... China's development of industrial investment funds has been basically mature. We can use the tool of industrial investment fund to integrate money, and organize it by expert management. In this way, the Chinese economy can be activated, so that the use of funds will be more efficient and scientific. ...

URL Address

... the very IT system 3 . Second, IT investment is not the objective itself but merely one of the possible means to improve quality and reduce cost of financial services. Third, it is thought that the competitiveness of securities firms rely much more on human resources (e.g., abilities of consultation ...

... the very IT system 3 . Second, IT investment is not the objective itself but merely one of the possible means to improve quality and reduce cost of financial services. Third, it is thought that the competitiveness of securities firms rely much more on human resources (e.g., abilities of consultation ...

Venture Eyes Ophthalmology— And Likes What It Sees

... managing director at New Leaf Venture Partners and an investor in Visiogen’s first institutional round, says Visiogen had a long list of characteristics VCs look for: it addressed large markets and unmet needs, with novel technology, strong IP, and low reimbursement risk. “There aren’t many investme ...

... managing director at New Leaf Venture Partners and an investor in Visiogen’s first institutional round, says Visiogen had a long list of characteristics VCs look for: it addressed large markets and unmet needs, with novel technology, strong IP, and low reimbursement risk. “There aren’t many investme ...

e - Homework Minutes

... Therefore, better governance would mean that an investor’s fund would be better used to give excess returns to shareholders. The returns may be in the form of dividends and/or increased market value. In either way, it means that governance achieves this excess by operating performance. Those firms w ...

... Therefore, better governance would mean that an investor’s fund would be better used to give excess returns to shareholders. The returns may be in the form of dividends and/or increased market value. In either way, it means that governance achieves this excess by operating performance. Those firms w ...

Investment Strategy Statement

... qualified person in undertaking such a review. If, at any time, investment in a security or product not previously known to the Committee is proposed, appropriate advice is sought and considered to ensure its suitability and diversification. The Fund’s target investment strategy is set out below. Th ...

... qualified person in undertaking such a review. If, at any time, investment in a security or product not previously known to the Committee is proposed, appropriate advice is sought and considered to ensure its suitability and diversification. The Fund’s target investment strategy is set out below. Th ...

Technical Advice on criteria and factors to be - eiopa

... include, for example: a. the type and transparency of the underlying; b. any hidden costs and charges; c. the use of features that draw investors’ attention but that do not necessarily reflect the suitability or overall quality of the product or service; d. visibility of risks; e. the use of product ...

... include, for example: a. the type and transparency of the underlying; b. any hidden costs and charges; c. the use of features that draw investors’ attention but that do not necessarily reflect the suitability or overall quality of the product or service; d. visibility of risks; e. the use of product ...

how hedge funds are structured

... limited partnerships between the fund manager and investors. While the specific structure can vary from fund to fund, there are a few characteristics that are applicable across the industry. This presentation provides a brief overview of some of the most common fund structures. ...

... limited partnerships between the fund manager and investors. While the specific structure can vary from fund to fund, there are a few characteristics that are applicable across the industry. This presentation provides a brief overview of some of the most common fund structures. ...

A2 PRIVATE INVESTMENTS IN NEW INFRASTRUCTURES

... social or moral reasons. If this is considered to be the case, it usually requires interference with the construction plans or pricing strategies for that infrastructure. For example, the Dutch and other governments require that every household is connected to fixed telephony at the same costs. Likew ...

... social or moral reasons. If this is considered to be the case, it usually requires interference with the construction plans or pricing strategies for that infrastructure. For example, the Dutch and other governments require that every household is connected to fixed telephony at the same costs. Likew ...

proposed post card text - University of North Carolina

... the ORP, you can look forward to a new, simplified selection of ORP investment funds from which to choose. They will continue to be offered by the four current ORP carriers, AIG VALIC, Fidelity Investments, Lincoln Financial Group and TIAA-CREF. This new selection of funds provides a broad array of ...

... the ORP, you can look forward to a new, simplified selection of ORP investment funds from which to choose. They will continue to be offered by the four current ORP carriers, AIG VALIC, Fidelity Investments, Lincoln Financial Group and TIAA-CREF. This new selection of funds provides a broad array of ...

Target Outcome Funds

... capital markets. The range of outcomes over a certain interval of time is defined when the fund is brought to market. The outcome orientation of these funds brings a new dimension to the rapidly growing market for index investing. In a Target Outcome Fund, the uncertainty of an unconstrained allocat ...

