Fact sheet UK

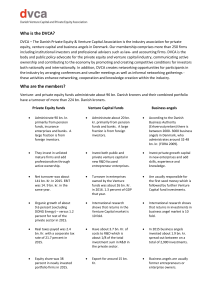

... DVCA – The Danish Private Equity & Venture Capital Association is the industry association for private equity, venture capital and business angels in Denmark. Our membership comprises more than 250 firms including institutional investors and professional advisers such as law- and accounting firms. D ...

... DVCA – The Danish Private Equity & Venture Capital Association is the industry association for private equity, venture capital and business angels in Denmark. Our membership comprises more than 250 firms including institutional investors and professional advisers such as law- and accounting firms. D ...

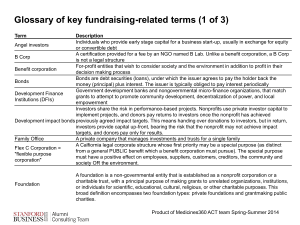

Glossary of Key Fundraising

... A PRI is a low-cost loan (or sometimes an equity investment or a guarantee), provided at belowmarket rates, to strengthen the recipient’s mission-focused work. The lending foundation is reasonably confident of repayment of its full principal amount with some limited returns. The goal of the PRI is f ...

... A PRI is a low-cost loan (or sometimes an equity investment or a guarantee), provided at belowmarket rates, to strengthen the recipient’s mission-focused work. The lending foundation is reasonably confident of repayment of its full principal amount with some limited returns. The goal of the PRI is f ...

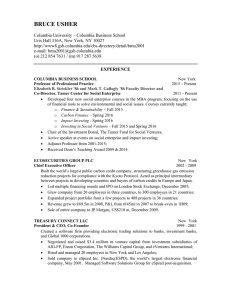

Curriculum Vitae

... Built the world’s largest public carbon credit company, structuring greenhouse gas emission reduction projects for compliance with the Kyoto Protocol. Acted as principal intermediary between projects in developing countries and buyers of carbon credits in Europe and Japan. Led multiple financing r ...

... Built the world’s largest public carbon credit company, structuring greenhouse gas emission reduction projects for compliance with the Kyoto Protocol. Acted as principal intermediary between projects in developing countries and buyers of carbon credits in Europe and Japan. Led multiple financing r ...

MicroVest announces new CIO and MD Equity

... the IIC he was the Managing Director for Clients, leading the investment teams in charge of all new lending and equity operations for projects, financial institutions, corporate clients, and SMEs. As Managing Director of Equity Mr. Young, who has been with MicroVest since 2006, will be responsible f ...

... the IIC he was the Managing Director for Clients, leading the investment teams in charge of all new lending and equity operations for projects, financial institutions, corporate clients, and SMEs. As Managing Director of Equity Mr. Young, who has been with MicroVest since 2006, will be responsible f ...

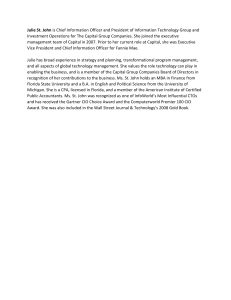

Julie St. John is Chief Information Officer and President of

... Julie St. John is Chief Information Officer and President of Information Technology Group and Investment Operations for The Capital Group Companies. She joined the executive management team of Capital in 2007. Prior to her current role at Capital, she was Executive Vice President and Chief Informati ...

... Julie St. John is Chief Information Officer and President of Information Technology Group and Investment Operations for The Capital Group Companies. She joined the executive management team of Capital in 2007. Prior to her current role at Capital, she was Executive Vice President and Chief Informati ...

Private Equity Funds in Namibia: Venturing Forth

... • Reluctance of insurance companies and pension funds to allow investment due to valuation problems and lack of liquidity • High proportion (19%) in manufacturing • Low number and value of exits ...

... • Reluctance of insurance companies and pension funds to allow investment due to valuation problems and lack of liquidity • High proportion (19%) in manufacturing • Low number and value of exits ...

Ministries approve Osaka University`s 10 billion in

... 10 billion yen in university venture capital (VC). The enforcement of the Industrial Competitiveness Enhancement Act in 2014 made it possible for national universities to establish VCs. This is the first undertaking under this new policy wherein a university will be creating new businesses based on ...

... 10 billion yen in university venture capital (VC). The enforcement of the Industrial Competitiveness Enhancement Act in 2014 made it possible for national universities to establish VCs. This is the first undertaking under this new policy wherein a university will be creating new businesses based on ...

RBC Capital Markets

... Some VC’s are in survival mode Corporate investment arms are reducing or eliminating their investment activity Crossover funds are focused on public market opportunities, if anything at all ...

... Some VC’s are in survival mode Corporate investment arms are reducing or eliminating their investment activity Crossover funds are focused on public market opportunities, if anything at all ...

Ismael Rodrigo Barco (CDTI Spain)

... No secondary market that makes good initiatives grow fast. ...

... No secondary market that makes good initiatives grow fast. ...

Colbar Completes $7.25 Million Series D Financing Round

... and Biomedical Investments in current round Tel Aviv, Israel – 7th September, 2004: Colbar, the Israeli manufacturer of reconstructive medicine and tissue engineering products, today announced the completion of a $7.25 million financing round. Vitalife, the Israeli life sciences venture capital fund ...

... and Biomedical Investments in current round Tel Aviv, Israel – 7th September, 2004: Colbar, the Israeli manufacturer of reconstructive medicine and tissue engineering products, today announced the completion of a $7.25 million financing round. Vitalife, the Israeli life sciences venture capital fund ...

HELIUM RISING STARS FUND SUCCESSFULLY LAUNCHED We

... accordance with the terms and conditions set forth in the prospectus pertaining to such funds if and when offered. While the information and data contained in this document has been obtained from sources deemed reliable, no representation is made as to its accuracy or completeness, and should not be ...

... accordance with the terms and conditions set forth in the prospectus pertaining to such funds if and when offered. While the information and data contained in this document has been obtained from sources deemed reliable, no representation is made as to its accuracy or completeness, and should not be ...

OrbiMed Advisors Offers `One-Stop Shop` for Health

... previous top health-care fund. OrbiMed’s growth counters industry trends. In recent years, venture capital has become more specialized, with smaller teams pursuing narrower strategies with modest-size funds. Instead of specializing, OrbiMed aims to provide companies in any medical sector or country ...

... previous top health-care fund. OrbiMed’s growth counters industry trends. In recent years, venture capital has become more specialized, with smaller teams pursuing narrower strategies with modest-size funds. Instead of specializing, OrbiMed aims to provide companies in any medical sector or country ...

XENETA RAISES $5.3 MILLION IN SERIES A

... translates to unparalleled insight into market trends and substantial opportunities for increased efficiency for Xeneta’s customers. ...

... translates to unparalleled insight into market trends and substantial opportunities for increased efficiency for Xeneta’s customers. ...

Hatchtech - Business.gov.au

... the company has been adequately resourced both in terms of capital and hiring the management team, bringing in corporate advisors and building the strategic business plan necessary to achieve the company’s impressive licensing deal”. Since 2004 Hatchtech has also received significant venture capital ...

... the company has been adequately resourced both in terms of capital and hiring the management team, bringing in corporate advisors and building the strategic business plan necessary to achieve the company’s impressive licensing deal”. Since 2004 Hatchtech has also received significant venture capital ...