... capital markets. The range of outcomes over a certain interval of time is defined when the fund is brought to market. The outcome orientation of these funds brings a new dimension to the rapidly growing market for index investing. In a Target Outcome Fund, the uncertainty of an unconstrained allocat ...

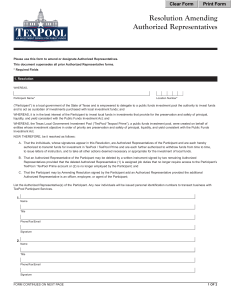

Resolution Amending Authorized Representatives

... List the name of the authorized representative listed above that will have primary responsibility for performing transactions and receiving confirmations and monthly statements under the participation agreement. ...

... List the name of the authorized representative listed above that will have primary responsibility for performing transactions and receiving confirmations and monthly statements under the participation agreement. ...

French Mid-Market Companies Display Financial

... The second group that we analysed consists of a sample of 90 midsize companies on which we performed a more detailed credit analysis, as part of the launch of our Mid-Market Evaluations (MME) service (for further details see "Some French Mid-Market Companies Exhibit Strong Business Profiles Despite ...

... The second group that we analysed consists of a sample of 90 midsize companies on which we performed a more detailed credit analysis, as part of the launch of our Mid-Market Evaluations (MME) service (for further details see "Some French Mid-Market Companies Exhibit Strong Business Profiles Despite ...

View/Open

... reports the quantities of all farm animals -- cattle, sheep, pigs, poultry, etc. The value of these individual components is aggregated to obtain the livestock. Ideally observations on live animal sales prices would be used to value local herds, but these data were not consistently available. In the ...

... reports the quantities of all farm animals -- cattle, sheep, pigs, poultry, etc. The value of these individual components is aggregated to obtain the livestock. Ideally observations on live animal sales prices would be used to value local herds, but these data were not consistently available. In the ...

How working capital management affects the profitability of Afriland

... Wolday, 2006). The fact that a company makes profits is not necessarily an indication of effective management of its working capital because a company can be endowed with assets and profitability but short of liquidity if its assets cannot readily be converted into cash. As such, there will be short ...

... Wolday, 2006). The fact that a company makes profits is not necessarily an indication of effective management of its working capital because a company can be endowed with assets and profitability but short of liquidity if its assets cannot readily be converted into cash. As such, there will be short ...

PDF

... consequence of the process of creative destruction. However, non-publicly traded firms in industries without such competitive pressures have also experienced large numbers of mergers and acquisitions (see figure I), so their cause remains an open question. In particular, cooperatives present a uniqu ...

... consequence of the process of creative destruction. However, non-publicly traded firms in industries without such competitive pressures have also experienced large numbers of mergers and acquisitions (see figure I), so their cause remains an open question. In particular, cooperatives present a uniqu ...

Wave 7 - BetterInvesting

... they had a sum of money to invest, they would invest roughly half in individual stocks or stock mutual funds. Investors are prompted to make changes to their portfolio as a result of things that have a direct impact on them personally. ...

... they had a sum of money to invest, they would invest roughly half in individual stocks or stock mutual funds. Investors are prompted to make changes to their portfolio as a result of things that have a direct impact on them personally. ...

Why do we invest ethically?

... would recover their values, and thus they were not indifferent between unrealized and realized losses. In addition, by their behaviour, they showed that they did not prefer more to less, as they eschewed the chance to increase total wealth by claiming tax benefits from the capital losses. Odean (199 ...

... would recover their values, and thus they were not indifferent between unrealized and realized losses. In addition, by their behaviour, they showed that they did not prefer more to less, as they eschewed the chance to increase total wealth by claiming tax benefits from the capital losses. Odean (199 ...

Wisconsin`s Uniform Prudent Management of Institutional Act

... To the extent practicable, any modification must be made in accordance with the donor’s probable intention. ...

... To the extent practicable, any modification must be made in accordance with the donor’s probable intention. ...

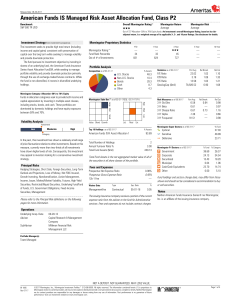

American Funds IS Managed Risk Asset Allocation Fund

... allocation and investment strategies do not perform as expected, which may cause the portfolio to underperform its benchmark, other investments with similar objectives, or the market in general. The investment is subject to the risk of loss of income and capital invested, and the advisor does not gu ...

... allocation and investment strategies do not perform as expected, which may cause the portfolio to underperform its benchmark, other investments with similar objectives, or the market in general. The investment is subject to the risk of loss of income and capital invested, and the advisor does not gu ...